Colgate-Palmolive India (COLPAL) | 1632

advertisement

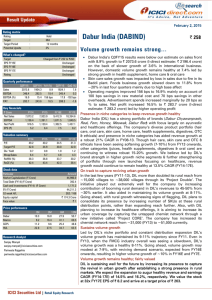

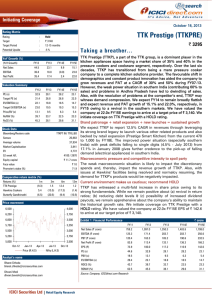

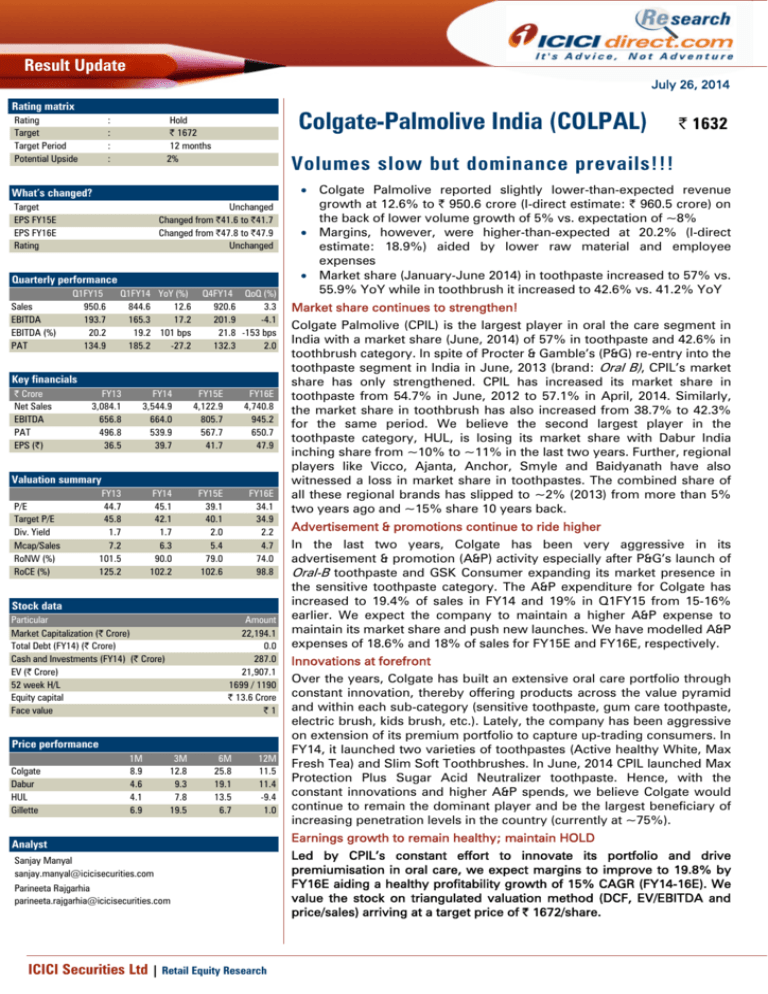

Result Update July 26, 2014 Rating matrix Rating Target Target Period Potential Upside : : : : Colgate-Palmolive India (COLPAL) Hold | 1672 12 months 2% Volumes slow but dominance prevails!!! What’s changed? Target EPS FY15E EPS FY16E Rating Unchanged Changed from |41.6 to |41.7 Changed from |47.8 to |47.9 Unchanged Quarterly performance Sales EBITDA EBITDA (%) PAT Q1FY15 950.6 193.7 20.2 134.9 Q1FY14 YoY (%) 844.6 12.6 165.3 17.2 19.2 101 bps 185.2 -27.2 Q4FY14 QoQ (%) 920.6 3.3 201.9 -4.1 21.8 -153 bps 132.3 2.0 Key financials | Crore Net Sales EBITDA PAT EPS (|) FY13 3,084.1 656.8 496.8 36.5 FY14 3,544.9 664.0 539.9 39.7 FY15E 4,122.9 805.7 567.7 41.7 FY16E 4,740.8 945.2 650.7 47.9 FY14 45.1 42.1 1.7 6.3 90.0 102.2 FY15E 39.1 40.1 2.0 5.4 79.0 102.6 FY16E 34.1 34.9 2.2 4.7 74.0 98.8 Valuation summary P/E Target P/E Div. Yield Mcap/Sales RoNW (%) RoCE (%) FY13 44.7 45.8 1.7 7.2 101.5 125.2 Stock data Particular Market Capitalization (| Crore) Total Debt (FY14) (| Crore) Cash and Investments (FY14) (| Crore) EV (| Crore) 52 week H/L Equity capital Face value Amount 22,194.1 0.0 287.0 21,907.1 1699 / 1190 | 13.6 Crore |1 Price performance Colgate Dabur HUL Gillette 1M 8.9 4.6 4.1 6.9 3M 12.8 9.3 7.8 19.5 | 1632 6M 25.8 19.1 13.5 6.7 12M 11.5 11.4 -9.4 1.0 Analyst Sanjay Manyal sanjay.manyal@icicisecurities.com Parineeta Rajgarhia parineeta.rajgarhia@icicisecurities.com ICICI Securities Ltd | Retail Equity Research • Colgate Palmolive reported slightly lower-than-expected revenue growth at 12.6% to | 950.6 crore (I-direct estimate: | 960.5 crore) on the back of lower volume growth of 5% vs. expectation of ~8% • Margins, however, were higher-than-expected at 20.2% (I-direct estimate: 18.9%) aided by lower raw material and employee expenses • Market share (January-June 2014) in toothpaste increased to 57% vs. 55.9% YoY while in toothbrush it increased to 42.6% vs. 41.2% YoY Market share continues to strengthen! Colgate Palmolive (CPIL) is the largest player in oral the care segment in India with a market share (June, 2014) of 57% in toothpaste and 42.6% in toothbrush category. In spite of Procter & Gamble’s (P&G) re-entry into the toothpaste segment in India in June, 2013 (brand: Oral B), CPIL’s market share has only strengthened. CPIL has increased its market share in toothpaste from 54.7% in June, 2012 to 57.1% in April, 2014. Similarly, the market share in toothbrush has also increased from 38.7% to 42.3% for the same period. We believe the second largest player in the toothpaste category, HUL, is losing its market share with Dabur India inching share from ~10% to ~11% in the last two years. Further, regional players like Vicco, Ajanta, Anchor, Smyle and Baidyanath have also witnessed a loss in market share in toothpastes. The combined share of all these regional brands has slipped to ~2% (2013) from more than 5% two years ago and ~15% share 10 years back. Advertisement & promotions continue to ride higher In the last two years, Colgate has been very aggressive in its advertisement & promotion (A&P) activity especially after P&G’s launch of Oral-B toothpaste and GSK Consumer expanding its market presence in the sensitive toothpaste category. The A&P expenditure for Colgate has increased to 19.4% of sales in FY14 and 19% in Q1FY15 from 15-16% earlier. We expect the company to maintain a higher A&P expense to maintain its market share and push new launches. We have modelled A&P expenses of 18.6% and 18% of sales for FY15E and FY16E, respectively. Innovations at forefront Over the years, Colgate has built an extensive oral care portfolio through constant innovation, thereby offering products across the value pyramid and within each sub-category (sensitive toothpaste, gum care toothpaste, electric brush, kids brush, etc.). Lately, the company has been aggressive on extension of its premium portfolio to capture up-trading consumers. In FY14, it launched two varieties of toothpastes (Active healthy White, Max Fresh Tea) and Slim Soft Toothbrushes. In June, 2014 CPIL launched Max Protection Plus Sugar Acid Neutralizer toothpaste. Hence, with the constant innovations and higher A&P spends, we believe Colgate would continue to remain the dominant player and be the largest beneficiary of increasing penetration levels in the country (currently at ~75%). Earnings growth to remain healthy; maintain HOLD Led by CPIL’s constant effort to innovate its portfolio and drive premiumisation in oral care, we expect margins to improve to 19.8% by FY16E aiding a healthy profitability growth of 15% CAGR (FY14-16E). We value