CGS-Ready Credit Application Forms_EMI_CITI14884_08-01

advertisement

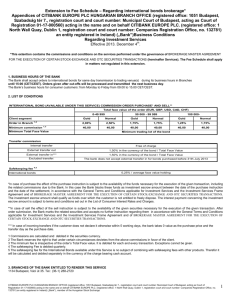

APPLICATION FOR CITIBANK READY CREDIT Please Tell Us About Yourself Applicant’s Name <Mr. <Ms. <Mrs. <Mx. :<Male <Female <Third Gender Sex Nationality a) Personal Use b) Any other use (please specify) Please sign this authorization VER 2.2/LOAN/RCAPP FORM/WPC/01-16 I/We request Citibank to grant me/us an overdraft under the Citibank Ready Credit program. I/We understand that overdrafts under the Citibank Ready Credit program are granted at Citibank's absolute discretion as per its policies. I/We acknowledge and confirm that I/We shall adhere to the terms and conditions of the Citibank Ready Credit overdraft facility as detailed in the agreement annexed to this document. I/We further state that I/We requested and authorise Citibank, N.A., to debit my savings account on the date my salary gets credited in the account, towards the principal minimum due repayment of 5% applicable on the outstanding amount. I/We also authorise Citibank to debit my savings account on the 1st working day of every month towards the interest due on the amount used. I/We understand that this Ready Credit facility is at the sole discretion of the bank. I/We have by our own hand filled this application form and all details as given above to the Bank are true and correct and no material information had been suppressed/withheld. I/We further certify that I/We am/are resident(s) of India and hold Indian citizenship. I/We undertake to inform the Bank of any change in residential status. I/We further authorise Citibank and or it's associates/subsidiaries/affiliates to verify any information or otherwise at my office/residence and/or contact me and/or my family members and/or my Employer/Banker/Credit Bureau/CIBIL/RBI and/or any third party's they deem necessary and/or to do any such acts as they deem necessary. I/We have read, understood and hereby agree to abide by the terms and conditions governing CitiAlert facility. I/We hereby agree to receive alert messages with respect to events/transactions relating to my/our account/linked accounts through email/over my mobile phone to the e-mail id/mobile phone number specified by me/us in the application form. I/We hereby agree that it shall be my/our sole responsibility to advice the bank, in the event of any change in any of the above details/information or if I/We do not wish to avail of statement-on-the-net or receive alerts/advices through e-mail/over mobile phone. I/We agree and undertake not to, and warrant and represent to Citibank that I/We shall not utilise the Ready Credit overdraft for any investments into Citi wealth management and insurance products, small saving certificates, antisocial, unlawful, money laundering, capital market use or speculative purposes and/ or purchase of gold/ gold bullions/ gold coins/gold jewelry/ gold exchange traded funds/ gold mutual funds. In the event that the overdraft funds have been used for purposes as prohibited above, the Bank shall be entitled to do all acts and things that the Bank deem necessary to comply with its policies, including but not limited to liquidating my/our holdings of Investments at that time. I/We agree to bear all costs and expenses the Bank incur as a result thereof. From time to time, Citibank brings great products, offers and value addition to its customers (e.g. Citibank Gourmet Pleasures, where you get up to 20% discount across leading restaurants and other such value added offers). Do you wish Citibank and its affiliates and/or partners to communicate these products and offers to you? g Yes g No I/we understand and agree that the above consent shall apply going forward for all the products availed by me/us including existing products from Citibank N.A. and all/any of the companies/entities/subsidiaries/affiliates there off under Citigroup. Please note that irrespective of any choice made above by you, you will still continue to receive account statements, important advices, alerts and other communication pertaining to the products that you have applied for with Citibank. Schedule of Charges - Citibank Ready Credit Account - Effective November 19, 2015 To be eligible for the Ready Credit Account, a minimum net salary credit of ` 20, 000 and at least one salary credit in the linked Suvidha account is required. Kindly note: in case your salary has been credited in the linked Suvidha account in the last 25 days, the Ready Credit request will be processed within the next 7 working days. In case your salary has not been credited, the request will be processed within 7 working days after the next salary is credited in the linked Suvidha account. If there is no salary credited within 30 days of receipt of the application, the same will be rejected. IMPORTANT INFORMATION ABOUT PROCEDURES FOR OPENING A NEW READY CREDIT LOAN ACCOUNT AT