introduction

advertisement

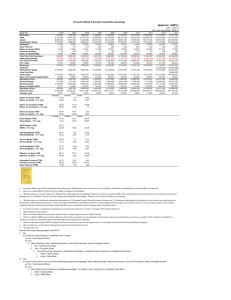

REAL CLIENT MANAGED PORTFOLIO RUI DENG FRANK DAMIAN PO-CHIEH SHIH March 29, 2012 AGENDA Introduction Macroeconomic Review Relevant Stock Market Company Review & Business Financial Analysis Financial Projections Recommendations INTRODUCTION Source: Capital IQ Benchmark S&P 500 INTRODUCTION – TARGET COMPANY EnerSys (ENS) is one of largest manufacturer, marketer and distributor of industrial batteries. ENS manufacture, market and distribute related products such as chargers, power equipment and battery accessories. In addition, ENS provides related after-market and customer-support services for industrial batteries. ENS’s products sell globally to over 10,000 customers in more than 100 countries. Source: ENS 2011 Annual Report, Form 10-K, p. 5 INTRODUCTION – TARGET COMPANY Position in GICS Map 201040 Electrical Equipment 20104010 Electrical Components & Equipment Companies that produce electric cables and wires, electrical components or equipment not classified in the Heavy Electrical Equipment Sub-Industry. INTRODUCTION – TARGET COMPANY STOCK PRICE Source: Morningstar INTRODUCTION – TARGET’S KEY STATISTICS Ticker ENS Stock Price 35.79 Beta: 1.79 52wk Range: 17.35 - 40.32 Market Cap: 1.71B P/E (ttm): 13.83 EPS (ttm): 2.59 Dividend Yield: N/A (N/A) Number of Shares Oustanding: Gross Profit Margin: 50,044,246 22.90% Operating Income Margin: 9.40% Net Profit Margin: 5.80% Return on Assets (ttm): 7.01% Return on Equity (ttm): 13.67% SOURCE: Yahoo Finance INTRODUCTION – TARGET’S KEY STATISTICS MACROECONOMICS REVIEW – GLOBAL STATISTICS MACROECONOMICS REVIEW – US STOCK MARKET RELEVENT STOCK MARKETINDUSTRY MARKET IN THE U.S. RELEVENT STOCK MARKETINDUSTRY COSTS STRUCTURE RELEVENT STOCK MARKETCOMPETITORS The industrial battery market is highly competitive. ENS’s competitors range from development stage companies to large domestic and international corporations. • Europe Exide Technologies, FIAMM, NorthStar, SAFT, and Hoppecke. • Americas Exide Technologies, East Penn Manufacturing, C&D Technologies Inc, NorthStar, SAFT and EaglePicher (OM Group). • Asia GS-Yuasa, Shin-Kobe and Zibo Torch, Coslight, Narada, and China Shoto. Source: ENS 2011 Annual Report, Form 10-K, p. 8 RELEVENT STOCK MARKETENS MARKET SHARE IN THE U.S. RELEVENT STOCK MARKETCOMPETITORS RELEVENT STOCK MARKETCOMPETITORS RELEVENT STOCK MARKETCOMPETITORS Competitor Comparisons ENS XIDE JCI Market Cap: 1.71B 252.07M 21.86B Employees: 8,400 10,027 162,000 12.90% -2.00% 9.20% 2.24B 3.08B 41.71B 21.97% 16.91% 15.07% 250.08M 185.88M 2.76B 9.02% 3.28% 4.79% 128.74M 45.75M 1.66B EPS (ttm): 2.59 0.55 2.41 P/E (ttm): 13.83 5.81 13.34 PEG (5 yr expected): 1.71 0.25 0.62 P/S (ttm): 0.75 0.08 0.53 Dividend Yield: N/A N/A 2.20% Return on Assets (ttm): 7.01% 3.05% 4.49% Return on Equity (ttm): 13.67% 11.08% 15.98% Qtrly Rev Growth (yoy): Revenue (ttm): Gross Margin (ttm): EBITDA (ttm): Operating Margin (ttm): Net Income (ttm): SOURCE: Yahoo Finance COMPANY REVIEW & BUSINESS HISTORY • EnerSys and its predecessor companies have been manufacturers of industrial batteries for over 100 years. • Morgan Stanley Capital Partners teamed with the management of Yuasa, Inc. in late 2000 to acquire from Yuasa Corporation (Japan) its reserve power and motive power battery businesses in North and South America. • On January 1, 2001, the company changed its name from Yuasa, Inc. to EnerSys to reflect our focus on the energy systems nature of our businesses. • In 2004, EnerSys completed an initial public offering (the “IPO”). Source: ENS 2011 Annual Report, Form 10-K, p. 6 COMPANY REVIEW & BUSINESS PRODUCTS & SERVICES ENS has two primary industrial battery product lines: reserve power products and motive power products. • Reserve power products • Backup power for the continuous operation of critical applications in telecommunications systems. • Uninterruptible power systems, or “UPS”, applications for computer and computer-controlled systems. • Other specialty power applications • Motive power products • Are used to provide power for manufacturing, warehousing and other material handling equipment, primarily electric industrial forklift trucks, mining equipment, and for diesel locomotive starting and other rail equipment. Source: ENS 2011 Annual Report, Form 10-K, p. 5 COMPANY REVIEW & BUSINES PRODUCTS & SERVICES ENS’s trademarks: ArmaSafePlus, Cyclon, DataSafe, Deserthog, Douglas Battery, Douglas Legacy, Energia , FIAMM Motive Power, General Battery, Genesis, Hawker, HUP, Ironclad, LifeGuard, LifePlus, Life Speed, LifeTech, Loadhog, Odyssey, Oerlikon Battery, Oldham, Perfect Plus, PowerGuard, PowerSafe, ProSeries, Redion, Smarthog, Superhog, Supersafe, TeleData, Varta, Waterless, Wi-IQ, Workhog and XFC Flex. ENS offer high-quality service, including preventative maintenance programs and customer support. The extensive industry experience of ENS’s sales organization results in strong long-term customer relationships. Source: ENS 2011 Annual Report, Form 10-K, p. 6 Financial Analysis Recent News: Mar 22, 2012 Completed a license and technology development agreement with PowerGenix Systems, Inc. to provide nickel-zinc batteries to EnerSys' industrial battery customers worldwide Mar 28, 2012 Announced the formation of a new joint venture company in India to produce and market batteries for industrial applications Expands the addressable markets for its products Source: ENS Investor Relations http://phx.corporate-ir.net/phoenix.zhtml?c=180086&p=irol-newsArticle&ID=1677641&highlight= http://phx.corporate-ir.net/phoenix.zhtml?c=180086&p=irol-newsArticle&ID=1675579&highlight= Financial Analysis Sales (2010-2011) ($million) Europe Americas Asia Total net sales 2010% Net sales 742 47.0% 700.3 