CHAPTER 18: REVENUE RECOGNITION Objectives:

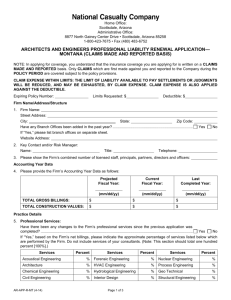

advertisement

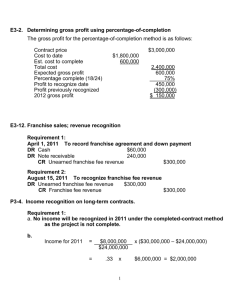

CHAPTER 18: REVENUE RECOGNITION Objectives: 1. “The General Rule”: Be able to assess “When is a sale a sale?” 2. Be able to describe and apply “Before delivery” rules: % of completion method Completed contract method 3. Be able to describe and apply “After delivery” rules: Installment sales Cost recovery Default/Repossession 4. Special rules: Franchises Consignments 1 Objective 1: General rule Income recognition: What we are concerned with is a. What to report (item defined) Our guidance is SFAC No. 6 (Elements of financial statements in business enterprises) which we have already covered CON6 Revenues 78. “Revenues are inflows or other enhancements of assets or settlements of its liabilities (or combination of both) from delivering or producing goods, rendering services, or other activities that constitute the entity’s ongoing major or central operations.” Comprehensive income… 2 Objective 1 (General Rule), continued b. How much to report (item measured) c. When to report (specific accounting period) “How much” and “when” is governed by RECOGNITION CRITERIA detailed in SFAC No. 5. 3 Objective 1, continued So the General Rule is: Revenue is earned through a continuous process involving production of product, sale of product and subsequent collection. The revenue principle says that the exchange has occurred (realization), the earnings process is substantially complete (done their work) and that revenues are measured at exchange values. Thus, revenue is recognized when realized or realizable and when earned. 4 Objective 1, continued What is difference between realized and realizable? Realized: when goods and services are exchanged for cash or claims to cash. Realizable: when assets received in exchange are readily convertible to known amounts of cash or claims to cash. How the General Rule translates: Exhibit in text is showing revenue recognition by nature of transaction. Key is uncertainty is removed. Date of sale/delivery (most common) When services performed and billed Passage of time 5 Objective 1, continued Date of sale/delivery exceptions: Buyback: no sale (economic substance) High rates of returns: no sale unless conditions met. 6 conditions noted in text remove uncertainties and future performance obligations. a. Fixed price b. Payment or obligation to pay not contingent on resale c. Product damage doesn’t impact obligation d. Buyer separate “economic substance” entity e. Minimal future performance obligations f. Can estimate future returns (and should do so) 6 Objective 2: Before delivery (LT construction contracts) Construction projects often span more than one accounting period. Should we recognize only at completion or during earnings process? Both are acceptable under GAAP. Choice impacts inventory valuation and income measurement. 7 Objective 2, continued Completed contract: 1. all costs are debited to Construction in Process (WIP) 2. all billings are credited to Billings on Construction in Process 3. at end of project, the accumulated balances are closed into Construction Expenses (for #1) and Revenue (for #2) so that gross profit is recognized in the last year only cost CIP (inventory) xx Wages, Material, etc. xx progress billings A/R Billings on CIP xx xx Cash collected Cash A/R xx xx 8 Objective 2, continued In last year, on completed contract Billings xx Revenue xx (recognize revenue from billings) Costs of construction xx CIP xx (move costs from inventory to expense) 9 Objective 2, continued Percentage Completion: recognize income each year based on % complete (cost-to-cost method) [(actual cost incurred to date)/(estimated cost to complete) x (estimated total revenue)]-revenue recognized to date = revenue for period 10 Objective 2, continued 1. all costs are debited to “construction in process” 2. all billings are credited to Billings on construction in process 3. each year, we debit “construction in process” for gross profit and credit revenue from long-term contracts for “revenue for period” computed above. A third account, construction expenses, is debited for the difference between gross profit and revenue. 4. A change in estimate is prospective. 11 Objective 2, continued cost CIP xx Materials, Wages xx Progress billings A/R xx Billings xx collections Cash A/R xx xx recognize revenue and gross profit (annually) CIP xx Construction exp xx Revenue from LTK xx Final approval of contract Billings xx CIP xx 12 Objective 2, continued Example: Frodo Construction Company received a contract for $6,000,000 in 2004 to build a parking deck for a large university. The following data was accumulated during the construction period: Costs to date Est. costs to complete Progress billings Cash collected 2004 2005 2006 $1,800,000 $2,700,000 $2,090,000 $3,410,000 $5,000,000 $0 $2,000,000 $2,000,000 $2,000,000 $1,500,000 $2,000,000 $2,500,000 13 Completed Contract: 14 Completed Contract: 15 Percentage of Completion: 16 Percentage of Completion: 17 Percentage of Completion: 18 Objective 2, continued Projected Losses: 1. Unprofitable contract: under both methods, recognize in full in the period in which a loss appears probable. 2. Profitable contract: expenses exceed in current period but overall contract is still profitable. Under % completion, need to adjust excess gross profit recognized in prior period (change in accounting estimate). Note: we did this in our previous example (CIP is debited, that is, we absorb the loss in the current period). 19 Objective 3:After delivery 1. Installment sales: gross profit only is deferred until period of cash collection due to difficulty in estimating uncollectible amounts. a. Cost of sales is recognized in period of sale, however, both cost of sales and sales are closed out to deferred gross profit. b. Not acceptable for financial accounting but used extensively in tax (cash basis accounting) Year by year computation: Gross profit realized is based on GP rate for the year x cash collections for sales for that year. 20 Objective 3, continued “After delivery” continued d. Special installment sales problems: Interest Interest receivable xx Interest revenue xx Uncollectibles Repossessions 2. Cost Recovery: no profit is recognized until cash payments by the buyer exceed the seller’s cost of merchandise sold. 21 Objective 4:Special Rules 1. Franchises (SFAS No.45): a. Nature of franchise agreements b. Types of franchise agreements c. Accounting for and disclosing the following: Initial franchise fees Continuing franchise fees Bargain purchases Franchisor’s costs Options to purchase 22 Objective 4, Special Rules, continued 2. Consignment: merchandise is shipped by consignor to consignee who acts as an agent for the consignor in sellling the merchandise. a. Merchandise shipped is property of ? b. How do we account for a sale? 23