TTK Prestige (TTKPRE)

advertisement

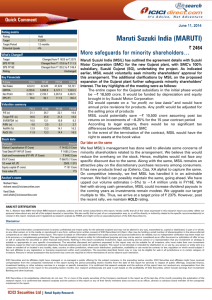

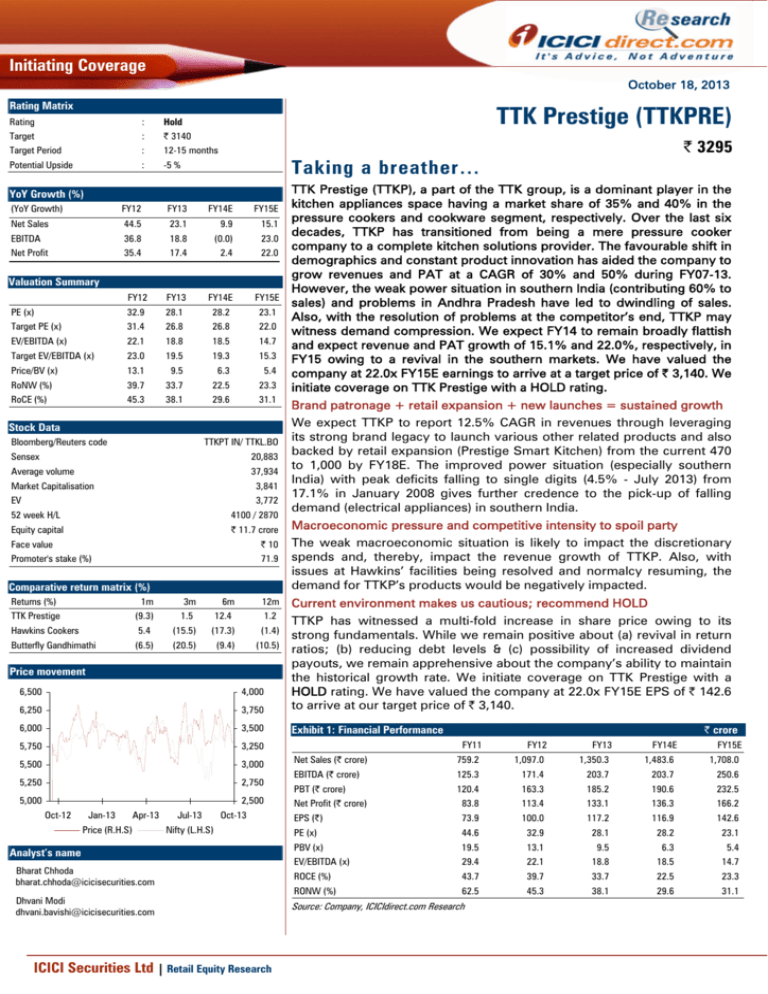

Initiating Coverage October 18, 2013 Rating Matrix TTK Prestige (TTKPRE) Rating : Hold Target : | 3140 Target Period : 12-15 months Potential Upside : -5 % | 3295 Taking a breather… 6,500 4,000 6,250 3,750 TTK Prestige (TTKP), a part of the TTK group, is a dominant player in the kitchen appliances space having a market share of 35% and 40% in the pressure cookers and cookware segment, respectively. Over the last six decades, TTKP has transitioned from being a mere pressure cooker company to a complete kitchen solutions provider. The favourable shift in demographics and constant product innovation has aided the company to grow revenues and PAT at a CAGR of 30% and 50% during FY07-13. However, the weak power situation in southern India (contributing 60% to sales) and problems in Andhra Pradesh have led to dwindling of sales. Also, with the resolution of problems at the competitor’s end, TTKP may witness demand compression. We expect FY14 to remain broadly flattish and expect revenue and PAT growth of 15.1% and 22.0%, respectively, in FY15 owing to a revival in the southern markets. We have valued the company at 22.0x FY15E earnings to arrive at a target price of | 3,140. We initiate coverage on TTK Prestige with a HOLD rating. Brand patronage + retail expansion + new launches = sustained growth We expect TTKP to report 12.5% CAGR in revenues through leveraging its strong brand legacy to launch various other related products and also backed by retail expansion (Prestige Smart Kitchen) from the current 470 to 1,000 by FY18E. The improved power situation (especially southern India) with peak deficits falling to single digits (4.5% - July 2013) from 17.1% in January 2008 gives further credence to the pick-up of falling demand (electrical appliances) in southern India. Macroeconomic pressure and competitive intensity to spoil party The weak macroeconomic situation is likely to impact the discretionary spends and, thereby, impact the revenue growth of TTKP. Also, with issues at Hawkins’ facilities being resolved and normalcy resuming, the demand for TTKP’s products would be negatively impacted. Current environment makes us cautious; recommend HOLD TTKP has witnessed a multi-fold increase in share price owing to its strong fundamentals. While we remain positive about (a) revival in return ratios; (b) reducing debt levels & (c) possibility of increased dividend payouts, we remain apprehensive about the company’s ability to maintain the historical growth rate. We initiate coverage on TTK Prestige with a HOLD rating. We have valued the company at 22.0x FY15E EPS of | 142.6 to arrive at our target price of | 3,140. 6,000 3,500 Exhibit 1: Financial Performance 5,750 3,250 YoY Growth (%) (YoY Growth) FY12 FY13 FY14E FY15E Net Sales 44.5 EBITDA 36.8 23.1 9.9 15.1 18.8 (0.0) Net Profit 35.4 23.0 17.4 2.4 22.0 Valuation Summary FY12 FY13 FY14E FY15E PE (x) 32.9 28.1 28.2 23.1 Target PE (x) 31.4 26.8 26.8 22.0 EV/EBITDA (x) 22.1 18.8 18.5 14.7 Target EV/EBITDA (x) 23.0 19.5 19.3 15.3 Price/BV (x) 13.1 9.5 6.3 5.4 RoNW (%) 39.7 33.7 22.5 23.3 RoCE (%) 45.3 38.1 29.6 31.1 Stock Data Bloomberg/Reuters code TTKPT IN/ TTKL.BO Sensex 20,883 Average volume 37,934 Market Capitalisation 3,841 EV 3,772 52 week H/L 4100 / 2870 Equity capital | 11.7 crore Face value | 10 Promoter's stake (%) 71.9 Comparative return matrix (%) Returns (%) 1m 3m 6m TTK Prestige (9.3) 1.5 12.4 12m 1.2 Hawkins Cookers 5.4 (15.5) (17.3) (1.4) Butterfly Gandhimathi (6.5) (20.5) (9.4) (10.5) Price movement 5,500 3,000 5,250 2,750 5,000 2,500 Oct-12 Jan-13 Apr-13 Price (R.H.S) Jul-13 Oct-13 Nifty (L.H.S) Analyst’s name Bharat Chhoda bharat.chhoda@icicisecurities.com Dhvani Modi dhvani.bavishi@icicisecurities.com ICICI Securities Ltd | Retail Equity Research | crore FY11 FY12 FY13 FY14E FY15E Net Sales (| crore) 759.2 1,097.0 1,350.3 1,483.6 1,708.0 EBITDA (| crore) 125.3 171.4 203.7 203.7 250.6 PBT (| crore) 120.4 163.3 185.2 190.6 232.5 Net Profit (| crore) 83.8 113.4 133.1 136.3 166.2 EPS (|) 73.9 100.0 117.2 116.9 142.6 PE (x) 44.6 32.9 28.1 28.2 23.1 PBV (x) 19.5 13.1 9.5 6.3 5.4 EV/EBITDA (x) 29.4 22.1 18.8 18.5 14.7 ROCE (%) 43.7 39.7 33.7 22.5 23.3 RONW (%) 62.5 45.3 38.1 29.6 31.1 Source: Company, ICICIdirect.com Research Shareholding pattern (Q1FY14) Shareholder Holding (%) Promoters 71.9 Institutional Investors 20.3 General Public 7.8 FII & DII holding trend (%) 20 15 13.3 12.4 13.5 16.0 10 5 2.8 3.3 3.4 4.4 Q2FY13 Q3FY13 Q4FY13 Q1FY14 - Company Background TTK Prestige, a part of the TTK group, was incorporated in 1955. Over the last almost six decades of operations, the company has got transformed from a mere pressure cooker player to one of the country’s largest kitchen appliances company. TTKP’s product portfolio comprises pressure cookers, non-stick cookware, rice cookers, OTGs, kitchen hoods (chimneys), hobs, LP gas stoves, coffee makers, kettles, sandwich toasters and many other small electrical appliances. The company also offers modular kitchen solutions with the widest range of options in terms of design, choice of materials, accessories and hardware. TTKP has been responsible for many innovations in the domestic kitchen appliance segment. Some of its innovations include gasket release system (GRS), gasket offset device (GOD) and double locking system, all firsts in India. The company is also the first kitchenware company in the country to receive the ISO 9001 Certification and the PED/CE Certification from TUV, Germany. TTKP has been awarded the select “Super Brand” validated by consumers and is also the most preferred brand in the kitchenware segment. TTKP exports its products to the US, Europe, South Africa, Kenya, Australia, Singapore, Middle East, Sri Lanka and many other countries. Products manufactured by the company meet every relevant global standard such as CE, GS, UL, etc. The company currently has manufacturing facilities in Hosur, Coimbatore and Roorkee and distributes from sales branches located across the country to cater to the needs of specific markets. TTKP boasts of a strong distribution network. Apart from its exclusive brand outlets of 470 Prestige kitchen stores, the company’s products are available in over 50,000 outlets. The company has a total employee strength of 2,000 employees and a dedicated sales staff of 1,000. Exhibit 2: TTKP's sales mix 2,000 62 (| crore) 1,500 45 28 1,000 500 - 27 449 50 494 349 101 225 128 245 141 272 568 163 326 21 104 87 61 241 193 81 154 317 413 511 557 624 FY10 FY11 FY12 FY13 FY14E FY15E Pressure Cookers Cookware Stoves Electrical Appliances (Kitchen) Others Source: Company, ICICIdirect.com Research ICICI Securities Ltd | Retail Equity Research Page 2 Exhibit 3: TTK Prestige's journey thus far... The company set up the second manufacturing unit in Hosur TTK Prestige was incorporated 1959 1955 1981 The company