the stock on triangulated valuation method (DCF, EV/EBITDA and price/sales) arriving at a target price of | 1672/share. Variance analysis Q1FY15 Q1FY15E Q1FY14 YoY (%) Q4FY14 QoQ (%) 950.6 960.5 844.6 12.6 920.6 3.3 Net Sales Operating Income 6.3 8.5 15.1 -58.5 6.7 -6.4 Raw Material Expenses Employee Expenses SG&A Expenses 357.2 58.4 180.6 385.1 68.7 122.9 328.3 62.0 101.4 8.8 -5.8 78.1 365.9 43.4 99.5 -2.4 34.6 81.5 Other operating Expenses 167.1 209.4 202.8 -17.6 216.7 -22.9 EBITDA EBITDA Margin (%) Depreciation 193.7 20.2 16.6 182.8 18.9 13.4 165.3 17.2 19.2 101 bps 11.7 41.0 0.0 6.5 0.0 15.0 0.0 17.1 NA -62.3 0.0 3.9 NA 63.7 PBT before exceptional Exceptional Items Tax Outgo 183.6 0.0 48.7 184.4 0.0 52.5 170.7 -70.6 56.1 7.6 NA -13.2 190.5 6.2 52.1 -3.6 -100.0 -6.6 PAT 134.9 131.8 185.2 -27.2 132.3 2.0 5.0 8.0 9.0 -400 bps NA NA NA 57.0 9.0 NA 11.0 NA 55.9 110 bps 7.0 57.1 NA -10 bps Volume Mkt Share (Toothbrush) 42.6 Source: Company, ICICIdirect.com Research NA 41.4 120 bps 42.3 30 bps Interest Other Income Key Metrics YoY growth (%) Volume Growth overall Volume Growth (Toothpastes) Volume Mkt Share (Toothpaste) 201.9 -4.1 21.8 -153 bps 15.3 8.2 Comments Revenue growth was led by ~5% growth in volumes and gain in market share both in toothpaste and toothbrush. Employee expenses declined by 5.8% YoY, aiding the margins Led by the increasing competitive intensity by players as HUL & P&G and new launches by Colgate during the quarter, marketing expenses have witnssed a significant uptick. Margins were supported by lower raw materials and employee cost. Higher depreciation is on the back of commencement of new facilities in Gujarat. Colgate's tax rate increased by ~330 bps to 26.5% following the end of tax exemptions at its production unit in Baddi The decline in volume growth depicts the persisting slowdown in the economy and increasing competition in the oral care segment Led by sustained marketing initiatives of the company, it has been able to strengthen its market share even in a slowing demand environment. Change in estimates (| Crore) Sales EBITDA EBITDA Margin (%) PAT EPS (|) Old 4,087.1 782.6 19.0 553.0 40.7 FY15E New % Change 4,122.9 0.9 805.7 3.0 19.4 42 bps 567.7 41.7 2.6 2.6 Old 4,683.3 934.3 19.8 650.7 47.8 FY16E New % Change 4,740.8 1.2 945.2 1.2 19.8 1 bps 650.7 47.9 Comments We are revising our margins slightly upwards for FY15E as we believe the higher number of new launches and higher marketing spends would drive premiumization at a higher rate than expected earlier. 0.0 0.0 Source: Company, ICICIdirect.com Research Assumptions Toothpaste Vol. Growth(%) Toothpaste Value Growth(%) FY13 10.0 18.2 FY14 9.4 14.0 Toothbrush Vol. Growth(%) Toothbrush Value Growth(%) Raw Material/Sales % Marketing Exp./Sales % 19.0 22.2 40.5 15.9 19.5 29.1 39.6 19.4 Current FY15E FY16E 9.4 8.8 14.8 13.9 17.5 20.4 38.7 18.6 15.0 19.0 39.5 18.0 Earlier FY15E FY16E 9.4 8.8 14.8 13.9 9.5 12.2 40.1 18.0 15.0 19.0 40.0 17.7 Comments Sustained higher marketing spends would keep volume growth healthy We expect value growth to remain strong following the revival in urban demand and rate of premiumization Increasing competition from P&G and HUL would keep ad-ex & sales promotion higher through FY16E Source: Company, ICICIdirect.com Research ICICI Securities Ltd | Retail Equity Research Page 2 Company Analysis Sustained market share to keep revenue growth healthy at 15.6% CAGR CPIL has successfully maintained its market leadership in the oral care segment with 56% share by volume (2013) in the toothpaste category and 41.5% volume share (2013) in the toothbrush category. The nearest competitors in the toothpaste and toothbrush categories are at almost half the share of CPIL with 22.8% (2013) and ~28% (2013) share by volume, respectively. With the ability to maintain the premium in its market share and comprehensive oral care portfolio CPIL registered strong revenue growth of 16.5% CAGR (FY08-13). Going ahead, we believe that led by CPIL’s strong brand equity it would continue to maintain its dominance in the segment and further boost its revenue growth through increasing presence in rural India. Hence, we expect healthy revenue CAGR of 15.6% in FY14-16E led by ~9% volume CAGR. Exhibit 1: Revenue CAGR to remain healthy at 14.9% (FY13-16E) 21.3 13.8 15.0 15.8 19.6 14.5 13.2 15.7 14.9 25 17.1 16.3 12.6 15.0 20 15 10 Revenues in | crore (LHS) 5 0 FY16E FY15E Q4FY15E Q3FY15E 1037 1057 1078 4123 4741 Q2FY15E Q1FY15 951 FY14 FY13 FY12 FY11 FY10 FY09 1473 1695 1962 2221 2693 3084 3545 FY08 5000 4500 4000 3500 3000 2500 2000 1500 1000 500 0 Revenue Growth (YoY) in % (RHS) Source: Company, ICICIdirect.com Research Exhibit 2: CPIL's market share has only strengthened over the years 41.5 41.4 41.4 41.5 42.3 