CITIBANK CLEAR CARD TERMS AND

advertisement

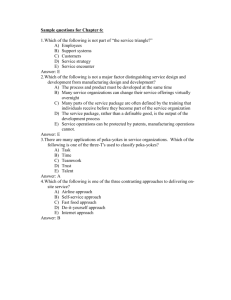

CITIBANK CLEAR CARD TERMS AND CONDITIONS CITIBANK CLEAR CARD TERMS AND CONDITIONS (EFFECTIVE 15th MARCH 2015) THE COFFEE BEAN & TEA LEAF Terms and Conditions 1. Subject to these Terms and Conditions, with effect from 15th March 2015 and until further notice, each principal or supplementary holder of the Citibank Clear credit card issued in Malaysia (“Citibank Clear Card“) (“Citibank Cardmember”) who purchases any beverage served in a cup, glass or bottle with a “Coffee Bean & Tea Leaf” logo from any “The Coffee Bean & Tea Leaf” stores in Peninsular Malaysia, except for the stores at HSBC Lebuh Ampang (“CBTL Drink”) using a Citibank Clear Card will receive 1 (one) complimentary CBTL Drink of the Citibank Cardmember’s choice of an equivalent value or less. Each Citibank card member is entitled to a maximum of 1 (one) complimentary CBTL Drink per transaction per day from Monday to Friday only. For avoidance of doubt, the complimentary CBTL Drink may not be exchanged for cash, credit or kind. 2. The benefit described above is referred to in these Terms and Conditions as “Privileges”. The Privileges do not apply in conjunction with any other promotion(s) relating to the Citibank Clear Card. 3. Citibank is not liable to any Citibank Cardmember for any default due to any act of God, war, riot, strike, lockout, industrial action, epidemic, pandemic, fire, flood, drought, storm, technical or systems failure or any event beyond the reasonable control of Citibank. 4. (a) Citibank is not liable for any losses, damages, costs or expenses suffered by any Citibank Cardmember in connection with the purchase of CBTL Drinks at any “The Coffee Bean & Tea Leaf” stores. (b) Any refunds sought for any reason, must be sought from The Coffee Bean & Tea Leaf (M) Sdn Bhd or in accordance with the terms and conditions stipulated by The Coffee Bean & Tea Leaf (M) Sdn. Bhd. (c) Citibank is not responsible for assisting any Citibank Cardmember if any claim for anything is made by any Citibank Cardmember in connection with the purchase of CBTL. Citibank will bear no responsibility for resolving any dispute and Citibank Cardmembers are not to liaise with Citibank in regard to all such matters. 5. (a) Citibank reserves the right as it deems fit to change or vary these Terms and Conditions. Such changes or variations may be made by Citibank by way of posting on Citibank's website – www.citibank.com.my (the "Website"), or in any other manner deemed suitable by Citibank. (b) Citibank Cardmembers agree to access the Website from time to time to ensure that they are kept up-to-date of any changes or variations to these Terms and Conditions. /Jan2015 CITIBANK CLEAR CARD TERMS AND CONDITIONS 6. These Terms and Conditions (as changed or varied from time to time pursuant to Clause 5) will prevail over any provisions contained in any other promotional materials advertising the Privileges. 7. Citibank has the right to cancel, terminate or suspend the Privileges by giving notice. Any such cancellation, termination or suspension by Citibank of the Privileges will not entitle the Cardmember to any compensation from Citibank for any loss or damage suffered by the Cardmember, whether directly or indirectly, as a result of such cancellation, termination or suspension. 8. To the fullest extent permitted by law, neither Citibank nor any of its officers, servants, employees, representatives and/or agents (including any third party service providers that Citibank may engage for the purposes of the Privileges) will be liable to Citibank Cardmembers, in respect of any loss or damages which may arise in connection with the Promotion. 9. Citibank's decision on all matters relating to the Privileges will be final and binding on all Citibank Cardmembers. All transactions as recorded by Citibank are final and conclusive and no further correspondence will be considered by Citibank. 