set up its first manufacturing unit in Bangalore Launch of inner lid pressure cookers; set up new capacities in Uttarakhand & Coimbatore 2002 - 03 Period of turbulence 2006 The company launched stainless steel pressure cookers, non-stick cookware 1990 1990 - 94 1990s Remained a single product (only aluminum pressure cookers) company with dominance in South India Started focusing on increasing exports; launch of Manttra Brand Largest capacity expansion initiative to back vision of 'A prestige in every kitchen ' Microwave cookers meet great success in export markets 2006 - 10 Transformed into a kitchen solution provider; introduced induction tops, microwave pressure cookers 2011 2012 2013 Turover crossed | 1,100 crore; alliances with global high end brands Source: Company, ICICIdirect.com Research Exhibit 4: TTKP’s varied product range Source: Company, ICICIdirect.com Research ICICI Securities Ltd | Retail Equity Research Page 3 Investment Rationale Changing Indian demographics: Big boon for consumption sector India has witnessed a demographic shift with per capita income (current prices) increasing at 11.7% YoY to | 68,747 (FY13). With increasing preference for branded products, the organised segment has witnessed healthy growth in the recent past. The demographic advantage continues to remain owing to a relatively low median age (~25 years), higher number of working women and increased urbanisation. Exhibit 5: Rising middle class Indian demographics have worked in favour of various consumption players. With rising aspirations and incomes, the preference for branded products has been on the rise (households in million) 350 300 23 8 250 2 200 31 148 85 150 100 186 180 2008 2020E 151 50 0 Lower Class Middle Class 2030E Upper Class Source: McKinsey Global Institute (MGI), ICICIdirect.com Research; Classes are based on income levels with the ‘Lower’ class representing income of <| 200,000 per annum; ‘Middle’ class between | 200,000 and | 1,000,000 per annum ; and ‘Upper’ class >| 1,000,000 per annum The burgeoning Indian middle class is a promising segment for consumer oriented companies like TTKP. With rising incomes, these families will demand sophisticated products and services. A report by McKinsey Global Institute (MGI) expects the number of urban middle class households to increase to 91 million by 2030E, from 22 million in 2008. Exhibit 6: Increasing working population in India Exhibit 7: Increasing female work participation rate 100 60 40 20 25.6 25 19.7 20 68 66 63 (%) (%) 80 30 32 34 38 15 22.3 12.1 10 0 5 2005 2015E Working Population 2025E Dependents Source: MGI, ICICIdirect.com Research; Working population: 15-64 years 0 1971 1981 1991 2001 Source: Census Data, ICICIdirect.com Research TTKP continuously strives to ease the kitchen and cooking experience. A higher number of working women will fuel demand for TTKP’s products as the time spent in the kitchen by an Indian women will come down. Therefore, the need for convenient and state-of-the-art products will go up. With increasing income in the hands of women, the aspiration to own branded kitchenware will also increase. ICICI Securities Ltd | Retail Equity Research Page 4 The MGI report indicates that the urbanisation rate in India could touch 40% by 2030E, thereby creating demand for a whole lot of modern amenities. With increased urbanisation, basic facilities like availability of electricity and LPG connection will further go up, which will be yet another trigger for TTKP’s products’ demand. A report by MGI expects urbanisation to touch 40% by Exhibit 8: Urbanisation rate in India likely to touch 40% by 2030E 2030E. This will mean more job creation and also lead to increased demand for sophisticated products, thereby 40 1600 45 fuelling demand for players in the organised space 36 30 28 26 27 800 (%) (in million) 1200 18 400 9 0 0 1991 2001 2008 Total Population 2030E Urbanisation Rate (RHS) Source: MGI, ICICIdirect.com Research Another factor working in favour of consumption companies is the increasing number of nuclear families. The average size of Indian households has dipped from 5.3 in 2001 to 4.9 in 2011. The total number of households in India has increased from 187 million in 2001 to 247 million in 2011, representing a CAGR of 2.8%. With increasing number of households the demand for kitchenware is also increasing. With the increase in the number of nuclear families and working women (and hence lower time in the kitchen) the Exhibit 9: Decreasing size of Indian households demand for convenience based products is on the rise 30 25 6 5.5 5.5 5.3 5.3 4.9 15 24.7 10 5 10.0 11.9 1971 1981 14.8 5 (nos) (in crore) 20 18.7 4 - Number of households 1991 2001 2011 Average household size (RHS) Source: Census Data, ICICIdirect.com Research ICICI Securities Ltd | Retail Equity Research Page 5 Dominant player in market with high potential TTK Prestige’s market share Particulars Market Share (%) Pressure cookers 35 Cookware 40 Cooktops 25 TTKP has a dominant presence in a highly fragmented industry. The unorganised segment in the domestic pressure cooker and cookware markets accounts for 40% and 50% of the total market, respectively. The company’s market share in the pressure cooker segment stands at ~35% while that in cookware and cooktops stands at ~40% and ~25%, respectively. Considering the changing demographics, increased number of working women and low penetration levels in each categories, these segments are likely to continue to grow over the next few years. According to a Council of International Education and Research (CIER) report, domestic pressure cooker volumes are likely to grow at a CAGR of 6% during FY12-20E. Similarly, a report by Technavio Research indicates that the induction cooktops market in India is likely to grow at a CAGR of 35.4% from $150.8 million in 2012 to $506.9 million in 2016. Exhibit 10: Indian pressure cooker segment volume growth 7 5.8 6 Exhibit 11: Indian cooktops market to grow to $506.9 million by 2016E 600 6.0 5.4 500 4 ($ million) (%) 5 3.4 2.6 3 2 400 300 1 100 0 0 FY91-97 FY97-02 FY02-07 FY07-12 506.9 200 150.8 2012 FY12-20E Source: CIER, ICICIdirect.com Research 2016E Source: Technavio Research, ICICIdirect.com Research We believe TTKP will be one of the biggest beneficiaries of the continued growth in the domestic kitchenware segment. The strong historical patronage of the Prestige brand, continuous innovations and the recent capacity addition (increasing of the pressure cooker and cookware capacity to 5 million and 12 million pieces, respectively) all work in favour of the company. We expect the company’s revenues to grow at a CAGR of 17.7% during FY13-15E. Exhibit 12: TTKP's topline growth trajectory 60 50.3 16.0 401 FY07 FY08 FY09 Net Sales FY10 1,493 50 40 30 15.1 23.1 20 10 508 326 - 281 500 1,358 22.2 26.9 1,103 1,000 26.6 764 (| crore) 1,500 1,719 44.5 (%) 2,000 9.9 FY11 FY12 FY13 FY14E FY15E Sales growth (RHS) Source: Company, ICICIdirect.com