Joseph Company issued $800,000, 11%, 10

advertisement

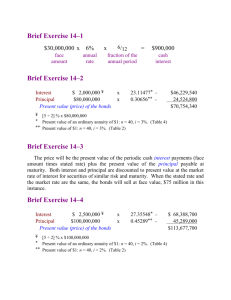

Joseph Company issued $800,000, 11%, 10-year bonds on December 31, 2007, for $730,000. Interest is payable semiannually on June 30 and December 31. Joseph Company uses the straight-line method to amortize bond premium or discount. Instructions Prepare the journal entries to record the following. The issuance of the bonds. (For multiple debit/credit entries, list amounts from largest to smallest eg 10, 5, 3, 2.) The payment of interest and the discount amortization on June 30, 2008. (For multiple debit/credit entries, list amounts from largest to smallest eg 10, 5, 3, 2.) The payment of interest and the discount amortization on December 31, 2008. (For multiple debit/credit entries, list amounts from largest to smallest eg 10, 5, 3, 2.) The redemption of the bonds at maturity, assuming interest for the last interest period has been paid and recorded. (a) Dec. 31 (b) June 30 (c) Dec. 31 (d) Dec. 31 2007 Cash ............................................................ 730,000 Discount on Bonds Payable ..................................... Bonds Payable ................................................ 2008 Bond Interest Expense............................................. Cash ($800,000 X 11% X 1/2) ....................... Discount on Bonds Payable ........................... ($70,000 ÷ 20) 2008 Bond Interest Expense............................................. Cash ($800,000 X 11% X 1/2) ....................... Discount on Bonds Payable ........................... 2017 Bonds Payable .......................................................... Cash................................................................. 70,000 800,000 47,500 44,000 3,500 47,500 44,000 3,500 800,000 On May 1, 2008, Newby Corp. issued $600,000, 9%, 5-year bonds at face value. The bonds were dated May 1, 2008, and pay interest semiannually on May 1 and November 1. Financial statements are prepared annually on December 31. Prepare the journal entry to 800,000 record the issuance of the bonds. Prepare the adjusting entry to record the accrual of interest on December 31, 2008. Show the balance sheet presentation on December 31, 2008. current liabiliteis, long term liablitities Prepare the journal entry to record payment of interest on May 1, 2009, assuming no accrual of interest from January 1, 2009, to May 1, 2009. (For multiple debit/credit entries, list amounts from largest to smallest eg 10, 5, 3, 2.) Prepare the journal entry to record payment of interest on November 1, 2009. Assume that on November 1, 2009, Newby calls the bonds at 102. Record the redemption of the bonds. (For multiple debit/credit entries, list amounts from largest to smallest eg 10, 5, 3, 2.) (a) May (b) (c) Dec. 1 31 2008 Cash .......................................................... 600,000 Bonds Payable.............................................. Bond Interest Expense .......................................... Bond Interest Payable ................................. ($600,000 X 9% X 2/12) 600,000 9,000 9,000 Current Liabilities Bond Interest Payable ........................................................ $ Long-term Liabilities Bonds Payable, due 2013.................................................... $600,000 (d) May 1 2009 Bond Interest Expense .......................................... ($600,000 X 9% X 4/12) Bond Interest Payable ........................................... 18,000 9,000 Cash .............................................................. (e) (f) Nov. Nov. 1 1 9,000 27,000 Bond Interest Expense .......................................... Cash ($600,000 X 9% X 1/2)....................... 27,000 Bonds Payable........................................................ Loss on Bond Redemption .................................... Cash ($600,000 X 1.02)................................ 600,000 12,000 27,000 612,000