CHAPTER 18 Revenue Recognition

advertisement

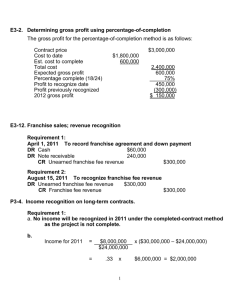

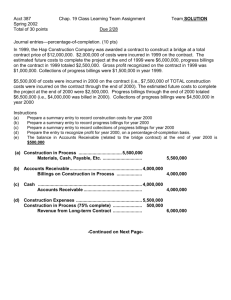

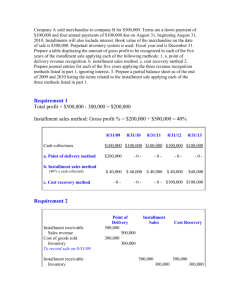

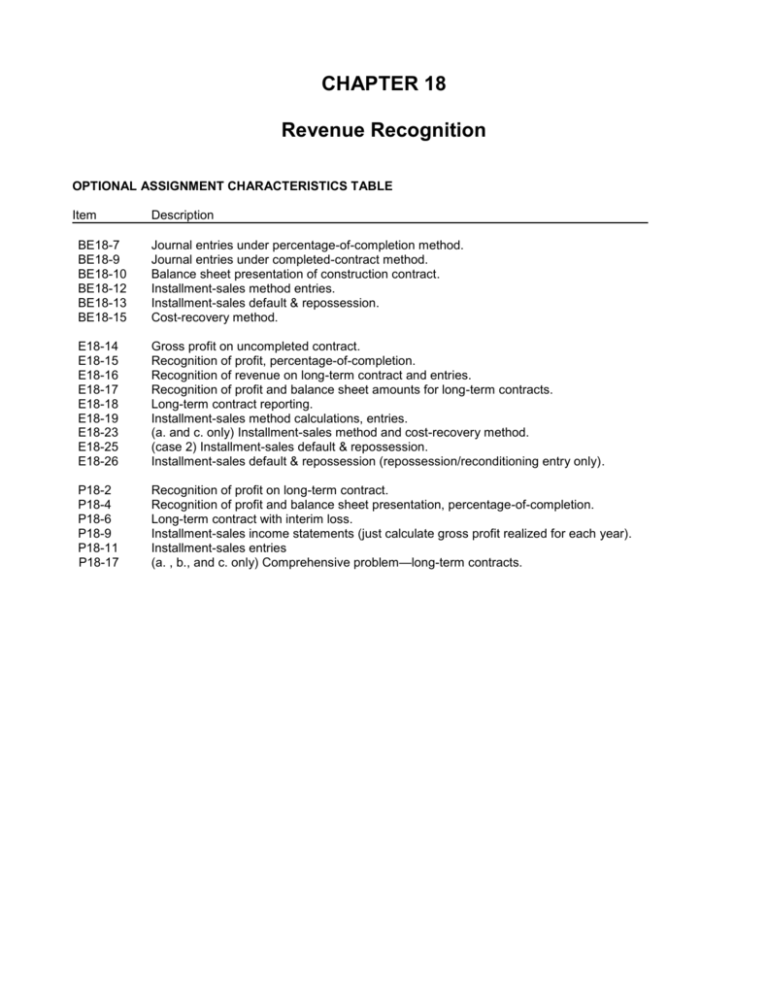

CHAPTER 18 Revenue Recognition OPTIONAL ASSIGNMENT CHARACTERISTICS TABLE Item Description BE18-7 BE18-9 BE18-10 BE18-12 BE18-13 BE18-15 Journal entries under percentage-of-completion method. Journal entries under completed-contract method. Balance sheet presentation of construction contract. Installment-sales method entries. Installment-sales default & repossession. Cost-recovery method. E18-14 E18-15 E18-16 E18-17 E18-18 E18-19 E18-23 E18-25 E18-26 Gross profit on uncompleted contract. Recognition of profit, percentage-of-completion. Recognition of revenue on long-term contract and entries. Recognition of profit and balance sheet amounts for long-term contracts. Long-term contract reporting. Installment-sales method calculations, entries. (a. and c. only) Installment-sales method and cost-recovery method. (case 2) Installment-sales default & repossession. Installment-sales default & repossession (repossession/reconditioning entry only). P18-2 P18-4 P18-6 P18-9 P18-11 P18-17 Recognition of profit on long-term contract. Recognition of profit and balance sheet presentation, percentage-of-completion. Long-term contract with interim loss. Installment-sales income statements (just calculate gross profit realized for each year). Installment-sales entries (a. , b., and c. only) Comprehensive problem—long-term contracts. CH 18 Optional Homework, P ag e |1 BRIEF EXERCISE 18-7 Construction in Process ................................................................................ Cash, Materials, Payables, etc. .......................................................... 1,700,000 Accounts Receivable ..................................................................................... Billings on Construction in Process .................................................... 1,200,000 Cash ............................................................................................................ Accounts Receivable .......................................................................... 960,000 Construction in Process [($1,700,000 / 5,000,000) = 34% X $2,000,000] ... Construction Expenses ................................................................................. Revenue from Construction Contract ($7,000,000,000 X 34%) ......... 680,000 1,700,000 1,700,000 1,200,000 960,000 2,380,000 BRIEF EXERCISE 18-9 Construction in Process ...................................................................................... Cash, Materials, Payables, etc. ................................................................ 1,700,000 Accounts Receivable ........................................................................................... Billings on Construction in Process .......................................................... 1,200,000 Cash .................................................................................................................. Accounts Receivable ................................................................................ 960,000 1,700,000 1,200,000 960,000 BRIEF EXERCISE 18-10 Current Assets Accounts Receivable ............................................................................... Inventories Construction in process ................................................................ Less: Billings ................................................................................ Costs in excess of billings ................................................................. $240,000 $1,715,000 1,000,000 715,000 BRIEF EXERCISE 18-12 Installment Accounts Receivable ....................................................................... Installment Sales ..................................................................................... 150,000 Cost of Installment Sales ........................................................................................ Inventory ...................................................................................................... 102,000 Cash ................................................................................................................. Installment Accounts Receivable ............................................................ 150,000 102,000 54,000 54,000 Installment Sales ....................................................................................................... Cost of Installment Sales ................................................................................ Deferred Gross Profit ..................................................................................... 150,000 Deferred Gross Profit ............................................................................................... Realized Gross Profit (32% X $54,000) ......................................................... [gross profit % = ($150,000 − $102,000) = $48,000 / $150,000 = 32%] 17,280 102,000 48,000 17,280 CH 18 Optional Homework, P ag e |2 BRIEF EXERCISE 18-13 Repossessed Inventory ...................................................................................... Deferred Gross Profit ($520 x 40%) ....................................................................... Loss on Repossession ....................................................................................... Installment Accounts Receivable ............................................................ 275 208 37 520 BRIEF EXERCISE 18-15 Year 2012 2013 2014 Cash Collections $10,000 5,000 5,000 Cost Recovery* $10,000 3,000 0 Gross Profit Realized $0 2,000 5,000 * must recover $13,000 before Gross Profit realized EXERCISE 18-14 Estimated contract cost at completion ($800,000 + $1,200,000) Fixed fee ..................................................................................................................... Total contract price ..................................................................................................... Total estimated cost ................................................................................................... Gross profit ................................................................................................................. Percentage of completion ($800,000 / $2,000,000) ................................................... Gross profit to be recognized ($450,000 X 40%) ....................................................... $2,000,000 450,000 2,450,000 2,000,000 450,000 40% $ 180,000 EXERCISE 18-15 (a) (1) Contract price (revenue) Costs incurred to date Estimated costs to complete Estimated total costs Estimated total profit 2012 $1,200,000 280,000 520,000 800,000 $400,000 % completion for 2012: $280,000 / $800,000 = 35% GP = gross profit 2012: $400,000 x 35% = $140,000 − $0 2013: $400,000 x 75% = $300,000 − $140,000 (a) 2. 2013 $1,200,000 600,000 200,000 800,000 $400,000 for 2013: $600,000 / $800,000 = 75% GP recognized $140,000 160,000 Construction in Process ($600,000 – $280,000) ......................................... Cash, Materials, Payables, etc. ...................................................... 320,000 Accounts Receivable ($500,000 – $150,000) ........................................... Billings on Construction in Process ................................................ 350,000 Cash ($320,000 – $120,000) ..................................................................... Accounts Receivable ...................................................................... 200,000 Construction in Process ............................................................................. Construction Expenses .............................................................................. Revenues from Construction Contracts [$1,200,000 X (75% – 35%)] 160,000 320,000 320,000 350,000 200,000 480,000 CH 18 Optional Homework, P ag e |3 EXERCISE 18-15 continued (b) Income Statement (2013) Revenues from Construction Contracts ...................................................