Ch 19 learning team assignment sol. s02

advertisement

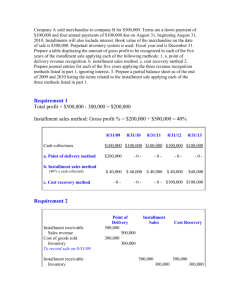

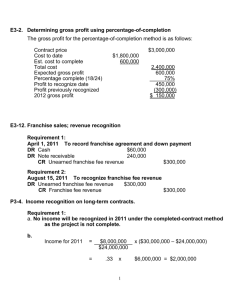

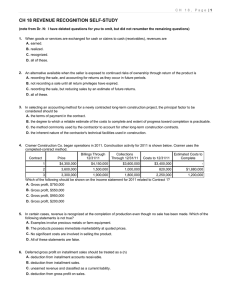

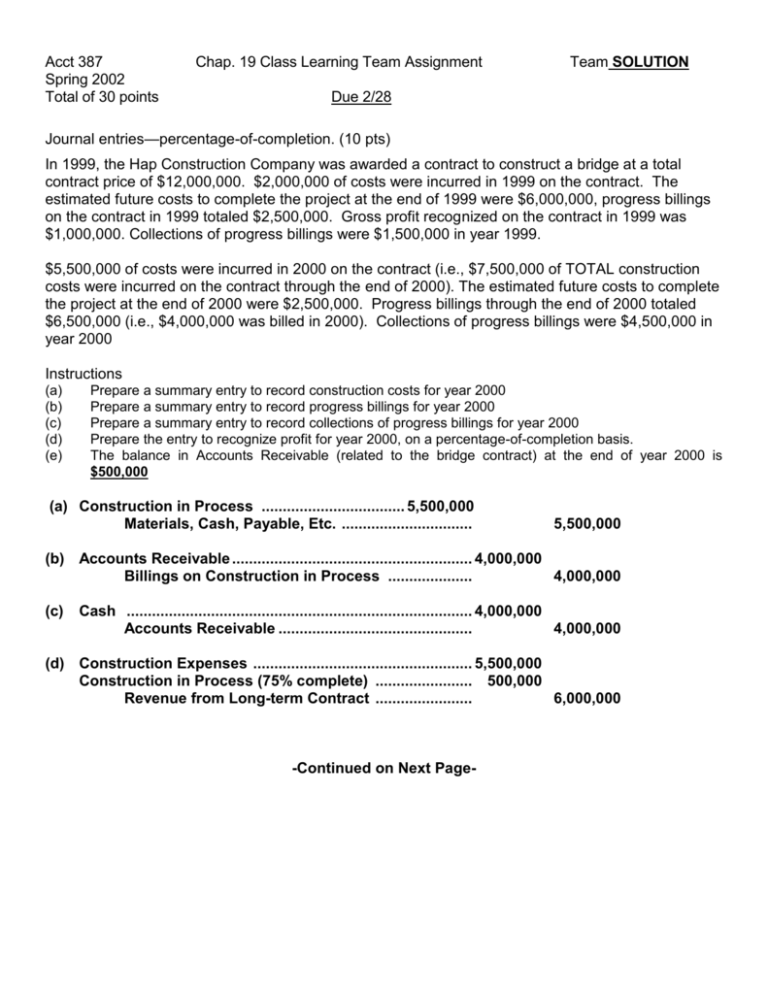

Acct 387 Spring 2002 Total of 30 points Chap. 19 Class Learning Team Assignment Team SOLUTION Due 2/28 Journal entries—percentage-of-completion. (10 pts) In 1999, the Hap Construction Company was awarded a contract to construct a bridge at a total contract price of $12,000,000. $2,000,000 of costs were incurred in 1999 on the contract. The estimated future costs to complete the project at the end of 1999 were $6,000,000, progress billings on the contract in 1999 totaled $2,500,000. Gross profit recognized on the contract in 1999 was $1,000,000. Collections of progress billings were $1,500,000 in year 1999. $5,500,000 of costs were incurred in 2000 on the contract (i.e., $7,500,000 of TOTAL construction costs were incurred on the contract through the end of 2000). The estimated future costs to complete the project at the end of 2000 were $2,500,000. Progress billings through the end of 2000 totaled $6,500,000 (i.e., $4,000,000 was billed in 2000). Collections of progress billings were $4,500,000 in year 2000 Instructions (a) (b) (c) (d) (e) Prepare a summary entry to record construction costs for year 2000 Prepare a summary entry to record progress billings for year 2000 Prepare a summary entry to record collections of progress billings for year 2000 Prepare the entry to recognize profit for year 2000, on a percentage-of-completion basis. The balance in Accounts Receivable (related to the bridge contract) at the end of year 2000 is $500,000 (a) Construction in Process .................................. 5,500,000 Materials, Cash, Payable, Etc. ............................... 5,500,000 (b) Accounts Receivable ......................................................... 4,000,000 Billings on Construction in Process .................... 4,000,000 (c) Cash .................................................................................. 4,000,000 Accounts Receivable .............................................. 4,000,000 (d) Construction Expenses .................................................... 5,500,000 Construction in Process (75% complete) ....................... 500,000 Revenue from Long-term Contract ....................... 6,000,000 -Continued on Next Page- Percentage-of-completion and completed-contract methods. (8pts) On February 1, 2000, Neer Contractors agreed to construct a building at a contract price of $6,000,000. Neer estimated total construction costs would be $5,000,000 on 2/1/2000 and the project would be finished in 2002. Information relating to the costs and billings for this contract is as follows: 2000 2001 2002 Total costs incurred to date $1,500,000 $3,920,000 $5,700,000 Estimated costs to complete at year end 3,500,000 1,680,000 -0Customer billings to date 2,700,000 4,000,000 6,000,000 Collections to date 2,000,000 3,500,000 5,900,000 Percentage complete at year end 30% 70% 100% Instructions Fill in the correct amounts on the following schedule. For percentage-of-completion accounting and for completed-contract accounting, show the gross profit that should be recorded for 2000, 2001, and 2002. (Note: round completion %'s to 3 decimal places when doing calculations) Percentage-of-Completion Gross Profit 2000 $300,000 2001 ($20,000) 2002 $ 20,000 2000 2001 2002 Completed-Contract Gross Profit $0 $0 $300,000 -Continued on Next Page- Installment sales. (6pts) Tanner Furniture Company concluded its first year of operations in which it made sales of $1,000,000, all on installment. Collections during the year from down payments and installments totaled $300,000. Purchases for the year totaled $800,000 recorded as a debit to inventory; the cost of merchandise on hand at the end of the year was $200,000. Instructions Using the installment method, make summary entries to record: (a) cost of goods sold; (b) installment sales (c) cash collections; (d) unrealized gross profit; (e) realized gross profit. (a) Cost of Installment Sales ................................................. Inventory ................................................................. 