Chapter 5 Accounting for Merchandising Activities - McGraw

advertisement

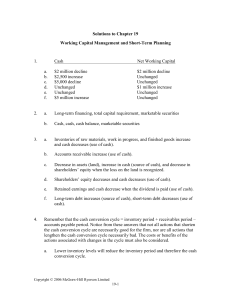

Last revised: October 26, 2012 Chapter 5 Accounting for Merchandising Activities QUICK STUDY Quick Study 5-1 Net sales .................................. Cost of goods sold ................. Gross profit from sales .......... Operating expenses ............... Net income (loss) ................... A $14,000 8,000 $ 6,000 9,000 $ (3,000) B $102,000 64,000 $ 38,000 31,000 $ 7,000 C $68,000 31,000 $37,000 22,000 $15,000 D $540,000 320,000 $220,000 261,000 $(41,000) E $398,000 215,000 $183,000 106,000 $ 77,000 Quick Study 5-2 a. b. c. d. e. Periodic AND perpetual inventory systems Perpetual inventory systems Perpetual inventory systems Periodic inventory systems Perpetual inventory systems Quick Study 5-3 a. This information reflects a perpetual inventory system. 150 + 340 – 60 = 430 Cost of Goods Sold (credit to Merchandise Inventory and debit to Cost of Goods Sold) b. This information reflects a periodic inventory system. 150 + 340 – 60 = 430 Cost of Goods Sold Quick Study 5-4 a. This information reflects a periodic inventory system. 170 + 700 – 120 = 750 Cost of goods sold b. This information reflects a perpetual inventory system. 200 + 1,000 – 75 = 1,125 Cost of Goods Sold Quick Study Solutions to accompany Fundamental Accounting Principles, 14th Canadian Edition. © 2013 McGraw-Hill Ryerson Ltd. 1 Last revised: October 26, 2012 Quick Study 5-5 May 1 14 15 30 Merchandise Inventory ................................................ Accounts Payable ................................................. To record purchase of merchandise; terms 1/10, n/30. 1,200 Accounts Payable ........................................................ Cash ....................................................................... To record payment of credit purchase. 1,200 Merchandise Inventory ................................................ Accounts Payable ................................................. To record purchase of merchandise; terms 2/15, n/30. 3,000 Accounts Payable ........................................................ Merchandise Inventory ......................................... Cash ....................................................................... To record payment of credit purchase within discount period; $3,000 x 2% = $60 discount. 3,000 1,200 1,200 3,000 60 2,940 Quick Study 5-6 Aug. 2 4 17 Merchandise Inventory ................................................ Accounts Payable ................................................. To record purchase of merchandise; terms 1/5, n/15. 14,000 Accounts Payable ........................................................ Merchandise Inventory ......................................... To record allowance regarding August 2 credit purchase. 1,500 Accounts Payable ........................................................ Cash ....................................................................... To record payment of credit purchase less allowance; 14,000 – 1,500 = 12,500. 12,500 14,000 1,500 Quick Study Solutions to accompany Fundamental Accounting Principles, 14th Canadian Edition. © 2013 McGraw-Hill Ryerson Ltd. 12,500 2 Last revised: October 26, 2012 Quick Study 5-7 Mar. 5 Merchandise Inventory ......................................... 2,000 Accounts Payable ......................................... To record purchase of merchandise; (500 × $5) × 80% = $2,000 7 Accounts Payable ................................................. Merchandise Inventory ................................. To record purchase return; (50/500) × $2,000 = $200 15 2,000 200 200 Accounts Payable ................................................. 1,800 Cash ............................................................... Merchandise Inventory ................................. To record payment within discount period; $2,000 - $200 = $1,800; $1,800 – ($1,800 × 2%) = $1,764 1,764 36 Quick Study 5-8 Sept. 1 1 14 15 15 25 Accounts Receivable – JenAir .................................... Sales ....................................................................... To record sale; terms 2/10, n/30. 6,000 Cost of Goods Sold ...................................................... Merchandise Inventory ......................................... To record cost of sales. 4,200 Cash .............................................................................. Accounts Receivable – JenAir ............................. To record collection from credit customer. 6,000 Accounts Receivable – Dennis Leval ......................... Sales ....................................................................... To record sale; terms 2/10, n/30. 1,800 Cost of Goods Sold ...................................................... Merchandise Inventory ......................................... To record cost of sales. 1,500 Cash .............................................................................. Sales Discounts ........................................................... Accounts Receivable – Dennis Leval .................. To record collection within discount period; $1,800 x 2% = $36 discount. 1,764 36 6,000 4,200 6,000 1,800 1,500 Quick Study Solutions to accompany Fundamental Accounting Principles, 14th Canadian Edition. © 2013 McGraw-Hill Ryerson Ltd. 1,800 3 Last revised: October 26, 2012 Quick Study 5-9 Oct. 15 15 16 25 Accounts Receivable – Leslie Garth .......................... Sales ....................................................................... To record sale; terms 1/5, n/20. 