Target.doc

advertisement

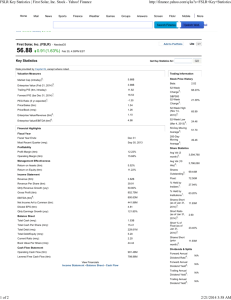

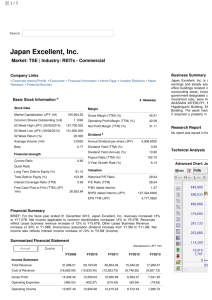

Target Corp.(TGT) Investment Recommendation Purchase price: $56.5 # of shares to purchase: 27 Stop-loss: $ 48 Take profit: $ 65 Pricing Closing Price 52 Week High $ 57.94 (11/10) $ 60.34 52 Week Low $ 44.70 Valuation FY ( Jan.) 2003 2004 2005 July 2005-July 2006 Profitability(ttm) ROA ROE Profit Margin Operating Margin Ya-hui Chang ycmp4@mizzou.edu Selection Criterion The desired weigh of service industry in our fund is 10% while the actual weigh is only 2.21%. Thus I choose the stock from the service industry. The criterion includes solid financial conditions, management, reasonable price, and growing EPS. Firm introduction Target Corporation operates general EPS $1.76 $2.07 $2.71 $2.88 merchandise discount stores in the United States. It offers an assortment of general merchandise, including consumables and commodities; electronics, entertainment, sporting goods, and toys; apparel and accessories; and home furnishings and decor; as well 8.48% 18.18% 4.58% 8.29% as a line of food items. The company operates kits stores under Target and ROE SuperTarget brands. It also sells its merchandise online, as well as offers credit cards to its customers. In addition, the company runs Target Clinics in select twin cities Target stores, which offer various services, including flu shots; and treatment for common illnesses, such as strep throat, bronchitis, and skin Market Data (11/10/06) Total Assets(July-2006) 35.4B Market Cap 49.75 Avg. Vol (3mo.) 5,490,520 EPS (ttm) $2.88 Trailing P/E Forward P/E Beta: Target Corp. 20.09 16.28 1.02 conditions. As of August 31, 2006, Target operated 1,444 stores in 47 states. The company was incorporated in 1902 and is headquartered in Minneapolis, Minnesota. Market and Competition Target focuses not only on lower price, but also on the design and the services. Based on the higher gross margin and the operation margin of Target, we can find that Target provides higher quality/designed products to consumers and it has a good cost control and management compared with its competitors. In the price, Target has higher P/E ratio than its competitors, but it has lower PEG ratio. We can see Target has higher growing opportunity than others. DIRECT COMPETITOR COMPARISON: TGT COST Market Cap: 49.12B 24.53B Employees: 338,000 Qtrly Rev Growth (yoy): 11.30% 19.00% Revenue (ttm): 55.36B Gross Margin (ttm): Pvt1 WMT Industry N/A 197.99B 2.22B N/A 133,0001 1,800,000 11.40K N/A 11.30% 9.60% 60.15B 19.09B2 329.86B 4.53B 32.37% 12.31% N/A 23.22% 28.33% EBITDA (ttm): 6.00B 2.08B N/A 24.45B 305.85M Oper Margins (ttm): 8.29% 2.71% N/A 5.87% 2.94% Net Income (ttm): 2.54B 1.10B 1.11B1 11.51B 48.15M EPS (ttm): 2.884 2.297 N/A 2.557 1.30 P/E (ttm): 19.83 22.82 N/A 18.57 18.59 PEG (5 yr expected): 1.05 1.49 N/A 1.13 1.29 P/S (ttm): 0.87 0.40 N/A 0.60 0.58 COST = Costco Wholesale Corp. Pvt1 = Kmart Corporation (subsidiary or division) WMT = Wal-Mart Stores Inc. Industry = Discount, Variety Stores Nov. 8th, 2006. From Yahoo Finance Price performance In the long term (5 years), we can see the performance of Target has been better than those of S&P 500 and WalMart. However, the price performed weakly in the past year, especially from 2005 Q4 to 2006 Q2. (One possible reason is that the growing in 2006 is slower.) Since August 2006, Target performs very well. One reason is the good expectation of future sales, and another may be the underestimated price in the past. 3 Months 1 Year 5 Years Financial Analysis Profit/Cost Structure: Target has a stable cost structure, where the COCS and SG&A account for around 87-88% of the total revenue. Interest expense is pretty low. The EBIT and EPS are growing. The cash dividend, which accounts for 14-16% of EPS, is growing. 2006Jan-July Revenue 2005Jan-July 2005 2004 2003 100% 100% 100% 100% 100% COCS 65.47% 65.55% 66.38% 67.13% 67.55% SG&A. 22.38% 21.96% 21.26% 20.92% 20.6% Interest exp. 1.03% 0.9% 0.88% 1.2% 1.3% EBIT 7.17% 7.09% 7.3% 6.47% 6.19% Diluted EPS $1.33 $1.16 $2.71 $2.07 $1.76 Cash dividend $0.22 $0.18 $0.38 $0.31 $0.27 Growth Trend: Target performs very well in FY2005 (Jan.29, 2005- Jan 28, 2006). The growing is slower in 2006. Target has a weaker sale in October, but it offered a forecast that its same-store sales will jump 4% to 7% in November. General expected growth rate for the next year is 15%. (from Yahoo Finance) 2006 Q1-Q2 2005 Five-year Compound Annual Growth rate 11.69% 12.3% 12.1% EBIT 12.9% 20.1% 16.9% EPS 14.53% 31.0% 20.7% Revenue B/S: The capital expenditures are growing since 2005 January. The long term debt/equity is stable. It seems that the quick ratio and current ratio are low, but compared with the competitor, WalMart, they are higher. (The current ratio in Jan 2006 of WalMart is 0.89. Because the industry is receiving cash everyday, the low current ratio can not be a big problem. 