5.03 STUDY GUIDE Adequate Disclosure Concept – states that

advertisement

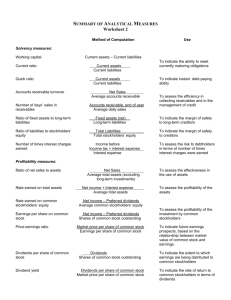

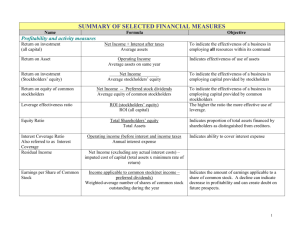

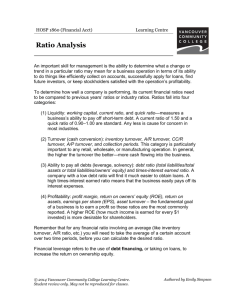

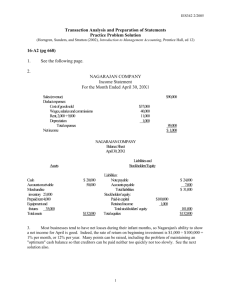

5.03 STUDY GUIDE Adequate Disclosure Concept – states that financial statements contain the information necessary to understand a business’s financial condition. Consistent Reporting Concept – states that the same accounting procedures must be followed in the same way in each accounting period. Some business decisions require a comparison of current financial statements with previous financial statements. Common objectives for analyzing financial information are to determine profitability, efficiency, short-term financial strength, and long-term financial strength. Financial analysis shows the relationship and changes between amounts from one period to another. Three common techniques to evaluate the information presented in financial statements are horizontal analysis, vertical analysis, and ratio analysis. The base year is the year used for comparison. Comparability is an accounting term that refers to financial information that can be compared from one accounting period to another or from one business to another. Horizontal trend analysis is the comparison of the same items on a company’s financial statements for two or more periods. The comparison can be of dollar amounts or percentages. Vertical trend analysis (component percentage) for the income statement expresses each dollar amount as a percentage of net sales; for the balance sheet, as a percentage of total assets, liabilities or stockholder’s equity. These are also referred to as component percentages. Industry standards refer to financial information and averages for entire industries. Businesses use industry standards as another use of financial analysis to determine if the business is performing above or below average. A comparison between two numbers showing how many times one number exceeds the other is called a ratio. A ratio may be expressed as a stated ratio, percentage, or fraction. Ratio analysis is the comparison of two amounts on a financial statement and the evaluation of the relationship between these amounts. Ratio analysis is used to evaluate a company’s liquidity, profitability, and financial strength. Acceptable ratios vary from industry to industry and even business to business within an industry. Managers need to be aware of industry standards and use these standards to help in management decision making when evaluating financial statements. Working capital is the amount of current assets available after current liabilities are paid. Working capital is current assets minus current liabilities. A liquidity ratio measures the ability of a business to pay its current debts and provide cash for unexpected needs. Current ratio is current assets divided by current liabilities. The current ratio determines if a company can pay its bills and repay its loans. Generally, a ratio of 2:1 is considered to be adequate for most businesses. Quick ratio (Acid-Test ratio) is short-term liquid assets (quick assets) divided by current liabilities. This ratio measures the company’s ability to pay all current liabilities almost immediately if necessary (short-term liquidity). Short-term liquid assets (quick assets) are assets that can be converted into cash quickly. They include cash, accounts receivable, and marketable securities. They do not include inventory or prepaid expenses. Merchandise inventory turnover is the number of times a company’s inventory is sold during a year. The ratio is the cost of merchandise sold divided by the average merchandise inventory. Merchandise inventory turnover should be compared to the industry average and also compared from one period to the next. This ratio will be different for each company because of its inventory valuation method. The faster a company sells its inventory, the more efficient and generally more profitable the business. Accounts receivable turnover is the number of times per year that the business collects the average balance of Accounts Receivable. The accounts receivable turnover ratio is net credit sales divided by average net accounts receivable. The ratio monitors the company’s accounts receivable collection efficiency. Accounts receivable turnover should also be looked at in terms of number of dates the receivables were on the books. This is called Average Number of Days for Payment and is determined by dividing 365 days by the turnover rate. Profitability refers to the ability to earn a profit. Profitability ratios are used to evaluate the earnings performance of the business during the accounting period. Return (Rate Earned) on Common Stockholders’ Equity measures how well a business has used the resources provided by the stockholders. This ratio is net income divided by average stockholder’s equity. Investors compare this rate with other companies to determine the best investment. Return (Rate Earned) on Average Total Assets is net income after federal income tax divided by average total assets. This shows how well a business is using its assets to earn net income. Return (Rate Earned) on Net Sales should be consistent from year to year if costs are controlled well. The rate is found by dividing net income after federal income tax by net sales. Earnings per share of Common Stock measures the amount of profit that can be assigned to each share of common stock. Stockholders and potential investors use this ratio to judge a company’s performance and compare its performance to those of other businesses. Earnings per share is usually reported on the income statement, below the net income amount. Price-Earnings Ratio is used to evaluate the reasonableness of the market price of a corporation’s stock. The price-earnings ratio is the market price per share divided by the earnings per share. Ratio of Stockholders’ Equity to Liabilities is total stockholders’ equity divided by total liabilities. This ratio is used by creditors and managers to evaluate financial strength. Creditors like to see a high ratio. Ratio of Property, Plant and Equipment to Long-Term Liabilities indicates to company’s ability to borrow more money on a long-term basis in the future. It is the book value of property, plant and equipment assets divided by total long-term liabilities. Equity per Share is the amount of stockholders’ equity belonging to a single share of stock. This ratio is total stockholders’ equity divided by the number shares of capital stock outstanding. Equity per share tells stockholders how much ownership of the company each share represents. Equity Ratio is stockholders’ equity divided by total assets. This ratio shows the percentage of assets that are provided by stockholders’ equity. Debt ratio is found by dividing total liabilities by total assets. This ratio shows the percentage of assets that are financed with borrowed capital. UNPACKED CONTENT I. Liquidity Ratios A. Working capital B. Current ratio C. Quick (Acid-Test) ratio D. Merchandise inventory turnover E. Accounts receivable turnover F. Average number of days for payment II. Profitability Ratios A. Return (rate earned) on common stockholders’ equity B. Return (rate earned) on average total assets C. Return (rate earned) on net sales D. Earnings per share of common stock E. Price-earnings ratio III. Financial Strength Ratios A. Ratio of stockholders’ equity to liabilities B. Ratio of property, plant, and equipment to long-term liabilities C. Equity per share D. Equity ratio E. Debt ratio