Adept-Analyst-Economic-Moats-Sample

advertisement

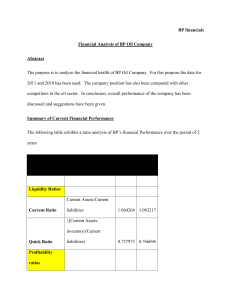

Economic Moats & Durable Competitive Advantage Apple Inc. (AAPL) Fiscal Year Net Income Sales Assets Shareholders' Equity Net Margin Asset Turnover Return on Assets (ROA) Financial Leverage Return on Equity (ROE) Cash Flow from Operations Capital Expenditures Free Cash Flow (FCF) FCF / Sales Net Income Dividends Shareholders' Equity Long-Term Debt Total Capital Return on Invested Capital (ROIC) Operating Income Net Fixed Assets Working Capital Return on Capital (ROC) Operating Income Enterprise Value Earnings Yield Return on Assets (TTM) Return on Assets - 5 Yr. Avg. Return on Investment (TTM) Return on Investment - 5 Yr. Avg. Return on Equity (TTM) Return on Equity - 5 Yr. Avg. Gross Margin (TTM) Gross Margin - 5 Yr. Avg. 2004 2005 2006 276,000 1,335,000 1,989,000 8,279,000 13,931,000 19,315,000 8,050,000 11,551,000 17,205,000 5,076,000 7,466,000 9,984,000 3.33% 9.58% 10.30% 1.03 1.21 1.12 3.43% 11.56% 11.56% 1.59 1.55 1.72 5.44% 17.88% 19.92% 934,000 2,535,000 2,220,000 (176,000) (260,000) (657,000) 758,000 2,275,000 1,563,000 9.16% 16.33% 8.09% 276,000 1,335,000 1,989,000 5,076,000 7,466,000 9,984,000 5,076,000 7,466,000 9,984,000 5.44% 17.88% 19.92% 326,000 1,650,000 2,453,000 707,000 817,000 1,281,000 4,375,000 6,816,000 8,038,000 6.41% 21.62% 26.32% 326,000 1,650,000 2,453,000 5,462,696 23,555,277 55,511,905 5.97% 7.00% 4.42% Company Industry Sector 19.34 6.4 12.83 23.65 7.83 12.57 24.62 30.93 11.74 14.05 32.62 -33.38 Operating Margin (TTM) Operating Margin - 5 Yr. Avg. 2008 4,834,000 32,479,000 39,572,000 21,030,000 14.88% 0.82 12.22% 1.88 22.99% 9,596,000 (1,091,000) 8,505,000 26.19% 4,834,000 21,030,000 21,030,000 22.99% 6,275,000 2,455,000 20,598,000 27.22% 6,275,000 165,141,717 3.80% 2009 5,704,000 36,537,000 53,851,000 27,832,000 15.61% 0.68 10.59% 1.93 20.49% 10,159,000 (1,144,000) 9,015,000 24.67% 5,704,000 27,832,000 27,832,000 20.49% 7,658,000 2,954,000 16,983,000 38.41% 7,658,000 72,012,296 10.63% 2010 14,013,000 65,225,000 75,183,000 47,791,000 21.48% 0.87 18.64% 1.57 29.32% 18,595,000 (2,005,000) 16,590,000 25.44% 14,013,000 47,791,000 47,791,000 29.32% 18,385,000 4,768,000 20,956,000 71.47% 18,385,000 184,298,606 9.98% 16.58 17 30.64 14.57 36.56 16.59 Company Industry Sector 37.62 19.15 40.4 19.78 EBITD Margin (TTM) EBITD - 5 Yr. Avg 2007 3,496,000 24,006,000 25,347,000 14,532,000 14.56% 0.95 13.79% 1.74 24.06% 5,470,000 (735,000) 4,735,000 19.72% 3,496,000 14,532,000 14,532,000 24.06% 4,409,000 1,832,000 12,657,000 30.43% 4,409,000 65,921,267 6.69% Date: 10/30/13 Last Fiscal Year Ended: 09/30/13 2011 2012 2013 25,922,000 41,733,000 37,037,000 108,249,000 156,508,000 170,910,000 116,371,000 176,064,000 207,000,000 76,615,000 118,210,000 123,549,000 23.95% 26.67% 21.67% 0.93 0.89 0.83 22.28% 23.70% 17.89% 1.52 1.49 1.68 33.83% 35.30% 29.98% 37,529,000 50,856,000 53,666,000 (4,260,000) (8,295,000) (8,165,000) 33,269,000 42,561,000 45,501,000 30.73% 27.19% 26.62% 25,922,000 41,733,000 37,037,000 (2,488,000) (10,564,000) 76,615,000 118,210,000 123,549,000 16,960,000 76,615,000 118,210,000 140,509,000 33.83% 33.20% 18.84% 33,790,000 55,241,000 48,999,000 7,777,000 15,452,000 16,597,000 17,018,000 19,111,000 29,628,000 136.28% 159.83% 106.00% 33,790,000 55,241,000 48,999,000 293,036,374 369,633,240 481,235,182 11.53% 14.94% 10.18% 18.4 18.02 49.16 50.85 -10.52 23.28 28.67 30.92 7.24 8.05 10.93 17.35 Pre-Tax Margin (TTM) Pre-Tax Margin - 5 Yr. Avg. 29.35 31.4 7.7 8.29 11.77 17.83 Net Profit Margin (TTM) Net Profit Margin - 5 Yr. Avg. 21.67 23.34 5.46 6.09 5.95 12.43 Effective Tax Rate (TTM) Effective Tax Rate - 5 Yr. Avg. 26.15 25.65 27.27 25.2 26.84 30.95 Receivable Turnover (TTM) Inventory Turnover (TTM) Asset Turnover (TTM) 14.22 83.45 0.89 8.19 20.89 1.49 5.92 140.75 0.96 Economic Moats can protect companies from competition, helping them earn more money for a long time, and therefore making them more valuable to an investor. Return on Capital (ROC) is the best way to judge a company’s profitability. Mistaken Moats: 1) Great Products (i.e. Krispy Kreme, Netscape), 2) Strong Market Share (i.e. Chrysler’s minivan, IBM’s PCs, General Motors), 3) Great Execution (i.e. Kodak), and 4) Great Management (i.e. JetBlue). They do not create long-term competitive advantages. They are nice to have, but they’re not enough. The four sources of structural competitive advantage are 1) Intangible Assets (brands, patents, licenses, etc.), 2) Customer Switching Costs (products or services that are hard to give up like banks), 3) Network Economics (i.e. credit cards, Microsoft Windows and Office), and 4) Cost Advantages (stems from process, location, scale or access to a unique asset). If you found a company with one of these characteristics with solid ROC, you’ve probably found a company with an economic moat. It’s easier to create a competitive advantage in some industries than it is in others. See page 118 for Moats by Sector. Measuring Return on Capital: 1. Return on Assets (ROA) measures how much income a company generates per dollar of assets. 