Asian Paints (ASIPAI)

advertisement

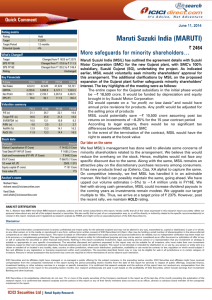

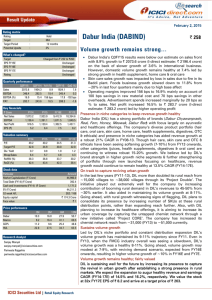

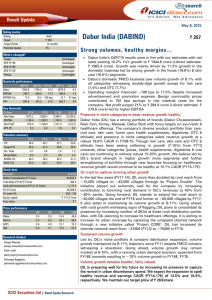

Result Update May 19, 2015 Rating matrix Rating Target Target Period Potential Upside : : : : Asian Paints (ASIPAI) Hold 729 12 months -6% Slow volume offtake hits topline… • What’s Changed? Target EPS FY16E EPS FY17E Rating Changed from | 825 to | 729 Changed from | 20.5 to | 17.5 Changed from | 23.6 at | 20.6 Unchanged Quarterly Performance Revenue EBITDA EBITDA (%) PAT Q4FY15 3,490.4 559.2 15.8 341.0 Q4FY14 3,266.4 485.1 14.7 287.4 YoY (%) 6.9 15.3 115bps 18.6 Q3FY15 QoQ (%) 3,602.8 -3.1 580.7 -3.7 15.9 -8bps 367.6 -7.2 Key Financials | Crore Revenue EBITDA Net Profit EPS (|) FY14 12,715 1,997.9 1,218.8 12.7 FY15E 14,183 2,235.4 1,395.2 14.5 FY16E 16,342 2,659.8 1,679.2 17.5 FY17E 18,636 3,090.6 1,974.8 20.6 FY14 61.1 57.4 36.8 18.5 34.0 47.4 FY15E 53.4 50.1 33.1 15.7 32.5 44.9 FY16E 44.4 41.6 27.8 14.1 34.3 47.2 FY17E 37.7 35.4 23.9 12.2 35.5 48.9 Valuation summary P/E Target P/E EV / EBITDA P/BV RoNW (%) RoCE (%) Stock data Particular Market Capitalization (| Crore) Total Debt (FY15) (| Crore) Cash and Investments (FY15) (| Crore) EV (| Crore) 52 week H/L (|) Equity capital (| Crore) Face value (|) Amount 74,529.8 78.3 590.3 74,017.8 922/460 95.9 1.0 Price performance (%) Asian Paints Berger Paints Kansai Nerolac Akzo Noble 1M (6.3) 1.7 (5.7) (0.3) 3M (6.7) (2.7) (10.1) (5.9) | 777 6M 9.5 16.7 13.9 9.5 12M 43.1 78.4 75.1 70.7 Research Analyst Sanjay Manyal sanjay.manyal@icicisecurities.com Hitesh Taunk hitesh.taunk@icicisecurities.com ICICI Securities Ltd | Retail Equity Research Asian Paints (APL) reported disappointing 6.9% topline growth in Q4FY15 on the back of muted 6.5% volume growth mainly due to sluggish demand for decorative paint. In the quarter, APL has passed on the benefit of lower raw material cost by cutting price ~2% with effect from February 2015 • Saving in raw material cost to the tune of 322 bps YoY was partially offset by ~128 bps YoY rise in other expenses (due to higher CSR expenses and ~81 bps YoY rise in employee cost (VRS/VSS for employees at Bhandup plant). As a result, operating margin improved ~115 bps YoY. Net profit witnessed ~19% YoY growth mainly on account of higher operative profits and other income • We have modelled ~14% revenue CAGR in FY15-17E largely supported by 11.5% volume CAGR but we assume limited headroom for price hike as APL may pass on the price benefit to customers Leader in paint segment, economic recovery to drive volume growth APL is the industry leader in the decorative paint segment with ~57% market share and a dealer network of over 35,000 across India. It derives ~85% of its topline from the decorative segment while the rest comes from the industrial segment. With limited competition in the market, APL recorded revenue CAGR of 10% in FY11-15 driven by volume CAGR of ~8% (amid economic slowdown) during the same period. In spite of inflationary pressure in FY11-15, gross margins expanded ~110 bps clearly indicating APL’s pricing power. Slowing Indian GDP growth (paints volume growth is 1.5-1.7x real GDP growth) and a slowdown in discretionary expenditure (slight shift in repainting demand) took a toll on overall volume growth of the paint industry. We believe an economic recovery (albeit at a slow pace) and repainting demand coupled with the new government’s focus on increasing spending in infrastructure projects would lead to 11.5% volume growth (demand staying intact in tier II, tier III cities) and moderate revenue CAGR of 14% between FY15 and FY17E. Moderate raw material price, favourable rupee movement to aid margin To avoid inflationary pressure, APL has successfully passed on the price hike (~6-7%) to its customers. However, the EBITDA margin tapered off during FY12-13 as raw material prices moved up sharply (~40% of raw material are imported) hit by elevated dollar value against the rupee (up 19% between FY11 and FY13) and bottoming out titanium di-oxide (TiO2) prices. During FY15, the company passed on the benefit of