0538479728_298429

advertisement

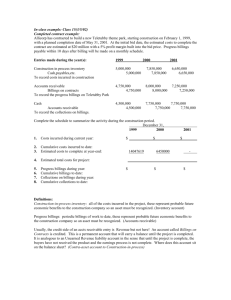

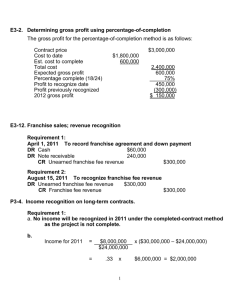

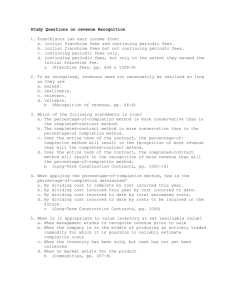

Chapter 8 18th Edition Revenue Recognition Intermediate Financial Accounting Earl K. Stice James D. Stice PowerPoint presented by Douglas Cloud Professor Emeritus of Accounting, Pepperdine University © 2012 Cengage Learning 8-1 Revenue Recognition Recognition refers to the time when transactions are recorded on the books. The FASB’s two criteria for recognizing revenues and gains are when: 1. They are realized or realizable. 2. They have been earned through substantial completion of the activities involved in the earnings process. Both of these criteria generally are met at the point of sale 8-2 Revenue Recognition • • Revenue is not recognized prior to the point of sale because either: A valid promise of payment has not been received from the customer. The company has not provided the product or service. Exceptions to these rules: The customer provides a valid promise of payment. Conditions exist that contractually guarantee the sale. (continued) 8-3 Revenue Recognition AICPA Statement of Position 97-2 gives companies more guidance through a checklist of four factors that amplify the two criteria: 1) Persuasive evidence of an arrangement exists. 2) Delivery has occurred. 3) The vendor’s fee is fixed or determinable. 4) Collectibility is probable. (continued) 8-4 Revenue Recognition • The FASB is currently engaged in a revenue recognition project in conjunction with the IASB (as of June 2010). • The FASB has tentatively decided to move away from the realization and substantial completion criteria and to instead emphasize the measurement of a seller’s satisfaction of performance obligations created through contracts with customers. 8-5 SAB 101 • Because SAB 101 was released to curtail specific abuses, it should not be seen as a comprehensive treatise on the entire area of revenue recognition. • Revenue recognition issues covered in SAB 101 may not be comprehensive, but they are extremely important. 8-6 Sarbanes-Oxley Act of 2002 • Section 404 of the Sabanes-Oxley Act of 2002 instructs the SEC to require all publicly traded companies to provide a report of the condition of the company’s internal controls. • This is to ensure that the public financial statements are not rendered irrelevant by secret side agreements. • A good internal control system establishes procedures to safeguard the value of a company’s assets. 8-7 Accounting for Consignments Seller Company ships goods costing $1,000 on consignment to Consignee Company. The retail price of the goods is $1,500. No sale should be recorded. However, there may be a journal entry made to reclassify the inventory. Inventory on Consignment Inventory 1,000 1,000 8-8 Accounting for a Layaway Sale Seller Company receives $100 cash from a customer. The $100 payment is a partial payment for goods costing $1,000 with a total retail price of $1,500. The following entry shows the receipt of $100 cash as initial layaway payment. Cash Deposit Received from Customers 100 100 (continued) 8-9 Accounting for a Layaway Sale Recording the receipt of the final $1,400 cash payment and the delivery of goods to customers requires two entries. One to record the sale and the second to remove the item from inventory and to record its cost. Cash Deposit Received from Customer Sales 1,400 100 Cost of Goods Sold Inventory 1,000 1,500 1,000 8-10 Bill-and-Hold Arrangements To consider merchandise as sold using the bill-and-hold arrangement, a seller must be able to demonstrate: • that the goods are ready to ship, • that they are segregated in act and cannot be used to fill other orders, and • that the buyer has requested, in writing, the bill-and-hold arrangement. 8-11 Customer Acceptance Provisions Seller Company receives $1,500 cash from a customer as payment in full for equipment costing $1,000. The sale is not complete until the equipment is installed at the customer’s place of business. The following entry is necessary to record the advance receipt of money: Cash Advance Payments Received from Customers 1,500 1,500 (continued) 8-12 Customer Acceptance Provisions Two entries are required to record customer acceptance of the installed equipment. Advance Payments Received from Customers Sales Cost of Goods Sold Inventory 1,500 1,500 1,000 1,000 8-13 Appropriate Accounting for a Service Provided Over an Extended Period Seller Company receives $1,000 cash from a customer as the initial sign-up fee for a service. In addition to the sign-up fee, the customer is required to pay $50 per month for the service. The expected economic life of this service agreement is 100 months. An entry is required