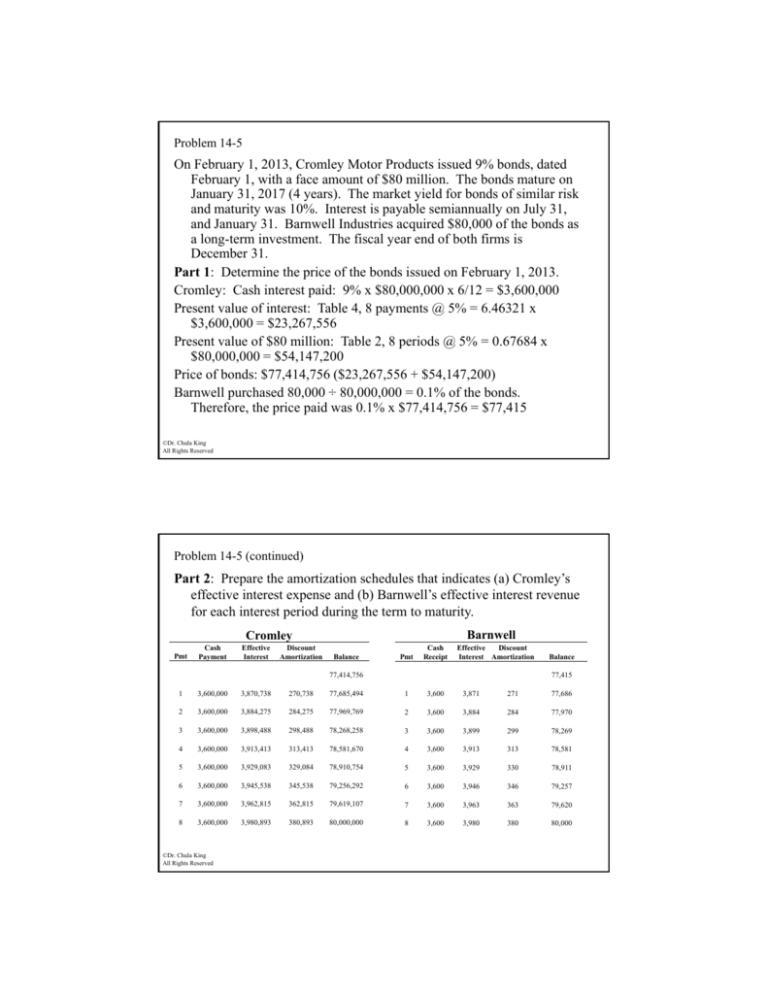

Problem 14-5

On February 1, 2013, Cromley Motor Products issued 9% bonds, dated

February 1, with a face amount of $80 million. The bonds mature on

January 31, 2017 (4 years). The market yield for bonds of similar risk

and maturity was 10%. Interest is payable semiannually on July 31,

and January 31. Barnwell Industries acquired $80,000 of the bonds as

a long-term

l

i

investment.

The

h fiscal

fi l year endd off both

b h firms

fi

is

i

December 31.

Part 1: Determine the price of the bonds issued on February 1, 2013.

Cromley: Cash interest paid: 9% x $80,000,000 x 6/12 = $3,600,000

Present value of interest: Table 4, 8 payments @ 5% = 6.46321 x

$3,600,000 = $23,267,556

p

@ 5% = 0.67684 x

Present value of $$80 million: Table 2,, 8 periods

$80,000,000 = $54,147,200

Price of bonds: $77,414,756 ($23,267,556 + $54,147,200)

Barnwell purchased 80,000 ÷ 80,000,000 = 0.1% of the bonds.

Therefore, the price paid was 0.1% x $77,414,756 = $77,415

©Dr. Chula King

All Rights Reserved

Problem 14-5 (continued)

Part 2: Prepare the amortization schedules that indicates (a) Cromley’s

effective interest expense and (b) Barnwell’s effective interest revenue

for each interest period during the term to maturity.