600,000 600,000 (b) Installment Accounts Receivable .................................... 1,000,000 Installment Sales .................................................... 1,000,000 (c) Cash ................................................................................... Installment Accounts Receivable ......................... 300,000 300,000 (d) Installment Sales .............................................................. 1,000,000 Cost of Installment Sales ...................................... Deferred Gross Profit (40%) .................................. (e) Deferred Gross Profit (40% × $300,000) .......................... Realized Gross Profit on Installment Sales ......... 600,000 400,000 120,000 120,000 Installment sales Repossessions. (2pts) Carlin Co. had installment sales of $800,000 and cost of installment sales of $560,000 in 2001. A 2001 sale resulted in a default in 2003, at which time the balance of the installment receivable was $10,000. The repossessed merchandise had a fair value of $5,500. Instructions Make the entry to record the repossession. Repossessed Merchandise ............................................... Deferred Gross Profit, 2001 (.30 × $10,000) ...................... Loss on Repossession ...................................................... Installment Account Receivable, 2001 ....................... -Continued on Next Page- 5,500 3,000 1,500 10,000 Essay Question 4 points: The Ag Parts Corp. manufactures tractor parts. The company has reported a profit every year since inception in 1974. However, 2001 has been a tough year and prospects for being profitable for the year are bleak. Tony Smith, the companies marketing manager, has determined a way to increase December sales, the last month of the Corp.'s fiscal year, by an amount sufficient to report a profit for 2001. He suggests to the CEO (Chief Executive Officer) that the company run a special sales campaign for the month of December 2001, during which time they will discount prices by 15% to all customers that purchase at least 5 times more than their average monthly purchases for the past 11 months. There is no doubt that this policy, if implemented, would result in 2001 being profitable. The CEO has asked you as the CFO (Chief Financial Officer) to indicate whether or not you would be in favor of implementing such a sales campaign? Number in your group in favor of the sales campaign____ Number in your group against the sales campaign . What do you see as the potential short-term (Year 2001) and long-term (Years 2002 and beyond) impact on the firm's financial statements, if the sales campaign is implemented. In the short-term (Year 2001) net income is going to increase, since the sales campaign gives a strong economic incentive to customers to buy goods in December 2001. It is also likely that most of the increased sales volume in December 2001 will reduce sales that would have otherwise been made in the next year (Year 2002). Thus, unless there is a general increase in demand for the company's products in Year 2002 and/or significant cost reductions in Year 2002, the Company will likely have to have a similar campaign in December 2002 in order to stimulate sales and report profits. Additionally, if customers begin to expect that Ag Parts routinely has a December year end sales campaign it is likely going to be necessary to continue having such campaigns in future years in order to maintain sales.