10 The Privileges are subject to these terms and conditions and the terms and conditions in the . Citibank Card Terms and Conditions governing the Citibank Clear Card. /Jan2015 CITIBANK CLEAR CARD TERMS AND CONDITIONS 1-FOR-1 FRIDAY MOVIE PRIVILEGES AT MAJOR CINEMAS Terms and Conditions 1. Subject to these terms and conditions, on Fridays with effect from 15th March 2015 and until further notice, the principal and supplementary holders of the Citibank Clear credit card (“Citibank Cardmembers”) will be entitled to purchase cinema tickets at: all Golden Screen Cinemas outlets (except Golden Screen Cinemas Signature and Golden Screen Cinemas Maxx outlets) (”GSC”) and all Tanjong Golden Village Cinemas (“TGV”) situated nationwide at a special rate as follows: 1 complimentary cinema ticket for every cinema ticket purchased using a Citibank Clear credit card at any GSC or TGV outlet, subject to the following conditions: (a) the offer applies only to over-the-counter purchases at the respective GSC or TGV outlets and not to purchases made by any other methods, including but not limited to e-payment ticketing facilities, online ticket purchases or purchases made over the telephone; (b) the offer applies only to purchases of tickets for normal seats in a common cinema hall, i.e. not to special seats howsoever named, such as but not limited to, “twin seats”, “couple seats”, “Premiere Class seats”, “Gold Class seats”, “seats in a Beanieplex” , nor tickets for screenings of premiere movies or digital 2D/3D movies; (c) the offer is not applicable to ‘kids below 12 years ticket’ at TGV and ‘Children ticket’ at GSC; (d) the complimentary ticket will be given only for the same screening of the movie for which the ticket paid for with the Citibank Clear credit card was purchased; and (e) each Citibank card member is entitled to a maximum of 1 complimentary cinema tickets per transaction per day at GSC and at TGV;and (f) the complimentary ticket is not exchangeable for cash, credit or kind. The benefit described above is referred to in these terms and conditions as “Privileges”. 2. Citibank is not liable to any Citibank Cardmember for any default due to any act of God, war, riot, strike, lockout, industrial action, epidemic, pandemic, fire, flood, drought, storm, technical or systems failure or any event beyond the reasonable control of Citibank. 3. (a) Citibank is not liable for any loss, damages, costs or expenses suffered by any Citibank Cardmember in connection with the purchase of cinema tickets. (b) any refunds sought for any reason, must be sought from Golden Screen Cinemas Sdn. Bhd. or TGV Cinemas Sdn. Bhd. /Jan2015 CITIBANK CLEAR CARD TERMS AND CONDITIONS (c) Citibank is not responsible for assisting any Citibank Cardmember if any claim is made by any Citibank Cardmember in connection with the purchase of cinema tickets. (d) Citibank is not responsible for resolving any dispute and Citibank Cardmembers are not to liaise with Citibank with regard to all such matters. 4. (a) Citibank reserves the right as it deems fit to change or vary these terms and conditions. Such changes or variations may be made by Citibank by way of posting on Citibank's website – www.citibank.com.my (the "Website"), or in any other manner deemed suitable by Citibank. (b) Citibank Cardmembers agree to access the Website from time to time to ensure that they are kept up-to-date of any changes or variations to these terms and conditions. 5. These terms and conditions prevail over any provisions contained in any other promotional materials advertising the Privileges. 6. Citibank has the right to cancel, terminate or suspend the Privileges by giving notice. Any such cancellation, termination or suspension by Citibank of the Privileges will not entitle the Cardmember to any compensation from Citibank for any loss or damage suffered by the Cardmember, whether directly or indirectly, as a result of such cancellation, termination or suspension. 7. To the fullest extent permitted by law, neither Citibank nor any of its officers, servants, employees, representatives and/or agents (including any third party service providers that Citibank may engage for the purposes of the Privileges) will be liable to Citibank Cardmembers, in respect of any loss or damages which may arise in connection with the Promotion. 8. Citibank's decision on all matters relating to the Privileges is final and binding on all Citibank Cardmembers. All transactions as recorded by Citibank are final and conclusive and no further correspondence will be considered by Citibank. 