Barnwell

Cromley

Pmt

Cash

C

h

Payment

Effective

Eff

ti

Interest

Discountt

Di

Amortization

1

3,600,000

3,870,738

270,738

2

3,600,000

3,884,275

3

3,600,000

4

3,600,000

5

Pmt

Cash

C

h

Receipt

77,685,494

1

3,600

3,871

271

77,686

284,275

77,969,769

2

3,600

3,884

284

77,970

3,898,488

298,488

78,268,258

3

3,600

3,899

299

78,269

3,913,413

313,413

78,581,670

4

3,600

3,913

313

78,581

3,600,000

3,929,083

329,084

78,910,754

5

3,600

3,929

330

78,911

6

3,600,000

3,945,538

345,538

79,256,292

6

3,600

3,946

346

79,257

7

3,600,000

3,962,815

362,815

79,619,107

7

3,600

3,963

363

79,620

8

3,600,000

3,980,893

380,893

80,000,000

8

3,600

3,980

380

80,000

Balance

Effective

Eff

ti

Di

Discount

t

Interest Amortization

77,414,756

©Dr. Chula King

All Rights Reserved

Balance

77,415

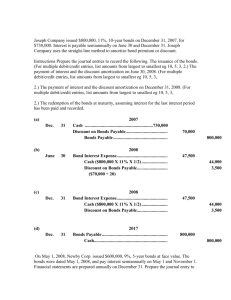

Problem 14-5 (continued)

Part 3: Prepare the journal entries to record (a) the issuance of the bonds

by Cromley and (b) Barnwell’s investment on February 1, 2013.

Cromley:

Cash

77,414,756

Discount on B/P

2,585,244

Bonds Payable

80,000,000

Barnwell:

Investment in Bonds

Discount on bond investment

Cash

80,000

2,585

,

77,415

©Dr. Chula King

All Rights Reserved

Problem 14-5 (continued)

Part 4: Prepare the journal entries by both firms to record all subsequent

events related to the bonds through January 31, 2015.

Cromley

7/31/13

Interest Expense

3,870,738

Discount on B/P

270,738

Cash

12/31/13

Interest Expense (3,884,275 x 5/6)

3,600,000

3,236,896

Discount on B/P (284,275 x 5/6)

236,896

Interest Payable (3,600,000 x 5/6)

1/31/14

I t

Interest

t Expense

E

(3,884,275

(3 884 275 x 1/6)

Interest Payable

Discount on B/P (284,275 x 1/6)

Cash

©Dr. Chula King

All Rights Reserved

3,000,000

647 379

647,379

3,000,000

47,379

3,600,000

Problem 14-5 (continued)

Cromley

7/31/14

Interest Expense

3,898,488

Discount on B/P

298,488

Cash

12/31/14

Interest Expense (3,913,413 x 5/6)

3 600 000

3,600,000

3,261,177

Discount on B/P (313,413 x 5/6)

261,177

Interest Payable (3,600,000 x 5/6)

1/31/15

Interest Expense (3,913,413 x 1/6)

Interest Payable

3,000,000

652,236

3,000,000

Discount on B/P (313,413 x 1/6)

52,236

Cash

3,600,000

©Dr. Chula King

All Rights Reserved

Problem 14-5 (continued)

Part 4: Prepare the journal entries by both firms to record all subsequent

events related to the bonds through January 31, 2015.

Barnwell

7/31/13

Cash

Disc on Bond Invest

3,600

271

Interest Revenue

12/31/13

3,871

Interest Receivable (3,600 x 5/6)

3,000

Disc on Bond Invest (284 x 5/6)

237

Interest Revenue (3,884 x 5/6)

1/31/14

C h

Cash

Disc on Bond Invest (284 x 1/6)

Interest Receivable

Interest Revenue (3,884 x 1/6)

©Dr. Chula King

All Rights Reserved

3,237

3 600

3,600

47

3,000

647

Problem 14-5 (continued)

Barnwell

7/31/14

Cash

Disc on Bond Invest

3,600

299

Interest Revenue

12/31/14

3,899

Interest Receivable (3,600 x 5/6)

3,000

Disc on Bond Invest (313 x 5/6)

261

Interest Revenue (3,913 x 5/6)

1/31/15

Cash

Disc on Bond Invest (313 x 1/6)

Interest Receivable

Interest Revenue (3,913 x 1/6)

©Dr. Chula King

All Rights Reserved

3,261

3,600

52

3,000

652

![S[i]r I have intentions to be at Barnwell on monday night, & ye next](http://s3.studylib.net/store/data/007180718_1-62d83531c236bdb8cd34ca199f626d19-300x300.png)