lower material cost to its customer by taking a minute price hike of 0.4% YoY. We have modelled a margin improvement of ~80 bps in FY15-17E albeit at a slow pace supported by benign raw material prices. However, higher fixed cost (due to addition of new facility) will weigh on margin. Strong fundamentals, revival in economy to drive valuation We have revised downward our revenue, PAT CAGR from 17% and 23% to 14% and 18%, respectively, considering the slow pick-up in paint demand. Also, passing on benefits of lower raw material prices coupled with higher fixed cost (due to addition of capacity) would restrict any sharp movement in EBITDA margin. We expect operating margins to inch up ~80 bps by FY17E. However, we believe the robust pace of growth in revenues and earnings would continue for a prolonged period with the economic recovery and with GDP growth coming back on track. Also, high cash on the books could lead to an increase in dividend payout and improvement in RoEs. We value the stock at 35x its FY17E earnings with a revised target price of | 732/share and HOLD recommendation. Variance analysis Q4FY15 Q4FY15E Q4FY14 YoY (%) Q3FY15 QoQ (%) 3,490.4 3,780.3 3,266.4 6.9 3,602.8 -3.1 42.4 33.2 31.1 36.4 32.1 32.2 1,941.9 2,154.6 1,922.6 1.0 2,051.7 -5.4 Employee Exp 216.4 221.2 176.1 22.9 231.9 -6.7 Manufacturing & Other exp 817.5 469.1 723.3 13.0 785.5 4.1 EBITDA EBITDA Margin (%) Depreciation Interest 559.2 15.8 67.2 10.2 622.8 16.1 78.3 9.8 485.1 14.7 62.2 11.7 15.3 115 bps 8.0 -13.1 580.7 15.9 65.2 9.8 -3.7 -8 bps 3.1 4.2 PBT Total Tax PAT 521.8 169.8 341.0 524.7 163.7 350.0 432.3 133.6 287.4 20.7 27.1 18.6 537.8 166.7 367.6 -3.0 1.8 -7.2 Key Metrics Volume growth (%) 6.5 11 13 2 Realisation growth (%) -0.4 5 6 3 Revenue Other Income Raw Material Exp Comments Net sales witnessed growth of 6.9% on the back of muted 6.5% volume growth mainly due to a sluggish demand of decorative paint Raw material cost to sales dipped 322 bps with crude derivative seeing a sharp dip in Q3FY15 Sharp growth in employee expenses due to VRS/VSS on account of closure of Bhandup plant Saving in raw material cost helped in expansion of EBITDA margin Net profit increased 18.6% on the back of higher EBITDA Slow offtake of decorative paint hit the volume during Q4 Price cut as company has passed on the benefit of lower raw material price Source: Company, ICICIdirect.com Research Change in estimates (| Crore) FY16E Old FY17E New % Change Old New % Change Revenue 17,053.1 16,341.9 -4.2 20,005.9 18,636.5 EBITDA 3,114.5 2,659.8 -14.6 3,672.1 3,090.6 Comment We have revised our estimates downward mainly due to expected lower volume -6.8 growth -15.8 EBITDA Margin % 18.3 16.3 -199bps PAT 1914.4 1679.2 -12.3 EPS (|) 20.0 17.5 -12.3 Source: Company, ICICIdirect.com Research 18.4 2281.7 23.8 16.6 1974.8 20.6 Margin revision is largely on account of pass on the benefit of lower raw material -177bps cost coupled with higher fixed cost attached to new capacity additions -13.4 -13.4 Assumptions FY13 FY14 Current FY15E FY16E FY17E FY15E Earlier FY16E FY17E 4.5 6.0 9.7 11.0 12.0 10.0 14.0 12.6 4.8 1.8 Realisation Growth (%) Source: Company, ICICIdirect.com Research 0.3 2.5 2.0 5.0 4.0 5.0 Volume Growth (%) ICICI Securities Ltd | Retail Equity Research Comments We have revised our volume growth estimates downwards due to slower recovery in urban discretionary demand Page 2 Company Analysis Leader in decorative paint segment with over ~57% market share Asian Paints (APL) has remained the industry leader among top four players (i.e. Berger Paints, Kansai Nerolac and Akzo Nobel) with a market share of 57% followed by Berger Paints with ~17% and Kansai Nerolac with ~14%. In spite of competition gaining momentum, in the last six years (2008-14), APL’s market share has improved 400 bps (in terms of value) supported by a strong dealer network, strong supply chain, brand building exercise and launch of premium products in domestic markets. The company has a strong dealer network of over 35,000 across India (~27,000 dealers with tinting machines), which is nearly double India’s No. 2 player