$480,000 Construction Expenses ...............................................................................320,000 Gross profit on long-term construction contract ...................................................... Balance Sheet (12/31/13) Current assets: Accounts Receivable ($500,000 – $320,000)............................................... Inventories: Construction in Process ($600,000 + $300,000) .................... $900,000 Less: Billings .......................................................................... (500,000) Costs and recognized profit in excess of billings .................................... $160,000 $180,000 $400,000 EXERCISE 18-16 (a) Contract price (revenue) Costs incurred during year Costs incurred to date Estimated costs to complete Estimated total costs Estimated total profit 2012 $2,200,000 $640,000 640,000 960,000 1,600,000 $600,000 2013 $2,200,000 $1,425,000 2,065,000 0 2,065,000 $135,000 % completion for 2012: $640,000 / $1,600,000 = 40% 2012: $2,200,000 x 40% = $880,000 − $0 2013: $2,200,000 x 100% = $2,200,000 − $880,000 Revenue recognized $ 880,000 1,320,000 (b) All $2,200,000 of the contract price is recognized as revenue in 2013. (c) Construction in Process............................................................................... Cash, Materials, Payables, etc. ........................................................ 640,000 Accounts Receivable ................................................................................... Billings on Construction in Process .................................................. 420,000 Cash .......................................................................................................... Accounts Receivable ........................................................................ 350,000 Construction Expenses................................................................................ Construction in Process ($600,000 x 40%) ................................................. Revenue from Construction Contract .............................................. 640,000 240,000 640,000 420,000 350,000 880,000 CH 18 Optional Homework, P ag e |4 EXERCISE 18-17 Contract price (revenue) Costs incurred to date Estimated costs to complete Estimated total costs Estimated total profit (a) 2012 $6,000,000 1,185,800 4,204,200 5,390,000 $610,000 Gross Profit to Be Recognized: $0; no gross profit to be recognized prior to completion of contract. Billings in Excess of Costs: Construction in Process.............................................................................................. Billings ($6,000,000 x 25%) ........................................................................................ Billings in Excess of Costs ......................................................................................... (b) $ 1,185,800 (1,500,000) $ (314,200) Gross Profit to Be Recognized: Percentage-of-completion: ($1,185,800 / $5,390,000) = 22% Gross profit to be recognized: ($610,000 X 22%) = $ 134,200 Billings and Recognized Profits in Excess of Costs: Construction in Process ($1,185,800 + $134,200) ..................................................... Billings ($6,000,000 x 25%) ........................................................................................ Billings and Recognized Profits in Excess of Costs ................................................... $ 1,320,000 (1,500,000) $ (180,000) EXERCISE 18-18 BERSTLER CONSTRUCTION COMPANY Partial Income Statement Year Ended December 31, 2012 Revenue from construction contract (Project 3) ...................................................................... Construction expenses (Project 3) .......................................................................................... Gross profit .............................................................................................................................. Loss on construction contract (Project 1)* .............................................................................. * Contract price.............................................................................. Total estimated costs ($450,000 + $130,000) ............................ Total estimated loss (recognize in 2010) .................................... $520,000 330,000 190,000 (20,000) $ 560,000 580,000 $ (20,000 ) BERSTLER CONSTRUCTION COMPANY Partial Balance Sheet December 31, 2012 Current assets: Accounts receivable ($1,080,000 – $990,000) ....................................... Inventories: Construction in process ($450,000 – $20,000) .............................. Less: Billings ............................................................................... Costs and recognized loss in excess of billings (Project 1) ........ Current liabilities: Billings on construction contract .................................................. Construction in process ................................................................ Billings in excess of costs (Project 2) .......................................... $90,000 $430,000 (360,000) $70,000 $220,000 126,000 $94,000 CH 18 Optional Homework, P ag e |5 EXERCISE 18-19 (a) Gross profit rate: 2012: ($900,000 – $594,000) / $900,000 2013: ($1,000,000 – $680,000) / $1,000,000 Gross profit realized: 2012: $370,000 X 34% 2013: on 2012 = $350,000 X 34% on 2013 = $450,000 X 32% Total (b) 2012 2013 34% 32% $125,800 $125,800 $119,000 144,000 $263,000 Installment Accounts Receivable ........................................................... Installment Sales ......................................................................... 1,000,000 Cost of Installment Sales ........................................................................ Inventory ...................................................................................... 680,000 Cash ($350,000 + $450,000) ...................................................................... Installment Accounts Receivable .......................................................... 800,000 Installment Sales .......................................................................................... Cost of Installment Sales ................................................................... Deferred Gross Profit ......................................................................... 1,000,000 Deferred Gross Profit ..................................................................................... Realized Gross Profit ........................................................................ 263,000 1,000,000 680,000 800,000 680,000 320,000 263,000 EXERCISE 18-23 (a. and c. only) (a) Must convert gross profit as a percentage of costs to gross profit as a percentage of sales: 2012 = 25% / (100% + 25%) = 20% 2013 = 28% / (100% + 28%) = 21.875% Gross profit realized: 2013: on 2012 = $240,000 X 20% on 2013 = $160,000 X 21.875% Total $48,000 35,000 $83,000 (c) 2012 2013: on 2010 sales on 2011 sales Cash Collections $130,000 240,000 160,000 Cost Recovery* $130,000 240,000 160,000 Gross Profit Realized $0 0 0 * 2012: must recover $384,000 [$480,000 x (100% − 20%)] before GP realized 2013: must recover $484,375 [$620,000 x (100% − 21.875%)] before GP realized EXERCISE 18-25 (case 2) Repossessed Inventory ...................................................................................... Deferred Gross Profit [$780 x ($1,500 − $1,200) / $1,500)] .................................. Installment Accounts Receivable [$1,500 − $240 – ($80 x 6)] ................ Gain on Repossession ............................................................................ 750 156 780 126 CH 18 Optional Homework, P ag e |6 EXERCISE 18-26 (repossession/reconditioning entry only) Repossessed Inventory ..................................................................................... Deferred Gross Profit ($1,300 x 30%) .................................................................... Loss on Repossession ....................................................................................... Installment Accounts Receivable ($1,800 − $500) .................................. Cash ........................................................................................................ 