57.1 54.0 54.5 38.7 39.3 39.8 55.4 54.6 55.9 56 42.6 57 42 41 40 56 39 54.5 38 June,'14 April,'14 CY13 Sep,'13 Jun,'13 Mar,'13 CY12 Sep,'12 Jun,'12 36 Toothpastes - LHS Toothbrush - RHS Source: Company, ICICIdirect.com Research ICICI Securities Ltd | Retail Equity Research 43 37 Mar,'12 58 57 57 56 56 55 55 54 54 53 53 52 Page 3 Toothpaste supremacy to drive revenues from segment at 14.4% CAGR (FY14-16E) Led by the dominance of CPIL in toothpastes with a presence across premium, popular and mass categories and having SKUs across variants (regular, sensitive, herbal, whitening, gum care, freshness), CPIL’s market share in toothpaste has strengthened from 49.4% in CY08 to 56% in CY13. Aided by the strengthening market share, toothpaste revenues (~75% of CPIL’s revenues in FY13) and increasing penetration revenues from the segment have grown at a CAGR of 16.9% in FY08-13. Going ahead, we believe that with toothpaste per capita consumption expected to grow at 5.6% CAGR in FY13-23E to ~240 gm by FY23E and Colgate’s ability to maintain its market leadership through increasing innovation and distribution, CPIL’s toothpaste volume CAGR would remain strong at 9.1% in FY14-16E. Further, with new launches both in the premium and economy segments maintaining their pace, we expect CPIL to post value growth of 14.4% CAGR in FY14-16E. Exhibit 3: Toothpaste revenue growth to remain healthy at 14.4% CAGR 5000 4000 3000 2000 1308.8 1492.4 1746.6 1977.5 2413.8 2852.0 3250.0 3732.4 4251.8 Exhibit 4: Volume growth to remain healthy at ~9% 20 15 10 17.0 14.0 13.2 14.0 12.2 11.0 12.0 12.0 9.0 18.2 14.0 10.0 9.4 14.8 9.4 13.9 8.8 5 1000 0 FY08 0 FY08 FY09 FY10 FY11 FY12 FY13 back of a significant increase in volume in FY07 led by a promotion offer by the company in FY07. We believe the offer was implemented by the company to de-stock its toothbrush inventory from its Sewri unit. The unit was shut down during that year and the company shifted the manufacturing of toothbrushes capacity to the Baddi unit 723.1 607.6 504.5 FY09 FY10 FY11 FY12 Volume Growth FY13 FY14E FY15E FY16E Value Growth 390.7 Exhibit 6: …led by volume CAGR of ~16% 40 30 26.8 29.7 24.2 24.7 21.6 26.0 15.6 14.9 20 29.1 22.2 20.4 19.0 19.0 19.5 17.5 15.0 6.6 10 0 -10 FY08 FY11 Strengthening presence in toothbrush to sustain growth at 19.7% CAGR (FY14-16E) CPIL’s undeterred market share at 41.5% (CY13) in the toothbrush segment (~11% of revenues in FY13) has been led by strong volume CAGR (FY08-13) of 21.2% and value CAGR of 19.4% (FY08-13). The company’s brand strength has enabled it to grab market share of unbranded players. Further, CPIL’s nearest competitor, P&G, with brand Oral-B, continues to maintain a distant No. 2 position in the segment with ~19% volume share in the segment. We believe that with consumers in need of upgrading in rural markets and uptrading demand by urban consumer, CPIL’s revenues from the toothbrush segment would continue to grow at 19.7% CAGR (FY14-16E) led by healthy volume CAGR of 16.2%. We expect CPIL’s strong brand equity to aid in further strengthening the market share for the company in the toothbrush segment. Exhibit 5: Toothbrush revenue growth to remain strong at 19.7% CAGR… 319.8 FY10 Source: Company, ICICIdirect.com Research The decline in toothbrush volume in FY08 was on the 213.4 246.6 161.2 200.2 FY09 FY14 FY15E FY16E Source: Company, ICICIdirect.com Research 800 700 600 500 400 300 200 100 0 22.1 25 FY12 FY13 FY14 FY15E FY16E FY08 -7.9 FY09 FY10 FY11 FY12 Volume Growth Source: Company, ICICIdirect.com Research ICICI Securities Ltd | Retail Equity Research FY13 FY14E FY15E FY16E Value Growth Source: Company, ICICIdirect.com Research Page 4 Increasing penetration, per-capita consumption to aid growth The penetration of toothpaste in India is ~71% (2012), with ~35 crore of the population still using conventional methods of brushing. Though urban penetration is higher at ~91% (2012), rural penetration lags behind at only 63% (2012). Hence, we believe there lies a huge untapped opportunity for CPIL to increase its reach and volumes being the market leader of the segment. Further, the overall per capita consumption of toothpaste in India is significantly lower at 137 gm (2012) compared to other developing nations, China at 277 gm, Philippines at 374 gm and Brazil at 622 gm, providing enough room for CPIL to maintain its volume growth. We believe increase in volume growth & per capita consumption would come through increasing awareness on oral hygiene, change in consumer habits (brushing twice daily) and increasing penetration, aiding the company to maintain its healthy volume and value growth Margins to gain strength on improving mix CPIL’s EBITDA margins have improved significantly from 15.4% in FY08 