Berger Paints in the decorative segment. The company has recorded revenue CAGR of 20% in FY05-08 led by ~16% volume growth supported by rising urbanisation, shorter repainting demand and launch of premium products. Leader in decorative paints segment continues to grow at a healthy pace with strong double digit volume growth mainly contributed by decorative paints demand The volume growth in the paint segment has remained higher than real GDP growth and commands a multiplier of 1.7x (average FY02-08). We have modelled revenue CAGR of 14% in FY15-17E led by 11.5% volume growth during the same period. Our estimate of volume growth is largely supported by demand remaining intact for decorative paints in tier II and tier III cities coupled with shorter repainting demand that will help in driving volume growth. Exhibit 1: Expect volume CAGR of ~11.5% in FY15-17E 20000 15 15000 (| crore) 20 10 (%) Exhibit 2: Net sales growth at ~14% CAGR in FY15-17E 5 5000 0 -5 10000 FY10 FY11 FY12 FY13E FY14E FY15E FY16E FY17E Volume Growth 0 FY10 Realisation growth FY11 FY12 FY13 Domestic FY14 FY15E FY16E FY17E Overseas Source: Company, ICICIdirect.com Research Source: Company, ICICIdirect.com Research Exhibit 3: Market share of leading paint companies (2008) Exhibit 4: Market share of leading paint companies (2014) Akzo Noble 10% Asian Paints 52% Berger Paints 17% Shalimar Paints 4% Akzo Noble 11% Kansai Nerolac 16% Source: Company, ICICIdirect.com Research ICICI Securities Ltd | Retail Equity Research Shalimar Paints 2% Kansai Nerolac 14% Berger Paints 17% Asian Paints 57% Source: Company, ICICIdirect.com Research Page 3 Sharp volume growth with timely price hike offsets inflationary pressure APL’s margin movement has been in the range of 15-16% during the bull run of FY05-08, supported by volume CAGR of ~16% and benefit of lower raw material prices [mainly Titanium Di Oxide (TiO2)]. However, APL had not been immune to the economic slowdown and the EBITDA margin in FY09 declined ~400 bps YoY (followed by a sharp gross margin correction of 440 bps) due to a sharp movement in crude oil prices. As majority of the raw material of paint companies is imported (~40% of raw material), an elevated dollar value against rupee and higher TiO2 prices (increased CAGR 11%) during FY11-14 restricted the average EBITDA margin to 15-16% with volume CAGR of ~8% during the same period. Raw material prices have remained benign in the last few years, which has helped an expansion in gross margin by ~110 bps during FY11-15. However, we believe the company would pass on the benefit of lower raw material prices, which would restrict a sharp growth in EBITDA margin, going forward. We have modelled an EBITDA margin improvement of ~80 bps in FY15-17E led by benefit of benign raw material prices (supported by favourable currency movement coupled with stabilising TiO2 prices). However, addition of new capacity in the near future (expansion in Rohtak plant is expected to be commissioned by Q4FY16) would restrict any sharp margin movement. Exhibit 5: Stabilising raw material cost (Tio2 Prices) Exhibit 6: Regular price hike to help in margin expansion 240 230 210 (%) (|/kg) 220 200 190 180 17.9 FY10 Apr-15 Mar-15 Feb-15 Jan-15 Dec-14 Nov-14 Oct-14 Sep-14 Aug-14 Jul-14 Jun-14 May-14 170 20.1 22 20 18 16 14 12 10 8 6 4 FY11 15.7 15.8 15.7 15.8 16.3 16.6 FY12 FY13 FY14 FY15E FY16E FY17E Source: Company, ICICIdirect.com Research Source: Company, ICICIdirect.com Research Exhibit 7: Fall in commodity prices to drive EBITDA margin by ~80 bps (FY15-17E) 2855.9 3000 2455.7 2500 16 (| crore) 2000 17 2057.9 1887.3 (%) 16 1500 1000 500 15 15 556.5 490.0 530.9 514.6 464.7 480.2 498.0 444.4 14 0 FY17E FY16E FY15 Q4FY15 Q3FY15 Q2FY15 Q1FY15 FY14 Q4FY14 Q3FY14 Q2FY14 Q1FY14 14 EBITDA (| crore) EBITDA margin (%) Source: Company, ICICIdirect.com Research ICICI Securities Ltd | Retail Equity Research 17 Page 4 Improvement in margin to drive PAT We believe PAT is likely to record a CAGR of 18% in FY15-17E, supported by an improvement in the EBITDA margin. The company has planned a total capex of ~ | 700 crore, which