Pension or lump sum

advertisement

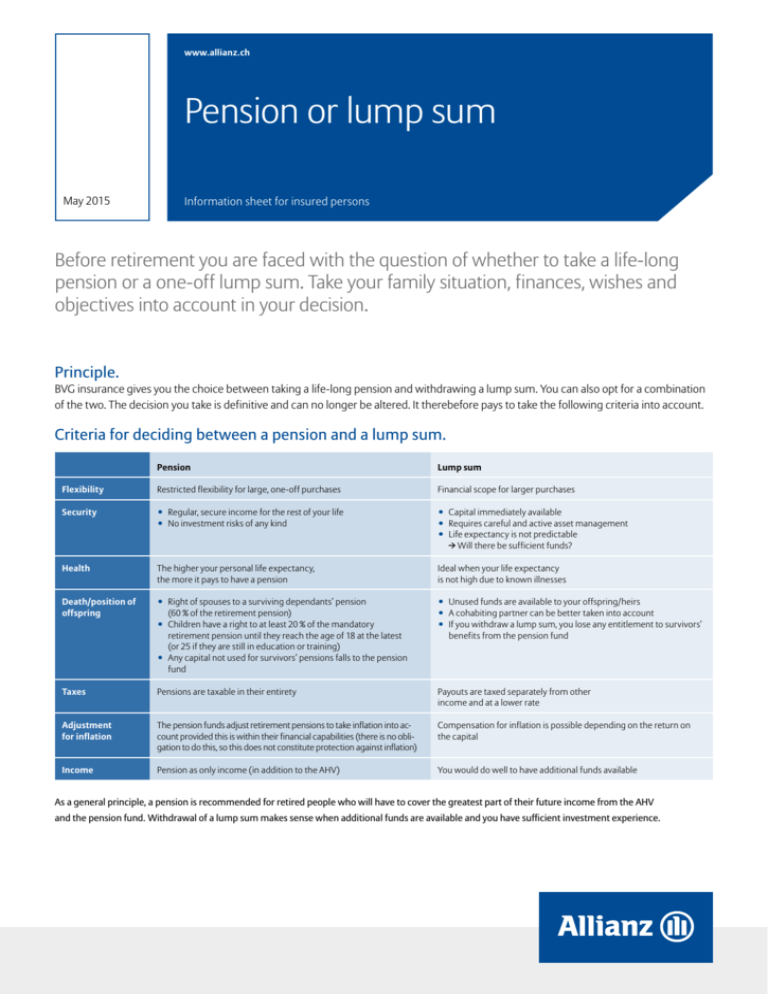

www.allianz.ch Pension or lump sum May 2015 Information sheet for insured persons Before retirement you are faced with the question of whether to take a life-long pension or a one-off lump sum. Take your family situation, finances, wishes and objectives into account in your decision. Principle. BVG insurance gives you the choice between taking a life-long pension and withdrawing a lump sum. You can also opt for a combination of the two. The decision you take is definitive and can no longer be altered. It therebefore pays to take the following criteria into account. Criteria for deciding between a pension and a lump sum. Pension Lump sum Flexibility Restricted flexibility for large, one-off purchases Financial scope for larger purchases Security • Regular, secure income for the rest of your life • No investment risks of any kind • Capital immediately available • Requires careful and active asset management • Life expectancy is not predictable → Will there be sufficient funds? Health The higher your personal life expectancy, the more it pays to have a pension Ideal when your life expectancy is not high due to known illnesses Death/position of offspring • Right of spouses to a surviving dependants’ pension • Unused funds are available to your offspring/heirs • A cohabiting partner can be better taken into account • If you withdraw a lump sum, you lose any entitlement to survivors’ (60 % of the retirement pension) • Children have a right to at least 20 % of the mandatory retirement pension until they reach the age of 18 at the latest (or 25 if they are still in education or training) • Any capital not used for survivors’ pensions falls to the pension fund benefits from the pension fund Taxes Pensions are taxable in their entirety Payouts are taxed separately from other income and at a lower rate Adjustment for inflation The pension funds adjust retirement pensions to take inflation into account provided this is within their financial capabilities (there is no obligation to do this, so this does not constitute protection against inflation) Compensation for inflation is possible depending on the return on the capital Income Pension as only income (in addition to the AHV) You would do well to have additional funds available As a general principle, a pension is recommended for retired people who will have to cover the greatest part of their future income from the AHV and the pension fund. Withdrawal of a lump sum makes sense when additional funds are available and you have sufficient investment experience. Es gelten die vertragsrelevanten Bedingungen der Allianz Suisse. Lump sum option Notice required If you decide to withdraw some or all of your retirement assets as a lump sum rather than taking a pension, you have to notify the pension fund of this (specifying the portions of your assets to be taken as a pension and withdrawn as a lump sum) before you reach the normal retirement age or take early retirement. Please note: Assets in the pension fund can only be withdrawn provided the insured person is not disabled on retirement. Procedure How to proceed: Complete either the form entitled «Pensionierung: Antrag auf Bezug der Altersleistung in Kapitalform» («Retirement: request to withdraw retirement benefits as a lump sum») or «Pensionierung: Bezug der Altersleistungen» («Retirement: taking retirement benefits»). Combination It is possible to combine withdrawing a lump sum with a pension. This gives you a secure income to cover your living costs, and the rest is available to you as capital. The following combinations are possible (lump sum / pension): 25 % : 75 % / 50 % : 50 % Revoking your decision If you have requested the withdrawal of a lump sum, you can no longer revoke this once you reach the normal retirement age or take early retirement. Once the lump sum has been paid or the first pension has been taken, you can no longer revoke your decision. In the case of a lump-sum withdrawal, the written agreement of your spouse or registered partner is required. Investment risk If you withdraw a lump sum, you assume the investment risk in full and have to accept any fluctuations in the value or your assets and in the returns from them. Purchase If you have made a purchase within three years prior to retirement, please note: The exclusion period for a lump sum payment within three years of the purchase applies, from a tax point of view, regardless of whether the capital results from the last purchase, and – with respect to several concurrent pension arrangements for an insured person – regardless of whether the lump sum payment results from the same or a different pension plan. The lump sum payment during the exclusion period results in the subsequent cancellation, by the competent tax authority, of the tax reduction for purchases made, by means of offsetting against the insured person’s taxable income. In accordance with the tax practice for each Canton, the relevant tax authority carries out a 2nd pillar complete general overview of the pension arrangement of a person, so that the tax-deductibility of the pension arrangement purchase shall only be acknowledged in this respect when, collectively, no over-financing exists through other pension arrangements. Options Lumpsum 100% 50% 25% 100% 75% Pension 50% Notification before retirement The contractual terms and conditions of Allianz Suisse apply. Notification before retirement