to 20.8% in FY13 led by gross margin expansion and increasing contribution of premium products in revenues. Led by the company’s strong brand equity, CPIL enjoys strong pricing power in the oral care industry enabling it to easily pass on higher raw material cost through increasing prices without impacting its volume growth and concurrently expanding its gross margins. Hence, higher gross margins have enabled the company to expand its EBITDA margins. Since Q1FY14, however, CPIL’s margins have been witnessing moderation following the increased competitive action in the oral care industry and slowing urban consumption demand (moderating the rate of premiumisation in the segment). The increased competitive activity (HUL’s aggressiveness and P&G’s re-entry) has pulled up the marketing & other expenditure (includes sales promotion expenses) of CPIL, thereby moderating its margins to 18.6% in FY14. We believe that though the high marketing expenses have stressed margins in the near term, they have aided CPIL in maintaining its market share and a healthy volume growth in a tough scenario. The change in portfolio mix aided by higher marketing spends has already improved the margins to 20.2% in Q1FY15. Hence, we believe that as consumption demand revives (driving premiumisation) and CPIL further gains market share in the segment, EBITDA margins would trend back to 19.8% by FY16E. Exhibit 7: EBITDA margins to improve to 19.8% by FY16E 21.6 15.4 20.2 21.5 20.8 18.6 20.2 19.1 19.3 19.1 19.4 19.8 15 657 664 194 199 206 207 806 Q1FY15 Q2FY15E Q3FY15E Q4FY15E FY15E 945 FY16E 579 FY14 FY10 449 FY13 424 FY12 260 FY11 227 FY09 10 EBITDA (| crore) - LHS EBITDA Margin (%) - RHS Source: Company, ICICIdirect.com Research ICICI Securities Ltd | Retail Equity Research 25 20 15.4 FY08 1000 900 800 700 600 500 400 300 200 100 0 Page 5 5 0 Exhibit 8: Marketing expenses to remain high until FY16E Exhibit 9: RM cost to sales ratio to remain low at ~40% until FY16E Marketing Expenses to Sales % FY16E FY15E Q4FY15E Q3FY15E FY08 FY16E FY15E Q4FY15E Q3FY15E Q2FY15E Q1FY15 FY14 FY13 FY12 FY11 FY10 FY09 FY08 0 Q2FY15E 5 Q1FY15 19.4 19.0 18.5 18.5 18.5 18.6 18.0 FY14 16.1 15.3 15.8 15.3 15.9 FY13 17.8 FY12 10 FY11 15 FY10 17.3 17.6 17.4 17.1 17.8 17.5 17.2 20 15.9 16.4 15.4 16.0 16.2 16.7 FY09 46 43.7 42.9 44 40.5 42 39.6 39.3 39.0 39.6 39.0 39.3 38.9 38.7 39.5 40 37.6 38 36 34 25 Raw Material Expenses to Sales % Other Expenditure to sales % Source: Company, ICICIdirect.com Research Source: Company, ICICIdirect.com Research Brand strength to aid in fighting competition CPIL’s brand strength has aided to keep competition away and maintain its strong dominance in toothpaste and toothbrush. However, since H1FY14 (re-entry of P&G and expanding portfolio by Dabur, GSK Consumer, HUL), competition has been getting aggressive targeting the huge untapped opportunity of the segment. This has pulled up CPIL’s sales & promotion expenses ~30% YoY pressurising margins (declined from ~21% in FY13 to ~18% in FY14). Though margins have been stressed, CPIL’s market share has further strengthened led by CPIL’s high brand equity aiding in keeping competition at bay. We believe there could be near term challenges for margins. However, with CPIL’s ability to innovate and maintain its dominance, margins would revive. Higher taxes to limit PAT growth Though we believe CPIL’s margins would get back to higher levels of ~20% by FY16E, PAT growth is estimated to moderate to 9.8% CAGR (FY14-16E) against 16.5% CAGR (FY08-13). The moderation in earnings growth would be led by higher tax incidence on CPIL’s Baddi plant (Himachal Pradesh). CPIL’s Baddi plant was under 100% tax exemption until March, 2010 and is currently enjoying ~30% tax exemption until FY15, after which it will enjoy no further exemptions. We estimate the effective tax rate for CPIL will increase from 25.8% in FY14 to 30% in FY16E, keeping earnings growth of CPIL under check. Exhibit 10: PAT growth to moderate following higher tax incidence 700 600 500 22.6 20.7 24.1 25.1 25.8 28.0 30.0 30 25 16.0 400 20 12.7 300 15 10 200 100 0 231.7 290.2 423.3 405.2 446.5 496.8 539.9 567.7 650.7 FY08 FY09 FY10 FY11 FY12 FY13 FY14E FY15E FY16E PAT (| crore) Tax Rate (% of PBT) Source: Company, ICICIdirect.com Research ICICI Securities Ltd | Retail Equity Research 35 Page 6 5 0 High dividend payout and strong return ratios CPIL has had exceptional return ratios of more than 100% mainly due to high dividend payout of ~70% and ~| 560 crore of free cash flow in FY13. The free cash flow of CPIL has increased from | 380 crore in FY08 to | 560 crore in FY13. Return ratios for CPIL have remained on a higher trajectory of ~100% since FY08 following the capital reduction by the company in FY08 and reducing