900 Cost of Goods Sold ...................................................... Merchandise Inventory ......................................... To record cost of sales. 600 Sales Returns and Allowances ................................... Accounts Receivable – Leslie Garth ................... To record allowance. 100 Cash .............................................................................. Accounts Receivable – Leslie Garth ................... To record collection; 900 – 100 = 800. 800 900 600 100 800 Quick Study 5-10 Apr. 1 1 4 4 11 Accounts Receivable ............................................ Sales ............................................................... To record credit sale. 2,000 Cost of Goods Sold .............................................. Merchandise Inventory ................................. To record cost of sales. 1,400 Sales Returns and Allowances ............................. Accounts Receivable .................................... To record sales return. 500 Merchandise Inventory ......................................... Cost of Goods Sold ....................................... To restore goods to inventory. 350 Cash ....................................................................... Sales Discounts .................................................... Accounts Receivable ..................................... To record payment on account; $2,000 – $500 = $1,500; $1,500 × 98% = $1,470. 2,000 1,400 500 350 1,470 30 Quick Study Solutions to accompany Fundamental Accounting Principles, 14th Canadian Edition. © 2013 McGraw-Hill Ryerson Ltd. 1,500 4 Last revised: October 26, 2012 Quick Study 5-11 Sales ......................................................... Sales discounts ....................................... Sales returns and allowances ................. Net sales ................................................... Cost of goods sold .................................. Gross profit from sales ............................ Gross profit ratio ...................................... (a) (b) (c) (d) $130,000 (4,200) (17,000) $108,800 (76,600) $ 32,200 29.60%1 $512,000 (16,500) (5,000) $490,500 (326,700) $163,800 33.39%2 $35,700 (400) (5,000) $30,300 (21,300) $ 9,000 29.70%3 $245,700 (3,500) (700) $241,500 (125,900) $115,600 47.87%4 Gross profit ratio calculations*: 1. ($32,200/$108,800) x 100 = 29.60% 2. ($163,800/$490,500)) x 100 = 33.39% 3. ($9,000/$30,300) x 100 = 29.70% 4. ($115,600/$241,500) x 100 = 47.87% *rounded to two decimal places Quick Study 5-12 July 31 Cost of Goods Sold .............................................. Merchandise Inventory ................................. To adjust for shrinkage; $34,800 – $32,900 = $1,900 1,900 1,900 Gross profit from sales = Net sales – Cost of goods sold = (157,200 – 1,700 – 3,500) – (102,000 + 1,900) = 152,000 – 103,900 = 48,100 Quick Study Solutions to accompany Fundamental Accounting Principles, 14th Canadian Edition. © 2013 McGraw-Hill Ryerson Ltd. 5 Last revised: October 26, 2012 Quick Study 5-13 a. Classified Multi-Step Income Statement JETCO Income Statement For Year Ended December 31, 2014 Sales .................................................................................... Less: Sales discounts ....................................................... Net sales .............................................................................. Cost of goods sold ............................................................. Gross profit from sales ...................................................... Operating expenses: Selling expenses: Sales salaries expense ............................................... Advertising expense ................................................... Total selling expenses ................................................ General and administrative expenses: Office salaries expense............................................... Office supplies expense ............................................. Total general and administrative expenses .............. Total operating expenses............................................... Income from operations..................................................... Other revenues/expenses: Interest revenue ............................................................. Net income .......................................................................... $100 4 $ 96 60 $ 36 $ 15 6 $ 21 $ 10 3 13 34 $ 2 5 $ 7 b. Single-Step Income Statement JETCO Income Statement For Year Ended December 31, 2014 Revenues: Net sales ......................................................................... Interest revenue ............................................................. Total revenues ............................................................... Expenses: Cost of goods sold ........................................................ Selling expenses ........................................................... General and administrative expenses ......................... Total expenses ............................................................... Net income .......................................................................... $ 96 5 $101 $ 60 21 13 94 $ 7 Quick Study Solutions to accompany Fundamental Accounting Principles, 14th Canadian Edition. © 2013 McGraw-Hill Ryerson Ltd. 6 Last revised: October 26, 2012 Quick Study 5-14 ($248,000 – $114,080)/$248,000 = 0.54 or 54% This means that Willaby realizes a gross margin of 54¢ for each $1 of sales. Willaby’s gross profit ratio of 54% is favourable in comparison to the industry average of 53%, or 53¢ for each $1 of sales. Quick Study 5-15 Dec. 31 31 31 31 Sales ....................................................................... Income Summary ........................................... To close Sales. 