includes capacity addition of 2 lakh tonnes in Rohtak plant and new capacity addition in southern India. We believe there would be near term pressure in free cash flows considering the capital outlay. Exhibit 8: PAT likely to grow at 23% CAGR in FY14-17E 2500 (| crore) 2000 1500 1218.8 1113.9 6 1000 500 335.2 251.1 4 338.7 347.3 367.6 341.0 275.2 326.8 329.4 287.4 2 0 PAT (| crore) FY17E FY16E FY15E Q4FY15 Q3FY15 Q2FY15 Q1FY15 FY14 Q4FY14 Q3FY14 Q2FY14 Q1FY14 FY13E Q4FY13 Q3FY13 0 PAT Margin (%) Source: Company, ICICIdirect.com Research Exhibit 9: Lighter balance sheet to help in driving return ratios (%) 60 55 50 45 40 35 30 25 20 15 FY11 FY12 FY13 FY14 RoE FY15E FY16E FY17E RoCE Source: Company, ICICIdirect.com Research ICICI Securities Ltd | Retail Equity Research Page 5 (%) 12 1974.8 10 1679.2 8 1395.2 Outlook and valuation APL being the market leader in the decorative segment with over 57% market share has commanded rich valuations compared to peers in spite of volume pressure and the declining trend of margin and return ratios. The company recorded revenue, PAT CAGR of 19.6%, 33%, respectively, supported by ~16% volume CAGR in FY05-08. Better operating leverage led to EBITDA margin expansion of 200 bps during the same period. The company has commanded an average one year forward earnings multiple of 22x during FY05-08 with average RoE of 39%. For FY11-13, revenue, PAT CAGR was 12%, 10%, respectively, supported by ~7-8% volume growth. Despite an EBITDA margin erosion by ~142 bps due to lower operating leverage (higher fixed cost) and RoE on a declining trend, the stock has commanded average one year forward earnings multiple of 30x. We have revised downward our revenue, PAT CAGR from 17% and 23% to 14% and 18%, respectively, considering the slow pick-up in paint demand. Also, passing on the benefit of lower raw material prices coupled with higher fixed cost (due to addition of capacity) would restrict any sharp movement in EBITDA margin. We expect operating margins to inch up ~80 bps by FY17E. However, we believe the robust pace of growth in revenues and earnings would continue for a prolonged period with the economic recovery and with GDP growth coming back on track. Also, high cash on the books could lead to an increase in dividend payout and improvement in RoEs. We value the stock at 35x its FY17E earnings with a revised target price of | 732/share and HOLD recommendation. Exhibit 10: Valuation FY14 FY15E FY16E FY17E Sales (| cr) 12714.8 14182.8 16341.9 18636.5 Growth (%) 11.5 15.2 14.0 EPS (|) 12.7 14.5 17.5 20.6 Growth (%) 14.5 20.4 17.6 PE (x) 61.1 53.4 44.4 37.7 EV/EBITDA (x) 36.8 33.1 27.8 23.9 RoNW (%) 34.0 32.5 34.3 35.5 Source: Company, ICICIdirect.com Research ICICI Securities Ltd | Retail Equity Research Page 6 RoCE (%) 47.4 44.9 47.2 48.9 Company snapshot 1,000 Target Price | 729 900 800 700 600 500 400 300 200 100 Mar-17 Dec-16 Sep-16 Jun-16 Mar-16 Dec-15 Sep-15 Jun-15 Mar-15 Dec-14 Sep-14 Jun-14 Mar-14 Dec-13 Sep-13 Jun-13 Mar-13 Dec-12 Sep-12 Jun-12 Mar-12 Dec-11 Sep-11 Jun-11 Mar-11 Dec-10 Sep-10 Jun-10 Mar-10 Dec-09 0 Source: Bloomberg, Company, ICICIdirect.com Research Key events Date Mar-10 Event Robust volume growth along with substantial improvement in operating margins ~18% (best in last six seven years) resulted in a rally in the stock May-10 Commenced operations in its new manufacturing facility at Rohtak, Haryana with a capacity of 1,50,000 kl at an investment of | 275 crore Jan-11 Margin decline due to slow & steady inch up of key crude based raw material prices Oct-11 Aggressive price hike to mitigate raw material pressure a respite to the stock price May-12 Started building a decorative paints plant in Khandala (Maharashtra) with a capacity of ~3,00,000 kl (scalable capacity of 4,00,000 kl) Jan-13 Sustained volumes along with ~20% decline in Titanium dioxide led to the positive movement in the stock Jul-13 The stock witnessed a steep decline in anticipation of adverse impact on results due to a volatile currency movement Nov-13 With sustained volumes and strong margins in Q2FY14 contrary to expectation, the stock