the face value to | 1/share from | 10/share. This improved the RoE from 57.1% in FY07 to 142.8% in FY08. With no major capex plans lined up by the company, we expect the payout to sustain at ~75% until FY16E, thereby keeping return ratios at healthy levels. Dividend payout dipped slightly in FY14E following CPIL’s capex in new facilities in Sanand, Gujarat and Sricity, Andhra Pradesh. However, with the Gujarat plant already in operation from Q1FY15 onwards, and no new capex plans ahead, we expect dividend payout to increase again to ~75% in FY15E. Exhibit 11: Return ratios to remain at elevated levels Exhibit 12: Dividend payout to return to ~75% by FY16E 130 150 120 130 110 110 90 100 70 90 50 80 30 FY08 FY09 FY10 FY11 FY12 FY13 FY14E FY15E FY16E RoCE (%) - LHS RoNW(%) - RHS Source: Company, ICICIdirect.com Research ICICI Securities Ltd | Retail Equity Research 40 35 30 25 20 15 10 5 0 90 80 70 60 50 40 30 20 10 0 FY08 FY09 FY10 FY11 FY12 Dividend Per share (|) - RHS FY13 FY14 FY15E FY16E Dividend Payout (%) - LHS Source: Company, ICICIdirect.com Research Page 7 Outlook & valuation With Colgate’s strengthening presence in toothpastes in spite of fierce competition in the segment we remain positive on the long term growth driven by increasing per-capita consumption and premiumisation in the segment. The company’s unmatched product portfolio would continue to maintain its dominance in the oral care segment. Though there are few near term concerns for margins given the increased competitive intensity in the segment, we believe CPIL’s higher marketing spends and strengthening market share would continue to yield positive long term returns for the company. However, we remain wary of the expensive valuations of the company. CPIL is currently trading at 34x its FY16E EPS of | 47.9, higher than its historical average P/E of 28x. We value CPIL on triangulated valuation method, assigning 50% weightage to price to sales multiple, 40% weightage to DCF and 10% to EV/EBITDA, arriving at a target price of | 1672 per share. We maintain our HOLD recommendation on the stock. Exhibit 13: Triangulated valuation method Assumption 5x Price to Sales of FY16E Terminal Growth rate - 4%; WACC - 10.9% 27x EV/EBITDA for FY16E Price/Sales DCF EV/EBITDA Target Price Price 1720.4 1616.6 1649.2 Weightage 50% 40% 10% Value 860 647 165 1672 Source: Company, ICICIdirect.com Research Exhibit 14: Two year forward price/earning multiple 2000 1600 1200 800 400 Price 35x 30x 25x 20x Apr-14 Nov-13 Jun-13 Jan-13 Aug-12 Mar-12 Oct-11 May-11 Dec-10 Jul-10 Feb-10 Sep-09 Apr-09 0 15x Source: Company, ICICIdirect.com Research Exhibit 15: Valuations FY13 FY14 FY15E FY16E Sales (| cr) 3084.1 3544.9 4122.9 4740.8 Growth (%) 14.5 14.9 16.3 15.0 EPS (|) 36.5 36.2 41.7 47.9 Growth (%) 22.6 -0.9 15.4 14.6 PE (x) 44.7 45.1 39.1 34.1 EV/EBITDA (x) 33.1 33.0 27.1 22.9 RoNW (%) 101.5 90.0 79.0 74.0 Source: Company, ICICIdirect.com Research ICICI Securities Ltd | Retail Equity Research Page 8 RoCE (%) 125.2 102.2 102.6 98.8 Company snapshot 2,000 Target Price 1672 1,600 1,200 800 400 Jun-16 Mar-16 Dec-15 Sep-15 Jun-15 Mar-15 Dec-14 Sep-14 Jun-14 Mar-14 Dec-13 Sep-13 Jun-13 Mar-13 Dec-12 Sep-12 Jun-12 Mar-12 Dec-11 Sep-11 Jun-11 Mar-11 Dec-10 Sep-10 Jun-10 Mar-10 Dec-09 Sep-09 Jun-09 Mar-09 Dec-08 0 Source: Bloomberg, Company, ICICIdirect.com Research Key events Date Jul-09 Event Rise in share price was aided by a special dividend of |8/share and the increasing attractiveness of the defensives (FMCG Index) following the economic downturn Nov-09 May-10 Jul-10 Mar-11 May-12 Second interim dividend of |7/share taking the total dividend in H1FY10 to |15/share The company did not pay any final dividend keeping the dividend per share for FY10 restricted at |20/share First interim dividend for FY11 of |10/share Laclustre performance of the stock following a lower sales growth of ~13% and a decline in margins and net profit following increased competition Significant jump in performance with reported sales growth of ~21% YoY, volume growth of ~12% and improvement in margins. Also, with run up in FMCG stocks, following the robust growth and subdued performance in other sectors, the stock price witnessed significant gains. Stock gained significantly mirroring the FMCG Index led by the preference of defensives with strong market leadership in a weak economic scenario The re-entry of P&G in the oral care market in the country increased pressure on the stock considering the concerns of increasing competition from a fierce player. Also, following the entry Colgate's marketing expenses were expected o increase, pressurizing margins. The concerns of subdued FMCG volume growth with softening consumer demand impacted the performance of complete FMCG