2006 July 2006 Jan 2005 Jan 35,423M 34,995M 32,293M Capital expenditures 1,899M(Half year) 3,388M 3,068M L-term Debt/ Equity 0.65 0.64 0.69 Quick ratio 0.76 0.89 1.03 1.4 1.5 1.69 Total Asset Current ratio Valuation: Two stage dividend discount model: Based on the information below: the Beta of Target is 1.02 (from Yahoo Finance), the expected S&P 500 return is 8.5%, and the interest rate of 10 years bond is 4.59%, I calculate the discounted rate of Target: 4.59% + 1.02 * ( 8.5% - 4.59%) = 8.58%. I expect the growth rate for the high growth phase is 15% (based on 2006 EPS growth rate), and the period of high growth phase is 3 years. The growth rate for staple stage is 6%. The payout ratio in high growth stage is 14.58% (the current dividend policy of Target) while the payout ratio in the stable stage is 45% (the same as WalMart). The result: Value of assets in place = $4.90 Value of stable growth = $12.37 Value of extraordinary growth = $47.46 Value of the stock = $64.72 Relative model: a. P/E ratio The P/E ratio in the industry is 18.59 (from Yahoo Finance), and the EPS of Target (July 2005-July 2006) is $ 2.88. Using the P/E ratio model, the price should be $53.54 (18.59 times 2.88). The current price is $ 57.94(11/10/2006). b. PEG ratio The expected growth rate (from Yahoo Finance) is 18.89%. The PEG ratio in the industry is 1.29. The price should be $70.18 (18.89 * 1.29 * 2.88). It is higher than the current price. Because Target has higher expected growth rate than its competitors, it deserves higher price and P/E ratio. I think the price from PEG ratio is more reasonable. Analyst opinion The mean target is $63.73, and the median target is $64, which is similar to the value from Dividend Discount Value. The consensus recommendation from CNN Money is “Overweight”. PRICE TARGET SUMMARY Mean Target: 63.73 Median Target: 64.00 High Target: 70.00 Low Target: 55.00 No. of Brokers: 15 Yahoo Finance 1.0 - 1.24: Buy 1.25 - 1.74: Overweight 1.75 - 2.24: Hold 2.25 - 2.74: Underweight 2.75 - 3.0: Sell Consensus Recommendations Current Mean 1.4 Number of Brokers 15 Industry Mean 7-Days Ago Mean 1.4 30-Days Ago Mean 1.3 60-Days Ago Mean 1.4 90-Days Ago Mean 1.5 Sector Mean WSJ/DJ US Mean 1.62 CNN Money News As the holiday session is coming soon, the retailers forecast the sales would grow. “In the wake of October's results, most analysts took down earnings estimates on Wal-Mart, but raised those on Target.” “On Friday, retail watchers were expecting Wal-Mart to deliver a per-share profit of 60 cents, down from an average of 62 cents a share, according to results culled from analysts reporting to Thomson First Call. They're projecting total sales at $84.48 billion, a near-11% increase over the year-ago period. “ “At Target, the average had crept up a penny to 55 cents a share. Total sales were forecast at $13.58 billion, up 11% over last year.” "Our outlook remains favorable for Target, and we believe sale momentum remains healthy as we enter the holiday season," Lehman Brothers analyst Robert Drbul wrote in a preview note. By Jennifer Waters, MarketWatch Economy and the risk The sales of retailers are affected by the economic situation significantly. We can use the Consumer Confidence Index to predict the sales in the Christmas holiday session. In October, CCI is slightly lower that CCI in September. The economy in USA may grow slower, and it is one risk for Target. Another risk is the interest rate. Because Target has its own credit card business, which is floating-rate, the fluctuation in the interest rate will increase the exposure of the interest rate risk. On the other hand, the interest rate has a huge impact on the whole economy, which affects the CCI and the sales of Target. As well as the interest rate, the inflation rate is another consideration for the whole economy. Unfortunately, both are uncertain now. The last one is the competitive industry. To increase the sales in the holiday selling session, Target’s main competitors, WalMart, will have some promotions to stimulate the sales. Conclusion Pros Cons Solid financial conditions Growth opportunity Higher margin Good cost control and management Uncertain economy Competitive industry Favorable opinions from analysts Recommendation I suggest purchasing 27 shares of Target when the price is below $56.5. The amount of the total assets of the fund is $78,193.79. The desired weigh of service industry is 10% while the actual weigh is only 2.21%. Thus I recommend that the weigh of Target is 2%. Hence the number of shares to purchase is 27. Based on the value from DDM and other analysts’ opinion, I take $64 as the target price to take profit. Reference: http://www.conference-board.org/ Yahoo Finance CNN Money Wall Street Journal 2005 annual report of Target 2006 Q2 report of Target