recovered and made a new high in November Nov-13 Company closed down the operation of its powder coating plant at Baddi (HP) for two years due to a significant decline in the processing volume Feb/14 Unconditional cash offer for the shares of Berger International (BIL), Singapore by Asian Paints (International) Ltd (APIL), Mauritius, to make BIL a wholly-owned subsidiary and delist from Singapore Exchange Securities Trading (SGX-ST) Asian Paints (International) Ltd, Mauritius, subsidiary of Asian Paints acquired 51% stake in Kadisco Chemical Industry PLC, Ethiopia Apr/14 May/14 Asian Paints acquired the entire stake of Ess Ess Bathroom Products Pvt Ltd, a prominent player in the bath and wash business segment in India Source: Company, ICICIdirect.com Research Top 10 Shareholders Rank 1 2 3 4 5 6 7 8 9 10 Shareholding Pattern Name Smiti Holding & Trading Company Pvt. Ltd. Isis Holding & Trading Company Pvt. Ltd. Geetanjali Trading & Investments Pvt. Ltd. Ojasvi Trading Pvt. Ltd. Life Insurance Corporation of India Vakil (Abhay Arvind) Elcid Investments, Ltd. Gujarat Organics Ltd Sudhanava Investments & Trading Company Pvt. Ltd. Rupen Investment & Industries Pvt. Ltd. Latest Filing Date % O/S Position (m) Change (m) 31-Mar-15 5.64 54.1 0.0 31-Mar-15 5.51 52.9 0.0 31-Mar-15 5.14 49.3 0.0 31-Mar-15 4.90 47.0 0.0 31-Mar-15 4.88 46.8 -6.2 31-Mar-15 2.97 28.5 0.0 31-Mar-15 2.95 28.3 0.0 31-Mar-15 2.38 22.8 0.0 31-Mar-15 1.98 19.0 0.0 31-Mar-15 1.96 18.8 0.0 (in %) Promoter FII DII Others Dec-13 Mar-14 Jun-14 Sep-14 Dec-14 52.8 52.8 52.8 52.8 52.8 19.5 18.0 18.3 18.1 17.3 7.9 9.4 9.2 9.2 9.9 19.9 19.9 19.7 19.9 20.1 Source: Reuters, ICICIdirect.com Research Recent Activity Buys Investor name Centaurus Trading & Investments Pvt. Ltd. Vontobel Asset Management, Inc. Vakil (Amrita A) Vakil (Varun Amar) GMO LLC ICICI Securities Ltd | Retail Equity Research Value 59.81m 54.56m 22.01m 21.13m 19.13m Shares 7.41m 3.94m 2.57m 2.23m 1.77m Sells Investor name Life Insurance Corporation of India Aberdeen Asset Management (Asia) Ltd. OppenheimerFunds, Inc. Reliance Capital Asset Management Ltd. Fidelity Management & Research Company Value -80.20m -75.32m -22.77m -21.73m -18.11m Shares -6.16m -5.78m -1.75m -1.67m -1.39m Page 7 Financial summary Profit and loss statement (Year-end March) Total Operating Revenue Growth (%) Raw Material Expenses Employee Expenses Marketing Expenses Administrative Expenses Other expenses Total Operating Expenditure EBITDA Growth (%) Depreciation Interest Other Income PBT Total Tax Minority Interest PAT Growth (%) EPS (|) | Crore FY14 12,714.8 15.9 7,340.7 759.7 1,125.4 483.5 1,007.5 10,716.9 1,997.9 15.4 245.7 42.2 134.2 1,844.2 571.5 44.0 1,218.8 9.4 12.7 FY15E 14,182.8 11.5 7,971.5 907.1 1,120.4 434.2 1,514.2 11,947.4 2,235.4 11.9 265.9 34.8 169.7 2,104.4 649.5 32.2 1,395.2 14.5 14.5 FY16E 16,341.9 15.2 9,163.5 1,081.2 1,194.2 516.4 1,726.7 13,682.1 2,659.8 19.0 311.4 47.8 186.7 2,487.2 771.0 37.0 1,679.2 20.4 17.5 FY17E 18,636.5 14.0 10,595.8 1,251.3 1,380.1 588.9 1,729.8 15,545.9 3,090.6 16.2 324.4 47.8 205.3 2,923.7 906.3 42.5 1,974.8 17.6 20.6 Source: Company, ICICIdirect.com Research Cash flow statement (Year-end March) Profit before Tax Add: Depreciation (Inc)/dec in Current Assets Inc/(dec) in CL and Provisions Others Tax Paid CF from operating activities (Inc)/dec in Investments (Inc)/dec in Fixed Assets Others CF from investing activities Issue/(Buy back) of Equity Inc/(dec) in loan funds Dividend paid & dividend tax Inc/(dec) in Sec. premium CF from financing activities Net Cash flow Opening Cash Closing Cash Free Cashflow | Crore FY14 1,834.3 255.6 -484.9 316.7 -41.6 -480.2 1,400.0 -390.3 -292.5 79.9 -602.9 0.0 -36.9 -546.7 0.0 -625.9 171.2 736.7 931.7 797.1 FY15E 2,076.9 265.9 -1,026.0 112.1 26.9 -649.5 540.3 -457.9 -107.3 0.0 -565.2 0.0 -117.4 -585.0 0.0 -702.4 -727.3 931.7 204.4 -24.9 FY16E 2,487.2 311.4 -608.6 748.0 45.6 -771.0 1,901.2 -45.0 -568.6 0.0 -613.6 0.0 -22.8 -1,151.0 0.0 -1,173.9 113.7 204.4 318.1 1,287.6 FY17E 2,923.7 324.4 -724.9 446.9 47.8 -906.3 1,787.2 -45.0 -455.6 0.0 -500.6 0.0 -22.8 -1,151.0 0.0 -1,173.9 