Index also impacting Colgate's stock performance. Jan-13 Jun-13 Nov-13 Source: Company, ICICIdirect.com Research Top 10 Shareholders Rank 1 2 3 4 5 6 7 8 9 10 Name Colgate-Palmolive Co OppenheimerFunds, Inc. Life Insurance Corporation of India ARISAIG Partners (Asia) Pte. Ltd. Vontobel Asset Management, Inc. Columbia Wanger Asset Management, LLC The Vanguard Group, Inc. Lombard Odier Darier Hentsch & Cie Wasatch Advisors, Inc. JPMorgan Asset Management U.K. Limited Shareholding Pattern Latest Filing Date % O/S Position (m) Change (m) 31-Mar-14 51.00 69.4 0.0 31-May-14 6.29 8.6 0.0 31-Mar-14 4.71 6.4 0.6 31-Mar-14 3.53 4.8 0.0 31-Mar-14 2.08 2.8 -0.1 31-May-14 0.96 1.3 0.0 31-May-14 0.60 0.8 0.0 30-Apr-14 0.46 0.6 0.0 31-Mar-14 0.44 0.6 0.0 31-Dec-13 0.37 0.5 0.0 (in %) Promoter FII DII Others Jun-13 Sep-13 Dec-13 Mar-14 Jun-14 51.00 51.00 51.00 51.00 51.00 21.32 19.82 20.01 19.97 20.63 5.64 6.66 6.54 6.98 6.65 22.04 22.52 22.45 22.05 21.72 Source: Reuters, ICICIdirect.com Research Recent Activity Buys Investor name Life Insurance Corporation of India PGGM Vermogensbeheer B.V. Motilal Oswal Asset Management Company Ltd. Mirae Asset Global Investments (India) Pvt. Ltd. Norges Bank Investment Management (NBIM) Value 12.58m 2.58m 1.89m 1.84m 1.35m Shares 0.55m 0.12m 0.08m 0.08m 0.06m Sells Investor name DSP BlackRock Investment Managers Pvt. Ltd. Manulife Asset Management (Europe) Limited Manulife Asset Management (US) LLC Franklin Templeton Asset Management (India) Pvt. Ltd. British Columbia Investment Management Corp. Value -11.89m -8.21m -5.25m -5.13m -2.77m Shares -0.59m -0.32m -0.24m -0.20m -0.12m Source: Reuters, ICICIdirect.com Research ICICI Securities Ltd | Retail Equity Research Page 9 Financial summary Profit and loss statement (Year-end March) Total Operating Income Growth (%) Raw Material Expenses Employee Expenses Marketing Expenses Administrative Expenses Other expenses Total Operating Expenditure EBITDA Growth (%) Depreciation Interest Other Income PBT Exceptional items Total Tax PAT Growth (%) EPS (|) | Crore FY13 3163.8 17.5 1,250.2 249.4 490.8 112.7 403.9 2,507.0 656.8 13.5 43.7 0.0 49.9 663.0 0.0 166.3 496.8 11.3 36.5 FY14 3578.8 13.1 1,402.0 211.8 688.7 87.4 349.7 2,914.8 664.0 1.1 50.8 0.0 50.3 663.6 64.4 188.1 539.9 8.7 39.7 FY15E 4150.8 16.0 1,596.1 261.9 767.4 129.5 590.2 3,345.1 805.7 21.3 68.4 0.0 51.5 788.8 0.0 221.1 567.7 5.1 41.7 FY16E 4772.3 15.0 1,872.7 284.5 853.4 189.6 627.0 3,827.1 945.2 17.3 75.5 0.0 60.0 929.6 0.0 278.9 650.7 14.6 47.9 Source: Company, ICICIdirect.com Research (Year-end March) Profit/Loss after Tax Add: Depreciation Add: Interest (Inc)/dec in Current Assets Inc/(dec) in Current Liabilities CF from operating activities (Inc)/dec in Investments (Inc)/dec in Fixed Assets Others CF from investing activities Issue/(Buy back) of Equity Inc/(dec) in loan funds Dividend paid & dividend tax Inc/(dec) in Sec. premium Others CF from financing activities Net Cash flow Opening Cash Closing Cash | Crore FY13 496.8 43.7 0.0 49.6 118.1 708.1 22.1 -102.5 -66.2 -146.6 0.0 0.0 -442.6 0.0 0.0 -442.6 119.0 309.8 428.8 FY14 539.9 50.8 0.0 -20.6 81.8 651.8 0.0 -365.5 1.4 -364.1 0.0 0.0 -429.6 0.0 0.0 -429.6 -141.8 428.8 287.0 FY15E 567.7 68.4 0.0 -161.4 124.9 599.6 -20.0 -90.0 62.6 -47.4 0.0 0.0 -448.8 0.0 0.0 -448.8 103.4 287.0 390.4 FY16E 650.7 75.5 0.0 -37.0 123.0 812.3 -20.0 -100.0 0.0 -120.0 0.0 0.0 -489.6 0.0 0.0 -489.6 202.7 390.4 593.1 FY13 FY14 FY15E FY16E 36.5 39.7 36.0 28.0 31.5 39.7 43.4 44.1 27.0 21.1 41.7 46.8 52.9 33.0 28.7 47.9 53.4 64.7 36.0 43.6 20.8 21.5 16.1 135.2 9.6 55.2 18.6 20.5 15.2 110.0 5.6 52.5 19.4 19.1 13.8 105.0 11.0 50.0 19.8 19.6 13.7 0.0 8.3 49.0 101.5 125.2 94.6 90.0 102.2 86.3 79.0 102.6 76.3 74.0 98.8 71.9 44.7 33.1 7.1 7.2 45.3 41.1 33.0 6.2 6.3 37.0 39.1 27.1 5.3 5.4 30.9 34.1 22.9 4.6 4.7 25.2 0.0 0.0 1.0 0.8 0.0 0.0 0.8 0.5 0.0 0.0 0.9 0.7 0.0 0.0 1.1 0.8 Source: Company, ICICIdirect.com Research Balance sheet Liabilities Equity Capital Reserve and Surplus Total Shareholders funds Total Debt Long Term Provisions Other Non-current Liabilities Total Liabilities Assets Gross Block Less: Acc Depreciation Net Block Capital WIP Deferred Tax Asset Non Current Investments LT Loans & Advances/Others Current Assets Inventory Debtors Cash Loans & Advances Other Current Assets Current Liabilities Creditors Provisions Other CL Net Current Assets Total Assets Cash flow statement | Crore FY13 FY14 FY15E FY16E 13.6 476.0 489.6 0.0 34.9 0.8 525.3 13.6 586.3 599.9 0.0 24.9 0.7 625.5 13.6 705.2 718.8 0.0 24.9 0.7 744.4 13.6 866.3 879.9 0.0 24.9 0.7 905.5 673.5 392.9 280.7 102.0 22.4 37.1 71.5 992.7 436.8 555.9 141.5 17.8 37.1 64.6 1,082.7 505.2 577.5 141.5 17.8 57.1 2.1 1,182.7 580.7 602.0 141.5 17.8 77.1 2.1 185.3 81.2 428.8 94.5 