2. Revenue Recognition - NYU Stern School of Business

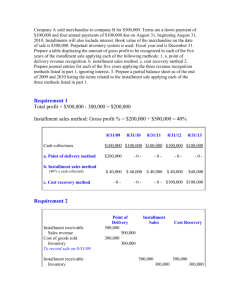

advertisement

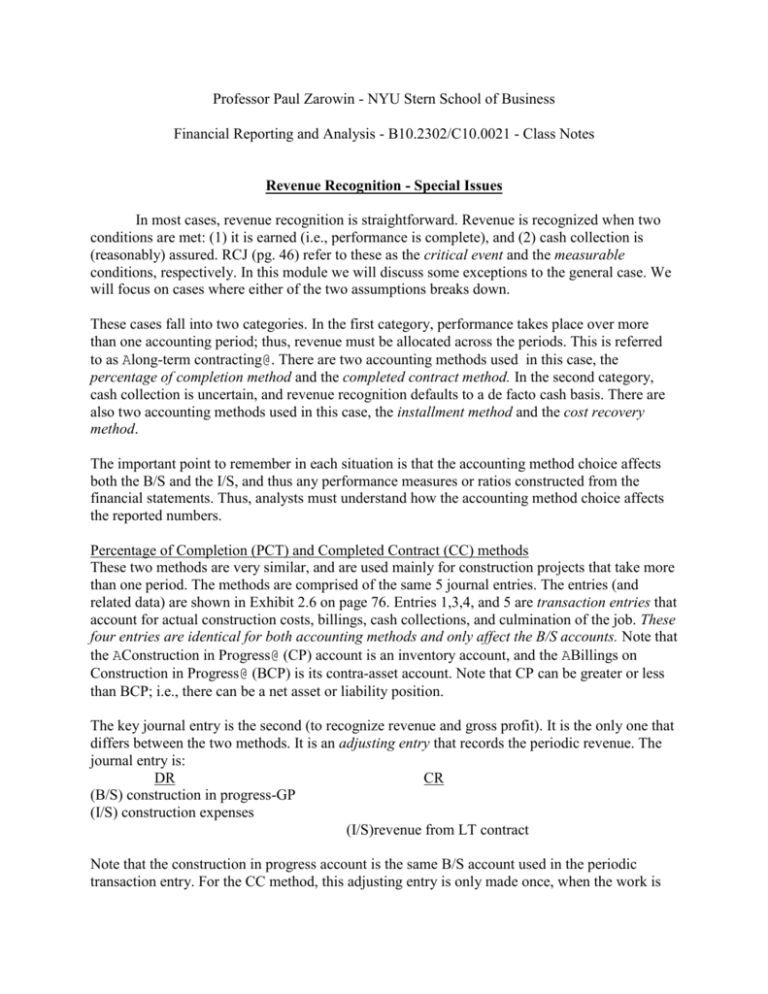

Professor Paul Zarowin - NYU Stern School of Business Financial Reporting and Analysis - B10.2302/C10.0021 - Class Notes Revenue Recognition - Special Issues In most cases, revenue recognition is straightforward. Revenue is recognized when two conditions are met: (1) it is earned (i.e., performance is complete), and (2) cash collection is (reasonably) assured. RCJ (pg. 46) refer to these as the critical event and the measurable conditions, respectively. In this module we will discuss some exceptions to the general case. We will focus on cases where either of the two assumptions breaks down. These cases fall into two categories. In the first category, performance takes place over more than one accounting period; thus, revenue must be allocated across the periods. This is referred to as Along-term contracting@. There are two accounting methods used in this case, the percentage of completion method and the completed contract method. In the second category, cash collection is uncertain, and revenue recognition defaults to a de facto cash basis. There are also two accounting methods used in this case, the installment method and the cost recovery method. The important point to remember in each situation is that the accounting method choice affects both the B/S and the I/S, and thus any performance measures or ratios constructed from the financial statements. Thus, analysts must understand how the accounting method choice affects the reported numbers. Percentage of Completion (PCT) and Completed Contract (CC) methods These two methods are very similar, and are used mainly for construction projects that take more than one period. The methods are comprised of the same 5 journal entries. The entries (and related data) are shown in Exhibit 2.6 on page 76. Entries 1,3,4, and 5 are transaction entries that account for actual construction costs, billings, cash collections, and culmination of the job. These four entries are identical for both accounting methods and only affect the B/S accounts. Note that the AConstruction in Progress@ (CP) account is an inventory account, and the ABillings on Construction in Progress@ (BCP) is its contra-asset account. Note that CP can be greater or less than BCP; i.e., there can be a net asset or liability position. The key journal entry is the second (to recognize revenue and gross profit). It is the only one that differs between the two methods. It is an adjusting entry that records the periodic revenue. The journal entry is: DR CR (B/S) construction in progress-GP (I/S) construction expenses (I/S)revenue from LT contract Note that the construction in progress account is the same B/S account used in the periodic transaction entry. For the CC method, this adjusting entry is only made once, when the work is completed (unless the job is unprofitable, see below); i.e., no revenue or expense is recognized until the final period. Thus, the construction project does not affect the I/S until this time. For the PCT method, this entry is made each period, according to the following algorithm, which is based on the year-to-year change in estimated total construction costs (this is an example of an accounting estimate, like bad debts %). 1. % complete = costs incurred so far/estimated total costs 2. Total revenue so far = % x total contract price 3. This period=s revenue = total - revenue previously recognized 4. This period=s expenses are actual expenses 5. Gross Profit (GP) = revenue - expenses The estimates are usually based on engineering/construction estimates. While the CC method has the advantage that it requires no such estimates, it has the disadvantage that it does not reflect periodic performance as well as the PCT method. Note that this method automatically accounts for year-to-year changes in estimated total costs (have you ever heard of cost overruns?) by the % in 1. No further adjustment is necessary. Also note that negative GP is possible just by following the algorithm. long term contract losses 1. Periodic losses (expenses > revenues) within an overall profitable job require no change in the method described above. The PCT method makes the usual calculation (it just happens to produce negative GP for the period - this happens when there is a large increase in estimated costs), and the CC method bypasses the entry altogether, as described above. 