9. The Privileges are subject to these terms and conditions and the terms and conditions in the Citibank Card Terms and Conditions governing the Citibank Clear Card. /Jan2015 CITIBANK CLEAR CARD TERMS AND CONDITIONS CITIBANK CLEAR CARD 3X REWARDS ALL YEAR LONG Terms and Conditions 1.These terms and conditions apply to the Citibank Clear Visa/MasterCard credit card. Eligibility 2.(a) Subject to Clause 3 below, with effect from 15th March 2015 and until further notice, all principal holders of Citibank Clear credit cards who are residents of Malaysia (“Eligible Cardmembers”) may enjoy three (3) times the Rewards Points (“3X Rewards Points”) that they would have been entitled to in accordance with the Citibank Rewards Program. (b)The term “Reward Point” has the same meaning as in the terms and conditions of the Citibank Rewards Program. The entitlement to 3X Rewards Points subject to these terms and conditions is referred to in these terms and conditions as “3X Rewards Points Feature”. 3.The following persons are NOT eligible to enjoy the 3X Rewards Points Feature: (a) a holder of a Citibank Clear credit card not issued in Malaysia; (b) a holder of a Citibank Clear credit card who is in default of facilities granted by Citibank or whose facilities granted by Citibank have been cancelled, subject to Citibank’s discretion; or (c) a holder of a Citibank Clear credit card who has committed or is suspected of committing any fraudulent or wrongful act in the use of his/her Citibank Clear credit card or any Citibank facility or service, including Citibank Online, defined as www.citibank.com.my. The 3X Rewards Points Feature 4. (a) An Eligible Cardmember who uses his/her Citibank Clear credit card to make any retail transaction at any of the retail outlets in Malaysia selected by Citibank (“Qualifying Outlets”) are entitled to receive 3X Rewards Points as set out in Clause 5 below. (b) At present, the Qualifying Outlets are : No. Name of Qualifying Outlets in Malaysia 1. Zouk Club Lumpur 2. G2000 3. Topshop 4. Topman 5. Vincci Kuala /Jan2015 CITIBANK CLEAR CARD TERMS AND CONDITIONS 6. Sakae Sushi 7. Quiksilver 8. Roxy 9. La Senza 10. GAP 11. Borders (c) For the purpose of the 3X Rewards Points Feature, the Qualifying Outlets selected are only the retail outlets which are stand-alone stores, and not those which are within other larger stores. The list of Qualifying Outlets is provided for Eligible Cardmembers’ information only, and there is no representation that the Qualifying Outlets listed above are Citibank merchants. (d) Citibank has the right as it deems fit to amend the list of Qualifying Outlets from time to time by giving notice by way of posting on its website at www.citibank.com.my (“Website”) or in any other manner deemed suitable by Citibank. 5. (a) Subject to these terms and conditions, Eligible Cardmembers are entitled to receive 3 Reward Points for every RM1.00 spent on retail transactions at Qualifying Outlets and posted to the Eligible Cardmember’s credit card account. (e.g. if an Eligible Cardmember has made a retail transaction of RM50 with his Citibank Clear credit card, he will be entitled to receive a total of 150 Rewards Points (RM50x3=150) for the month.) (b) Citibank is not liable for any delay in the actual posting of the retail transactions and/or Rewards Points earned to the Eligible Cardmember’s credit card account, unless such delay is due to the wilfull default or negligence of Citibank. 6. (a) Citibank is not responsible for the quality, merchantability or the fitness for any purpose or any other aspect of the products and/or services provided by third parties. (b) Citibank is not liable for any loss, damages, or costs suffered by any Eligible Cardmember in connection with any retail transaction. (c) Citibank is not responsible for assisting any Eligible Cardmember if any claim is made by any Eligible Cardmember in connection with such retail transaction. (d) Citibank is not responsible for resolving any dispute, and Eligible Cardmembers are not to liaise with Citibank in regard to such matters. 