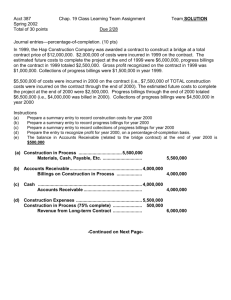

E3-2. Determining gross profit using percentage-of

advertisement

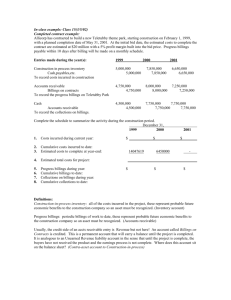

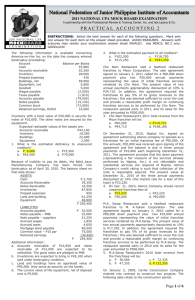

E3-2. Determining gross profit using percentage-of-completion The gross profit for the percentage-of-completion method is as follows: Contract price Cost to date Est. cost to complete Total cost Expected gross profit Percentage complete (18/24) Profit to recognize date Profit previously recognized 2012 gross profit $3,000,000 $1,800,000 600,000 2,400,000 600,000 75% 450,000 (300,000) $ 150,000 E3-12. Franchise sales; revenue recognition Requirement 1: April 1, 2011 To record franchise agreement and down payment DR Cash $60,000 DR Note receivable 240,000 CR Unearned franchise fee revenue $300,000 Requirement 2: August 15, 2011 To recognize franchise fee revenue DR Unearned franchise fee revenue $300,000 CR Franchise fee revenue $300,000 P3-4. Income recognition on long-term contracts. Requirement 1: a. No income will be recognized in 2011 under the completed-contract method as the project is not complete. b. Income for 2011 = = $8,000,000 $24,000,000 .33 x 1 x ($30,000,000 – $24,000,000) $6,000,000 = $2,000,000 Note: Materials purchased but not used are not included in the numerator of the cost percentage for 2011 but are included in the estimated total project costs ($8,000,000 + $15,500,000 + $500,000). Requirement 2: DR Construction in progress DR Material inventory CR Cash Percentage of completion $8,000,000 500,000 $8,500,000 DR Accounts receivable CR Billings on contract $9,000,000 DR Cash CR Accounts receivable $7,500,000 DR Construction in progress DR Construction expenses CR Construction revenue $2,000,000 8,000,000 Completed contract (same) (same) $9,000,000 (same) $7,500,000 (No entry) $10,000,000 P3-5. Long-term construction contract accounting (AICPA adapted) Completed-Contract Method Year 2011 DR Construction in progress CR Cash, payables, materials, etc. $290,000 $290,000 DR Accounts receivable CR Billings on contract $260,000 DR Cash CR Accounts receivable $240,000 $260,000 $240,000 Since the project is incomplete, no revenue is recognized for the year 2011. 2 Balance Sheet Presentation at the End of 2011 Completed-Contract Method Current Assets: Construction in progress $290,000 Less: Billings on contract (260,000) Unbilled costs of construction $30,000 Accounts receivable $20,000 Year 2012 DR Construction in progress CR Cash, payables, materials, etc. $150,000 $150,000 DR Accounts receivable CR Billings on contract $265,000 DR Cash CR Accounts receivable $285,000 DR Billings on contract CR Construction in progress CR Income on long-term construction contracts $525,000 $265,000 $285,000 $440,000 85,000 Alternate entry: DR Construction expense DR Billings on contract CR Construction in progress CR Construction revenue $440,000 525,000 $440,000 525,000 Percentage-of-Completion Method Year 2011 DR Construction in progress CR Cash, payables, materials, etc. $290,000 $290,000 DR Accounts receivable CR Billings on contract $260,000 DR Cash CR Accounts receivable $240,000 $260,000 $240,000 DR Construction in progress1 CR Income on long-term construction contracts $60,000 $60,000 3 Alternate entry: DR Construction in progress1 DR Construction expense CR Construction revenue $ 60,000 290,000 $350,000 1 Contract price - Actual costs to date - Estimated costs to complete Total estimated costs of project Estimated total gross margin $525,000 ($290,000) (145,000) (435,000) $90,000 Revenue earned during the period: ($290,000/$435,000) x $525,000 = $350,000 Gross margin earned during the period: ($290,000/$435,000) x $90,000 = $60,000 Balance Sheet Presentation at the End of 2011 Percentage-of-Completion Method Current Assets: Construction in progress $350,000 Less: Billings on contract (260,000) Unbilled costs of construction $90,000 Accounts receivable $20,000 Year 2012 DR Construction in progress CR Cash, payables, materials, etc. $150,000 $150,000 DR Accounts receivable CR Billings on contract $265,000 DR Cash CR Accounts receivable $285,000 $265,000 $285,000 DR Construction in progress CR Income on long-term construction contracts $25,000 $25,000 Alternate Entry: DR Construction in progress DR Construction expense $ 25,000 150,000 4 CR Construction revenue $175,000 Total 2011 Construction revenue $525,000 $350,000 Construction expense (440,000) (290,000) Gross margin $ 85,000 $ 60,000 P3-6. Determining income under installment sales method (AICPA adapted) 2012 $175,000 (150,000) $ 25,000 Income before income taxes on installment sale contract: Sales Cost of sales Gross profit $556,000 (417,000) 139,000 Interest income (from following calculations) Income before income taxes 27,360 $166,360 Calculations to determine interest income on installment sale contract: Cash selling price Less: July 1, 2011, payment Interest rate Annual interest Interest July 1, 2011, to December 31, 2011 ($54,720 x 1/2) 5 $556,000 (100,000) 456,000 12% $ 54,720 $ 27,360