2. The only change in the above method comes when the overall job is judged to be unprofitable. This occurs when the total cost estimate increases above the contracted revenues. In this case, the expected total loss from the job must be recognized immediately (remember, accounting is conservative). For the CC method, just make the following entry, which records the loss and decreases the construction in progress account: DR CR Loss from LT contracts Construction in Progress (loss) The loss (CR to construction in progress) equals the overall expected loss (since zero GP was recognized previously). This is the only time when the CC method makes a profit or loss entry before the job is complete. If the estimated total loss increases, the entry must be made again for the additional loss. If there are no further estimate changes, no additional entries are made, even in the last year (because the correct total GP has already been recognized). If the estimated total loss decreases, the positive GP is recognized only in the last year (conservatism). For the PCT method, the negative GP must wipe out the positive GP recognized so far plus the total loss expected for the job. For example, if the positive GP recognized previously was 100 and the overall loss is expected to be 150, the negative GP this period is 250 (for the CC method, this period=s negative GP is 150).The recognized revenue this period is computed as per the above algorithm, and this period=s expenses are a plug (to achieve the desired negative GP). Like the CC method, only further changes in estimates require additional revenue, expense, and GP entries. In summary, until a project=s last year, the PCT method will generally show both higher NI and thus higher O/E (because of the periodic revenue recognition, and its affect on R/E) and higher Total Assets (because of the higher inventory balance, Construction in Progress). In the last year, the CC method will show higher NI, and both methods will show the same B/S figures. Installment (IN) and Cost Recovery (CREC) Methods These methods recognize revenue after delivery, essentially on a cash basis. They are also a tandem, like the PCT and CC methods, and only differ by the one (adjusting) entry that records the periodic revenue. There are five entries shown (with related data) on page 83. All except entry #5 are the same for both methods (except that the CREC method does not use the term Ainstallment@). Entries 1-4 are standard entries for sales, cash collections, and CGS that you should all know. The only new twist is the term Ainstallment@. Note that deferred gross profit is a liability account (unearned revenue). The key entry is entry #5: DR CR (B/S) deferred GP (I/S) realized GP When the sale is first made, all of the GP is deferred, and it becomes realized later. The IN method is analogous to the PCT method in that it makes this entry and recognizes (realizes) GP each period. The CREC method is analogous to the CC method in that it makes this entry and recognizes (realizes) GP later (only after all of the costs have been covered - there may be more than one period with realized gross profit). For the IN method, realized GP = GP% x cash received; GP% = (sales price-CGS)/sales price. For the CREC method, no GP is realized until total cash collected exceeds CGS, and then cash collected equals realized GP. Installment sales often have an interest component, since the cash is collected over time. The present value (PV) of the cash received equals the sales price. Assume for example, installment sales for $200K, and that the cash is collected evenly (the usual way) over 3 years and that the interest rate = 10%. Thus, the PV of the 3 year annuity equals $200. At r=10%, each period=s cash collection equals $80.42 (total cash collected = 3 x $80.42 = $241.26). You should understand the annuity calculation. The cash collected is composed of Installment A/R of $200 and interest revenue of $41.26. Each period=s interest revenue equals the interest rate x the balance of the Installment A/R. The CR to the A/R is a plug. For the CREC method, interest is handled in the same way; (i.e., interest revenue = r% x A/R balance) and the CR to A/R is a plug so that the total equals the cash collected. The periodic journal entries are as follows:1 Year 1: DR Cash 80.42 Year 2: DR Cash 80.42 CR Installment A/R 60.42 Interest revenue 20.00 CR Installment A/R 66.46 Interest revenue 13.96 Year 3: DR Cash 80.42 (20.00 = 10% x 200.00) [13.96 = 10% x (200.00-60.42)] CR Installment A/R 73.11 Interest revenue 7.31 [7.31 = 10% x (200.00-60.42-66.46)] When there is interest, the realized GP each period equals the GP% x the CR to the A/R (not GP% x cash received). This is easy to see if you remember that it is the total CR=s to the A/R that equal $200, whereas the total cash collected equals $241.26. Thus, the realized GP=s each period in this example (GP% = 25%) are: $15.10, $16.62, and $18.28. Sometimes merchandise sold under the installment method is repossessed (the buyer can=t make the payments). The repossessed merchandise is an inventory account, and it should be recorded at fair market value (FMV). The journal entry records the acquisition of the merchandise and wipes out the remaining balances in the Deferred GP and Installment A/R balances. A gain or loss (usually a loss, as shown) is usually needed to balance the entry. In the above example, assume that merchandise with an FMV of $20 is repossessed after the second period. At this time, the remaining Installment A/R and Deferred GP balances are $73.12 and $18.28, respectively (you should be able to derive these balances for yourself). The repossession journal entry is: DR CR (B/S) repossessed merchandise 20.00 FMV (B/S) Deferred GP 18.28 (I/S) Loss on repossession 34.84 (plug) (B/S) Installment A/R 73.12 1 My example here assumes an annuity in arrears (cash collected at the end of the year).