112.7 318.1 430.8 1,286.6 FY14 FY15E FY16E FY17E 12.7 15.7 42.1 6.2 97.1 14.5 17.7 49.4 6.1 21.3 17.5 21.1 54.9 12.0 33.2 20.6 24.4 63.5 12.0 44.9 15.7 14.6 9.7 59.2 31.8 50.0 15.8 14.8 10.0 58.1 30.3 50.0 16.3 15.4 10.4 58.0 30.0 48.0 16.6 15.9 10.7 58.0 30.0 48.0 34.0 47.4 36.8 32.5 44.9 28.8 34.3 47.2 31.4 35.5 48.9 31.9 61.1 39.0 5.9 5.9 18.5 53.4 36.2 5.3 5.3 15.7 44.4 30.3 4.6 4.6 14.1 37.7 26.0 4.0 4.1 12.2 0.0 0.0 1.2 0.6 0.0 0.0 1.5 0.8 0.0 0.0 1.4 0.7 0.0 0.0 1.4 0.7 Source: Company, ICICIdirect.com Research Note: adjusted for FY15E Balance sheet (Year-end March) Liabilities Share Capital Reserve and Surplus Total Shareholders funds Long term loans Long Term Provisons Minority Interest/Other LT liab Current Liabilities Creditors Other CL Total Liabilities Assets Gross Block Less: Acc Depreciation Net Block Capital WIP Non- Current Investments LT loans & advances Deffered Tax Assets Other Non-current Assets Current Assets Inventory Debtors Cash & Bank Loans & Advances Other Current Assets Total Assets | Crore FY14 FY15E FY16E FY17E 95.9 3,943.3 4,039.2 41.4 108.5 445.2 95.9 4,646.5 4,742.4 78.3 119.7 454.9 95.9 5,174.7 5,270.6 78.3 139.7 516.9 95.9 5,998.5 6,094.4 78.3 159.7 584.4 1,745.7 1,659.4 1,548.8 1,968.5 2,151.7 2,113.5 2,453.6 2,258.5 8,039.4 8,912.5 10,270.6 11,628.8 3,665.7 1,245.5 2,420.2 71.6 192.1 130.3 2.19 166.6 4,000.1 1,511.5 2,488.6 121.6 385.9 278.5 0.2 282.5 4,650.1 1,822.9 2,827.2 371.6 395.9 303.5 2.4 292.5 5,200.1 2,147.2 3,052.8 621.6 405.9 328.5 2.4 302.5 2,069.9 1,110.3 931.7 246.5 698.2 8,039.4 2,258.5 1,179.9 204.4 262.0 1,450.5 8,912.5 2,600.0 1,344.8 318.1 224.1 1,590.5 10,270.6 2,964.7 1,533.5 430.8 255.6 1,730.5 11,628.8 Source: Company, ICICIdirect.com Research Key ratios (Year-end March) Per share data (|) EPS Cash EPS BV DPS Cash Per Share Operating Ratios (%) EBITDA Margin PBT / Total Operating income PAT Margin Inventory days Debtor days Creditor days Return Ratios (%) RoE RoCE RoIC Valuation Ratios (x) P/E EV / EBITDA EV / Net Sales Market Cap / Sales Price to Book Value Solvency Ratios Debt/EBITDA Debt / Equity Current Ratio Quick Ratio Source: Company, ICICIdirect.com Research . ICICI Securities Ltd | Retail Equity Research Page 8 ICICIdirect.com coverage universe (Consumable) CMP M Cap EPS (|) P/E (x) EV/EBITDA (x) (|) TP(|) Rating (| Cr) FY15E FY16E FY17E FY15E FY16E FY17E FY15E FY16E FY17E Sector / Company 777 729 Hold 74,530 14.5 17.5 20.6 53.4 44.4 37.7 33.1 27.8 23.9 Asian Paints (ASIPAI) 246 264 Buy 2,454 -5.3 11.8 15.0 0.0 20.8 16.4 61.6 10.6 9.0 Bajaj Electricals (BAJELE) 271 259 Hold 16,908 6.2 8.8 10.9 43.9 30.8 25.0 22.8 17.7 14.6 Havells India (HAVIND) 218 253 Buy 11,856 5.0 6.5 7.9 43.9 34.0 27.8 25.6 20.3 16.8 Kansai Nerolac (GOONER) 597 560 Hold 30,307 10.0 12.8 16.0 60.1 46.6 37.4 38.6 30.4 24.6 Pidilite Industries (PIDIND) 134 142 Buy 2,010 9.0 10.6 13.2 14.3 12.1 9.7 6.8 5.9 5.1 Essel Propack (ESSPAC) 2,240 3,101 Buy 7,597 40.6 52.8 73.8 53.4 41.1 29.4 40.9 31.2 22.4 Symphony Ltd (SYMCOM) 940 876 Hold 2,883 23.7 28.2 37.4 40.8 34.3 25.8 25.1 20.9 16.3 V-Guard Ind (VGUARD) 294 348 Buy 9,724 11.4 11.0 13.8 25.9 26.8 21.3 22.6 18.7 14.3 Voltas Ltd (VOLTAS) Source: Company, ICICIdirect.com Research ICICI Securities Ltd | Retail Equity Research RoCE (%) RoE (%) FY15E FY16E FY17E FY15E FY16E 44.9 47.2 48.9 32.5 34.3 1.5 19.5 20.8 -8.3 16.2 27.5 33.3 35.0 21.2 26.1 23.4 25.8 26.5 16.7 18.4 30.7 35.0 38.1 23.7 27.2 16.8 17.8 19.2 18.0 18.6 52.2 55.0 58.0 41.2 43.2 22.8 24.4 27.5 18.7 19.2 15.3 16.7 19.5 17.9 15.5 Page 9 FY17E 35.5 17.6 27.0 19.0 29.4 20.1 45.7 21.4 17.4 RATING RATIONALE ICICIdirect.com endeavours to provide objective opinions and recommendations. ICICIdirect.com assigns ratings to its stocks according to their notional target price vs. current market price and then categorises them as Strong Buy, Buy, Hold and Sell. The performance horizon is two years unless specified and the notional target price is defined as the analysts' valuation for a stock. Strong Buy: >15%/20% for large caps/midcaps, respectively, with high conviction; Buy: >10%/15% for large