7. The following transactions will not qualify for 3X Rewards Points: (a) Purchases made using the Citibank Easy Payment Plan, Flexi Payment Plan, Autobilling or similar program; /Jan2015 CITIBANK CLEAR CARD TERMS AND CONDITIONS (b Cash advance or cash withdrawal debited to the Citibank Clear credit card account; (c) Outstanding balance transferred from any other credit card account to the Citibank Clear credit card under the Citibank Balance Transfer Program or similar program; (d) Payment made towards any fees and/or charges prescribed by Citibank in connection with the Citibank Clear credit card (including, among others, entrance fee, annual fee, finance charges, handling charges and interest payment charges); (e) Charges to the Citibank Clear credit card which are disputed by the Eligible Cardmember (principal and/or supplementary), or which are alleged to be made on unauthorized or fraudulent retail transactions, and are subsequently reversed by Citibank; and (f) Any other charge that is subsequently reversed by Citibank for any other reason. 8. Subject to these terms and conditions, transactions made at any Qualifying Outlet by a supplementary holder of a Citibank Clear credit card will also qualify for 3X Rewards Points. However, only the principal Eligible Cardmember will be able to redeem the Rewards Points. 9. (a) Rewards Points must be redeemed and used only by the principal Eligible Cardmembers themselves, subject to Citibank’s discretion as it deems fit. (b) Citibank reserves the right as it deems fit to cancel Rewards Points earned on a credit card account where: (i) the minimum payment has been due for 30 days or more; (ii) where the credit limit has been exceeded; (iii)where an account is believed by Citibank to be operated fraudulently or has been closed by Citibank for any other reason. 10. (a) Rewards Points earned are not transferable and cannot be sold to any other person. (b) If the 3X Rewards Points are awarded to a person who is not an Eligible Cardmember, Citibank has the right to disqualify such a person from enjoying the additional Rewards Points, and/or from redeeming or using the additional Rewards Points. Miscellaneous 11. The 3X Rewards Points Feature is subject to these terms and conditions and the terms and conditions in the Citibank Card terms and conditions and the Citibank Rewards Program. 12. (a) Citibank reserves the right as it deems fit to change or vary these terms and conditions, and to cancel, terminate or suspend the 3X Rewards Points feature by giving notice. Notice may be given by Citibank by way of posting on Citibank's /Jan2015 CITIBANK CLEAR CARD TERMS AND CONDITIONS website – www.citibank.com.my (the "Website"), or in any other manner deemed suitable by Citibank. (b) The Eligible Cardmembers agree to access the Website from time to time to ensure that they are kept up-to-date of any changes or variations to these terms and conditions. (c) Eligible Cardmembers are not entitled to any compensation against Citibank for any injury, bodily harm, losses or damages that may be suffered by a Eligible Cardmember, directly or indirectly, as a result of changes or variations to these terms and conditions or cancellation, termination or suspension of the 3X Rewards Points feature. 13. Citibank is not liable to any Eligible Cardmember for any default due to any act of God, war, riot, strike, lockout, industrial action, epidemic, pandemic, fire, flood, drought, storm, technical or systems failure or any event beyond the reasonable control of Citibank. 14. (a) Citibank’s decisions on all matters relating to the 3X Rewards Points, including the determination of Eligible Cardmembers, will be final and binding. (b) Citibank may, as it deems fit by giving notice, decide whether to take into account or refuse any card transaction, charges or retail purchase in the calculation of Rewards Points, and to vary the basis of calculation of Rewards Points. Citibank does not have to give any reason for such decisions it may make. 15. To the fullest extent permitted by law, neither Citibank nor any of its officers, servants, employees, representatives and/or agents (including any third party service providers that Citibank may engage for the purposes of the 3X Rewards Points Feature) will be liable to any Eligible Cardmember, in respect of any loss or damages which may arise in connection with the Promotion. /Jan2015