650 390 320 1,300 60 PROBLEM 18-2 (a) Contract price Costs to date Estimated cost to complete Estimated total cost Estimated total gross profit (b) 2012 $900,000 270,000 330,000 600,000 $300,000 2013 $900,000 450,000 150,000 600,000 $300,000 % completion for 2012: $270,000 / $600,000 = for 2013: $450,000 / $600,000 = 45% 75% GP = gross profit 2012: $300,000 x 45% = $135,000 − $0 2013: $300,000 x 75% = $225,000 − $135,000 2014: $290,000 x 100% = $290,000 − $225,000 GP recognized $135,000 90,000 65,000 2014 $900,000 610,000 0 610,000 $290,000 In 2012 and 2013, $0 gross profit would be recognized. In 2014, all $290,000 is recognized. PROBLEM 18-4 (a) Contract price Costs to date Estimated cost to complete Estimated total cost Estimated total gross profit (b) 2012 $6,600,000 1,620,000 3,780,000 5,400,000 $1,200,000 2013 $6,600,000 3,850,000 1,650,000 5,500,000 $1,100,000 % completion for 2012: $1,620,000 / $5,400,000 = for 2013: $3,850,000 / $5,500,000 = 30% 70% GP = gross profit 2012: $1,200,000 x 30% = $360,000 − $0 2013: $1,100,000 x 70% = $770,000 − $360,000 2014: $1,010,000 x 100% = $1,010,000 − $770,000 GP recognized $360,000 410,000 240,000 2014 $6,510,000 5,500,000 0 5,500,000 $1,010,000 HEWITT CONSTRUCTION COMPANY Balance Sheet December 31, 2013 Current assets: Accounts receivable ($3,300,000 – $2,800,000) .............. Inventories: Construction in process ($3,850,000 + $770,000) .... Less: Billings ........................................................... Costs and recognized profit in excess of billings $ 500,000 $4,620,000 (3,300,000) 1,320,000 CH 18 Optional Homework, P ag e |7 PROBLEM 18-6 (a) Contract price Costs incurred during year Costs to date Estimated cost to complete Estimated total cost Estimated total gross profit 2012 $8,400,000 2,880,000 2,880,000 3,520,000 6,400,000 $2,000,000 2013 $8,400,000 2,230,000 5,110,000 2,190,000 7,300,000 $1,100,000 % completion for 2012: $2,880,000 / $6,400,000 = for 2013: $5,110,000 / $7,300,000 = 2014 $8,400,000 2,190,000 7,300,000 0 7,300,000 $1,100,000 45% 70% GP = gross profit 2012: $2,000,000 x 45% 2013: $1,100,000 x 70% = $770,000 − $900,000 2014: $1,100,000 x 100% = $1,100,000 − $770,000 GP (loss) recognized $900,000 (130,000) 330,000 (b) Profit (loss) recognized under Completed-Contract Method 2012: $0 2013: $0 (contract still has an overall profit) 2014: $1,100,000 PROBLEM 18-9 (just calculate gross profit realized for each year) 2012 Gross profit rate: 2012: ($320,000 − $214,400) / $320,000 2013: ($275,000 − $176,000) / $275,000 2014: ($380,000 − $228,000) / $380,000 Gross profit realized: 2012: $100,000 x 33% 2013: on 2012 = $90,000 x 33% on 2013 = $110,000 x 36% 2014: on 2012 = $ 40,000 x 33% on 2013 = $140,000 x 36% on 2014 = $125,000 x 40% Total gross profit realized * 2013 2014 ** 33% 36% 40% $33,000 $29,700 39,600 $33,000 $69,300 $13,200 50,400 50,000 $113,600 PROBLEM 18-11 (a) Installment Accounts Receivable ................................................................ Installment Sales .............................................................................. 500,000 Cost of Installment Sales ............................................................................. Inventory ........................................................................................... 350,000 Cash .......................................................................................................... Installment Accounts Receivable ...................................................... 180,000 Repossessed Inventory .......................................................................... Deferred Gross Profit ($24,000 x 30%*)...................................................... Loss on Repossession ............................................................................ Installment Accounts Receivable ...................................................... * gross profit rate = [($500,000 − $350,000) = $150,000 / $500,000 = 30%] 500,000 350,000 180,000 11,200 7,200 5,600 24,000 CH 18 Optional Homework, P ag e |8 PROBLEM 18-11 continued (a) (b) Installment Sales ......................................................................................... Cost of Installment Sales .................................................................. Deferred Gross Profit ........................................................................ 500,000 Deferred Gross Profit................................................................................... Realized Gross Profit ($180,000 x 30%) .......................................... 54,000 350,000 150,000 54,000 PROBLEM 18-17 (a., b., and c. only) For both methods: Contract price Costs incurred to date Estimated costs to complete Estimated total costs Estimated total profit (loss) A $300,000 248,000 72,000 320,000 $(20,000) B $350,000 67,800 271,200 339,000 $11,000 C $280,000 186,000 0 186,000 $94,000 D $200,000 118,000 87,000 205,000 $(5,000) E $240,000 190,000 10,000 200,000 $40,000 A $(20,000) B $11,000 C $94,000 D $(5,000) E $40,000 (a) Schedule to compute gross profit (loss): Estimated total profit (loss) Percentage-of-completion: A: (not applicable; 100% since loss) B: ($67,800 / $339,000) C: ($186,000 / $186,000) D: (not applicable; 100% since loss) E: ($190,000 / $200,000) Gross profit (loss) recognized — 20% 100% — $(20,000) $ 2,200 $94,000 $(5,000) 95% $38,000 Schedule to Compute ―Costs and Recognized Profits (Losses) in Excess of Billings‖ or ―Billings in Excess of Costs and Recognized Profit‖ (note that CIP & Billings accounts are closed out for Project C since complete) Costs & Recognized Profits (Losses) a $228,000 b 70,000 c 113,000 d 228,000 A B D E a $248,000 – $20,000 (b) Related Billings $200,000 110,000 35,000 205,000 b Costs & Recognized Profits (Losses) in Excess of Billings $ 28,000 $67,800 + $2,200 Billings in Excess of Costs & Recognized Profits (Losses) $40,000 78,000 23,000 $129,000 c $118,000 – $5,000 $40,000 d $190,000 + $38,000 Partial Income Statement Revenue from long-term contracts ......................................................................................... Construction expenses ($252,500** + $67,800 + $186,000 + $120,122*** + $190,000) Gross profit ............................................................................................................................. *A: B: C: D: E: ** *** $300,000 X ($248,000 / $320,000) $350,000 X 20% $280,000 X 100% $200,000 X ($118,000 / $205,000) $240,000 X 95% Total revenue recognized = = = = = $232,500 70,000 280,000 115,122 228,000 $925,622 expense (JE ―plug‖) = $232,500 revenue + $20,000 loss recognized = $252,500 expense (JE ―plug‖) = $115,122 revenue + $5,000 loss recognized = $120,122 $925,622* 816,422 $109,200 CH 18 Optional Homework, P ag e |9 PROBLEM 18-17 continued (a., b., and c. only) Partial Balance Sheet Current assets: Accounts receivable ($830,000 – $765,000) ........................ Inventories: Construction in process ........................................................... Less: Billings .......................................................................... Costs and recognized profits (losses) in excess of billings ..... $ 65,000 $569,000 * (440,000) ** 129,000 Current liabilities: Billings ($110,000) in excess of costs and recognized profit ($70,000) (project B) $ 40,000 * project A $228,000 + project D $113,000 + project E $228,000 ** project A $200,000 + project D $35,000 + project E $205,000 (c) Schedule to compute gross profit (loss)—include profit only for completed project; include loss for projects with overall loss A B C D E Gross profit (loss) recognized $(20,000) $ 0 $94,000 $(5,000) $0 Schedule to Compute ―Costs and Recognized Losses in Excess of Billings‖ or ―Billings in Excess of Costs‖ (note that CIP & Billings accounts are closed out for Project C since complete) Costs & Recognized Losses a $228,000 b 67,800 c 113,000 d 190,000 A B D E Related Billings $200,000 110,000 35,000 205,000 Costs & Recognized (Losses) in Excess of Billings $ 28,000 Billings in Excess of Costs $42,200 78,000 15,000 $57,200 $106,000 a $248,000 – $20,000 b $67,800 c $118,000 – $5,000 d $190,000