CITIBANK To help prevent money laundering and terrorist financing, the laws of many jurisdictions, as well as Citi policy, require Citi to obtain, verify, and record information that identifies each person who opens an account. What this means for you: When you open an account, we will ask for your name, address, date of birth, and other information that will allow us to identify you. We may also ask to see a photo ID or other identifying documents. We appreciate your cooperation. $ Between 16% - 19% p.a. The exact rate of interest assigned will be communicated to the customer once the Ready Credit line is assigned. Interest is calculated on a daily reducing balance. Daily interest rate is calculated as: (Amount Outstanding at End of Day * ROI% /365) [ROI = Rate of Interest] *In case the customer has applied for a credit line increase, the approval is at the sole discretion of the bank. The bank may review your account details before the line increase is processed. Declaration on Bank director/ senior officer position or relative of such position holders Service Tax c YES, I am a director/senior officer of Citibank and/or their Relative AND / OR director of other banks and/or their Relative c NO, I am not a director/senior officer of Citibank and/or their Relative AND / OR director of other banks and/or their Relative *Service Tax (Including Swachh Bharat Cess) and other Government taxes & levies as applicable will be levied on all fees, interest and charges If yes or for more details on the definition of such positions, pls. fill up/refer the below I declare so by providing the details of relationship, position of the officer etc below: Name of the Director of Citibank NA or other bank / Senior Officer of Citibank NA Name of the other bank / Position with other bank Relationship I declare that I am making the aforesaid declaration solemnly and sincerely believing the same to be true and in case of any change on the above I shall immediately inform the Bank of such change Note: 1. “Director” would include Director on Citibank NA’s Board abroad or Member of Local Operations Management Committee (LOMC) of Citibank NA, India. (includes ‘Nominee directors’ and ‘Chairman/Managing Director’ ). This would also include directors of Subsidiaries/Trustees of Mutual Funds/Venture Capital Funds set up by Citibank or any other bank. 2. “Senior Officer” would include any officer in senior management level in Grade C16 and above (Title ‘Managing Director’ and above). 3. “Relative" includes: (a) Spouse (b)Father (c) Mother (including step-mother) (d) Son (including step-son) (e) Son's Wife (f) Daughter (including step-daughter) (g) Daughter's Husband (h) Brother (including step-brother) (i) Brother's wife (j) Sister (including step-sister) (k) Sister's husband (l)Brother (including step-brother) of the spouse (m) Sister (including stepsister) of the spouse. Date D D M M Y Y Y Y # For charges/ limits common between the Suvidha Banking account and the Ready Credit account for transactions like - Stop Cheque, Draft making, etc., please refer to the Suvidha Account Schedule of Charges *Annual Renewal Fee will be charged one year from the date of first usage $ Interest rate is assigned based on the CIBIL Score and income profile of the applicant ^As per RBI communication, cash limit of ` 10,000 per withdrawal will be permitted on non- Citibank ATMs. % The number of free cash withdrawals allowed from a non-Citibank ATM may differ from corporate to corporate and will be informed to the account holder at the time of opening his Corporate Suvidha Banking account. Free ATM cash withdrawal limit shall also include Cash withdrawals from the linked Savings/Salary account. Charges First Time Usage Fee :` 500 | Annual Renewal fee : 2% of line amount or ` 750 whichever is lower.| Interest Rate : 16 % p.a. to 19% p.a. (based on the CIBIL score and income profile of the applicant) (based on the CIBIL score and income profile of the applicant) Modified date: 01-Feb-2016 The Overdraft Line in the Current Account shall be available to me/us at the Bank’s sole discretion. I/We agree and undertake not to, and warrant and represent to Citibank that I/We shall not utilise the Ready Credit overdraft for any investments into Citi wealth management and insurance products, small saving certificates, antisocial, unlawful, money laundering, capital market use or speculative purposes and/ or purchase of gold/ gold bullions/ gold coins/gold jewelry/ gold exchange traded funds/ gold mutual funds. In the event that the overdraft funds have been used for purposes as prohibited above, the Bank shall be entitled to do all acts and things that the Bank deem necessary to comply with its policies, including but not limited to liquidating my/our holdings of Investments at that time. I/We agree to bear all costs and expenses the Bank incur as a result thereof. Modified date: 01-Feb-2016