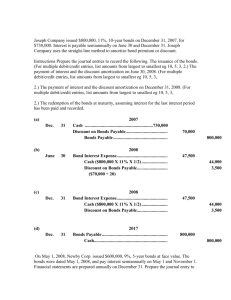

Brief Exercise 14–9

advertisement

Brief Exercise 14–1 $30,000,000 x face amount 6% annual rate 6/12 x = $900,000 fraction of the annual period cash interest Brief Exercise 14–2 Interest $ 2,000,000 ¥ Principal $80,000,000 Present value (price) of the bonds x x 23.11477* 0.30656** = = $46,229,540 24,524,800 $70,754,340 ¥ [5 ÷ 2] % x $80,000,000 * Present value of an ordinary annuity of $1: n = 40, i = 3%. (Table 4) ** Present value of $1: n = 40, i = 3%. (Table 2) Brief Exercise 14–3 The price will be the present value of the periodic cash interest payments (face amount times stated rate) plus the present value of the principal payable at maturity. Both interest and principal are discounted to present value at the market rate of interest for securities of similar risk and maturity. When the stated rate and the market rate are the same, the bonds will sell at face value, $75 million in this instance. Brief Exercise 14–4 Interest $ 2,500,000 ¥ Principal $100,000,000 Present value (price) of the bonds x x 27.35548* 0.45289** = = ¥ [5 ÷ 2] % x $100,000,000 * Present value of an ordinary annuity of $1: n = 40, i = 2%. (Table 4) ** Present value of $1: n = 40, i = 2%. (Table 2) $ 68,388,700 45,289,000 $113,677,700 Brief Exercise 14–5 Interest will be the effective rate times the outstanding balance: 4% x $82,218,585 = $3,288,743 Brief Exercise 14–6 Interest will be the effective rate times the outstanding balance: June 30 Interest expense (2% x $69,033,776) ................................ Discount on bonds payable (difference) ................. Cash (1.5% x $80,000,000) ....................................... December 31 Interest expense (2% x [$69,033,776 + 180,676]) .......... Discount on bonds payable (difference) ................. Cash (1.5% x $80,000,000)....................................... 1,380,676 180,676 1,200,000 1,384,289 184,289 1,200,000 Interest expense for the year: $1,380,676 + 1,384,289 = $2,764,965 Brief Exercise 14–7 Interest will be a plug figure: $80,000,000 – 69,033,776 = $10,966,224 discount $10,966,224 ÷ 40 semiannual periods = $274,156 reduction each period June 30 Interest expense (to balance) ............................................. Discount on bonds payable (difference) ................. Cash (1.5% x $80,000,000) ....................................... December 31 Interest expense (to balance) ............................................. Discount on bonds payable (difference) ................. Cash (1.5% x $80,000,000) ....................................... 1,474,156 274,156 1,200,000 1,474,156 274,156 1,200,000 Interest expense for the year: $1,474,156 + 1,474,156 = $2,948,312 Brief Exercise 14–8 Interest will be the effective rate times the outstanding balance: June 30 Cash (1.5% x $80,000,000) .......................................... Discount on investment in bonds (difference) ........... Interest revenue (2% x $69,033,776) ............................ 1,200,000 180,676 December 31 Cash (1.5% x $80,000,000) .......................................... Discount on investment in bonds (difference) ........... Interest revenue (2% x [$69,033,776 + 180,676]) ...... 1,200,000 184,289 1,380,676 1,384,289 Brief Exercise 14–9 Interest $6,000¥ x 2.72325 * Principal $300,000 x 0.86384 ** Present value (price) of the note = = $ 16,340 259,152 $275,492 ¥ 2% x $300,000 * Present value of an ordinary annuity of $1: n = 3, i = 5%. (Table 4) ** Present value of $1: n = 3, i = 5%. (Table 2) Equipment (price determined above) ................................ Discount on notes payable (difference) .......................... Notes payable (face amount) ...................................... 275,492 24,508 300,000 Brief Exercise 14–10 $300,000 ÷ 2.72325 = amount of loan (from Table 4) n = 3, i = 5% $110,162 installment payment Helpful, but not required: Cash Payment 1 2 3 110,162 110,162 110,162 Effective Interest 5% x Outstanding Balance .05 (300,000) = .05 (204,838) = .05 (104,918) = 15,000 10,242 5,246 Decrease in Outstanding Balance Balance Balance Reduction 95,162 99,920 104,918* 300,000 204,838 104,918 0 * rounded Interest expense (5% x ($300,000 – [$110,162 – 5% x $300,000])) Note payable (difference) ............................................... Cash (payment determined above) ................................. 10,242 99,920 110,162 EXERCISE 14–9 1. Price of the bonds at January 1, 2013 Interest $18,000¥ x 6.87396 * Principal $600,000 x 0.75941 ** Present value (price) of the bonds = = $123,731 455,646 $579,377 ¥ 3% x $600,000 * Present value of an ordinary annuity of $1: n = 8, i = 3.5% (Table 4) ** Present value of $1: n = 8, i = 3.5% (Table 2) 2. January 1, 2013 Cash (price determined above) ........................... Discount on bonds (difference) ....................... Bonds payable (face amount) ....................... 579,377 20,623 600,000 3. Amortization schedule Cash Payment 3% x Face Amount 1 2 3 4 5 6 7 8 18,000 18,000 18,000 18,000 18,000 18,000 18,000 18,000 144,000 *rounded .035 .035 .035 .035 .035 .035 .035 .035 Effective Increase in Outstanding Interest Balance Balance 3.5% x Outstanding Balance Discount Reduction (579,377) (581,655) (584,013) (586,453) (588,979) (591,593) (594,299) (597,099) = = = = = = = = 20,278 20,358 20,440 20,526 20,614 20,706 20,800 20,901* 2,278 2,358 2,440 2,526 2,614 2,706 2,800 2,901 164,623 20,623 579,377 581,655 584,013 586,453 588,979 591,593 594,299 597,099 600,000 Exercise 14–9 (concluded) 4. June 30, 2013 Interest expense (3.5% x $579,377) .................... Discount on bonds payable (difference) ...... Cash (3% x $600,000)................................... December 31, 2013** Interest expense (3.5% x [$579,377 + 2,278]) .... Discount on bonds payable (difference) ...... Cash (3% x $600,000)................................... 20,278 2,278 18,000 20,358 2,358 18,000 5. Liability at December 31, 2013 Bonds payable (face amount) ..................................... Less: discount .......................................................... Initial balance, January 1, 2013 ............................... June 30, 2013 discount amortization .................... Dec. 31, 2013 discount amortization .................... December 31, 2013 net liability .............................. $600,000 (20,623) $579,377 2,278 2,358 $584,013 6. Interest expense for year ended December 31, 2013 June 30, 2013 interest expense ................................ Dec. 31, 2013 interest expense ................................ Interest expense for 2013 ......................................... 7. December 31, 2016 Interest expense (3.5% x $597,099) .................... Discount on bonds payable (difference) ...... Cash (3% x $600,000)................................... $20,278 20,358 $40,636 20,901* 2,901 18,000 * rounded value from amortization schedule Bonds payable ..................................................... Cash .......................................................... 600,000 600,000