caps/midcaps, respectively; Hold: Up to +/-10%; Sell: -10% or more; Head – Research Pankaj Pandey pankaj.pandey@icicisecurities.com ICICIdirect.com Research Desk, ICICI Securities Limited, 1st Floor, Akruti Trade Centre, Road No 7, MIDC, Andheri (East) Mumbai – 400 093 research@icicidirect.com ICICI Securities Ltd | Retail Equity Research Page 10 ANALYST CERTIFICATION We /I, Sanjay Manyal, MBA (Finance) and Hitesh Taunk, MBA (Finance), Research Analysts, authors and the names subscribed to this report, hereby certify that all of the views expressed in this research report accurately reflect our views about the subject issuer(s) or securities. We also certify that no part of our compensation was, is, or will be directly or indirectly related to the specific recommendation(s) or view(s) in this report. Terms & conditions and other disclosures: ICICI Securities Limited (ICICI Securities) is a full-service, integrated investment banking and is, inter alia, engaged in the business of stock brokering and distribution of financial products. ICICI Securities is a wholly-owned subsidiary of ICICI Bank which is India’s largest private sector bank and has its various subsidiaries engaged in businesses of housing finance, asset management, life insurance, general insurance, venture capital fund management, etc. (“associates”), the details in respect of which are available on www.icicibank.com. ICICI Securities is one of the leading merchant bankers/ underwriters of securities and participate in virtually all securities trading markets in India. We and our associates might have investment banking and other business relationship with a significant percentage of companies covered by our Investment Research Department. ICICI Securities generally prohibits its analysts, persons reporting to analysts and their relatives from maintaining a financial interest in the securities or derivatives of any companies that the analysts cover. The information and opinions in this report have been prepared by ICICI Securities and are subject to change without any notice. The report and information contained herein is strictly confidential and meant solely for the selected recipient and may not be altered in any way, transmitted to, copied or distributed, in part or in whole, to any other person or to the media or reproduced in any form, without prior written consent of ICICI Securities. While we would endeavour to update the information herein on a reasonable basis, ICICI Securities is under no obligation to update or keep the information current. Also, there may be regulatory, compliance or other reasons that may prevent ICICI Securities from doing so. Non-rated securities indicate that rating on a particular security has been suspended temporarily and such suspension is in compliance with applicable regulations and/or ICICI Securities policies, in circumstances where ICICI Securities might be acting in an advisory capacity to this company, or in certain other circumstances. This report is based on information obtained from public sources and sources believed to be reliable, but no independent verification has been made nor is its accuracy or completeness guaranteed. This report and information herein is solely for informational purpose and shall not be used or considered as an offer document or solicitation of offer to buy or sell or subscribe for securities or other financial instruments. Though disseminated to all the customers simultaneously, not all customers may receive this report at the same time. ICICI Securities will not treat recipients as customers by virtue of their receiving this report. Nothing in this report constitutes investment, legal, accounting and tax advice or a representation that any investment or strategy is suitable or appropriate to your specific circumstances. The securities discussed and opinions expressed in this report may not be suitable for all investors, who must make their own investment decisions, based on their own investment objectives, financial positions and needs of specific recipient. This may not be taken in substitution for the exercise of