Insurance

advertisement

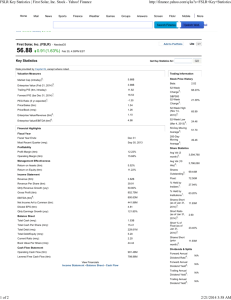

KWESI ACQUAY - WILLIAM KURINSKAS - CHRISTELLE KHOURI - ALEXANDRA RHEINHARDT WHY AUTO INSURANCE? AGENDA INDUSTRY STRUCTURE INDUSTRY OVERVIEW INDUSTRY ORGANIZATION COMPETITIVE LANDSCAPE MAJOR PLAYERS ADVERTISING STRATEGIES RECOMMENDATIONS INDUSTRY STRUCTURE INDUSTRY OVERVIEW Top 10 Brand Advertisers on TV (2011) $1,100 AT&T $702 Verizon… $415 $336 $326 $316 $283 $278 $266 $240 Geico State Farm DirecTV Wal-mart Comcast Home… Dish Allstate $0 $200 $400 $600 $800 TV advertising expenditures ($mm) $1,000 $1,200 AD/SALES RATIO: 1.2 AD GROWTH: 4.7% SALES GROWTH: 5.4% RECOVERY of AUTO INDUSTRY EXPECTED GROWTH INCREASE IN CONSUMER DEMAND HIGHER PREMIUMS UNDERWRITING SOFTWARE LOW PRODUCTION COSTS INDUSTRY ORGANIZATION INSURANCE CARRIER UNDERWRITING SOFTWARE BROKERS or AGENTS COMPETITIVE LANDSCAPE Other 33% State Farm 18% All State 10% American Family 2% Travelers 2% NationWide USAA Liberty 4% 4% 5% HHI 1170 Geico 9% Farmers 6% Progressive 8% Source: IBISWorld MAJOR PLAYERS 18.4% MARKET SHARE $33 billion REVENUE ABSENT FROM STOCK MARKET CROSS PROMOTION 9.5% MARKET SHARE $17 billion REVENUE 70% of PROPERTY & PREMIUMS PRODUCT BUNDLING 8.6% MARKET SHARE $15 million REVENUE LOW PRICES Until 1973: FEDERALEMPLOYEE-ONLY INSURER ADVERTISING STRATEGIES GEICO AD Percentage of Times Correctly Identified Brand/Character Recognition 100% 90% 80% 70% 60% 50% 40% Amount of Correct Identifications 30% 20% 10% 0% Allstate's Mayhem State Farm's Aaron Rodgers Farmer's Professor Allstate's Dennis Progressive's Flo Firm and Ad Character Geico's Gecko N=73 ALL STATE Aaron Rodgers GEICO CELEBRITY Chris Paul UNIVERSITY OF FARMERS Facebook response rates to insurance ads Nationwide Insurance 76.9% Progressive 76.5% State Farm 73.1% Allstate 57.9% Geico 56.1% Liberty Mutual 51.7% American Family Insurance 50.0% Farmers 46.4% 0% 10% 20% 30% 40% 50% 60% 70% Response rate (number of FB posts that received a response/ total) 80% 90% RECOMMENDATIONS Industry recommendations: Continue to promote online and adjust to evolving trends in social media Have more balance in commercials between building brand and selling product Emphasize more features in coverage or service attributes for better product differentiation Ensure commercial characters have stronger tie to actual product of insurance Allstate (ALL) key statistic s Previous closing price Market cap Enterprise Value/EBITDA $49.01 $23.4B 6.9 x P/E 10.5 x EPS $4.68 Dividend yield Investment Thesis: Strong recent market performance Superior margins compared to competitors Solid growth prospects (premium increases have been successful to compensate for low interest rates) Dividend increase despite Sandy $1.1B hit shows strength 2.0% ALL PGR Industry Market Cap: 23.40B 15.05B 2.78B Employees: 38,000 25,889 2.10K 0.04 0.09 0.02 33.32B 17.38B 2.46B 0.23 0.09 0.23 3.90B 1.62B 351.20M 0.11 0.09 0.07 2.31B 953.30M N/A Qtrly Rev Growth (yoy): Revenue (ttm): Gross Margin (ttm): EBITDA (ttm): Operating Margin (ttm): Net Income (ttm): EPS (ttm): 4.68 1.57 1.75 P/E (ttm): 10.47 15.9 12.72 1.24 1.89 1.4 0.7 0.86 0.87 PEG (5 yr expected): P/S (ttm): Free cash flows ($mm) Projections 2012A 2013E 2014E 2015E 2016E 2017E Terminal $27,027 $27,653 $28,387 $28,128 $28,386 $28,954 $29,533 2.3% 2.7% (0.9%) 0.9% 2.0% 2.0% 2,458 2,765 2,850 3,324 3,354 3,421 3,490 9.1% 10.0% 10.0% 11.8% 11.8% 11.8% 11.8% (968) (997) (1,163) (1,174) (1,197) (1,221) 245 245 245 245 245 245 0 0 0 0 0 0 0.0% 0 0.0% 0.0% 0 0.0% 0.0% 0 0.0% 0.0% 0 0.0% 0.0% 0 0.0% 0.0% 0 0.0% Unlevered free cash flow for discounting $2,042 $2,097 $2,405 $2,425 $2,468 $2,513 Discount period Discount factor Discounted free cash flows 0.875 92.7% $1,894 1.875 85.1% $1,784 2.250 82.4% $1,981 3.250 75.6% $1,832 4.250 69.3% $1,711 4.250 69.3% $24,889 Revenue % growth EBIT % margin Less: taxes at 35.0% Plus: D&A Less: capex % revenue Less: increases in NWC % revenue Present value of explicit cash flows Present value of perpetual cash flows Enterprise value Plus: cash Less: debt Less: non controlling interest and other Plus: unconsolidated investments Equity value Divided by shares outstanding Price per share $9,203 24,889 $34,092 4 (6,012) 0 0 $28,084 477.4 $58.81 Implied share price Discount rate 10.0% 9.5% 9.0% 8.5% 8.0% 1.0% $46.44 $49.02 $51.89 $55.13 $58.80 Terminal growth rate 1.5% 2.0% 2.5% $49.00 $51.87 $55.12 $51.88 $55.12 $58.83 $55.12 $58.81 $63.07 $58.80 $63.04 $67.99 $63.02 $67.95 $73.77 3.0% $58.85 $63.10 $68.04 $73.84 $80.75 DCF range: $51.88- $67.99 Valuation represents a 6% -39% premium over Monday’s closing price of $49.01