Ratio Analysis

advertisement

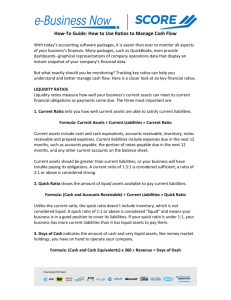

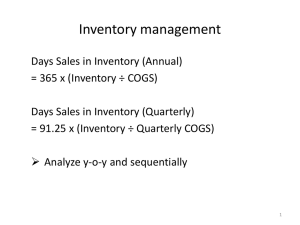

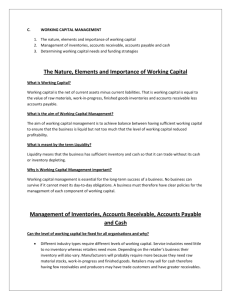

Ratio Analysis Worksheets Use these ratios to: 1) Compare historical trends for the company over time and 2) Compare the business with others in the same industry Source: Rocky Wade, University of Oklahoma Economic Development Institute Financial Analysis Worksheets: Page 1 of 7 Income Statement Ratios Used to analyze the control of costs Note: Comparisons made to the Sales/Income figures Ratio Sales Growth Formula This year’s Sales Minus Last Year’s sales Equals Sales difference Definition Analysis The percentage increase in sales over the past year Over time, sales growth should be continuing, but gradual, to avoid the fast growth syndrome The percentage of each sales dollar which is spent to make the product or service Over time, COGS/Sales should be stable or declining and consistent with or better than the industry The percentage of each sales dollar which remains after all expenses to make the product or service Over time, Gross Profit/Sales should be stable or increasing and consistent with or better than the industry The percentage of each sales dollar that is spent to operate the company, not including COGS Over time, Operating Expenses/Sales should be stable or increasing and consistent with or better than the industry The percentage of each sales dollar that is profit Over time, earnings / Sales should be stable or increasing and consistent with or better than the industry Divided by Last Year’s Sales Multiplied by100 COGS to Sales COGS Divided by Sales Gross Profit to Sales Gross Profit Divided by Sales Operating Expenses to Sales Operating Expenses Divided by Sales Earnings Before Tax to Sales Earnings before Tax Divided by Sales Financial Analysis Worksheets: Page 2 of 7 Worksheet: Calculating Income Statement Ratios Year 1 Year 2 Year 3 Sales Growth: How much have the company’s sales grown? This year’s Sales - Last Year’s Sales -= / = Sales Difference / Last Year’s Sales -= / x 100 x 100 = = % Sales Growth x 100 % = % COGS/Sales: Has the company been able to control its variable costs? Cost of Goods Sold / Sales / = COGS as % of Sales = / % = / % = % Gross Profit/Sales: Has the company maintained its gross profit margin? Gross Profit / Sales / = GP as % of Sales = / % = / % = % Operating Expenses/Sales: Has the company been able to control fixed & discretionary costs? Operating Expenses / Sales / = OpEx as % of Sales = / % = / % = % Earnings Before Tax/Sales: How much of each sales $ remains as profit before taxes are paid? EBT / Sales / = EBT as % of Sales = / % = / % = % Earnings After Tax/Sales: How much of each sales $ remains as profit after taxes are paid? PAT / Sales / =PAT as % of Sales = / % = / % = % Financial Analysis Worksheets: Page 3 of 7 Balance Sheet Ratios Used to analyze the liquidity of the business Ratio Formula Definition Analysis Current Ratio Current Assets Divided by Current Liabilities Compares cash available from operations and cash which must be paid for operations 1:1 means the business can generate $1 in cash for every $1 it owes. Over time, it should be stable or increasing and consistent with or better than the industry Quick Ratio Cash + Receivables Divided by Current Liabilities Compares cash which can be collected quickly and cash which must be paid for operation excluding inventory 1:1 means the business can generate $1 in cash from only cash and receivables for every $1 it owes. Over time, it should be stable or increasing and consistent with or better than the industry Current Assets Minus Current Liabilities Cash remaining after all operating (current) assets are collected and all operating (current) liabilities are paid Working capital should be positive and increasing over time. Negative WC means the business must obtain additional funds through equity investment or a line of credit Allows you to see whether the company is funded by debt or equity, therefore who is financing the company In most situations, this should be going down. Over time, it should be stable or decreasing and consistent with or better than the industry aka: Acid Test Working Capital Debt to Equity Ratio aka: Leverage Ratio Total Liabilities Divided by Net Worth Financial Analysis Worksheets: Page 4 of 7 Worksheet: Calculating Balance Sheet Ratios Year 1 Year 2 Year 3 Current Ratio: Can company generate current/operating cash to pay bills due in next 12 mo? Current Assets / Current Liabilities / / / = Current Ratio = = = Quick Ratio: Can company generate enough cash & A/R to pay bills due in next 12 months? CASH & Marketable Securities + Receivables + + + = Quick Cash Available = / = / = / = = = / Current Liabilities = Quick Ratio Working Capital: How much cash remains after the company pays its bills in next 12 mo? Current Assets -- Current Liabilities -- -- -- = Working Capital = = = Debt/Equity Ratio: How has the company financed operations between debt & equity? Total Liabilities / Net Worth / / / = Debt/Equity Ratio = = = Financial Analysis Worksheets: Page 5 of 7 Operating Cycle Ratios Used to analyze the use of cash in business operations Ratio Formula Days Receivable (D/R) Receivables Divided by Sales X 360 Average number of days that the business takes to collect from its customers D/R of 30 means that the business averages 30 days to collect from customers. D/R should be: 1. Consistent with terms offered to customers 2. Stable or declining over time 3. Consistent with or better than the industry Inventory Divided by COGS X 360 Average length of time it takes the business to make its product, from buying inventory, to making the product, until sale of the product D/I of 45 means that the business has its cash tied up in inventory for 45 days until the product is sold. D/I should be: 1. Consistent with the company’s projected production cycle 2. Stable or declining over time 3. Consistent with or better than the industry Payables Divided by COGS X 360 Average number of days that the business takes to pay its suppliers D/R of 30 means that the business averages 30 days to pay its suppliers. D/P should be: 1. Consistent with terms offered by suppliers 2. Stable or declining over time 3. Consistent with industry Days Receivable + Days Inventory - Days Payable Average number of days that the business has its cash tied up in operations Shorter O/C means a lesser need for working capital. Longer O/C means greater working capital need for the company. RMA: Sales/ Receivables Days Inventory (D/I) RMA: Cost of Sales/ Inventory Days Payable (D/P) Definition RMA: Cost of Sales/ Payables Operating Cycle RMA: Analysis Does no total Financial Analysis Worksheets: Page 6 of 7 Worksheet: Operating Cycle Ratios Year 1 Year 2 Year 3 Days Receivable: How long, on average, does the company take to collect from customers? Receivables / Sales / / / X 360 days in Period X 360 X 360 X 360 = Days Receivable = = = Days Inventory: How long, on average, does the company have cash invested in the inventory/manufacturing process? Inventory / Cost of Goods Sold / / / X 360 days in Period X 360 X 360 X 360 = Days Inventory = = = Days Payable: How long, on average, does the company take to pay its suppliers? Payables / Cost of Goods Sold / / / X 360 days in Period X 360 X 360 X 360 = Days Payable = = = Operating Cycle: How long, on average, does the company have its cash tied up in the operations of the business? + Days Receivable + + + + Days Inventory + + + -- Days Payable -- -- -- = Operating Cycle = = = Financial Analysis Worksheets: Page 7 of 7