Research ICICI Securities Ltd | Retail Equity Research Page 6 Capacity additions, alliances, retail expansion+ new product launches = Growth TTKP has incurred a capex of | 300 crore to expand capacities. As these expansions are complete and new plants are being commissioned, we expect the company’s revenues to increase at a CAGR of 17.7% during FY13-15E Planned capex to fuel revenues and aid in maintaining leadership Over the last three years, the company has undertaken a capex of | 300 crore to expand its existing capacities. Considering the immense potential in the domestic kitchenware segment, TTKP has undertaken a capacity expansion drive to (a) capitalise on the strong growth opportunities in the domestic kitchen segment and (b) maintain its leadership position across segments. Exhibit 13: Capacity expansion 14 12.0 12 (in million pieces) 10 8.0 8 6 4.8 4 2.0 2 Pressure Cookers FY11 Cookware FY14E Source: Company, ICICIdirect.com Research Global alliances With the aim of continuously innovating and providing the best in kitchenware, TTKP has entered into alliances with various global players. In 2012, the company entered into three such alliances across various segments To produce quality kitchen appliances, TTKP has followed a strategy of joining hands with the best in the game. The company has entered into various tie-ups with global players, which will not only aid in increasing revenues but also help better its knowledge in the Indian kitchenware space. TTKP has scouted for suitable partners, which will create synergies with the existing product portfolio. In 2011-12, the company entered into three such alliances, out of which it has decided to part ways with one. JV with World Kitchen: Access to tableware In May 2012, TTKP entered into a JV agreement with US based World Kitchen (India) to distribute its brands Corelle (glass dinnerware), Corningware (glass ceramic), Vision (glass cookware), Pyrex (glass bakeware) & Snapware (storage ware). However, the company decided to call off this agreement as it did not achieve the desired financial outcome. Tie up with German glassmaker Schott: Targeting premium gas stove market TTKP had entered into yet another joint venture agreement in May 2012 with a Germany based glass maker to launch a high range of cooking appliances. Through this tie-up, the company has launched glass based gas tables and induction cooktops, which can withstand high level thermal shocks and mechanical impacts. Tie up with US based Meyer TTKP has entered into a joint venture with US based cookware company Meyer to market its high-end cookware (both aluminium and stainless steel based) in India (June 2012). This tie-up would give TTKP access to brands such as Anolon, Circulon, Farberware, KitchenAid, SilverStone and Bonjour. ICICI Securities Ltd | Retail Equity Research Page 7 Expanding retail reach With a focus on strengthening the brand, TTKP plans to aggressively expand its exclusive retail outlets – Prestige Smart Kitchen (PSK). The company plans to add 100-150 stores each year to its existing network of 470 stores. TTKP plans to reach 1000 stores by FY18. We believe that an asset light – franchisee based model (to expand its retail presence) will not only aid the company to increase the pace of revenue growth but also help TTKP to maintain a healthy balance sheet as it will not have funds blocked (as the case would be, had the company decided to expand retail presence through company owned stores). Exhibit 14: PSK outlet stocking products from Prestige house Exhibit 15: PSK outlet ramp up target by FY15E 1200 1000 1000 (numbers) 800 600 470 400 200 0 FY13 FY18E Source: Company, ICICIdirect.com Research Source: Company, ICICIdirect.com Research New product launches: Additional kicker TTKP has been a pioneer in the kitchen appliances and kitchenware segment. The company has many firsts to its credit. TTKP’s product innovation and the vision to have a Prestige in every kitchen have led to addition of several SKUs over the years. The continuous product development and innovation has Exhibit 16: TTKP's product launch history aided TTKP in maintaining its leadership position and also Year TTKP's new initiatives aided revenue growth. With more and more innovations FY04 50 new product variants, new delux range of pressure cookers in aluminum Hard anodised, stainless steel pressure cookers and launches, the company is likely to continue to benefit from these launches FY05 Introduced 50 new variants, Omega range of non-stick cookware FY06 54 new variants, pressure kadai, duplex gas tables Modular kitchen, handi pressure cookers in different materials Prestige Nakshatra (inner lid range), barbeques FY07 89 new product launches across seven categories Selective modular kitchens FY08 86 SKUs and 5 new categories FY09 Induction cooktops FY10 Microwave pressure cookers, induction compatible pressure cookers and cookware 2 Prestige kitchen boutiques offering a wide range of modular kitchens Apple range of inner lid pressure cookers, fresh range of induction cooktops FY11 67 new SKUs FY12 60 new SKUs FY13 World Kitchen and Meyer products Prestige Premia Source: Company, ICICIdirect.com Research ICICI Securities Ltd | Retail Equity Research Page 8 Pressure cooker segment to grow at a CAGR of 10.6% during FY13-15E TTKP’s largest segment, the pressure cooker segment, is likely to grow at a CAGR of 10.6% during FY13-15E. The expanded facilities are now fully operational and the company is likely to benefit from the same. The pressure cooker segment has grown consistently (volume CAGR – 20.3% realisation CAGR – 0.5% during FY07-13) on the back of constant innovation. The company has launched innovative products like inner-lid pressure cookers, induction compatible pressure cookers, microwave cookers, etc. Despite an expanding base, the company’s pressure cooker sales have been increasing as TTKP endeavours to push products through promotions, bundling of pressure cookers with induction cooktops, etc. We expect pressure cooker volumes to grow at 9.5% CAGR in FY13-15E. We expect the pressure cooker segment to grow at a CAGR of 10.6% during FY13-15E, led by volume growth of 9.5% Exhibit 17: Volumes to grow at CAGR of 9.5% during FY13-15E… Volumes to grow at CAGR of 9.5% during FY13-15E (pieces in million) 6 5 5.5 4 6.0 929 940 4.5 3.7 3 2 960 6.6 (| per piece) 7 Exhibit 18: …with realisations likely to increase at CAGR of 1.0% 2.8 922 940 931 920 900 880 860 852 852 FY10 FY11 840 1 820 800 FY10 FY11 FY12 FY13 FY14E FY15E Source: Company, ICICIdirect.com Research The share of pressure cookers in the overall product mix has dropped from 46.8% in FY10 to 37.1% in FY13. We expect this to come down further to 35.8% by FY15E FY12 FY13 FY14E FY15E Source: Company, ICICIdirect.com Research TTKP had started operations primarily as a pressure cooker manufacturer. However, over the years, the share of pressure cookers in the product mix has been