3.3 225.7 54.7 287.0 102.7 1.7 282.4 124.3 390.4 134.0 5.6 337.7 108.0 593.1 128.0 9.5 466.6 64.6 250.2 11.6 525.3 510.0 70.4 282.9 -191.5 625.5 564.8 91.4 332.0 -51.6 744.4 636.4 95.5 379.3 65.1 905.5 Source: Company, ICICIdirect.com Research Key ratios (Year-end March) Per share data (|) EPS Cash EPS BV DPS Cash Per Share Operating Ratios (%) EBITDA Margin PBT / Net Sales PAT Margin Inventory days Debtor days Creditor days Return Ratios (%) RoE RoCE RoA Valuation Ratios (x) P/E EV / EBITDA EV / Net Sales Market Cap / Sales Price to Book Value Solvency Ratios Debt/EBITDA Debt / Equity Current Ratio Quick Ratio Source: Company, ICICIdirect.com Research . ICICI Securities Ltd | Retail Equity Research Page 10 ICICIdirect.com coverage universe (FMCG) EPS (|) CMP M Cap Sector / Company (|) TP(|) Rating (| Cr) FY14 FY15E FY16E 1,632 1,672 Hold 22,194 39.7 41.7 47.9 Colgate (COLPAL) 199 182 Hold 34,702 5.2 1.3 1.7 Dabur India (DABIND) 662 600 Hold 143,158 17.9 18.8 21.6 Hindustan Unilever (HINLEV) 357 387 Buy 283,929 11.1 12.6 14.4 ITC Limited (ITC) 181 188 Hold 3,276 4.5 7.4 8.9 Jyothy Lab (JYOLAB) 249 262 Buy 16,061 7.5 8.6 10.5 Marico (MARIN) 5,171 4,615 Hold 49,857 115.9 120.2 130.6 Nestle (NESIND) 154 182 Buy 9,523 7.8 7.1 8.8 Tata Global Bev (TATTEA) 1,635 1,664 Buy 2,524 98.8 81.8 97.9 VST Industries (VSTIND) Source: Company, ICICIdirect.com Research ICICI Securities Ltd | Retail Equity Research P/E (x) FY14 FY15E FY16E 41.1 39.1 34.1 38.0 153.8 119.1 37.0 35.1 30.7 32.3 28.3 24.8 40.2 24.4 20.3 33.2 28.9 23.6 44.6 43.0 39.6 19.8 21.5 17.5 16.6 20.0 16.7 EV/EBITDA (x) RoCE (%) RoE (%) FY14 FY15E FY16E FY14 FY15E FY16E FY14 FY15E FY16E 33.0 27.1 22.9 102.2 102.6 98.8 90.0 79.0 74.0 38.0 31.7 27.4 42.4 43.2 41.2 38.3 36.1 33.2 31.5 27.2 23.3 128.6 131.0 131.3 118.0 109.9 107.0 22.5 19.4 17.1 44.9 47.0 47.8 34.4 35.0 36.1 23.3 18.5 16.0 10.0 9.5 10.6 9.3 14.0 15.3 22.6 19.3 16.0 29.3 30.0 31.7 22.3 21.4 21.9 25.4 24.4 22.7 46.0 54.8 60.8 47.2 47.4 50.3 13.1 12.0 10.0 8.8 9.1 10.5 9.4 8.2 9.4 11.2 12.9 10.6 58.8 48.0 59.2 46.3 38.3 43.8 Page 11 RATING RATIONALE ICICIdirect.com endeavours to provide objective opinions and recommendations. ICICIdirect.com assigns ratings to its stocks according to their notional target price vs. current market price and then categorises them as Strong Buy, Buy, Hold and Sell. The performance horizon is two years unless specified and the notional target price is defined as the analysts' valuation for a stock. Strong Buy: >15%/20% for large caps/midcaps, respectively, with high conviction; Buy: >10%/15% for large caps/midcaps, respectively; Hold: Up to +/-10%; Sell: -10% or more; Pankaj Pandey Head – Research pankaj.pandey@icicisecurities.com ICICIdirect.com Research Desk, ICICI Securities Limited, 1st Floor, Akruti Trade Centre, Road No 7, MIDC, Andheri (East) Mumbai – 400 093 research@icicidirect.com ANALYST CERTIFICATION We /I, Sanjay Manyal, MBA (Finance); Parineeta Rajgarhia, MBA research analysts, authors and the names subscribed to this report, hereby certify that all of the views expressed in this research report accurately reflect our personal views about any and all of the subject issuer(s) or securities. We also certify that no part of our compensation was, is, or will be directly or indirectly related to the specific recommendation(s) or view(s) in this report. Analysts aren't registered as research analysts by FINRA and might not be an associated person of the ICICI Securities Inc. Disclosures: ICICI Securities Limited (ICICI Securities) and its affiliates are a full-service, integrated investment banking, investment management and brokerage and financing group. We along with affiliates are leading underwriter of securities and participate in virtually all securities trading markets in India. We and our affiliates have investment banking and other business relationship with a significant percentage of companies covered by our Investment Research Department. Our research professionals provide important input into our investment banking and other business selection processes. ICICI Securities generally prohibits its analysts, persons reporting to analysts and their dependent family members from maintaining a financial interest in the securities or derivatives of any companies that the analysts cover. The information and opinions in this report have been prepared by ICICI Securities and are subject to change without any notice. The report and information contained herein is strictly confidential and meant solely for the selected recipient and may not be altered in any way, transmitted to, copied or distributed, in part or in whole, to any other person or to the media or reproduced in any form, without prior written consent of ICICI Securities. While