Solutions to Chapter 19

Solutions to Chapter 19

Working Capital Management and Short-Term Planning

1. Cash a. b.

$2 million decline

$2,500 increase c. $5,000 decline d. Unchanged e. Unchanged f. $5 million increase

Net Working Capital

$2 million decline

Unchanged

Unchanged

$1 million increase

Unchanged

Unchanged

2. a. Long-term financing, total capital requirement, marketable securities b. Cash, cash, cash balance, marketable securities

3. a. Inventories of raw materials, work in progress, and finished goods increase and cash decreases (use of cash). b. Accounts receivable increase (use of cash). c. Decrease in assets (land), increase in cash (source of cash), and decrease in shareholders’ equity when the loss on the land is recognized. d. Shareholders’ equity decreases and cash decreases (use of cash). e. Retained earnings and cash decrease when the dividend is paid (use of cash). f. Long-term debt increases (source of cash), short-term debt decreases (use of cash).

4. Remember that the cash conversion cycle = inventory period + receivables period – accounts payable period. Notice from these answers that not all actions that shorten the cash conversion cycle are necessarily good for the firm, nor are all actions that lengthen the cash conversion cycle necessarily bad. The costs or benefits of the actions associated with changes in the cycle must also be considered. a. Lower inventory levels will reduce the inventory period and therefore the cash conversion cycle.

Copyright © 2006 McGraw-Hill Ryerson Limited

191

b. The accounts payable period will fall, which will lengthen the cash conversion cycle. c. The accounts receivable period will fall, which will shorten the cash conversion cycle. d. The accounts receivable period will rise (since customers pay their bills more slowly), which will lengthen the cash conversion cycle.

5. The firm can use its new system to maintain lower inventory levels. This will reduce the inventory period and therefore the cash conversion cycle, and will reduce net working capital as well.

6. Accounts receivable period = Ошибка!

= 8.0 days

Inventory period =

Ошибка!

= 47.8 days

Accounts payable period =

Ошибка!

= 23.5 days

Cash conversion cycle = 8.0 + 47.8 – 23.5 = 32.3 days

7. The cash conversion cycle equals inventory period plus receivables period minus accounts payable period. a. The discount should induce some customers to pay cash. Accounts receivable, the receivables period, and the cash conversion cycle will fall.

b. Lower inventory turnover implies more days in inventory. The cash conversion cycle increases.

c. If the firm produces goods more quickly, inventory levels corresponding to work in progress will fall. Therefore, the inventory period and the cash conversion cycle fall.

d. If the accounts payable period falls, the cash conversion cycle will increase.

e. Because the goods are already ordered, inventory of finished product will fall relative to sales. Therefore the inventory period and the cash conversion cycle fall.

f. Inventory increases imply a longer inventory period and cash conversion cycle.

13. Month 3:

18,000 + (.5

90,000) + (.3

120,000) + (.2

100,000) = $119,000

Copyright © 2006 McGraw-Hill Ryerson Limited

192

Month 4:

14,000 + (.5

70,000) + (.3

90,000) + (.2

120,000) = $100,000

15. The order is .75 times the following quarter’s sales forecast

Quarter Order

1 .75

360 = 270

2 .75

336 = 252

3 .75

384 = 288

4 .75

384 = 288

16. Since the first quarter’s sales forecast was $372, orders placed during the fourth quarter of the preceding year would have been .75

$372 = $279.

Quarter

1

2

3

Payment*

1/3

279 + 2/3

270 = 273

1/3

270 + 2/3

252 = 258

1/3

252 + 2/3

288 = 276

1/3

288 + 2/3

288 = 288 4

*Payment = (1/3)

previous period order + (2/3)

current period order

17. Quarter Collections*

1

2

3

2/3

336 + 1/3

372 = 348

2/3

372 + 1/3

360 = 368

2/3

360 + 1/3

336 = 352

2/3

336 + 1/3

384 = 352 4

*Collections = (2/3)

previous period sales + (1/3)

current period sales

18.

Sources of cash

Quarter

First Second Third Fourth

Copyright © 2006 McGraw-Hill Ryerson Limited

193

Collections on accounts receivable

Uses of cash

Payments of accounts payable

Labour & administrative expenses

Interest on long-term debt

Total uses of cash

Net cash inflow

(= sources – uses)

19.