declining. In absolute terms, sales of pressure cookers have more than tripled from | 163.4 crore in FY07 to | 510.7 crore in FY13. However, with the launch of various other products, the share of pressure cookers has been gradually dipping. A well diversified product portfolio aids the company to de-risk its business model and reduce dependence on a particular product. (%) Exhibit 19: TTKP's reducing dependence on pressure cooker segment 100 90 80 70 60 50 40 30 20 10 - 4.2 3.4 2.5 3.3 3.3 3.6 20.2 25.0 31.3 32.6 32.6 32.6 11.9 10.5 17.0 20.0 9.0 9.3 9.3 9.3 20.1 17.8 18.0 18.7 46.8 41.1 37.0 37.1 36.8 35.8 FY10 FY11 FY12 FY13 FY14E FY15E Pressure Cookers Cookware Stoves Electrical Appliances (Kitchen) Others Source: Company, ICICIdirect.com Research ICICI Securities Ltd | Retail Equity Research Page 9 Cookware segment: Sailing high on rising aspirations The Indian kitchen has got transformed from functional to fashionable. Indian women are increasingly becoming brand conscious and the same is extending to the kitchen as well. TTKP has received a healthy response to its cookware with sales growing at 33.4% CAGR during FY07-13 (albeit on a small base). During this period, volumes grew at a CAGR of 27.0% while realisations increased 5.0%. Going forward, we expect the segment to grow at a CAGR of 15.3%, led by 12.0% volume growth and 3.0% realisation growth during FY13-15E. The cookware segment is expected to grow at a CAGR of 15.3% during FY13-15E. We expect volumes to touch 6.2 million pieces, growing at a CAGR of 12.0% in FY13-15E Exhibit 20: Volumes to grow at CAGR of 12.0% during FY13-15E… (pieces in million) 600 Volumes to grow at CAGR of 12.0% during FY13-15E 6 5 5.1 4 3 6.2 5.4 5.0 3.5 450 435 444 FY10 FY11 FY12 495 504 525 FY13 FY14E FY15E 400 300 200 2 1 500 (| per piece) 7 Exhibit 21: …with realisations growing at CAGR of 3.0% 1.9 100 - FY10 FY11 FY12 FY13 FY14E FY15E Source: Company, ICICIdirect.com Research Source: Company, ICICIdirect.com Research The rising penetration of LPG has worked in favour of the company by fuelling demand for better quality vessels and gas stoves. The share of households using LPG as a fuel for cooking has increased from 18% in 2001 to 29% in 2011 LPG penetration in India is also on the rise. Total customers catered to has increased from 11 million in 1985 to 135 million currently. Similarly, LPG sales have jumped from 1241 thousand metric tonnes (TMT) in 198586 to 13,912 TMT in 2010-11. With rising penetration of LPG, demand for modern cookware is likely to increase. Share of LPG in total fuels used in domestic households has increased from 18% in 2001 to 29% in 2011 (census data). This ratio is significantly higher (~80%+) in urban areas. Exhibit 22: Household dependence on various cooking fuels (2001) Exhibit 23: Household dependence on various cooking fuels (2011) 10% 48% 9% 10% 52% 8% 2% 2% 7% 3% 18% Firewood Coal, Lignite, Charcoal Electricity Crop 1% residue Kerosene Biogas Source: Census Data, ICICIdirect.com Research 29% 1% Cowdung cake LPG Others Firewood Coal, Lignite, Charcoal Electricity Crop residue Kerosene Biogas Cowdung cake LPG Others Source: Census Data, ICICIdirect.com Research Also, with the increasing sales of induction cooktops, sales of induction friendly cookware have also aided the strong performance of this segment. ICICI Securities Ltd | Retail Equity Research Page 10 Electrical appliances segment: Induction cooktops key contributor TTKP has a large product portfolio under the appliances segment. Its electrical appliances portfolio comprises coffee makers, blenders, juicers, mixers, electric kettles, toasters, grinders, etc. This segment has grown from a small size of | 71.0 crore in FY09 to | 449.0 crore in FY13, growing at a CAGR of 58.6% during the period. The share in the overall product mix has increased from 17% in FY09 to 33% in FY13. We expect TTKP to grow the appliance segment revenues at a CAGR of 12.5% to | 568.0 crore by FY15E. The electrical appliances segment is expected to grow at a CAGR of 12.5% during FY13-15E to | 568.0 crore Exhibit 24: Electrical appliances segment to grow at CAGR of 12.5% during FY13-15E 568 600 500 400 (| crore) 494 449 349 300 193 200 100 104 71 FY09 FY10 FY11 FY12 FY13 FY14E FY15E Source: Company, ICICIdirect.com Research The largest contributor to the electrical appliances segment has been induction cooktops. TTKP commenced sales of induction cooktops in FY09 with a sale of 17,000 units. Over the years, the company has grown the sales to 1.2 million pieces as on FY13. The reduced availability of LPG has led to higher demand for induction cooktops. As indicated by the management, induction cooktops are also a cost effective option as compared to non-subsidised cylinders. The cost of running an induction cooktop is one-third less than a non-subsidised cylinder while it is 25% more than a subsidised cylinder. Going forward, as the power supply situation in India improves, the sale of induction cooktops and other electrical appliances will further go up. We expect the segment to grow at a CAGR of 23.1% during FY13-15E, led by volume growth of 19.0%. The induction cooktops segment accounts for ~50% of the electrical appliances segment. The induction cooktops segment has witnessed healthy growth in the past. We expect it to grow at a CAGR of 23.1% during FY13-15E Exhibit 25: Induction cooktops volumes to grow at CAGR of 19.0%... 2,400 Volumes to grow at CAGR of 19.0% during FY13-15E 1.7 1.4 1.2 1 0.9 - 0.1 0.4 FY10 FY11 2,302 2,000 (| per piece) (pieces in million) 2 Exhibit 26: …while realisations are likely to grow 3.5% during FY13-15E 1,757 1,833 1,897 1,935 FY11 FY12 FY13 FY14E 2,032 1,600 1,200 800 400 - FY12 FY13 FY14E Source: Company, ICICIdirect.com Research ICICI Securities Ltd | Retail Equity Research FY15E FY10 FY15E Source: Company, ICICIdirect.com Research Page 11 The power supply situation in India is also improving. The base deficit has come down from a peak of 14.6% in April 2010 to 2.7% in August 2013. Similarly, the peak deficit has also come down from a peak of 17.1% in January 2008 to 3.0% in August 2013. According to a sample study of 97,882 households in 2002, electricity was the main source of lighting for 53% of rural households compared to 36% in 1993. Also, the per capita consumption of power has increased from 567 kWh in FY03 to 879 kWh in FY12, representing a CAGR of 4.5%. Exhibit 27: Reducing power deficit in India Base Deficit Jul-13 Jan-13 Jul-12 Jan-12 Jul-11 Jan-11 Jul-10 Jan-10 Jul-09 Jan-09 Jul-08 Jan-07 2013) (%) also reduced from 17.1% (January 2008) to 3.0% (August Jan-08 2010) to 2.7% in August 2013 while the peak deficit has 18 16 14 12 10 8 6 4 2 Jul-07 The base deficit has come down from mid teens (April Peak Deficit Source: CEA, ICICIdirect.com Research The per capita consumption of power has increased at a Exhibit 28: All-India per capita consumption of electricity CAGR of 4.5% during FY03-12 1000 