method bonds

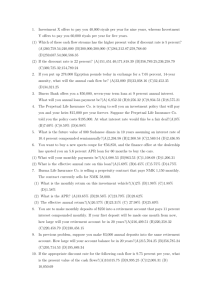

advertisement

Accy 510, Sp 2008, UIUC (Doogar). Diagnostic Test (Quiz 0, Ungraded) Logan Corporation issued $600,000 of 8% bonds on October 1, 2004, due on October 1, 2009. The interest is to be paid twice a year on April 1 and October 1. The bonds were sold to yield 10% effective annual interest. Logan Corporation closes its books annually on December 31. Required: (a) Complete the following amortization schedule for the dates indicated. (Round all answers to the nearest dollar.) Use the effective interest method. Cash October 1, 2004 Interest Expense Bond Discount Carrying Amount of Bond $553,668 April 1, 2005 October 1, 2005 (b) Prepare the adjusting entry for December 31, 2005. Use the effective interest method. (c) Compute the interest expense to be reported in the income statement for the year ended December 31, 2005. (d) Assume that on January 1, 2006, Logan retired $150,000 of these bonds at 101 plus accrued interest. Prepare journal entries to record the retirement on January 1, 2006. Accy 510, Sp 2008, UIUC (Doogar). Solution to Diagnostic Test (Quiz 0, Ungraded) Logan Corporation issued $600,000 of 8% bonds on October 1, 2004, due on October 1, 2009. The interest is to be paid twice a year on April 1 and October 1. The bonds were sold to yield 10% effective annual interest. Logan Corporation closes its books annually on December 31. Instructions (a) Complete the following amortization schedule for the dates indicated. (Round all answers to the nearest dollar.) Use the effective interest method. Credit Cash October 1, 2004 April 1, 2005 October 1, 2005 $24,000 24,000 Debit Interest Expense $27,684 27,868 Credit Carrying Amount Bond Discount of Bonds $553,668 $3,684 557,352 3,868 561,220 (b) Prepare the adjusting entry for December 31, 2005. Use the effective interest method. Interest Expense ($561,220 × 10% × 3/12) ....................................... Interest Payable (1/2 × $24,000) ........................................... Discount on Bonds Payable ($14,031 – $12,000) 14,031 12,000 2,031 Ask yourself what are the account balances as of 12/31/2005? In what accounts? What is the carrying value on 12/31/2005? (see below for hints). (c) Compute the interest expense to be reported in the income statement for the year ended December 31, 2005. $13,842 … (1/2 of $27,684) 27,868 14,031 $55,741 (d) Assume that on January 1, 2006, Logan retired $150,000 of these bonds at 101 plus accrued interest. Prepare journal entries to record the retirement on January 1, 2006. Interest Payable ($150,000 × 8% × 3/12) ................................................ Cash ($150,000 × 8% × 3/12) ................................................ Bonds Payable .......................................................................................... Loss on Redemption of Bonds ........................................................... Discount on Bonds Payable [(1/4 × ($38,780-2030)] ........... Cash ....................................................................................... Hint/solution: * unamortized discount on 10/01/05: 600,000- 561,220 = 38,780 unamortized discount on 12/31/05: 38,780-2,030=36,750. 3,000 3,000 150,000 10,687 9,187 151,500