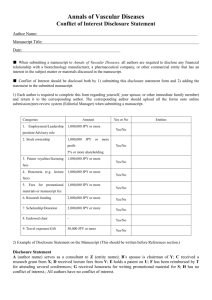

Japan Excellent, Inc.

advertisement

頁1/3

Search :

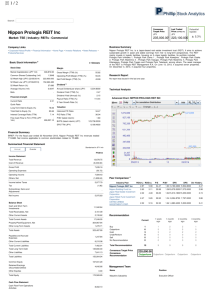

Japan Excellent, Inc.

Market: TSE | Industry: REITs - Commercial

Company Links

Business Summary

• Corporate History/Profile • Executives • Financial Information • Home Page • Investor Relations • News

Releases • Products/Services

Japan Excellent, Inc. is a re

earnings and steady asset g

office buildings located in

surrounding areas, includ

government-designated citie

investment ratio, were Kowa

AKASAKA INTERCITY, Mus

Higashiguchi Building, Shiba

Building. The asset mana

it acquired a property in To

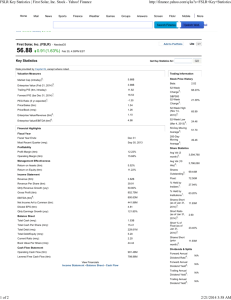

Basic Stock Information Ø

Stock Data

Margin

Market Capitalization (JPY 'mil)

165,904.20

Common Shares Outstanding ('mil)

1.1248

52 Week High (JPY) (22/05/2014)

137,700.000

52 Week Low (JPY) (30/08/2013)

101,600.000

52 Week Return (%)

20.000

Average Volume ('mil)

0.0020

Beta

0.77

Gross Margin (TTM) (%)

42.51

Operating Profit Margin (TTM) (%)

42.08

Net Profit Margin (TTM) (%)

31.11

No report was issued in the las

Dividend §

4,906.8000

Annual Dividend per share (JPY)

Dividend Yield (TTM) (%)

3.59

Dividend Yield (Annual) (%)

Financial strength

Current Ratio

0.65

Quick Ratio

10.80

Payout Ratio (TTM) (%)

102.72

3-Year Growth Rate (%)

-6.14

-

Long Term Debt to Equity (%)

81.10

Total Debt to Equity (%)

103.88

Interest Coverage Ratio (TTM)

3.93

Free Cash Flow to Firm (TTM) (JPY

'mln)

26,552.84

Valuation

Historical P/E Ratio

28.64

P/E Ratio (TTM)

28.64

P/BV (latest interim)

BVPS (latest interim) (JPY)

1.27

107,324.6000

EPS TTM (JPY)

4,777.0620

Financial Summary

BRIEF: For the fiscal year ended 31 December 2013, Japan Excellent, Inc. revenues increased 13%

to Y17.27B. Net income applicable to common stockholders increased 13% to Y5.37B. Revenues

reflect Lease business revenue increase of 12% to Y15.67B, Other Lease Business Revenue

increase of 33% to Y1.58B, Anonymous association dividend increase from Y1.5M to Y11.3M. Net

income also reflects Interest Income increase of 12% to Y3.5M (income).

Summarized Financial Statement

Annual

Standarized in JPY ‘mln

Quarter

FY2009

FY2010

FY2011

FY2012

FY2013

31,086.01

29,193.08

28,854.39

15,340.02

17,269.07

(16,693.59)

(15,833.45)

(15,923.70)

(8,746.65)

(9,927.72)

14,392.42

13,359.63

12,930.69

6,593.37

7,341.35

(485.02)

(452.97)

(515.45)

(80.94)

(74.63)

13,907.40

12,906.66

12,415.24

6,512.43

7,266.72

Income Statement

Total Revenue

Cost of Revenue

Gross Profit

Operating Expenses

Operating Income

Research Report

Technical Analysis

Advanced Chart: Japa

頁2/3

FY2009

FY2010

FY2011

FY2012

FY2013

Others, Net

(3,377.38)

(3,464.61)

(3,328.69)

(1,766.03)

(1,891.72)

Income before Taxes

10,530.02

9,442.05

9,086.55

4,746.40

5,375.00

(4.03)

(4.02)

(4.11)

(2.18)

(2.00)

-

-

-

-

-

10,525.99

9,438.03

9,082.44

4,744.22

5,373.00

5,281.62

6,032.98

8,500.38

3,596.80

4,707.85

921.03

897.12

1,250.25

650.87

833.90

Other Current Assets

23,605.60

22,508.24

22,937.58

11,889.77

13,364.06

Total Current Assets

29,808.25

29,438.34

32,688.21

16,137.45

18,905.80

342,051.89

346,358.61

385,527.97

202,612.76

229,538.04

18,325.74

18,100.61

18,175.17

9,269.83

9,457.50

390,185.89

393,897.56

436,391.35

228,020.04

257,901.34

Payables and Accrued

Expenses

1,419.90

1,522.25

1,536.07

898.23

1,261.72

Other Current Liabilities

50,993.14

67,770.26

30,822.97

15,906.10

27,974.86

Total Current Liabilities

52,413.04

69,292.51

32,359.03

16,804.33

29,236.58

Total Long Term Debt

158,797.86

145,942.69

195,327.07

97,800.00

97,900.00

Other Liabilities

161.32

-

-

8,870.45

10,051.44

Total Liabilities

211,372.21

215,235.20

227,686.11

123,474.78

137,188.02

Common Equity

174,166.06

174,166.06

204,104.77

102,052.38

117,901.29

4,647.61

4,496.30

4,600.47

2,492.87

2,812.03

-

-

-

0.00

-

178,813.67

178,662.36

208,705.24

104,545.26

120,713.32

Cash Flow From Operations

Activities

21,813.76

13,798.99

21,041.82

10,337.01

8,216.34

Cash Flow From Investing

Activities

(2,512.73)

(8,981.80)

(51,283.97)

(5,691.00)

(28,444.11)

Cash Flow From Financing

Activities

(21,386.70)

(5,047.60)

33,145.93

(4,029.53)

22,816.93

Currency Translation

Adjustments

-

-

-

-

-

Net Change in Cash

(2,085.66)

(230.41)

2,903.78

616.48

2,589.17

Tax

Extraordinary Items and

Adjustments

Net Income

Balance Sheet

Cash and Short Term

Investments

Total Receivables, Net

Property/Plant/Equipment, Net

Other Long Term Assets

Total Assets

Retained Earnings

(Accumlated Deficit)

Other Equities

Total Equity

Cash Flow Statement

Ratios & Other data

ROA (%)

8.76

8.76

4.25

4.25

2.21

ROE (%)

18.76

18.76

9.08

9.08

4.77

DPS (JPY)

62,247.6000

62,247.6000

9,776.8000

9,776.8000

4,906.8000

EPS (JPY)

63,591.7301

63,591.7301

10,059.2971

10,059.2971

4,777.0616

Selected data supplied by

Peer Comparison Ø

Industry Peer

Japan Excellent, Inc.

Nippon Building Fund Inc.

Japan Real Estate Investment

Corporation

Japan Retail Fund Investment

Corporation

UNITED URBAN

INVESTMENT CORP.

Recommendation

Buy

Outperform

Hold

UnderPerform

Sell

No Recommendation

Total Recommendation

Consensus Target Price

Consensus

Recommendation

Management Team

Name

Hidehiko Ogawa

Chifumi Toda

頁3/3

Company Related News

No News available!

All information contained on Phillip Stock Analytics is provided on an “as is” and “as available” basis.