717 734 2008-09 2004-05 672 2007-08 592 632 2005-06 567 2003-04 500 613 2002-03 (in kWh) 750 779 819 879 250 2011-12 (P) 2010-11 2009-10 2006-07 0 Source: CEA, ICICIdirect.com Research With the increasing availability of power, the use of electrical appliances can further increase. The target audience for TTKP continues to rise with the rising penetration of electricity. Currently, the use of electricity in cooking stands at 0.1% of the fuels used (Census 2011). As the share of electricity used for cooking goes up, the use of electrical appliances is slated to increase further. ICICI Securities Ltd | Retail Equity Research Page 12 Risks & Concerns Volatility in input prices TTKP’s key raw materials, steel and aluminium are both traded internationally and their prices are highly dependant on the global macroeconomic situation. Any significant move in prices can impact the operating margin as the price hike would be passed on with a lag of about three months. (%) Exhibit 29: Trends in raw material mix 100 90 80 70 60 50 40 30 20 10 - 71 66 29 33 FY07 FY08 53 59 57 56 62 62 62 48 42 43 44 38 38 38 FY09 FY10 FY11 FY12 FY13 FY14E FY15E Aliminium & Steel Costs Others Source: Company, ICICIdirect.com Research Currency fluctuations to impact operating margin TTKP imports some of its products directly from China, thereby exposing it to currency fluctuation risks. While the company does take price hikes to pass on the impact of the currency fluctuation, it may not always be possible to pass on the impact to customers. Any adverse fluctuations may thereby weigh on the operating margin. However, with the recently concluded expansion, the company’s reliance on imports is likely to come down, thereby mitigating a part of this risk. Competitive pressure: Will the company be able to maintain its dominance? Exhibit 30: Sales growth: Comparison between TTKP and Hawkins 60 50.3 44.5 50 (%) 40 30 20 26.9 26.8 23.1 22.2 26.9 10 FY07 16.0 17.6 18.3 18.3 16.9 10.1 FY08 FY09 FY10 FY11 FY12 Hawkins Cookwers 15.6 FY13 TTK Prestige Source: Company, ICICIdirect.com Research In the last three years, TTKP has grown faster than Hawkins Cookers (Hawkins) as there were some issues at Hawkins’ manufacturing facilities. With the issues being resolved and Hawkins’ sales picking up, TTKP’s topline could take a hit. Though we have factored in lower growth rates in ICICI Securities Ltd | Retail Equity Research Page 13 our estimates, a higher-than-expected decline in revenues could impact the bottomline. Also, in order to maintain its leadership position, TTKP has adopted a strategy of taking minimal price hikes. If a price war is triggered between its competitors, TTKP may be forced to keep prices low, which may further dampen the operating margin and, thereby, the profitability. Improper utilisation of excess cash may impact return ratios We expect cash flows to increase as the capex is over and the company will now reap the benefits of the same. Additionally, inflows from the allotment to Cartica Capital will help lower debt. While we expect the company to increase dividend payout and use the cash prudently for the right acquisitions, any inefficient utilisation of the cash would have a significant bearing on the return ratios. Overall slowdown in economy The company’s product portfolio comes under the discretionary spends segment. A slowdown in the economy, rising interest rates and increasing inflation all have a direct bearing on discretionary spends. If there is a prolonged period of slowdown and such a macroeconomic turmoil, the company’s revenues could be significantly impacted. ICICI Securities Ltd | Retail Equity Research Page 14 Financials Revenues to grow at CAGR of 12.5% in FY13-15E Exhibit 31: We expect TTKP’s revenues to grow at a CAGR of 12.5% during FY13-15E 60 50.3 1,719 44.5 22.2 764 326 401 FY07 FY08 FY09 FY10 50 40 30 15.1 23.1 20 10 508 281 500 1,493 26.9 16.0 - 1,358 1,000 26.6 1,103 (| crore) 1,500 (%) 2,000 9.9 FY11 Net Sales FY12 FY13 FY14E FY15E Sales growth (RHS) Source: Company, ICICIdirect.com Research Over the last six years, the company’s revenues have grown at a CAGR of 30.0% (during FY07-13). A large part of this growth (~23.0%) came on the back of volume growth. Considering the current slowdown and the expanding base, we expect the revenue CAGR to come down to 12.5% during FY13-15E. During this period, we expect volumes to grow at a CAGR of 11.5% while realisations are likely to grow at a CAGR of 0.9%. The company has also undertaken a capacity expansion plan and these incremental capacities are operational now. We expect revenue growth to pick up once again, as and when the macroeconomic situation improves. A revival in the southern markets will also be a key trigger for the company’s revenue growth. Considering that this year (FY14) is a tough one, we expect a lower topline growth of 9.9%. 1,140 1,157 FY14E FY15E 826 FY11 1,137 885 FY10 FY13 913 600 FY09 20 800 875 40 5.8 1,000 1,034 1,200 60 FY08 4.5 1,400 843 3.9 12.1 80 FY07 3.5 10.8 15.1 (|) 9.3 13.3 (%) 400 200 - Volumes FY15E FY14E FY13 FY12 FY11 FY10 FY09 FY08 FY07 0 Volume Growth (RHS) Source: Company, ICICIdirect.com Research - Realisation per piece FY12 (in million pieces) 16 14 12 10 8 6 4 2 Exhibit 33: Realisation growth likely to be flattish at 0.9% 30 25 20 15 10 5 0 -5 -10 (%) Exhibit 32: Volumes to grow at CAGR of 11.5% during FY13-15E Realisation Growth (RHS) Source: Company, ICICIdirect.com Research Realisations of the company have increased from | 843 per piece in FY07 to | 1,137 per piece in FY13, representing a CAGR of 5.1% during the period. As stated above, going forward also, we expect growth to be largely volume led and expect realisations to grow at a CAGR of 0.9% during FY13-15E. We expect realisations to reach | 1,157 per piece by FY15. ICICI Securities Ltd | Retail Equity Research Page 15 Operating margins to remain relatively subdued Over the years, with the launch of products with high operating margin and increased operating leverage, the company has managed to scale up the operating margin from 9.4% in FY07 to 15.1% in FY13. TTKP’s operating margin has stabilised in the 14.5–15.5% range. However, owing to the significant depreciation of the rupee and lower sales offtake, the operating margin has shrunk 200 bps to 13.2% in H1FY14. As a strategy to gain market share and maintain its dominance, the company plans to take price hikes only to the extent required. Hence, we do not expect any significant up move in the operating margin in FY15 as well. TTKP’s operating margin has stabilised in the 14.5-15.5% Exhibit 34: EBITDA margin to remain under pressure owing to rupee depreciation, slow demand range over the last few years. However, with the operating margin has shrunk 200 bps to 13.2% in H1FY14 16.5 (| crore) 15.6 15.3 240 180 204 171 120 60 17 15.1 26 - FY07 10.1 9.9 33 39 FY08 FY09 204 15 14.7 13 13.7 125 9.4 251 (%) 300 depreciation of the rupee and slower revenue