44.3% 137.1 8.7% 1579.4 100.0% 2011% Net sales $ Increase % Increase 890.3 45.3% 148.3 20.0% 896.6 45.6% 196.3 28.0% 177.5 9.0% 40.4 29.5% 1964.4 100.0% 385 24.4% Reserve power Motive power Total net sales 820.5 758.9 1579.4 970.4 994 1964.4 52.0% 48.0% 100.0% 49.4% 50.6% 100.0% 149.9 235.1 385 18.3% 31.0% 24.4% Contributions to % Increase Europe Americas Asia Reserve power Motive power Volume Price Acquisition FoEx Total % Increase 16% 6% 3% -5% 20.0% 19% 4% 5% 28.0% 25% -2% 6% 29.5% 16% 21% 2% 6% 2% 6% -2% -2% 18.3% 31.0% Financial Analysis Interest Expense 2009 395.8 5.00% 19.8 4.3 1.7 25.8 ($million) Avg debt outstanding Avg cash interest rate Interest Accured interest Amortization of deferred financing fees Interest expense 2010 364.1 4.30% 15.7 5.4 1.7 22.8 2011 326.3 4.40% 14.4 5.9 1.9 22.2 Average 362.1 4.57% 5.2 1.8 Estimated Interest Expense ($ million) Avg debt outstanding Avg cash interest rate Interest Accured interest Amortization of deferred financing fees Interest expense 2012 2013 2014 2015 2016 2017 2018 362.1 4.57% 16.5 5.2 1.8 23.5 362.1 4.57% 16.5 5.2 1.8 23.5 362.1 4.57% 16.5 5.2 1.8 23.5 362.1 4.57% 16.5 5.2 1.8 23.5 362.1 4.57% 16.5 5.2 1.8 23.5 362.1 4.57% 16.5 5.2 1.8 23.5 362.1 4.57% 16.5 5.2 1.8 23.5 Financial Analysis Profitability For the Fiscal Period Ending Profitability Return on Assets % Return on Capital % Return on Equity % Return on Common Equity % 12 months Mar-312007 12 months Mar-312008 12 months Mar-312009 12 months Mar-312010 4.2% 6.3% 9.1% 9.2% 5.3% 8.0% 9.6% 9.7% 6.1% 9.0% 12.0% 12.0% 5.1% 7.2% 8.5% 8.6% 12 months Mar-312007 12 months Mar-312008 12 months Mar-312009 12 months Mar-312010 20.7% 14.7% 9.1% 6.0% 6.0% 3.0% 18.8% 12.3% 8.9% 6.6% 6.5% 2.9% 21.0% 13.0% 10.3% 8.0% 8.0% 4.2% 22.9% 14.8% 10.9% 8.1% 8.1% 3.9% 12 months LTM Mar-31- 12 months 2011 Jan-01-2012 6.8% 10.0% 12.9% 12.9% 7.0% 10.1% 13.7% 13.8% Margin Analysis For the Fiscal Period Ending Margin Analysis Gross Margin % SG&A Margin % EBITDA Margin % EBITA Margin % EBIT Margin % Net Income Margin % 12 months LTM Mar-31- 12 months 2011 Jan-01-2012 22.9% 13.2% 12.0% 9.7% 9.7% 5.8% 22.0% 13.0% 11.2% 9.1% 9.0% 5.8% Financial Analysis Outperform the benchmark Source: Bloomberg Financial Analysis Asset Turnover For the Fiscal Period Ending Asset Turnover Total Asset Turnover Accounts Receivable Turnover Inventory Turnover 12 months Mar-312007 12 months Mar-312008 12 months Mar-312009 12 months Mar-312010 12 months LTM Mar-31- 12 months 2011 Jan-01-2012 1.1x 4.6x 5.8x 1.3x 4.7x 5.8x 1.2x 4.6x 5.7x 1.0x 4.3x 5.3x 12 months Mar-312007 12 months Mar-312008 12 months Mar-312009 12 months Mar-312010 1.7x 1.0x 0.2x 1.7x 1.0x 0.0x 2.2x 1.5x 0.6x 2.1x 1.4x 0.3x 2.2x 1.3x 0.2x 2.2x 1.2x 0.3x 80.1 77.2 79.5 85.5 78.8 71.1 63.3 63.4 63.8 69.5 71.0 68.3 52.3 48.3 49.4 47.1 51.5 46.9 91.0 92.3 93.8 107.9 98.3 92.4 1.1x 4.6x 5.1x 1.2x 5.1x 5.3x Short-term