Company A sold merchandise to company B for $500000

advertisement

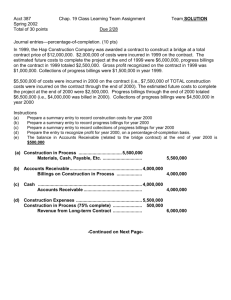

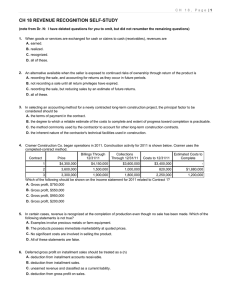

Company A sold merchandise to company B for $500,000. Terms are a down payment of $100,000 and four annual payments of $100,000 due on August 31, beginning August 31, 2010. Installments will also include interest. Book value of the merchandise on the date of sale is $300,000. Perpetual inventory system is used. Fiscal year end is December 31. Prepare a table displaying the amount of gross profit to be recognized in each of the five years of the installment sale applying each of the following methods: 1. a. point of delivery revenue recognition. b. installment sales method. c. cost recovery method 2. Prepare journal entries for each of the five years applying the three revenue recognition methods listed in part 1, ignoring interest. 3. Prepare a partial balance sheet as of the end of 2009 and 2010 listing the items related to the installment sale applying each of the three methods listed in part 1. Requirement 1 Total profit = $500,000 - 300,000 = $200,000 Installment sales method: Gross profit % = $200,000 ÷ $500,000 = 40% 8/31/09 8/31/10 8/31/11 8/31/12 8/31/13 Cash collections $100,000 $100,000 $100,000 $100,000 $100,000 a. Point of delivery method $200,000 -0- -0- -0- -0- $ 40,000 $ 40,000 $ 40,000 $ 40,000 $40,000 -0- -0- b. Installment sales method (40% x cash collected) c. Cost recovery method - 0 - $100,000 $100,000 Requirement 2 Installment receivable Sales revenue Cost of goods sold Inventory To record sale on 8/31/09. Installment receivable Inventory Point of Delivery 500,000 500,000 300,000 300,000 Installment Sales 500,000 Cost Recovery 500,000 300,000 300,000 Deferred gross profit To record sale on 8/31/09. Cash Installment receivable Entry made each Aug. 31. 200,000 100,000 100,000 100,000 Deferred gross profit Realized gross profit To record gross profit. 200,000 100,000 100,000 100,000 40,000 40,000 (entry made each Aug. 31) Deferred gross profit Realized gross profit To record gross profit. 100,000 100,000 (entry made 8/31/12 & 8/31/13) Requirement 3 Point of Delivery Installment Sales Cost Recovery December 31, 2009 Assets Installment receivables Less: Deferred gross profit Installment receivables, net 400,000 400,000 (160,000) 240,000 400,000 (200,000) 200,000 December 31, 2010 Assets Installment receivables Less: Deferred gross profit Installment receivables, net 300,000 300,000 (120,000) 180,000 300,000 (200,000) 100,000