growth, the 11 77 9 FY10 FY11 EBITDA FY12 FY13 FY14E FY15E EBITDA Margin (RHS) Source: Company, ICICIdirect.com Research Lower interest outgo to aid PAT growth TTKP had to resort to bank borrowings in FY12 and FY13 to fund its capex of | 300 crore. Owing to that, PAT margins declined 110 bps, from 11.0% in FY11 to 9.9% in FY13. As the capex is complete, we expect depreciation costs to go up. However, with improving cash flows and the money raised through the stake sale to Cartica Capital (| 106 crore), we expect the company to retire the debt by FY15E. Owing to this, we expect the company’s PAT to grow at a CAGR 11.8% (FY13-15E) to | 166.3 crore. to come down. Hence, we expect the company to report a Exhibit 35: PAT margin to expand 80 bps owing to lower interest expense PAT of | 166.3 crore in FY15E 10.4 11.0 10.3 135 9.9 9.2 9.7 12 (| per share) 9 6.3 90 5.6 166 4.2 113 45 133 136 84 12 21 22 FY07 FY08 FY09 - PAT 6 (%) With reducing debt, the company’s interest outgo is likely 3 52 FY10 FY11 FY12 FY13 FY14E FY15E PAT Margin (RHS) Source: Company, ICICIdirect.com Research ICICI Securities Ltd | Retail Equity Research Page 16 Comfortably leveraged TTKP virtually maintains a debt-free status barring years wherein it had a capacity expansion plan. Owing to strong cash flow generation, the company has managed to retire debt within a year or two. The company outlaid a capex plan of | 300 crore in FY11 owing to which debt levels increased to | 115 crore in FY13. We expect TTKP to repay the debt over the next two years. TTKP has maintained a virtually debt-free status. As and Exhibit 36: Debt-equity ratio trend when the company plans a capacity expansion it has to flows, the company was able to retire the debt in a couple 100 of years 1.6 1.2 0.8 0.6 47 40 1.0 79 74 (| crore) 80 60 1.4 0.4 30 3 2 FY08 21 FY07 9 20 - (x) 120 115 leverage itself. However, owing to strong internal cash FY09 FY10 FY11 Debt 0.2 - FY12 FY13 FY14E FY15E Debt / Equity (RHS) Source: Company, ICICIdirect.com Research Return ratios to pick up In the past, TTKP has enjoyed healthy return ratios backed by healthy asset turns. However, as operating margins remain range-bound and the asset turnover is likely to come down from the peak of 9.8x in FY11 to 5.2x in FY15E we expect return ratios to stabilise in the 25–35% band. In FY14, return ratios are likely to further dip owing to the allotment of three lakh shares to Cartica Capital. As the newly set up capacities stabilise and the asset turnover picks up in FY15E, we expect the company to report an RoE and RoCE of 23.3% and 31.1%, respectively. We expect return ratios to pick up in FY15E as the Exhibit 37: Trends in return on equity and return on capital employed (%) expanded capacities fully stabilise 70 58.1 60 62.5 45.3 50 (%) 30 18.7 20 10 38.1 34.0 40 42.2 25.0 30.0 21.4 43.7 39.7 29.6 31.1 22.5 23.3 FY14E FY15E 33.7 26.4 FY07 FY08 FY09 ROE FY10 FY11 FY12 FY13 ROCE Source: Company, ICICIdirect.com Research ICICI Securities Ltd | Retail Equity Research Page 17 Dividend payout to increase as cash flow generation improves The company is able to generate healthy cash flows each year. Barring years in which TTKP has capex plans, it typically pays healthy dividends. Considering that the capex has recently concluded, the dividend payout of the company is likely to go up. We expect the dividend payout to increase from 15% in FY13 to 30% in FY15E. Dividend payout is likely to increase from 15% in FY13 to Exhibit 38: Dividend payout trend 30% in FY15E owing to improved cash flows 15 15 4 - FY07 6 74 62 11 43 46 4 62 97 100 14 17 FY11 FY12 20 15 50 20 27 FY13 FY14E 25 (%) 20 17 50 161 22 19 3 35 30 25 150 (| crore) 30 29 120 200 10 5 - FY08 Dividend payout FY09 FY10 Cash from operations FY15E Dividend Payout Ratio (RHS) Source: Company, ICICIdirect.com Research ICICI Securities Ltd | Retail Equity Research Page 18 Valuation Over the last several years, the stock has performed well and the stock price has jumped from | 150 in April 2006 to over | 3700 now. This multifold growth in the share price has taken place on the back of (a) a strong growth trajectory exhibited by the company (topline CAGR of 30% during FY07-13); (b) healthy operating margin expansion from 9.4% in FY07 to 15.1% in FY13; (c) robust PAT growth – CAGR of 49.8% during FY07-13 and (d) return ratios improvement – RoE expanded from 21.4% in FY07 to 33.7% in FY13. The price to earnings multiple of the company has also expanded in line with the strong performance exhibited by the company. TTKP is currently trading closer to its one year forward multiple average (last five years) of 23.8x. Owing to the concerns on moderation of growth rates in the backdrop of the weak macroeconomic environment and rising competitive pressure we have valued the company at a multiple of 22.0x FY15E EPS of | 142.6 to arrive at a target price of | 3,140. Exhibit 39: One year forward P/E band chart 4,000 24.0x 20.0x 3,000 (|) 16.0x 2,000 12.0x 8.0x 1,000 Avg. Price 8.0x 12.0x 16.0x 20.0x Apr-13 Oct-12 Apr-12 Oct-11 Apr-11 Apr-10 Oct-10 - 24.0x Source: Company, ICICIdirect.com Research A comparison of various other companies in the consumption space also reveals that companies having healthy return ratios and consistent growth get rewarded with an average multiple of 27.8x FY15E earnings. In a volatile market situation as well, investors are on the look out for companies with stable growth, low/no leverage, healthy return ratios and TTKP meets these criterions well. Exhibit 40: Comparison of companies with similar return ratios (FY15E) Company Marico Dabur Titan Page Industries Asian Paints Jubilant Foods Average Market Cap (| crore) 29,497 21,520 20,659 4,843 7,642 28,490 RoE (%) 36.4 34.3 33.8 54.8 31.2 23.6 35.7 P/E (x) 26.7 21.9 31.0 24.7 34.5 27.9 27.8 EV/EBITDA (x) 21.1 14.1 19.6 15.0 18.1 20.3 18.0 Revenue CAGR (FY13-15E) 14.9 18.1 13.9 27.3 31.3 40.1 24.3 Source: Bloomberg, ICICIdirect.com Research ICICI Securities Ltd | Retail Equity Research Page 19 Over the past two to three years, the share price has not moved significantly owing to the short-term overhangs of pressure on the operating margin, compression of return ratios owing to the capex plans and also slowdown in sales growth due to power problems in Southern India. However, the company has overcome these challenges and is once again poised for robust growth. With regard to the operating margin, the management is confident of maintaining margins in the range of 14.5– 15.5% despite competitive pressure. However, we have been conservative and expect the operating margin to remain at the lower end of the guidance in FY15E. The return ratios of the company are slated to move upwards, as the capex has concluded and the company plans to retire the entire debt by FY15E. Lastly, with regard to the concentration of revenues in the southern region, the company has gradually expanded its presence to the rest of the country and now ~40% of the