Pension vs lump sum

advertisement

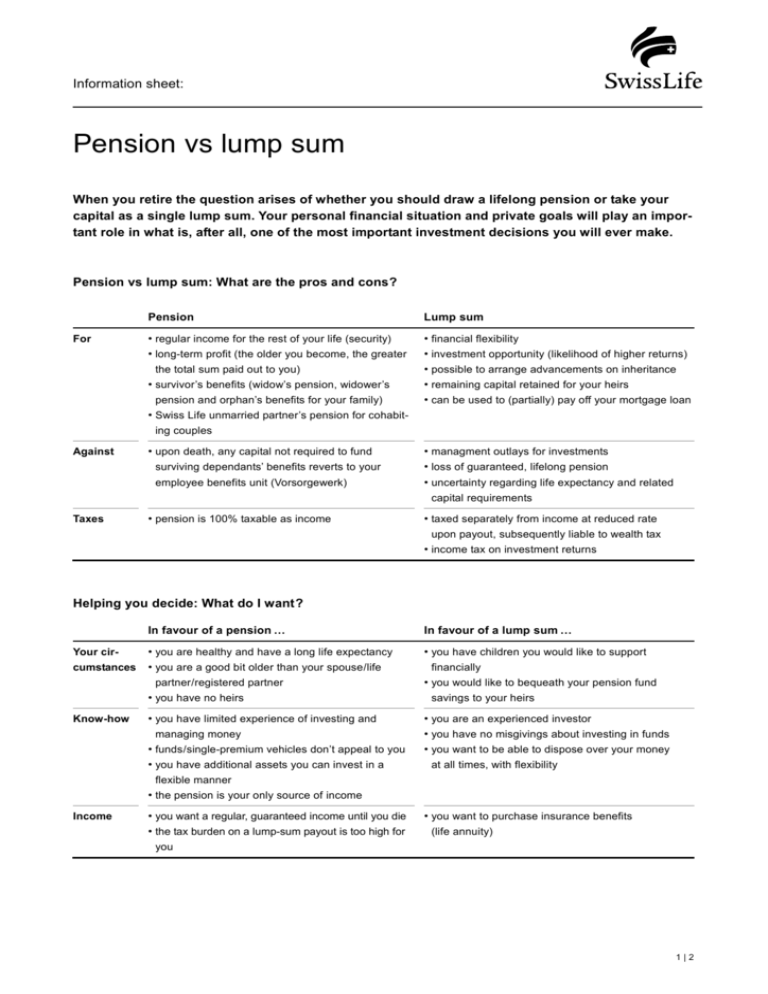

Information sheet: Pension vs lump sum When you retire the question arises of whether you should draw a lifelong pension or take your capital as a single lump sum. Your personal financial situation and private goals will play an important role in what is, after all, one of the most important investment decisions you will ever make. Pension vs lump sum: What are the pros and cons? For Pension Lump sum • regular income for the rest of your life (security) • long-term profit (the older you become, the greater • financial flexibility • investment opportunity (likelihood of higher returns) • possible to arrange advancements on inheritance • remaining capital retained for your heirs • can be used to (partially) pay off your mortgage loan the total sum paid out to you) • survivor’s benefits (widow’s pension, widower’s pension and orphan’s benefits for your family) • Swiss Life unmarried partner’s pension for cohabiting couples Against • upon death, any capital not required to fund surviving dependants’ benefits reverts to your employee benefits unit (Vorsorgewerk) • managment outlays for investments • loss of guaranteed, lifelong pension • uncertainty regarding life expectancy and related capital requirements Taxes • pension is 100% taxable as income • taxed separately from income at reduced rate upon payout, subsequently liable to wealth tax • income tax on investment returns Helping you decide: What do I want? Your circumstances In favour of a pension … In favour of a lump sum … • you are healthy and have a long life expectancy • you are a good bit older than your spouse/life • you have children you would like to support partner/registered partner • you have no heirs Know-how • you have limited experience of investing and managing money • funds/single-premium vehicles don’t appeal to you • you have additional assets you can invest in a financially • you would like to bequeath your pension fund savings to your heirs • you are an experienced investor • you have no misgivings about investing in funds • you want to be able to dispose over your money at all times, with flexibility flexible manner • the pension is your only source of income Income • you want a regular, guaranteed income until you die • the tax burden on a lump-sum payout is too high for • you want to purchase insurance benefits (life annuity) you 1|2 How can a lump sum be used for reinvestment? How do I apply for the lump sum option? • to buy securities with staggered maturities • You must inform Swiss Life of your intention to draw • to invest in shares • for tax-optimised future provisions via single premiums invested in cash value life insurance policies with staggered maturities (a form of endowment insurance) • in private life insurance (annuity) • in a combination of the above solutions your retirement savings as a lump sum (commutation right) no later than one year prior to retirement. • The commutation right cannot be exercised without written consent from your spouse/registered partner. • Swiss Life will automatically send the “Commutation right” form to your employer once you are approaching the deadline for such a decision – but still leaving you What particular points do I need to keep in mind? plenty of time. You can request the form from the person • Since 1 January 2005, as an insured person, you may within your company responsible for employee benefits. request that one quarter of your retirement capital be Or you can download it at www.swisslife.ch/formulare. paid out in the form of a one-off lump sum when you Complete the form; the person within your company re- retire. More extensive options are normally provided sponsible for employee benefits will then take care of eve- for in the regulations. If additional benefits have been rything that needs to be done, together with Swiss Life. purchased from the pension fund, the commutation right is not permitted within the following three years. • You should begin looking into whether to take the avail- There are no standard solutions. In many cases the best option is not a pension or a lump sum, but a com- able retirement capital as a pension, a lump sum or a bination of the two. A Swiss Life insurance consultant combination of the two by age 55, at the latest. will be happy to discuss the personal pros and cons • You will automatically receive a pension, unless you with you and to work out a solution tailored to your notify your employee benefits institution otherwise. If need. You can find further information in the Internet you do wish to receive a lump sum, you must submit at www.swisslife.ch/unternehmen. notification of your intentions no later than one year prior to retirement or to your early retirement. • The decision in favour of a lump sum demands a great degree of personal responsibility since it becomes irrevo- 944 045 – 07.2010 cable one year prior to retirement. 2|2