Income Measurement (1) PowerPoint

advertisement

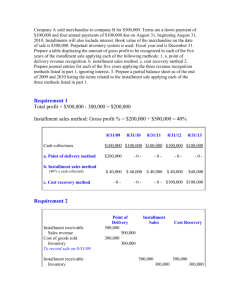

Income Measurement (Part 1) I N T ERMEDIATE ACCOU N T I NG I CHA PT ER 5 Revenue Amounts earned for providing a good or service. The timing of revenue recognition is critical to income measurement and accurate reporting. Revenue Recognition The realization principle indicates that revenue should be recognized when the following two criteria have been met: The earnings process is judged to be complete or virtually complete There is reasonable certainty as to the collectibility of the asset to be received Additional criteria from SAB No 101 & 104 include • Persuasive evidence of an arrangement exists • Delivery has occurred or services have been rendered • The seller’s price to the buyer is fixed or determinable • Collectibility is reasonably assured POINT OF DELIVERY Revenue and expenses are generally recognized in the period in which the product/service is delivered. Revenue from the sale of products can be delayed past delivery if material uncertainties exist or allowed prior to delivery for long-term contracts. Service revenue often is recognized over time, in proportion to the amount of service performed. If there is one final service that is critical to the earnings process, revenues and costs are deferred and recognized after this service has been performed. POINT OF DELIVERY REVENUE RECOGNITION – TYPICAL TRANSACTION Example On April 1, 2014, X Company sold inventory on account to Y, Inc. for $100,000. The inventory cost X $60,000. Accounts Receivable 100,000 Sales Cost of Goods Sold Inventory 100,000 60,000 60,000 The realization principles has been met in that 1) the product has been sold and delivered. 2) There is reasonable certainty as to the collectibility of cash. Any minor uncertainties regarding the collection of cash can be accounted for with allowances for returns and bad debts. INSTALLMENT SALES A sales transaction requiring the buyer to make a series of payments (usually annual) over a period of time. Revenue recognition for most installment sales takes place at the point of delivery, because reliable estimates of potential uncollectible amounts can be made. When extreme uncertainty exists regarding the ultimate collectibility of cash, we delay recognizing revenue and related expenses using either Installment Sales Method Cost Recovery Method INSTALLMENT SALES - POINT OF DELIVERY REVENUE RECOGNITION Example On October 1, 2014, Harmon Company sold and delivered inventory to Lee, Inc. for $450,000. The inventory cost Harmon $210,000. Terms of the sale called for a down payment of $150,000 and three annual installments of $100,000 each. Oct 1, 2014 Installment Receivables 450,000 Sales Cost of Goods Sold 450,000 210,000 Inventory Cash Installment Receivables 210,000 150,000 150,000 Note that all the revenue was recognized when the inventory was sold and delivered even though the payment will be spread over several installments. INSTALLMENT SALES METHOD • • • Recognizes revenue and costs only when cash payments are received. Each payment is composed of a partial recovery of the cost of the item sold and a gross profit component. Gross profit on the initial sale is deferred. The installment sales method realizes (recognizes) gross profit as payments are made by applying the gross profit percentage on the sale to the amount of cash actually received. Total Gross Profit Gross Profit Percentage Sales Price – Cost of Goods Sold Gross Profit/Sales Price Gross Profit Recognized Cash Collections X Gross Profit Percentage INSTALLMENT SALES METHOD Example On November 1, 2013, the Belmont Corporation, a real estate developer, sold a tract of land for $800,000. The sales agreement requires the customer to make four equal annual payments of $200,000 plus interest on each November 1, beginning November 1, 2013. The land cost $560,000 to develop. The company’s fiscal year ends on December 31. Total Gross Profit: $800,000 – $560,000 = $240,000 Gross Profit Percentage: $240,000/$800,000 = 30% Annual Gross Profit Recognition Date Nov. 1, 2013 Nov. 1, 2014 Nov. 1, 2015 Nov. 1, 2016 Totals Cash Collected $200,000 200,000 200,000 200,000 $800,000 Gross Profit ($240/$800=30%) $ 60,000 60,000 60,000 60,000 $240,000 INSTALLMENT SALES METHOD Example (continued – journal entries) Installment Receivables 800,000 Inventory 560,000 Deferred Gross Profit 240,000 To record installment sale Cash 200,000 Installment Receivables 200,000 To record cash collection from installment sale Deferred Gross Profit Realized Gross Profit To recognize gross profit from installment sale 60,000 60,000 COST RECOVERY METHOD Used when there is an extremely high degree of uncertainty regarding the ultimate cash collection on an installment sale. All gross profit recognition is deferred until the cost of the item sold has been recovered. After costs have been recovered, any remaining cash collections are gross profit. COST RECOVERY METHOD Example On November 1, 2013, the Belmont Corporation, a real estate developer, sold a tract of land for $800,000. The sales agreement requires the customer to make four equal annual payments of $200,000 plus interest on each November 1, beginning November 1, 2013. The land cost $560,000 to develop. The company’s fiscal year ends on December 31. Gross Profit Recognition Date Cash Collected Cost Recovery Nov. 1, 2013 $200,000 $200,000 Nov. 1, 2014 200,000 200,000 -0- Nov. 1, 2015 200,000 160,000 40,000 Nov. 1, 2016 200,000 Totals $800,000 -0$560,000 Gross Profit $ -0- 200,000 $240,000 Nov 1 2013 Installment Receivables 800,000 Inventory 560,000 Deferred Gross Profit 240,000 COST RECOVERY METHOD Journal Entries To record installment sale Nov 1 2013 Cash 200,000 Installment Receivables 200,000 To record cash collection from installment sale No entry to recognize gross profit from installment sale in 2013 or 2014 Nov 1, 2015 Deferred Gross Profit 40,000 Realized Gross Profit 40,000 To recognize gross profit from installment sale Nov 1, 2016 Deferred Gross Profit Realized Gross Profit To recognize gross profit from installment sale 200,000 200,000 This entry will be repeated for 2014, 2015 & 2016. Income Measurement (Part 1) I N T ERMEDIATE ACCOU N T I NG I – CHA PT ER 5 E N D OF P R ESENTATION