to show receipt of cash. Cash Unearned Initial Sign-up Fees 1,000 1,000 (continued) 8-14 Appropriate Accounting for a Service Provided Over an Extended Period A second entry is required to record receipt of the monthly payment. Cash Monthly Service Revenue 50 50 Another entry is necessary to record partial recognition of the initial sign-up fee as revenue ($1,000/100 months). Unearned Initial Sign-up Fees Initial Sign-up Fee Revenue 10 10 8-15 Subtopic 605-25 • The focus of Subtopic 605-25 is on the “unit of accounting.” • An element of multiple-element arrangement is considered to be a unit of accounting if that element has standalone value. • An element has standalone value if it is sold separately or if the customer resells it. 8-16 Income Statement Presentation of Revenue: Gross or Net Characteristic of a transaction in which a company should report revenue on a net basis are given as follows: • The company does not maintain an inventory of the product being sold but simply forwards orders to a supplier. • The company is not primarily responsible for satisfying customer requirements, request, complaints, and so forth; those requirements are satisfied by the supplier of goods. (continued) 8-17 Income Statement Presentation of Revenue: Gross or Net • The company earns a fixed amount, or a fixed percentage, and doesn’t bear the risk of fluctuations in the margin between the selling price and the cost of goods sold. • The company does not bear the credit risk associated with collecting from the customer; that risk is borne by the supplier. 8-18 A Contract Approach to Revenue Recognition The contract approach contains three basic steps: 1) Identify the performance obligations accepted by a seller in its contracts with its buyers. 2) For multiple-element transactions, allocate transaction prices based on relative separate selling prices. 3) Recognize revenue when performance obligations are satisfied. (continued) 8-19 A Contract Approach to Revenue Recognition • With the contractual performance obligation focus, the FASB and IASB have agreed that revenue arises when a seller satisfies a performance obligation to a buyer. • The general idea that no revenue should be recognized until something of value has been delivered to the customer goes back to SAB 101 and even back to the traditional revenue recognition criteria. (continued) 8-20 A Contract Approach to Revenue Recognition Ashley Company has provided goods, on account, to customers during the month of June with a total billing price of $100,000. Bad debts are expected to be 1.0% of the gross sales amount, and sales returns are expected to be 2.5% of the gross sales amount. A summary journal entry follows: June 30 Accounts Receivable Sales Revenue [$100,000 x (100.0% ‒ 1.0% ‒ 2.5%)] (continued) 96,500 96,500 8-21 A Contract Approach to Revenue Recognition Wilks Company sells a plasma TV and 2-year warranty to a customer for the joint price of $2,000. Wilks Company has generated the following information regarding the sale of the plasma TV. • Cost of plasma TV, $1,500 • Sales price of plasma TV sold separately is unknown. Other consumer electronic products have profit margins that range between 16% and 22% of cost. (continued) 8-22 A Contract Approach to Revenue Recognition • Sales price of warranty if sold separately, unknown. A 2-year warranty for a refrigerator/freezer with the same wholesale cost sells for $300. Wilks estimates that repair costs for the plasma TV would be 5% higher ($300 + ($300 x .05) = $315). TV delivery obligation: $1,700 = $2,000 x [$1,785/($1,785 + $315)] Warranty service obligation: $300 = $2,000 x [$315/$1,785 + $315)] (continued) 8-23 A Contract Approach to Revenue Recognition The journal entry to record the asset and liability at the contract signing is as follows: Cash Contract Liability—TV Contract Liability—Warranty 2,000 1,700 300 When the plasma TV is delivered, the following journal entries are required: Contract Liability—TV Sales Revenue Cost of Goods Sold Inventory 1,700 1,700 1,500 1,500 8-24 Introduction • If a Company waits until the production or service period is complete to recognize revenue, this approach is referred to as the completed-contract method. All income from the contract is related to the year of completion. • Percentage-of-completion accounting was developed to relate recognition of revenue on long-term construction-type contracts to the activities of a firm in fulfilling these contracts. 8-25 Percentage-of-Completion Accounting In 1981, the AICPA identified several elements that should be present if the percentage-ofcompletion accounting is to be used. 1. Dependable estimates can be made of contract revenues, contract costs, and the extent of progress toward completion. 