Wealth-Newsletter-January-2015

advertisement

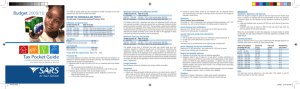

VOLUME 11 I JANUARY 2015 Retirement Savings Have you made the most of your tax deductions? GRAYSWAN Wealth Are you a smart investor and actively making the most of SARS’s income tax concessions to enhance your long-term savings? The 2014/2015 tax year end is around the corner and you only have until the end of February to make a new or an additional contribution to a Retirement Annuity (“RA”) in order to take full advantage of the current tax deduction regime. Two important factors to consider are: • The contribution must reflect in the administrator’s bank account by Friday, 27 February 2015 to receive a RA contribution tax certificate that will be effective for the 2014/5 tax year. • We are not encouraging investors to top up old fashioned contractual RAs, but rather to use noncontractual RAs on a LISP (Linked Investment Service Provider)/platform. Why? Any additions are likely to be exposed to penalties should you wish to stop or decrease your contributions in future or transfer the RA to another administrator. What is a RA? A RA is a retirement product designed for individuals to provide them with a tax efficient investment vehicle to save for retirement. You may invest in a RA regardless of whether you are already a member of an employer pension or provident fund or not. You may only retire from a RA at the age of 55 but there is no maximum retirement age. At retirement you may take one third in cash but have to purchase a compulsory annuity with the remaining two thirds or you have the option to withdraw the entire amount in cash if the value of the RA is less than R75,000. What are the tax benefits of a RA? The main tax benefits, according to current legislation, are: 1. Contributions to a RA are tax deductible In respect of current contributions, a taxpayer is allowed to deduct the greater of: • • • 15% of non-retirement funding income per annum; R3,500 less allowable pension fund contributions; or R1,750. Non-retirement funding income refers to other income that is not taken into account by your employer to calculate contributions to a pension or provident fund. Examples of other income includes rental income from a property after the expenses have been taken into account or interest income after the exemption of R23,800 has been taken into account or bonuses (if excluded as retirement funding income by your employer). Non retirement funding income excludes retirement fund lump sum benefits, assessed losses, capital gains and local dividends. Contributions to RAs may be used by retirees to obtain a deduction against the annuity income they may be receiving (unless it originates from a provident fund). As noted before, there is no maximum retirement age for members of RAs. Unused deductions can be carried forward to future years or used to increase the tax-free amount at retirement. GraySwan Wealth is a division of Gray Swan Financial Services (Pty) Ltd (Reg. No. 2010/009813/07) which is an authorized Financial Services Provider (FSP No. 42290) 2. How do contributions to a RA work? Investment returns are tax free There is no income tax or dividend tax or capital gains tax payable on the investment returns of a RA. In other words, the investment growth of a RA is tax free. 3. No estate duty Estate duty (currently 20% of net asset value) taxes is not applicable to a RA. This presents a good opportunity to build up savings in a RA should the value of an estate exceed the current R3.5 million abatement. There are three ways to invest in a RA: 1. 2. 3. Lump sum investment; or Monthly contribution; or A combination of the above. The minimum investment amount for a lump sum and/or monthly contributions depend on the rules of the administrator of the RA. Let us look at a basic (example 1) and a more complex example (example 2) to illustrate the tax implications of making a contribution to a RA. Example 1 Investor Y is not a member of a company pension fund and currently invests R1,000 p.m. in a RA. Investor Y receives the following forms of income per annum: Salary= R240,000 Other taxable income = R 60,000 Total non-retirement funding income = R300,000 The allowable RA contribution is the greater of: • • • R45,000 (R300,000 x 15%); or R3,500 - allowable pension fund contribution (not applicable in this scenario) = R3,500; or R1,750 The greater of the three options is R45,000. Because Investor Y has already