Whole Foods 2 - Salem State University

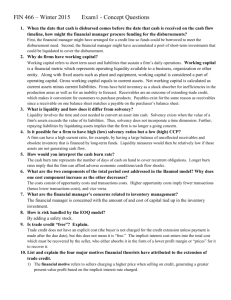

advertisement

TO: Whole Foods FROM: DATE: November 23, 2009 RE: Whole Foods Financial Performance Recommendations: The analysis of the Whole Foods’ financial performance revealed high financial risk due to a weak strategy. Restore your ability to pay current liabilities either by borrowing funds or employing equity financing. Change your aggressive expansion strategy to a moderate one. Do not open new stores, or remodel old locations, until liquidity is restored. Consider declining profitability, and a low rate of return on assets, when revising expansion goals. Employ price penetration strategy to attract wider customer base resulting in increased inventory turnover and rapid cash inflow. Current Situation and Relevant Facts: The liquidity ratios revealed the following changes in the company’s sort-term solvency measures between fiscal years ended September 30, 2006 and 2007 respectively. Current ratio decreased dropping to 0.85, quick ratio fell almost twice, cash ratio went down from 0.0044 to zero, and working capital plunged to negative $116,530 thousands. Activity ratios showed increase in days in inventory and decrease in inventory turnover. The long-term solvency measures reflected increase in debt-to-asset ratio by 0.2356. Debt-to-equity ratio went up drastically reaching 0.5616, long-term debt-to equity ratio also raised by almost 0.5 and timesinterest earned ratio sank from 996.93 to 70.36. The radical change in long-term solvency was due to the acquisition of the company’s leading competitor, Wild Oats, and aggressive expansion goals. Profitability ratios showed a slight decrease in gross profit, operating profit, and net profit margins. Return on total assets dropped from 9.98% in 2006 to 5.56% in 2007. (Attachment A) Analysis and conclusions: The fall of Whole Foods’ current ratio under 1.0 signals the company’s inability to pay current liabilities with current assets. In addition, 2007’s quick ratio is almost half the current ratio indicating an impaired ability to pay current liabilities and a dependence on the sale of inventory. In addition, inventory turnover dropped by 3.00 and days in inventory increased by 4.09 days reflecting decelerating conversion of inventory into cash. The cash ratio shows no cash reserves to cover current liabilities. Negative working capital confirms Whole Foods’ lack of internal funds to satisfy current liabilities on a timely basis, and the inability to finance expansion without resorting to borrowing or raising more equity capital. The long-term solvency measures provide an optimistic picture compared to liquidity measures. Debt-to-asset ratio is only 0.2368 which provides room to borrow more funds and increase cash inflow. Debt-to-equity ratio is less than 1.0 which confirms moderate debt level. In addition, long-term debt-to-equity ratio shows most debt is long-term. The high times-interest earned ratio indicates Whole Foods’ creditworthiness and ability to pay annual interest charges from operating income. Profitability ratios such as gross profit, operating profit, and net profit margins decreased slightly due to the sluggish economy. The drop in return on total assets indicates a decrease in return on investments. Whole Foods’ new store locations, as well as acquired stores, do not produce returns fast enough to cover extensive expenditures. Whole Foods’ liquidity ratios show the company’s lack of the assets to pay current liabilities. However, the company is solvent long term. The current situation was created by an aggressive expansion policy that exhausted Whole Foods’ cash reserves. New stores do not produce cash inflow fast enough to finance further expansion. Whole Foods’ profitability is slowly declining resulting in decreased cash inflow.