2. The contract clearly specifies the enforceable rights regarding goods or services to be provided and received by the parties, the consideration to be exchanged, and the manner and terms of settlement. (continued) 8-26 Percentage-of-Completion Accounting 3. The buyer can be expected to satisfy obligations under the contract. 4. The contractor can be expected to perform the contractual obligation. The completed-contract method should be used only when an entity has primarily short term contracts, when the conditions of using percentage-of-completion accounting are not met, or when there are inherent uncertainties in the contract. (continued) 8-27 Percentage-of-Completion Accounting • • Cost-to-cost method is perhaps the most popular of the input measures. The degree of completion is determined by comparing costs already incurred with the most recent estimates of total expected costs to complete the project. Engineers are often called in to help provide estimates. 8-28 Accounting for Long-Term Construction-Type Contracts In January 2012, Strong Construction Company was awarded a contract with a total price of $3,000,000. Strong expects to earn $400,000 profit on the contract. The construction was completed over a 3-year period. (continued) 8-29 Accounting for Long-Term Construction-Type Contracts 2012 Construction in Progress Materials, Cash, etc. To record costs incurred. 1,040,000 1,040,000 Accounts Receivable 1,000,000 Progress Billings on Construction Contracts 1,000,000 To record billings. Cash 800,000 Accounts Receivable 800,000 To record cash collections. (continued) 8-30 Accounting for Long-Term Construction-Type Contracts 2013 Construction in Progress Materials, Cash, etc. To record costs incurred. 910,000 Accounts Receivable Progress Billings on Construction Contracts To record billings. Cash Accounts Receivable To record cash collections. 900,000 (continued) 910,000 900,000 850,000 850,000 8-31 Accounting for Long-Term Construction-Type Contracts 2014 Construction in Progress Materials, Cash, etc. To record costs incurred. 650,000 650,000 Accounts Receivable 1,100,000 Progress Billings on Construction Contracts 1,100,000 To record billings. Cash 1,350,000 Accounts Receivable 1,350,000 To record cash collections. 8-32 Completed-Contract Method • No other entries would be required in 2012 and 2013 under the completed-contract method. • In both years, the balance of Construction in Progress exceeds the amount in Progress Billings on Construction Contracts; thus, the latter account would be offset against the inventory account in the balance sheet. (continued) 8-33 Completed-Contract Method 2013 Using the completed-contract method, the balance sheet at the end of 2013 would disclose the following balances related to the construction contract: Current assets: Accounts receivable $250,000 Construction in progress $1,950,000 Less: Progress billings on construction contracts 1,900,000 $50,000 (continued) 8-34 Completed-Contract Method 2014 Under the completed-contract method, the following entries would be made to recognize revenue and costs and to close out the inventory and billing accounts. Progress Billings on Construction Contracts Revenue from Long-Term Construction Contracts (continued) 3,000,000 3,000,000 8-35 Completed-Contract Method 2014 Cost of Long-Term Construction Contracts Construction in Progress 2,600,000 2,600,000 8-36 Using Percentage-of-Completion Accounting: Cost-to-Cost Method 2012 If the company used the percentage-ofcompletion method of accounting, the $400,000 profit would have to be spread over all three years of construction according to the estimated percentage of completion each year. Percentage of completion to date 2012 2013 40% 75% (continued) 2014 100% 8-37 Using Percentage-of-Completion Accounting: Cost-to-Cost Method 2012 Cost of Long-Term Construction Contracts* Construction in Progress Revenue from Long-Term Construction Contracts *Actual costs 1,040,000 160,000 1,200,000 (continued) 8-38 Using Percentage-of-Completion Accounting: Cost-to-Cost Method 2013 Cost of Long-Term Construction Contracts Construction in Progress Revenue from Long-Term Construction Contracts 910,000 140,000 1,050,000 ($3,000,000 0.75) $1,200,000 (continued) 8-39 Using Percentage-of-Completion Accounting: Cost-to-Cost Method 2014 Cost of Long-Term Construction Contracts Construction in Progress Revenue from Long-Term Construction Contracts 650,000 100,000 750,000 $3,000,000 $1,200,000 $1,500,000 (continued) 8-40 Using Percentage-of-Completion Accounting: Cost-to-Cost Method 2014 Construction in Progress 1,040,000 160,000 910,000 140,000 650,000 100,000 3,000,000 3,000,000 Progress Billings on Construction Contracts Construction in Progress