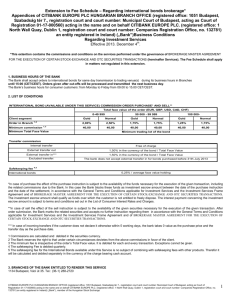

new brokerage account application - entity

advertisement