70 Income Summary .................................................. Sales Discounts ............................................ Sales Returns and Allowances .................... Cost of Goods Sold........................................ Depreciation Expense ................................... Advertising Expense ..................................... To close income statement accounts with debit balances. 41 Income Summary .................................................. Tony Ingram, Capital...................................... To close income summary account to capital. 29 Tony Ingram, Capital ............................................ Tony Ingram, Withdrawals ............................ To close withdrawals account to capital. 1 70 3 4 25 2 7 29 Quick Study Solutions to accompany Fundamental Accounting Principles, 14th Canadian Edition. © 2013 McGraw-Hill Ryerson Ltd. 1 7 Last revised: October 26, 2012 *Quick Study 5-16 a. QS5-5 – Periodic May 1 14 15 30 Purchases ..................................................................... Accounts Payable ................................................. To record purchase; terms 1/10, n/30. 1,200 Accounts Payable ........................................................ Cash ....................................................................... To record payment of credit purchase. 1,200 Purchases ..................................................................... Accounts Payable ................................................. To record purchase; terms 2/15, n/30. 3,000 Accounts Payable ........................................................ Purchase Discounts .............................................. Cash ....................................................................... To record payment within discount period; $3,000 x 2% = $60 discount. 3,000 1,200 1,200 3,000 60 2,940 b. QS5-6 – Periodic Aug. 2 4 17 Purchases ..................................................................... Accounts Payable ................................................. To record purchase; terms 1/5, n/15. 14,000 Accounts Payable ........................................................ Purchase Returns and Allowances ..................... To record allowance. 1,500 Accounts Payable ........................................................ Cash ....................................................................... To record payment less allowance. 12,500 14,000 1,500 Quick Study Solutions to accompany Fundamental Accounting Principles, 14th Canadian Edition. © 2013 McGraw-Hill Ryerson Ltd. 12,500 8 Last revised: October 26, 2012 *Quick Study 5-16 (concluded) c. QS5-7 - Periodic Mar. 5 7 15 Purchases ..................................................................... Accounts Payable ................................................ (500 × $5) × 80% = $2,000 2,000 Accounts Payable ........................................................ Purchase Returns and Allowances ..................... (50/500) × $2,000 = $200 200 Accounts Payable ........................................................ Cash ...................................................................... Purchase Discounts ............................................ $1,800 – ($1,800 × 2%) = $1,764 1,800 2,000 200 1,764 36 *Quick Study 5-17 a. QS5-8 - Periodic Sept. 1 14 15 25 Accounts Receivable – JenAir .................................... Sales ....................................................................... To record sale; terms 2/10, n/30. 6,000 Cash .............................................................................. Accounts Receivable – JenAir ............................. To record collection from credit customer. 6,000 Accounts Receivable – Dennis Leval ......................... Sales ....................................................................... To record sale; terms 2/10, n/30. 1,800 Cash .............................................................................. Sales Discounts ........................................................... Accounts Receivable – Dennis Leval .................. To record collection within discount period; $1,800 x 2% = $36 discount. 1,764 36 6,000 6,000 1,800 Quick Study Solutions to accompany Fundamental Accounting Principles, 14th Canadian Edition. © 2013 McGraw-Hill Ryerson Ltd. 1,800 9 Last revised: October 26, 2012 *Quick Study 5-17 (concluded) b. QS5-9 - Periodic Oct. 15 16 25 Accounts Receivable – Leslie Garth ............................ Sales ....................................................................... To record sale; terms 1/5, n/20. 900 Sales Returns and Allowances ..................................... Accounts Receivable – Leslie Garth.................... To record sales allowance. 100 Cash ................................................................................ Accounts Receivable – Leslie Garth.................... To record payment less allowance. 800 900 100 800 c. QS5-10 - Periodic Apr. 1 4 11 Accounts Receivable ..................................................... Sales ....................................................................... To record sales; terms 2/10, EOM. 2,000 Sales Returns and Allowances ..................................... Accounts Receivable ............................................ To record sales return; returned to inventory. 500 Cash ................................................................................ Sales Discounts ............................................................. Accounts Receivable ............................................ To record payment less return and discount. 1,470 30 2,000 500 1,500 *Quick Study 5-18 Merchandise inventory, January 1, 2014 ..................................... Purchases....................................................................................... Less: Purchase discounts ........................................................... Add: Transportation-in ................................................................. Net Purchases ................................................................................ Cost of Goods Available for Sale ................................................. Less: Merchandise inventory, December 31, 2014 .................... Cost of Goods Sold ....................................................................... $ 40,000 $180,000 1,400 14,000 192,600 $232,600 22,000 $210,600 Quick Study Solutions to accompany Fundamental Accounting Principles, 14th Canadian Edition. © 2013 McGraw-Hill Ryerson Ltd. 10 Last revised: October 26, 2012 *Quick Study 5-19 Dec 31 31 31 31 Sales ................................................................................ Purchase Discounts....................................................... Merchandise Inventory .................................................. Income Summary................................................... To close all credit balance temporary accounts. 450,000 1,400 22,000 Income Summary ........................................................... Merchandise Inventory ......................................... Sales Returns and Allowances ............................ Purchases .............................................................. Transportation-In ................................................... Salaries Expense ................................................... Depreciation Expense ........................................... To close all debit balance temporary accounts. 412,000 Income Summary ........................................................... Kay Bondar, Capital .............................................. To close the income summary to capital. 61,400 Kay Bondar, Capital ....................................................... Kay Bondar, Withdrawals ..................................... To close the withdrawals account to capital. 65,000 473,400 40,000 27,000 180,000 14,000 120,000 31,000 61,400 Quick Study Solutions to accompany Fundamental Accounting Principles, 14th Canadian Edition. © 2013 McGraw-Hill Ryerson Ltd. 65,000 11 Last revised: October 26, 2012 *Quick Study 5-20 Sales .......................................................... Sales discounts ........................................ Net Sales ................................................... a $130,000 (4,200) $125,800 b $512,000 (16,500) $495,500 c $35,700 (400) $35,300 d $245,700 (3,500) $242,200 Merchandise inventory, Jan. 1, 2014 ...... Purchases ................................................. Purchase returns and allowances .......... Cost of goods available for sale ............. Merchandise inventory, Dec. 31, 2014 .... Cost of goods sold ................................... $ 8,000 120,000 (4,000) $124,000 (7,500) $116,500 $ 21,000 350,000 (14,000) $357,000 (22,000) $335,000 $ 1,500 29,000 (750) $29,750 (900) $28,850 $ 4,300 131,000 (3,100) $132,200 (4,100) $128,100 Gross profit from sales ............................ Gross profit ratio ...................................... $ 9,300 7.39%1 $160,500 32.39%2 $ 6,450 18.27%3 $114,100 47.11%4 Calculations*: 1. 9,300/125,800 x 100 = 7.39% 2. 160,500/495,500 x 100 = 32.39% 3. 6,450/35,300 x 100 = 18.27% 4. 114,100/242,200 x 100 = 47.11% *Rounded to two decimal places *Quick Study 5-21 Mar. 1 Merchandise Inventory ........................................... GST Receivable ....................................................... Accounts Payable ........................................... To record credit purchase; $5,000 x 5% = 250 GST. 5,000 250 5,250 *Quick Study 5-22 Mar. 17 17 Accounts Receivable .............................................. PST Payable ..................................................... GST Payable .................................................... Sales ................................................................. To record credit sale; $5,800 x 7% = $406 PST; $5,800 x 5% = $290 GST. 6,496 Cost of Goods Sold ................................................. Merchandise Inventory ................................... To record cost of sale. 5,000 406 290 5,800 Quick Study Solutions to accompany Fundamental Accounting Principles, 14th Canadian Edition. © 2013 McGraw-Hill Ryerson Ltd. 5,000 12 Last revised: October 26, 2012 *Quick Study 5-23 Mar. 1 Purchases .............................................................. GST Receivable ..................................................... Accounts Payable ......................................... To record credit purchase; $5,000 x 5% = 250 GST. 5,000 250 5,250 *Quick Study 5-24 Mar. 17 Accounts Receivable ............................................ PST Payable ................................................... GST Payable .................................................. Sales ............................................................... To record credit sale; $5,800 x 7% = $406 PST; $5,800 x 5% = $290 GST. 6,496 Quick Study Solutions to accompany Fundamental Accounting Principles, 14th Canadian Edition. © 2013 McGraw-Hill Ryerson Ltd. 406 290 5,800 13