Progress Billings on Construction Contracts 3,000,000 1,000,000 900,000 1,100,000 3,000,000 3,000,000 3,000,000 8-41 Using Percentage-of-Completion Accounting: Other Methods In 2012, an engineering estimate measure was used, and 42% of the contract was assumed to be completed. The gross profit recognized would therefore be computed and reported as follows: Recognized revenue (42% of $3,000,000)$1,260,000 Cost (42% of $2,600,000) 1,092,000 Gross profit (42% of $400,000) $ 168,000 (continued) 8-42 Using Percentage-of-Completion Accounting: Other Methods Using the data from the previous slide and knowing that the actual cost incurred to date is $1,040,000, the revenue and costs to be reported on the 2012 income statement would be as follows: Actual cost incurred to date Recognized gross profit (42% of $2,600,000) Gross profit (42% of $400,000) $1,040,000 168,000 $ 168,000 8-43 Revision of Estimate Instead of the previous illustration, assume that at the end of 2013, it was estimated that the remaining cost to complete construction was $720,000 rather than $650,000. This would increase the total estimated cost to $2,670,000, reduce the expected profit to $330,000, and change the percentage of completion for 2013 to 73% ($1,950,000/$2,670,000). (continued) 8-44 Revision of Estimates 2012 Under the percentage-of-completion method, the following additional entries would be made to recognize revenue. Cost of Long-Term Construction Contracts 1,040,000 Construction in Progress 160,000 Revenue from Long-Term Construction Contracts 1,200,000 (continued) 8-45 Revision of Estimates 2013 Cost of Long-Term Construction Contracts Construction in Progress Revenue from Long-Term Construction Contracts 910,000 80,000 990,000 ($3,000,000 0.73) $1,200,000 (continued) 8-46 Revision of Estimates 2014 Cost of Long-Term Construction Contracts Construction in Progress Revenue from Long-Term Construction Contracts 700,000 110,000 810,000 8-47 Reporting Anticipated Contract Losses • When a loss on a total contract is anticipated, GAAP requires reporting the loss in its entirety in the period when the loss is first anticipated. • This is true under either the completedcontract or the percentage-of-completion method. (continued) 8-48 Reporting Anticipated Contract Losses • Assume in the earlier construction example, the estimated cost to complete the contract at the end of 2013 was $1,300,000. • Because $1,950,000 of costs had already been incurred, the total estimated cost of the contract would be $3,250,000, or $250,000 more than the contract price. (continued) 8-49 Anticipated Contract Loss: Percentage-of-Completion Method Continuing with the construction contract example, assume the cumulative recognized revenue at the end of 2013 would be $1,800,000 (60% x $3,000,000), and the cumulative cost at the same date would e $2,050,000 ($1,800,000 + $250,000). A profit of $160,000 was recognized in 2012, the total loss to be recognized in 2013 is $410,000 ($160,000 + $250,000). (continued) 8-50 Anticipated Contract Loss: Percentage-of-Completion Method The entry to record the revenue, costs, and adjustments to Construction in Progress for the loss in 2013 would be as follows: Cost of Long-Term Construction Contract Revenue from Long-Term Construction Contracts Construction in Process 1,010,000 600,000 410,000 8-51 Proportional Revenue Recognition Most service contracts involve three different types of costs: 1. Initial direct costs related to obtaining and performing initial services on the contract 2. Direct costs related to performing the various service acts 3. Indirect costs related to maintaining the organization to service the contract 8-52 Installment Sales Method • Under the installment sales method, profit is recognized as cash is collected rather than at the time of sale. • It is used most commonly in cases of real estate sales where contracts may involve little or no down payment, payments are spread over 10 to 30 to 40 years, and a high probability of default in the early years exists because of a small investment by the buyer. • The market prices of the property often are unstable. 8-53 Cost Recovery Method • Under the cost recovery method, no income is recognized on a sale until the cost of the item sold it recovered through cash receipts. • This method is used only when the circumstances surrounding a sale are so uncertain that earlier recognition is impossible. 8-54 Cash Method • If the probability of recovering product or service costs is remote, the cash method of accounting could be used. • Seldom would this method be applicable for sales of merchandise or real estate because the right of repossession would leave considerable value to the seller. 8-55 Chapter 8 ₵ The End $ 8-56 8-57