2. Return on Equity (ROE) measures the efficiency with which a company uses shareholders’ equity and is a great overall measure on returns on capital. (Note: A flaw in using ROE is a company can take on a lot of debt and boost ROE without becoming more profitable) 3. Return on Invested Capital (ROIC) combines the best in both worlds by measuring the return on all capital invested in the firm (both debt and equity). Bet on the horse, not the jockey. Management matters, but far less than moats. The Moat Process: Has the firm historically generated solid ROC? i) No (1) Is the firm’s future likely to be different from its past? (a) No = No Economic Moat (b) Yes (i) High Switching Costs, Network Economics, Low-Cost Production, and/or Intangible Assets 1. No = No Economic Moat 2. Yes = Economic Moat a. How strong is the company’s competitive advantage? Is it likely to last a long time or a relatively short time? i. Short = Narrow Moat ii. Long = Wide Moat ii) Yes (1) Does the firm have on or more of the following competitive advantages: High Switching Costs, Network Economics, Low-Cost Production, and/or Intangible Assets? (a) No = No Economic Moat (b) Yes (i) How strong is the company’s competitive advantage? Is it likely to last a long time or a relatively short time? 1. Short = Narrow Moat 2. Long = Wide Moat Valuation Tools to Consider: o Price-to-Sales = most useful for companies temporarily unprofitable or posting lower profit margins. o Price-to-Book = most useful for financial services firms, because the book value of these companies more closely reflects tangible value of the business. o Price-Earnings = beware of the Earnings used, because forecasts aren’t always reliable. Estimate your own Earnings o Price-to-Cash Flow = can help you spot that earns lots of cash relative to earnings. o Yield-based Valuations = useful because you can compare the results directly with alternatives. Warren thinks that the best kind of business to own is one with high profit margins and high turnover. Warren believes the second-best kind of business to own is one with either high profit margins or a high turnover to compensate for lower profit margins. Warren is not interested in owning a business with both low profit margins and low turnover. Warren has a selective contrarian investment philosophy where he will pass on price-competitive businesses regardless of how great the buying opportunities look. Two-types of Competitive Advantage: 1) Unique Product or 2) Unique Service. Not just competitive advantage but Durable Competitive Advantage (a business must be able to keep its competitive advantage well into the future without having to expend great sums of capital to maintain it). o Low-cost Durability like Hersey’s chocolate company. Four-types of businesses with Durable Competitive Advantages: 1) Businesses that fulfill a repetitive consumer need with products that wear out fast or are used up quickly, that have brand-name appeal, and that merchants have to carry or use to stay in business. 2) Advertising businesses, which provide a service that manufacturers must continuously use to persuade the public to buy their products. 3) Businesses that provide repetitive consumer services that people and businesses are consistently in need of (i.e. tax preparers, cleaning services, security services and pest control). 4) Low-cost producers and sellers of common products that most people have to buy at some time in their life (i.e. jewelry, furniture, carpet, and insurance). Quality companies are protected by economic moats, the all-important competitive advantage that makes it hard for competitors to gain market share. This economic moat is a concept worth remembering and applying in your analysis; even a good company without an economic moat won’t last long. Four basic types of economic moats: a. Brand (Coca-Cola is sells better and is more profitable than a generic brand of soda). b. Switching (customer loyalty or the inability and unwillingness to go elsewhere). c. Cost (dominating a commodity type industry through lower prices for the same or better value). d. Protection (ownership of a product or service that no one else is able to offer). ROE and Net Profit Margin are two of the first ratios to look at to determine possible economic moats. Compare them to industry averages and are trending higher they are worth looking at. If not, it’s a waste of time so look elsewhere. To look for Economic Moats, look for firms that consistently earn high profits. Focus on Free Cash Flow, Net Margins, ROE and ROA. In general, there are five ways that a firm can build a durable competitive advantage: o Creating real product differentatiation through superior technology or features. o Creating perceived product differentiation through trusted brand or reputation. o Driving costs down and offering a similar product or service at a lower price. o Locking in customers by creating a high switching costs. o Locking out competitors by creating high barriers to entry or high barriers to success. Like Economic Moats, some industries are easier to make money in than others. Measuring Growth = Four Sources: o Selling more goods or services. o Raising prices. o Selling new goods or services. o Buying another company. Free Cash Flow = Cash Flow from Operations – Capital Spending o FCF / Sales => Anything above 5% is doing a solid job at generating excess cash.