Feeschedule extension

advertisement

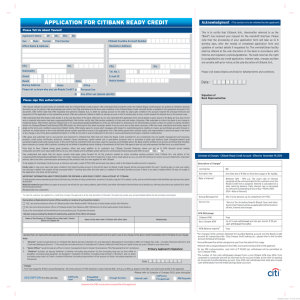

Extension to Fee Schedule – Regarding international bonds brokerage* Appendices of CITIBANK EUROPE PLC HUNGARIAN BRANCH OFFICE (registered office: 1051 Budapest, Szabadság tér 7., registration court and court number: Municipal Court of Budapest, acting as Court of Registration 01-17-000560) acting in the name and on behalf CITIBANK EUROPE PLC. (registered office: 1 North Wall Quay, Dublin 1, registration court and court number: Companies Registration Office, no. 132781) an entity registered in Ireland) („Bank”)Business Conditions Regarding Investment Services th Effective 2013. December 4 . *This extention contains the commissions and conditions on the services performed under the governance of BROKERAGE MASTER AGREEMENT FOR THE EXECUTION OF CERTAIN STOCK-EXCHANGE AND OTC SECURITIES TRANSACTIONS (hereinafter Services). The Fee Schedule shall apply in matters not regulated in this extension. 1. BUSINESS HOURS OF THE BANK The Bank shall accept orders to international bonds for same day transmission to trading venue(s) during its business hours in Branches until 15:00 (CET/CEST). Orders given after cut-offs will be processed and transmitted the next business day. The Bank’s business hours for consumer customers: from Monday to Friday from 09.00 to 15.00 CET/CEST. 2. LIST OF CONDITIONS INTERNATIONAL BOND (AVAILABLE UNDER THIS SERVICE) COMMISSION ORDER PURCHASE* AND SELL** Total face value of the order (EUR, GBP, USD, CAD, CHF) 0-49 999 Client segment Order in Branch 1,2 Minimum commission 1,3 50 000 - 99 999 100 000- Gold Normal Gold Normal Gold Normal 2,00% 2,50% 1,75% 1,75% 1,25% 1,75% 40,00 40,00 40,00 40,00 40,00 40,00 Minimum Total Face Value Minimum trading lot of the bond Transfer commission Internal transfer Free of charge External transfer out 1,50% in the currency of the bond / Total Face Value External transfer in*** 1,50% in the currency of the bond / Total Face Value Excluded transfer: The bank does not accept external transfer in for bonds purchased before 31th July 2013 Safekeeping fee 4,5 International bonds 0,25% / average face value holding *In case of purchase the effect of the purchase instruction is subject to the availability of the funds necessary for the execution of the given transaction, including the related commissions due to the Bank. In this case the Bank blocks these funds as investment escrow amount between the date of the purchase instruction and the date of the settlement, in accordance with the General Terms and Conditions applicable for Investment Services and the Investment Services Frame Agreement and of BROKERAGE MASTER AGREEMENT FOR THE EXECUTION OF CERTAIN STOCK-EXCHANGE AND OTC SECURITIES TRANSACTIONS. The investment escrow amount shall qualify as funds over which the customer is not entitled to freely dispose. The interest payment concerning the investment escrow amount is subject to terms and conditions set out in the List of Consumer Interest Rates and Charges. **In case of sell the effect of the sell instruction is subject to the availability of the given securities necessary for the execution of the given transaction. After order submission, the Bank marks the related securities and accepts no further instruction regarding them in accordance with the General Terms and Conditions applicable for Investment Services and the Investment Services Frame Agreement and of BROKERAGE MASTER AGREEMENT FOR THE EXECUTION OF CERTAIN STOCK-EXCHANGE AND OTC SECURITIES TRANSACTIONS. *** In case of incoming transfers if the customer does not declare it otherwise within 5 working days, the bank takes 0 value as the purchase price and the transfer day as the purchase date. 1 Commissions are calculated and debited in the securities currency. 2 The Bank reserves the right to that under certain circumstances devietes from the above commissions in favor of the client. 3 The minimum fee is irrespective of the order’s Total Face value. It is debited for each and every transaction. Exceptions cannot be given. 4 The safekeeping Fee is debited quarterly. 5 The safekeeping fee for the International Bonds available under this Service is no subject of combining with safekeeping fees with other products. Therefor it will be calculated and debited separately in the currency of the charge bearing cash account. 3. BRANCHES OF THE BANK ENTITLED TO RENDER THIS SERVICE 1134 Budapest, Váci út 35. Tel.: (36-1) 288-2720 CITIBANK EUROPE PLC HUNGARIAN BRANCH OFFICE (registered office: 1051 Budapest, Szabadság tér 7., registration court and court number: Municipal Court of Budapest, acting as Court of Registration 01-17-000560) acting in the name and on behalf CITIBANK EUROPE PLC. (registered office: 1 North Wall Quay, Dublin 1, registration court and court number: Companies Registration Office, no. 132781) an entity registered in Ireland) („Bank”), member of the Hungarian Stock Exchange 1