Liquidity For the Fiscal Period Ending Short Term Liquidity Current Ratio Quick Ratio Cash from Ops. to Current Liability Avg. Days Sales Outstanding 12 months LTM Mar-31- 12 months 2011 Jan-01-2012 Avg. Days Inventory Outstanding Avg. Days Payable Outstanding Avg. Cash Conversion Cycle Financial Analysis Solvency For the Fiscal Period Ending Long Term Solvency Total Debt/Equity Total Debt/Capital LT Debt/Equity LT Debt/Capital Total Liabilities/Total Assets 12 months Mar-312007 12 months Mar-312008 12 months Mar-312009 12 months Mar-312010 73.8% 42.5% 69.7% 40.1% 61.3% 61.4% 38.0% 53.6% 33.2% 59.4% 57.7% 36.6% 52.9% 33.5% 54.8% 45.9% 31.5% 42.5% 29.1% 52.5% 12 months Mar-312007 12 months Mar-312008 12 months Mar-312009 12 months Mar-312010 12.4% 47.1% 13.9% 30.5% 6.8% 11.5% 170.2% 21.8% 68.9% 6.8% 22.7% 32.0% 43.1% 43.3% 13.0% 21.4% 96.6% 27.6% (94.5%) 6.3% 8.3% 37.2% (29.2%) (37.6%) (11.4%) (12.7%) 14.2% (3.1%) 5,361.3% 26.9% (12.7%) (24.0%) 7.7% 21.5% 4.6% 10.7% 28.9% 16.4% (37.7%) (21.1%) 12 months LTM Mar-31- 12 months 2011 Jan-01-2012 26.5% 20.9% 26.1% 20.6% 46.5% 28.4% 22.1% 26.0% 20.3% 46.7% Growth For the Fiscal Period Ending Growth Over Prior Year Gross Profit Net Income Accounts Receivable Inventory Net PP&E Total Assets Tangible Book Value Common Equity Cash from Ops. Capital Expenditures 12 months LTM Mar-31- 12 months 2011 Jan-01-2012 24.6% 82.1% 21.0% 31.7% 9.3% 10.7% 42.8% 24.9% (44.0%) 32.9% 16.6% 27.3% 8.0% 14.3% 3.8% 3.5% 4.8% 6.6% 112.3% (3.4%) Comparables – Multiples Valuation Reality Check DuPont Analysis 2008 2009 2010 2011 NPM 2.9% 4.2% 3.9% 5.8% TAT 1.30 2.53 9.7% 1.23 2.35 12.0% 1.00 2.17 8.6% 1.13 1.98 12.9% EM ROE Estimated 2012 2013 2014 2015 2016 2017 2018 NPM 7.2% 8.2% 8.9% 9.3% 9.6% 9.8% 9.9% TAT 1.24 1.86 1.28 1.80 1.29 1.70 1.27 1.57 1.25 1.44 1.20 1.34 1.16 1.24 16.6% 19.0% 19.4% 18.5% 17.2% 15.8% 14.2% EM ROE DCF Model CAPM WACC Risk -free rate Beta Risk Premium CAPM 2% 1.79 6% 12.7% Historical ROE ROE 31-Mar 31-Mar 31-Mar 31-Mar 2007 2008 2009 2010 2011 2012 9.2% 9.7% 12.0% 8.6% 12.9% 13.8% Cost of Equity CAPM ROE Cost of equity LTM 12m 31-Mar 1-Jan Weight 12.74% 80% 13.35% 20% 12.86% Debt 253,400 Cost of debt 7.26% Equity 1,679,493 Cost of equity 12.86% Tax rate 28.80% WACC 11.9% Discount Rate Adjustment Discount rate 1.0% 12.9% Financial Analysis Sensitivity Analysis Sensitive to discount rate 1% increase in discount rate Price estimation drops to $33 (13% decrease) 1% decrease in discount rate Price estimation increases to $45 (17% increase) Recommendation • • • Current Price = $34.77 DCF Model = $35.80 Comparables Approach = $36.31 • • Uncertainty over its ability to compete with new technologies and companies in Asia Insider Transaction Need to see tangible results from its cost-cutting initiatives and recent acquisitions Still believe in management and business • Recommendation: WATCH LIST • •