we would endeavour to update the information herein on reasonable basis, ICICI Securities, its subsidiaries and associated companies, their directors and employees (“ICICI Securities and affiliates”) are under no obligation to update or keep the information current. Also, there may be regulatory, compliance or other reasons that may prevent ICICI Securities from doing so. Non-rated securities indicate that rating on a particular security has been suspended temporarily and such suspension is in compliance with applicable regulations and/or ICICI Securities policies, in circumstances where ICICI Securities is acting in an advisory capacity to this company, or in certain other circumstances. This report is based on information obtained from public sources and sources believed to be reliable, but no independent verification has been made nor is its accuracy or completeness guaranteed. This report and information herein is solely for informational purpose and may not be used or considered as an offer document or solicitation of offer to buy or sell or subscribe for securities or other financial instruments. Though disseminated to all the customers simultaneously, not all customers may receive this report at the same time. ICICI Securities will not treat recipients as customers by virtue of their receiving this report. Nothing in this report constitutes investment, legal, accounting and tax advice or a representation that any investment or strategy is suitable or appropriate to your specific circumstances. The securities discussed and opinions expressed in this report may not be suitable for all investors, who must make their own investment decisions, based on their own investment objectives, financial positions and needs of specific recipient. This may not be taken in substitution for the exercise of independent judgment by any recipient. The recipient should independently evaluate the investment risks. The value and return of investment may vary because of changes in interest rates, foreign exchange rates or any other reason. ICICI Securities and affiliates accept no liabilities for any loss or damage of any kind arising out of the use of this report. Past performance is not necessarily a guide to future performance. Investors are advised to see Risk Disclosure Document to understand the risks associated before investing in the securities markets. Actual results may differ materially from those set forth in projections. Forward-looking statements are not predictions and may be subject to change without notice. ICICI Securities and its affiliates might have managed or co-managed a public offering for the subject company in the preceding twelve months. ICICI Securities and affiliates might have received compensation from the companies mentioned in the report during the period preceding twelve months from the date of this report for services in respect of public offerings, corporate finance, investment banking or other advisory services in a merger or specific transaction. It is confirmed that Sanjay Manyal, MBA (Finance); Parineeta Rajgarhia, MBA research analysts and the authors of this report have not received any compensation from the companies mentioned in the report in the preceding twelve months. Our research professionals are paid in part based on the profitability of ICICI Securities, which include earnings from Investment Banking and other business. ICICI Securities or its subsidiaries collectively do not own 1% or more of the equity securities of the Company mentioned in the report as of the last day of the month preceding the publication of the research report. It is confirmed that Sanjay Manyal, MBA (Finance); Parineeta Rajgarhia, MBA research analysts and the authors of this report or any of their family members does not serve as an officer, director or advisory board member of the companies mentioned in the report. ICICI Securities may have issued other reports that are inconsistent with and reach different conclusion from the information presented in this report. ICICI Securities and affiliates may act upon or make use of information contained in the report prior to the publication thereof. This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction, where such distribution, publication, availability or use would be contrary to law, regulation or which would subject ICICI Securities and affiliates to any registration or licensing requirement within such jurisdiction. The securities described herein may or may not be eligible for sale in all jurisdictions or to certain category of investors. Persons in whose possession this document may come are required to inform themselves of and to observe such restriction. ICICI Securities Ltd | Retail Equity Research Page 12