Transaction Analysis and Preparation of Statements

advertisement

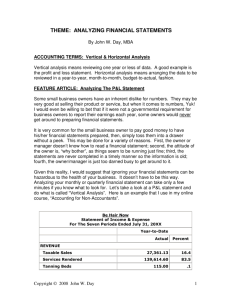

IES342 2/2005 Transaction Analysis and Preparation of Statements Practice Problem Solution (Horngren, Sundem, and Stratton (2002), Introduction to Management Accounting, Prentice Hall, ed 12) 16-A2 (pg 668) 1. See the following page. 2. NAGARAJAN COMPANY Income Statement For the Month Ended April 30, 20X1 Sales (revenue) Deduct expenses: Cost of goods sold Wages, salaries and commissions Rent, 2,000 + 9,000 Depreciation Total expenses Net income $90,000 $37,000 40,000 11,000 1,000 89,000 $ 1,000 NAGARAJAN COMPANY Balance Sheet April 30, 20X1 Liabilities and Stockholders' Equity Assets Cash Accounts receivable Merchandise inventory 23,000 Prepaid rent 4,000 Equipment and fixtures 35,000 Total assets $ 20,000 50,000 $132,000 Liabilities: Note payable Accounts payable Total liabilities Stockholders' equity: Paid-in capital Retained income Total stockholders' equity Total equities $ 24,000 7,000 $ 31,000 $100,000 1,000 101,000 $132,000 3. Most businesses tend to have net losses during their infant months, so Nagarajan's ability to show a net income for April is good. Indeed, the rate of return on beginning investment is $1,000 ÷ $100,000 = 1% per month, or 12% per year. Many points can be raised, including the problem of maintaining an "optimum" cash balance so that creditors can be paid neither too quickly nor too slowly. See the next solution also. 1 IES342 2/2005 NAGARAJAN COMPANY Analysis of Transactions for April 20X1 (in thousands of dollars) Description 1. Incorporation 2. Purchased merchandise Assets = Equities MerPreEquipLiabilities Stockholders' Equity Accounts chandise paid ment and = Note Accounts Paid-in Retained Cash + Receivable +Inventory + Rent + Fixtures = Payable + Payable + Capital + Income +100 = -35 3. Purchased merchandise 4a. Sales b. Cost of inventory sold 5. Collections 6. Disbursements to trade creditors 7. Purchased equipment 8. Prepaid rent 9. Rent expense 10. Wages, etc. 11. Depreciation 12. Rent expense Balances, April 30, 20X1 +25 +15 +35 = +25 = -37 = = = +65 -15 -18 +100 +25 +90(revenue) -37(expense) = -12 -6 -9 -40 +36 +6 -1 -2 +20 +50 +23 +4 +35 ________________________________________ 132 -18 = = = = = +24 = = - 2(expense) +24 +7 +100 +1 __________________________ - 9(expense) -40(expense) - 1(expense) 132 2 IES342 2/2005 16-B1 Balance Sheet Equation (pg 669) Computations are in millions of dollars. A = 4,551.4 - (587.0 +2,114.3) = 1,850.1 B = 3,764.0 + 68.9 = 3,832.9 C = 2,114.3 – 68.9 – 0.0 = 2,045.4 D = 587.0 + 1,331.7 = 1,918.7 E = 2,832.8 + 1,918.7 + 2,045.4 = 6,796.9 16-B2 Analysis of Transactions, Preparation of Statements (pg 670) 2. PACCAR Statement of Earnings For the Month Ended January 31 (in millions) Sales Deduct expenses: Cost of goods sold Selling and administrative expenses Depreciation Total expenses Net earnings $650 $400 190 20 610 $ 40 PACCAR Balance Sheet January 31 (in millions) Liabilities and Stockholders' Equity Assets Cash Accounts receivable Inventories Prepaid expenses & other assets Property, plant, and equipment Total $ 178 5,537 485 876 947 $8,023 Accounts payable Other liabilities Stockholders’ equity $1,784 4,088 2,151 Total $8,023 3 IES342 2/2005 PACCAR Analysis of Transactions for January 2000 (in millions of dollars) Assets Transaction Balances 1/1/00 = Equities Prepaid Property, Exp. & Liabilities Stockholders' Equity Accounts Inven- Plant, & Other =Accounts Other Paid-in Capital & Cash + Receivable + tories + Equip. + Assets = Payable + Liabilities Retained Earnings +528 +5,337 +385 + 967 +716 = +1,734 +4,088 +2,111 1a. 1b. 2. 3. 4. +150 5. 6. 7. 8. -450 -100 Balances, 1/31/00 +500 -400 +500 +300 -250 -300 +250 - 90 - 20 +178 +5,537 +485 +947 +876 ________________________________________ +8,023 = = = = = = = = = +650(increase revenue) -400(increase expense) +500 -450 -100(increase expense) - 90(increase expense) -20(increase expense) = +1,784 +4,088 +2,151 __________________________ +8,023 4 IES342 2/2005 16-34 Balance Sheet Effects (pg 675) 1. The bank's assets (cash) and equities (deposits, a major liability) would each increase by $1,000. Personal assets would change, but equities would not, assuming that the cash on hand had already been recorded as, say, cash on hand (asset) and personal capital (equity). If the latter recording had been made, the deposit would merely represent the transforming of one asset (cash on hand) into another (cash in bank); no equities would be affected. 2. The bank's total assets and equities would be unaffected. The only change would be in the form of assets. Cash would decrease by $800,000, and notes receivable would increase by the same amount. 3. Personal cash (asset) would increase, and personal liabilities (note payable) would increase. 5