made total contributions of R12,000 (R1,000 monthly debit order x 12), he can make an additional lump sum contribution of up to R33,000 (R45,000 – R12,000) to a RA to receive the maximum tax benefit. How does this affect Investor Y’s income tax liability? The tables below compare the income tax payable prior and post the lump sum contribution. Income tax payable pre lump sum RA contribution: Income tax payable post lump sum RA contribution: Gross Income R 300 000 Taxable income R Less: DeductionsLess: Deductions RA fund contributions R (12 000) RA fund contributions R Taxable Income R 288 000 Taxable Income R Tax per scale R 60 547 Tax per scale R Less: Primary Rebate R (12 726) Less: Primary Rebate R Tax Payable R 47 821 Tax Payable R 300 000 (45 000) 255 000 51 532 (12 726) 38 806 By contributing an additional R33,000, Investor Y has saved income tax of R 9 016. GraySwan Wealth is a division of Gray Swan Financial Services (Pty) Ltd (Reg. No. 2010/009813/07) which is an authorized Financial Services Provider (FSP No. 42290) Giving meaning to numbers Example 2 Investor X receives the following forms of income: Fees from a private practice Salary from employment (member of pension fund) Interest Annuity income = R600,000 = R360,000 = R 26,800 = R 40,000 He has the following expenses: Expenses for running the practice (all tax deductible) = R70,000 Pension fund contributions = R15,000 He has not made any contributions to a RA during the year. The allowable pension fund contribution is the greater of: • • R1,750; or R27,0000 (7.5% x R360,000 retirement funding income) Thus the full R15,000 is allowed as a deduction as he is allowed to deduct a maximum of R27,000. The allowable RA contribution is the greater of: • • • R85,950 (15% x R573,000* non-retirement funding income); or R3,500 – R15,000 (allowable pension fund contribution) = R0; or R1,750 The greater of the three options is R85,950. Thus investor X can contribute a lump sum of up to R85,950 to a RA to receive the maximum tax benefit. *Non-retirement funding income is calculated as: Fees R 600,000 Less expenses of practice R (70,000) Interest R 26,800 Less interest exemption R (23,800) Annuity incomeR 40,000 Non-retirement funding income R 573,000 GraySwan Wealth is a division of Gray Swan Financial Services (Pty) Ltd (Reg. No. 2010/009813/07) which is an authorized Financial Services Provider (FSP No. 42290) How does this affect Investor X’s income tax liability? The tables below compare the income tax payable prior and post the lump sum contribution. Income tax payable pre lump sum RA contribution: Income tax payable post lump sum RA contribution: Taxable income R1 026 800 Taxable income R1 026 800 Fees from private practice R 600 000 Fees from private practice R 600 000 Salary from employment R 360 000 Salary from employment R 360 000 Interest R 26 800 Interest R 26 800 Annuity Income R 40 000 Annuity Income R 40 000 Less: Exemptions R (23 800) Less: Exemptions R (23 800) Basic interest R (23 800) Basic interest R (23 800) Less: Deductions R (85 000) Less: Deductions R(170 950) Expenses of running practice R (70 000) Expenses of running practice R (70 000) Pension fund contributions R (15 000) Pension fund contributions R (15 000) RA fund contributions R - RA fund contributions R (85 950) Taxable Income R 918 000 Taxable Income R 832 050 Tax per scale R 293 172 Tax per scale R 258 792 Less: Primary Rebate R (12 726) Less: Primary Rebate R (12 726) Tax Payable R 280 446 Tax Payable R 246 066 By contributing an additional R85,950 Investor X has saved income tax of R 34 380. If you would like to make use of this opportunity to boost your retirement savings while increasing your tax deduction, kindly contact one of our Wealth Investment Consultants. Our consultants will not only provide you with advice regarding your tax savings but will also empower you to invest the monies in regulated, low cost and well diversified investment products which are managed by the top investment teams in the country. WE’D LIKE TO HEAR FROM YOU Tania Theron Head of Wealth 021 852 9092 071 605 1863 tania@grayswan.co.za Mart-Marié de Jongh Investment Consultant (CFP® Professional) 021 852 9092 072 380 9139 martmarie@grayswan.co.za A2, The Beachhead, 10 Niblick Road, Somerset West, 7130 www.grayswan.co.za GraySwan Wealth is a division of Gray Swan Financial Services (Pty) Ltd (Reg. No. 2010/009813/07) which is an authorized Financial Services Provider (FSP No. 42290)