Implementing an effective collections system

Provided by Business Partners Ltd, South Africa's leading investor in SMEs

Having systems in place for all aspects of your business operations, not only ensures that you're always

on top of things, but also that you appear professional and business-like to your customers. This is if

particular importance when collecting on invoices, a vital element of maintaining your cash flow.

Customers and service providers prefer to deal with companies that are efficient in every area of their

business, whether it be product packaging, friendly and helpful employees, and even your collections

system.

By having a systematic collections system, you come across as businesslike and customers learn that

your invoices are a top priority if you can quickly reference their account when they call.

Your customer will know that you are to be taken seriously and you have a better chance of getting your

invoices to the top of the pile and paid more quickly than a competitor who may not be as organised as

you are.

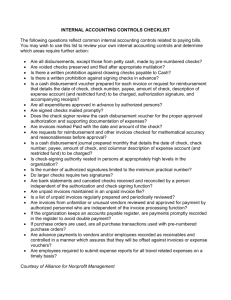

Implementing an efficient collection system:

Be professional

All correspondence should be sent out on a company letterhead. The services provided and amount

owed must be readily understandable, with payment terms and expectations clearly written.

Invoices that are hand-scrawled, with spelling or grammar errors, convey the impression that the

business isn't professionally run, and need not be taken seriously.

Prearranged schedule

Timing is crucial when it comes to collections. Invoices not paid on time have a tendency to be put off

even longer. To combat late payment, send invoices at the same time of the month or immediately after

the service is performed. Then follow up every 15 or 30 days with statements or collection notices. This

type of scheduled billing procedures conveys the professionalism and seriousness that leads to prompt

payment.

Stepped message approach

Simply sending the same invoice with the amount due isn't enough. The customers must be informed

that they are late in paying. The notices you send must communicate that the invoices are seriously

overdue, and reminded that you've sent a third or fourth notice. The tone of the message should

become progressively more firm. If you collect interest on overdue amounts, the amount accumulating

must be made clear.

Special cases

Your collections system must take into account that you may not necessarily treat all accounts

receivable equally. Pay special attention to customers owing large amounts of money. In these cases,

consider supplementing your official invoicing approach with telephone calls at strategic times or to

strategic people. Include a personal letter or note with certain overdue notices, especially if you were

promised prompt payment, to gently remind the customer that you are keeping track of the account.

Overall policy

Most importantly, your invoicing system must convey how seriously you take your collections process,

especially for customers who becoming a problem. Show them that you have thought through the

collection process and that you are prepared to follow through, whether it's by referring the account to

a collection agency, loss of credit and possibly even court action.

Having said this; be flexible enough to allow for the human factor and variations among companies.

Sometimes the key to getting paid is making sure the invoice gets into the right hands, or appears at the

right time of the month.

The underlying system, however, will help you communicate your message to customers about getting

paid, improve your cash flow and entrench your relationships with loyal customers.

Copyright © 2012 Business Partners Ltd.

All rights reserved.