TYL-OSV_Stock_Analyzer-0217

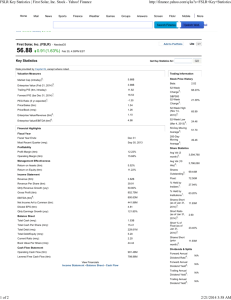

advertisement

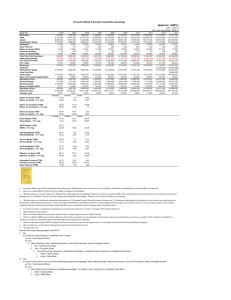

Tyler Technologies, Inc. (TYL) Company Overview Tyler Technologies, Inc. provides integrated information management solutions and services for the public sector with a focus on local governments in the United States and internationally. It operates through Enterprise Software Solutions, and Appraisal and Tax Software Solutions and Services segments. The company’s financial management solutions include modular fund accounting systems for government agencies and not-for-profit entities; and utility billing systems to support the billing and collection of metered and non-metered services. It also offers products to automate various city functions, such as municipal courts, parking tickets, equipment and project costing, animal and business licenses, permits and inspections, code enforcement, citizen complaint tracking, ambulance billing, fleet maintenance, and cemetery records management; financial management, student information, and transportation solutions to K-12 schools; and software applications to manage public sector pension funds. In addition, the company provides integrated suite of judicial solutions comprising court case management, court and law enforcement, prosecutor, and supervision systems to Strong Moat Good Financials $ $ $ $ $ $ $ 94.20 0.59 13.91 14.32 50.04 112.72 52.36 Price vs DCF Intrinsic Value $120.00 Margin of Safety -100.0% Under Valued Well Managed Valuation Current Price NCAV Total Net Reprod. Cost Earnings Power Value (EPV) Discounted Cash Flow (DCF) Katsenelson Absolute PE Ben Graham Formula February 17, 2014 Figures in Millions except per share values Low Risk 5 4 3 High Growth 2 1 0 $100.00 -100.0% -100.0% $80.00 -88.2% 16.4% $60.00 -79.9% $40.00 Key Statistics Mkt Cap ($M) 52 Wk High 52 Wk Low % off 52Wk Low Company Stats $ $ $ 3,061.31 55.23 31.14 16.7% Cash Flows Free Cash Flow 5 yr FCF Growth 10 yr FCF Growth 17.2% 10.2% Shares Outstanding Shares Float Insider Ownership Insider Transactions Institutional Ownership Float Short 32.5 30.8 2.00% -5.9% 91.3% 2.1% Short Ratio Piotroski (TTM) Altman (MRQ) 3.5 7 9.7 Beneish (TTM) -2.9 Effectiveness Margins & Profitability CROIC Avg FCF/S Avg ROA Avg ROE Avg 20.2% 10.5% 9.5% Gross Gross Margin Operating Operating Margin Net Profit Net Margin 46.4% 16.1% 9.4% 21.8% Financial Strength (MRQ) Efficiency Receivables Turnover (TTM) Inventory Turnover (TTM) Days Sales Outstanding (TTM) 3.8 0.0 101.9 Current Ratio(MRQ) Quick Ratio(MRQ) LTD/Eq(MRQ) Tot D/Eq(MRQ) 1.1 1.1 0.0 0.0 $20.00 $0.00 Feb-03 Feb-05 Feb-07 Stock Price Feb-09 Feb-11 Intrinsic Value Fundamental Ratios Feb-13 Buy Price 2011 2012 TTM P/E P/E (cash adjusted) EV/EBITDA 38.27 38.22 19.48 49.89 49.70 23.93 82.94 80.93 39.29 EV/Free Cash Flow P/S P/BV P/Tang BV P/CF P/FCF ROE 25.23 3.41 13.50 (16.58) 23.19 23.88 35.3% 33.44 4.53 11.33 (76.02) 32.51 33.21 22.7% 81.04 7.82 13.23 37.75 48.85 83.05 15.9% 9.3% 14.7% 23.6% 0.71 0.78 0.00 9.8% 15.8% 23.7% 0.72 0.12 0.00 8.8% 22.5% 22.6% 1.13 0.00 0.00 ROA ROIC CROIC Current Ratio Total Debt/Equity Ratio Inventory Turnover Selected Financial Statements (In Millions, Except per Share Amounts) Revenue Gross Profit Margin % R&D Margin % Operating Income Margin % Net Income Margin % Earnings Per Share Basic Diluted $ $ $ $ $ $ $ Weighted Average Diluted Shares Outstanding Dividends Per Share Dividend Yield Net Cash From Operating Activities 2008 265 110 41.41% 7 2.75% 37 14.01% 15 5.61% 0.39 0.38 $ $ $ $ $ $ $ 39.18 $ $ 2009 290 129 44.36% 11 3.84% 45 15.43% 27 9.30% 0.77 0.74 $ $ $ $ $ $ $ 36.62 $ 0.00% 48 $ 2010 289 128 44.46% 14 4.84% 42 14.43% 25 8.68% 0.74 0.71 $ $ $ $ $ $ $ 35.53 $ 0.00% 43 $ 2011 309 142 45.87% 16 5.31% 47 15.04% 28 8.91% 0.88 0.83 $ $ $ $ $ $ $ 33.15 $ 0.00% 35 $ 2012 363 168 46.16% 20 5.54% 57 15.57% 33 9.08% 1.09 1.00 $ $ $ $ $ $ $ 32.92 $ 0.00% 56 $ TTM/Latest 417 193 46.37% 23 5.58% 67 16.11% 39 9.38% 1.23 1.14 34.59 $ 0.00% 59 $ 0.00% 66 (Dollars in Millions) Net Property, Plants & Equipment Total Assets Long-term Debt Stockholders' Equity $ $ $ $ 27 252 8 114 $ $ $ $ 36 271 7 134 $ $ $ $ 35 264 32 107 $ $ $ $ 41 295 66 78 $ $ $ $ 45 338 23 145 $ $ $ $ 65 444 6 246