independent judgment by any recipient. The recipient should independently evaluate the investment risks. The value and return on investment may vary because of changes in interest rates, foreign exchange rates or any other reason. ICICI Securities accepts no liabilities whatsoever for any loss or damage of any kind arising out of the use of this report. Past performance is not necessarily a guide to future performance. Investors are advised to see Risk Disclosure Document to understand the risks associated before investing in the securities markets. Actual results may differ materially from those set forth in projections. Forward-looking statements are not predictions and may be subject to change without notice. ICICI Securities or its associates might have managed or co-managed public offering of securities for the subject company or might have been mandated by the subject company for any other assignment in the past twelve months. ICICI Securities or its associates might have received any compensation from the companies mentioned in the report during the period preceding twelve months from the date of this report for services in respect of managing or co-managing public offerings, corporate finance, investment banking or merchant banking, brokerage services or other advisory service in a merger or specific transaction. ICICI Securities or its associates might have received any compensation for products or services other than investment banking or merchant banking or brokerage services from the companies mentioned in the report in the past twelve months. ICICI Securities encourages independence in research report preparation and strives to minimize conflict in preparation of research report. ICICI Securities or its analysts did not receive any compensation or other benefits from the companies mentioned in the report or third party in connection with preparation of the research report. Accordingly, neither ICICI Securities nor Research Analysts have any material conflict of interest at the time of publication of this report. It is confirmed that Sanjay Manyal, MBA (Finance) and Hitesh Taunk, MBA (Finance), Research Analysts of this report have not received any compensation from the companies mentioned in the report in the preceding twelve months. Compensation of our Research Analysts is not based on any specific merchant banking, investment banking or brokerage service transactions. ICICI Securities or its subsidiaries collectively or Research Analysts do not own 1% or more of the equity securities of the Company mentioned in the report as of the last day of the month preceding the publication of the research report. Since associates of ICICI Securities are engaged in various financial service businesses, they might have financial interests or beneficial ownership in various companies including the subject company/companies mentioned in this report. It is confirmed that Sanjay Manyal, MBA (Finance) and Hitesh Taunk, MBA (Finance), Research Analysts do not serve as an officer, director or employee of the companies mentioned in the report. ICICI Securities may have issued other reports that are inconsistent with and reach different conclusion from the information presented in this report. Neither the Research Analysts nor ICICI Securities have been engaged in market making activity for the companies mentioned in the report. We submit that no material disciplinary action has been taken on ICICI Securities by any Regulatory Authority impacting Equity Research Analysis activities. This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction, where such distribution, publication, availability or use would be contrary to law, regulation or which would subject ICICI Securities and affiliates to any registration or licensing requirement within such jurisdiction. The securities described herein may or may not be eligible for sale in all jurisdictions or to certain category of investors. Persons in whose possession this document may come are required to inform themselves of and to observe such restriction. ICICI Securities Ltd | Retail Equity Research Page 11