company’s revenues come from non-southern markets (as compared to 25% earlier). Till the overhang of slowdown remains, we expect multiples to remain relatively subdued. The key monitorable will be the pick-up of demand and fair utilisation of expanded capacities. Exhibit 41: Peer comparison (FY13) Particulars Unit EBITDA Margin % TTK Prestige 15.1 Hawkins Cookers 11.9 Butterfly Gandhimathi 9.8 PAT Margin % 9.9 8.0 4.8 Return on Equity % 33.7 64.1 18.1 Return on Capital Employed % 38.1 79.4 24.1 P/E (TTM) x 28.1 32.2 14.4 Market Cap | crore 3840.7 952.4 511.1 Source: Company, ICICIdirect.com Research ICICI Securities Ltd | Retail Equity Research Page 20 Financial Tables Exhibit 42: Profit & loss account (| crore) Net Sales % Growth Other Operating Income Raw Materials Manufacturing Expenses Employee Expenses Sell. & Distri. Expenses Admin. Expenses Total Exp. % Growth Operating Profit Depreciation Interest expense Other Income PBT Tax Net Profit % Growth Equity Dividend % EPS FY10 505.2 26.9 2.7 264.6 13.1 39.3 38.0 75.5 430.6 18.9 77.4 3.6 3.5 1.1 71.43 23.0 48.5 134.3 11.3 99.9 46.3 FY11 759.2 50.3 4.4 409.8 15.6 53.0 47.2 112.7 638.2 48.2 125.3 4.3 4.4 4.3 120.94 36.6 84.3 59.7 11.3 124.9 73.9 FY12 1,097.0 44.5 6.5 617.9 21.3 73.0 69.8 149.9 932.0 46.0 171.4 6.2 6.4 4.5 163.26 49.9 113.4 35.4 11.3 149.8 100.0 FY13 1,350.3 23.1 8.2 776.6 35.5 83.6 85.2 173.9 1,154.8 23.9 203.7 9.0 14.3 4.7 185.21 52.1 133.1 17.4 11.4 174.8 117.2 FY14E 1,483.6 9.9 9.5 882.8 37.1 92.0 92.0 185.4 1,289.3 11.7 203.7 15.5 8.0 10.5 190.63 54.3 136.3 2.4 11.7 233.9 116.9 FY15E 1,708.0 15.1 10.9 999.9 44.4 106.2 104.2 213.5 1,468.2 13.9 250.6 25.9 4.3 12.0 232.51 66.3 166.2 22.0 11.7 427.9 142.6 FY11 11.3 180.1 2.2 3.3 197.0 41.9 49.5 22.6 105.0 74.7 53.5 77.9 0.3 311.5 228.5 83.0 197.0 FY12 11.3 273.9 78.1 1.3 5.0 6.8 376.5 150.8 79.4 0.0 174.9 106.0 22.8 37.8 0.5 342.0 195.6 146.4 376.5 FY13 11.4 384.1 63.7 51.4 5.0 10.1 525.7 168.1 140.1 0.0 235.5 143.2 32.6 69.7 1.5 482.5 265.0 217.5 525.7 FY14E 11.7 594.7 29.7 5.0 13.0 654.0 317.2 14.0 0.0 304.8 154.5 98.5 89.0 1.5 648.3 325.4 322.8 654.0 FY15E 11.7 702.6 8.5 5.0 16.0 743.8 312.7 8.4 0.0 336.9 177.8 162.9 119.6 1.5 798.6 376.0 422.7 743.8 Source: Company, ICICIdirect.com Research Exhibit 43: Balance sheet (| crore) Equity Share Capital Reserves & Surplus. Secured Loans Unsecured Loans Other LT Liabilities Deferrred Tax Total Liabilities Net Block CWIP Investments Inventories Sundry Debtors Cash & Bank Loans & Adv. Other Current Assets Current Assets CL & Prov. Net Current Assets Total Assets FY10 11.3 112.8 2.8 3.1 130.1 40.5 23.5 0.4 61.3 60.3 44.0 42.4 0.2 208.1 142.4 65.7 130.1 Source: Company, ICICIdirect.com Research ICICI Securities Ltd | Retail Equity Research Page 21 Exhibit 44: Cash flow statement (| crore) Net Profit Before Tax Depreciation Interest Expense Direct Tax Paid (Profit)/Loss on sale of Assets (net) Interest / Dividend Income CF before change in WC Inc./Dec. in WC CF from operations Pur. of Fix Assets (net) Purchase of Investments (net) Others CF from Investing Inc./(Dec.) in Debt Inc./(Dec.) in Net worth Others CF from Financing Opening Cash balance Closing Cash balance FY10 71.4 3.6 1.1 (23.1) (1.1) 51.9 9.7 61.7 (4.0) 1.1 (2.9) (17.9) (7.8) (25.7) 10.9 44.0 FY11 120.4 4.4 0.8 (35.1) (3.7) 86.6 (12.3) 74.3 (31.8) (22.2) 3.7 (50.2) (14.5) (14.5) 44.0 53.5 FY12 163.3 6.4 6.4 (46.8) (0.2) (2.4) 126.6 (64.7) 61.9 (152.3) 22.2 2.4 (127.6) 57.5 (22.9) 34.6 53.9 22.8 FY13 185.2 9.0 14.7 (32.4) (0.0) (3.2) 173.2 (76.0) 97.3 (92.4) 3.5 (88.9) 35.9 (34.6) 1.3 22.9 32.5 FY14E 190.6 15.5 8.0 (54.3) 159.8 (39.4) 120.4 (37.3) (37.3) (85.4) 106.5 (38.2) (17.1) 32.4 98.5 FY15E 232.5 25.9 4.3 (66.3) 196.4 (35.4) 161.0 (15.8) (15.8) (21.1) (59.7) (80.8) 98.5 162.9 Source: Company, ICICIdirect.com Research Exhibit 45: Key ratios FY10 FY11 FY12 FY13 FY14E FY15E Expenditure Break-up (%) Raw Material Expenses Manufacturing, Admin & Selling Exp. Personnel Expenses 61.5 29.4 9.1 64.2 27.5 8.3 66.3 25.9 7.8 67.2 25.5 7.2 68.5 24.4 7.1 68.1 24.7 7.2 Profitability Ratios (%) EBITDA Margin PAT Margin 15.3 10.4 16.5 11.0 15.6 10.3 15.1 9.9 13.7 9.2 14.7 9.7 448.2 68.2 3,259.1 109.6 38.8 46.3 49.4 10.0 673.7 110.6 3,250.1 168.9 47.2 73.9 77.6 12.5 973.5 151.3 3,345.4 251.7 20.1 100.0 105.5 15.0 1,196.4 179.4 3,368.1 348.3 28.7 117.2 125.1 17.5 1,281.0 174.8 3,236.4 520.3 84.5 116.9 130.3 23.4 1,474.8 215.1 3,163.0 612.8 139.7 142.6 164.9 42.8 42.2 58.1 63.5 43.7 62.5 71.2 39.7 45.3 33.2 33.7 38.1 27.8 22.5 29.6 25.4 23.3 31.1 29.7 Per Share Data (|) Revenue per share EBITDA per share EV per share Book Value per share Cash per share EPS Cash EPS DPS Return Ratios (%) RoNW RoCE RoIC Source: Company, ICICIdirect.com Research ICICI Securities Ltd | Retail Equity Research Page 22 Exhibit 46: Key ratios Financial Health Ratios Operating Cash flow (| crore) Free Cash flow (| crore) Capital Employed (| crore) Debt to Equity (x) Debt to Capital Employed (x) Interest Coverage (x) Debt to EBITDA (x) FY10 61.7 59.3 127.0 0.0 0.0 21.2 0.0 FY11 74.3 22.4 193.7 0.0 0.0 27.3 0.0 FY12 61.9 (73.8) 364.7 0.3 0.2 25.8 0.5 FY13 97.3 (19.4) 510.6 0.3 0.2 13.7 0.6 FY14E 120.4 73.4 636.0 0.0 0.0 23.5 0.1 FY15E 161.0 135.4 722.8 0.0 0.0 52.6 0.0 0.7 1.0 0.1 3.9 1.0 0.7 1.0 0.2 3.9 1.0 0.7 1.0 0.2 2.9 1.3 0.7 1.0 0.1 2.6 1.3 0.7 1.0 0.1 2.3 1.1 0.7 1.0 0.1 2.3 1.0 (YoY Growth %) Net Sales EBITDA Net Profit 26.9 97.0 134.3 50.3 62.0 59.7 44.5 36.8 35.4 23.1 18.8 17.4 9.9 (0.0) 2.4 15.1 23.0 22.0 Turnover Ratios Working Capital / Sales (x) Inventory turnover (days) Debtor turnover (days) Creditor turnover (days) Current Ratio (x) 0.0 44.3 43.5 36.7 1.5 0.0 50.5 35.9 35.7 1.4 0.1 58.2 35.3 28.7 1.7 0.1 63.7 38.7 33.8 1.8 0.2 75.0 38.0 30.0 2.0 0.2 72.0 38.0 30.0 2.1 Free Cash Flow (| crore) EBIT (post-tax) Add: Depreciation Less: Changes in working capital Less: Capex FCF 50.0 3.6 (9.7) 4.0 59.3 84.4 4.3 12.3 54.0 22.4 114.7 6.2 64.7 130.1 (73.8) 139.9 9.0 76.0 92.4 (19.4) 134.6 15.5 39.4 37.3 73.4 160.7 25.9 35.4 15.8 135.4 Valuation Ratios Price to earnings ratio (x) EV / EBITDA (x) EV / Sales (x) Dividend Yield (%) Price / BV (x) 71.2 47.8 7.3 0.3 30.1 44.6 29.4 4.9 0.3 19.5 32.9 22.1 3.5 0.4 13.1 28.1 18.8 2.8 0.5 9.5 28.2 18.5 2.5 0.5 6.3 23.1 14.7 2.2 0.7 5.4 DuPont Analysis (x) PAT / PBT PBT / EBIT EBIT / Net Sales Net Sales / Total Assets Total Assets / Networth Source: Company, ICICIdirect.com Research ICICI Securities Ltd | Retail Equity Research Page 23 RATING RATIONALE ICICIdirect.com endeavours to provide objective opinions and recommendations. ICICIdirect.com assigns ratings to its stocks according to their notional target price vs. current market price and then categorises them as Strong Buy, Buy, Hold and Sell. The performance horizon is two years unless specified and the notional target price is defined as the analysts' valuation for a stock. Strong Buy: >15%/20% for large caps/midcaps, respectively, with high conviction; Buy: > 10%/ 15% for large caps/midcaps, respectively; Hold: Up to +/-10%; Sell: -10% or more; Pankaj Pandey Head – Research pankaj.pandey@icicisecurities.com ICICIdirect.com Research Desk, ICICI Securities Limited, 1st Floor, Akruti Trade Centre, Road No. 7, MIDC, Andheri (East) Mumbai – 400 093 research@icicidirect.com ANALYST CERTIFICATION We /I, Bharat Chhoda M.B.A.