$348 $368

273 258

65 65

40 40

378 363

-$30 $ 5

Quarter

$352 $352

276

65

40

381

–$29

288

65

40

393

-$41

Cash at start of period

+ Net cash inflow

(from problem 18)

= Cash at end of period

Minimum operating cash balance

Cumulative short-term financing required (minimum cash balance minus cash at end of period)

26.

First

$40

–30

10

30

$20

Second

$10

+ 5

15

30

$15

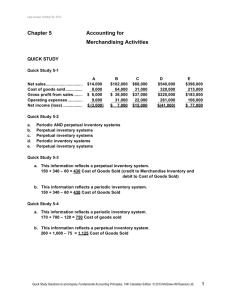

Fiscal year ending 2005 ($ million) Sears Holding Corp.

Inventory turnover

14,601

(3,281

3,238)/2

Third Fourth

$15 -$14

-29 - 41

- 14

30

$44

- 55

30

$85

Wal-Mart.

215,493

(29,447

26,612)/2

Days to sell inventory

Receivable turnover

=4.48

(365/4.48)= 81.5

19,701

(646

301)/2

=7.69

( 365/7.69) = 47.5

286 , 103

( 1 , 715

1 , 254 ) / 2

Avg. collection period in days

A/C payables turnover = COGS/Avg. payable

= 41.607

(365/41.607)=

14 , 601

( 1 , 092

820 ) /

8.77

2

= 192.73

(365/192.73)

= 1.89

215 , 493

( 21 , 671

19 , 332 ) /

Accounts payable period in days

Cash Conversion Cycle

= 15.27

(365/15.3) =

66.4

23.9

= 10.52

(365/ 10.52)= 34.73

14.66

Let us look at the extent to which Walmart’s working capital will decline if its cash conversion cycle decreases by 1 day. Assuming we hold average collection period and accounts payable period constant by decreasing cash conversion cycle by 1 day

2

Copyright © 2006 McGraw-Hill Ryerson Limited

194

we have to decrease days to sell inventory by 1 day (47.5 to 46.5 days). Actually, we could have changed any one of the other variables as well; we really need to hold two of the variables constant and change one of the variables.

365

215 , 493 x

26 , 612

46 .

5 → x

26 , 612

215 , 493

365

2

46 .

5

2 x

54 , 906 .

44

26 , 612

28 , 294 .

44

Therefore change in working capital = 29,447 - 28,294.44 =$1152.56 million or $

1.152 billion; Wal-mart’s working capital will fall by this amount.

Wal-Mart sales, net income and total assets per employee ratios have generally been increasing over the past five fiscal year. Sears Holding Corp. on the other hand, has been experiencing fluctuating ratios including a negative net income per employee ratio from 2000 to 2003 fiscal year. Wal-Mart per employee ratios in all three categories (sales, net income and total assets) are higher than corresponding

Sears ratios. Hence, Wal-Mart appears to have has greater efficiencies in terms of higher employee utilization.

Based on the efficiency and profitability ratios, it seems that the market responded more positively to Wal-Mart in comparison to Sears holding Corp. For example,

Wal-Mart has enjoyed relatively stable price –earnings ratios. Wal-Mart’s stock prices have remained relatively stable when compared with Sears.

27.

Sources of cash

Collections on current sales

February March April

Collections on accounts receivable

Total sources of cash

Uses of cash

$100

90

$190

$110 $ 90

100 110

$210 $200

Payments of accounts payable

Cash purchases

Labour and administrative expenses

Capital expenditures

Taxes, interest, and dividends

Total uses of cash

$ 30

70

30

100

10

$240

$ 40 $ 30

80

30

0

10

60

30

0

10

$160 $130

Net cash inflow (sources – uses) -$50 +$50 +$70

Cash at start of period $100 $ 50 $100

Copyright © 2006 McGraw-Hill Ryerson Limited

195

+ Net cash inflow

= Cash at end of period

Minimum operating cash balance

Cumulative short-term financing required (minimum cash balance minus cash at end of period)

- 50 + 50 + 70

$ 50 $100 $170

$100 $100 $100

$ 50 $ 0 -$70

Copyright © 2006 McGraw-Hill Ryerson Limited

196

Copyright © 2006 McGraw-Hill Ryerson Limited

197