(FINANCE) Dhvani Modi M.B.A.(FINANCE) research analysts, authors and the names subscribed to this report, hereby certify that all of the views expressed in this research report accurately reflect our personal views about any and all of the subject issuer(s) or securities. We also certify that no part of our compensation was, is, or will be directly or indirectly related to the specific recommendation(s) or view(s) in this report. Analysts aren't registered as research analysts by FINRA and might not be an associated person of the ICICI Securities Inc. Disclosures: ICICI Securities Limited (ICICI Securities) and its affiliates are a full-service, integrated investment banking, investment management and brokerage and financing group. We along with affiliates are leading underwriter of securities and participate in virtually all securities trading markets in India. We and our affiliates have investment banking and other business relationship with a significant percentage of companies covered by our Investment Research Department. Our research professionals provide important input into our investment banking and other business selection processes. ICICI Securities generally prohibits its analysts, persons reporting to analysts and their dependent family members from maintaining a financial interest in the securities or derivatives of any companies that the analysts cover. The information and opinions in this report have been prepared by ICICI Securities and are subject to change without any notice. The report and information contained herein is strictly confidential and meant solely for the selected recipient and may not be altered in any way, transmitted to, copied or distributed, in part or in whole, to any other person or to the media or reproduced in any form, without prior written consent of ICICI Securities. While we would endeavour to update the information herein on reasonable basis, ICICI Securities, its subsidiaries and associated companies, their directors and employees (“ICICI Securities and affiliates”) are under no obligation to update or keep the information current. Also, there may be regulatory, compliance or other reasons that may prevent ICICI Securities from doing so. Non-rated securities indicate that rating on a particular security has been suspended temporarily and such suspension is in compliance with applicable regulations and/or ICICI Securities policies, in circumstances where ICICI Securities is acting in an advisory capacity to this company, or in certain other circumstances. This report is based on information obtained from public sources and sources believed to be reliable, but no independent verification has been made nor is its accuracy or completeness guaranteed. This report and information herein is solely for informational purpose and may not be used or considered as an offer document or solicitation of offer to buy or sell or subscribe for securities or other financial instruments. Though disseminated to all the customers simultaneously, not all customers may receive this report at the same time. ICICI Securities will not treat recipients as customers by virtue of their receiving this report. Nothing in this report constitutes investment, legal, accounting and tax advice or a representation that any investment or strategy is suitable or appropriate to your specific circumstances. The securities discussed and opinions expressed in this report may not be suitable for all investors, who must make their own investment decisions, based on their own investment objectives, financial positions and needs of specific recipient. This may not be taken in substitution for the exercise of independent judgment by any recipient. The recipient should independently evaluate the investment risks. The value and return of investment may vary because of changes in interest rates, foreign exchange rates or any other reason. ICICI Securities and affiliates accept no liabilities for any loss or damage of any kind arising out of the use of this report. Past performance is not necessarily a guide to future performance. Investors are advised to see Risk Disclosure Document to understand the risks associated before investing in the securities markets. Actual results may differ materially from those set forth in projections. Forward-looking statements are not predictions and may be subject to change without notice. ICICI Securities and its affiliates might have managed or co-managed a public offering for the subject company in the preceding twelve months. ICICI Securities and affiliates might have received compensation from the companies mentioned in the report during the period preceding twelve months from the date of this report for services in respect of public offerings, corporate finance, investment banking or other advisory services in a merger or specific transaction. It is confirmed that Bharat Chhoda M.B.A.(FINANCE) Dhvani Modi M.B.A.(FINANCE) research analysts and the authors of this report have not received any compensation from the companies mentioned in the report in the preceding twelve months. Our research professionals are paid in part based on the profitability of ICICI Securities, which include earnings from Investment Banking and other business. ICICI Securities or its subsidiaries collectively do not own 1% or more of the equity securities of the Company mentioned in the report as of the last day of the month preceding the publication of the research report. It is confirmed that Bharat Chhoda M.B.A.(FINANCE) Dhvani Modi M.B.A.(FINANCE) research analysts and the authors of this report or any of their family members does not serve as an officer, director or advisory board member of the companies mentioned in the report. ICICI Securities may have issued other reports that are inconsistent with and reach different conclusion from the information presented in this report. ICICI Securities and affiliates may act upon or make use of information contained in the report prior to the publication thereof. This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction, where such distribution, publication, availability or use would be contrary to law, regulation or which would subject ICICI Securities and affiliates to any registration or licensing requirement within such jurisdiction. The securities described herein may or may not be eligible for sale in all jurisdictions or to certain category of investors. Persons in whose possession this document may come are required to inform themselves of and to observe such restriction. ICICI Securities Ltd | Retail Equity Research Page 24