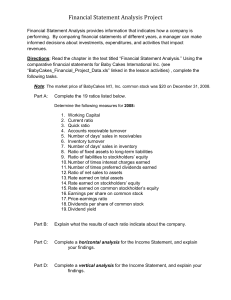

ratio analysis worksheet 2

advertisement

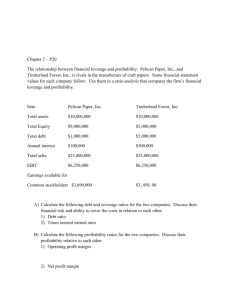

SUMMARY OF ANALYTICAL MEASURES Worksheet 2 Method of Computation Use Solvency measures: Working capital Current assets – Current liabilities Current ratio Current assets Current liabilities Quick ratio Current assets Current liabilities Accounts receivable turnover Number of days’ sales in receivables Net Sales Average accounts receivable Accounts receivable, end of year Average daily sales To indicate the ability to meet currently maturing obligations To indicate instant debt-paying ability To assess the efficiency in collecting receivables and in the management of credit Ratio of fixed assets to long-term liabilities Fixed assets (net) Long-term liabilities To indicate the margin of safety to long-term creditors Ratio of liabilities to stockholders’ equity Total Liabilities Total stockholders’ equity To indicate the margin of safety to creditors Number of times interest charges earned Income before Income tax + interest expense Interest expense To assess the risk to debtholders in terms of number of times interest charges were earned Profitability measures: Ratio of net sales to assets Rate earned on total assets Net Sales Average total assets (excluding long-term investments) Net income + Interest expense Average total assets Rate earned on common stockholders’ equity Net income – Preferred dividends Average common stockholders’ equity Earnings per share on common stock Net income – Preferred dividends Shares of common stock outstanding Price-earnings ratio Dividends per share of common stock Dividend yield Market price per share of common stock Earnings per share of common stock To assess the effectiveness in the use of assets To assess the profitability of the assets To assess the profitability of the investment by common stockholders To indicate future earnings prospects, based on the relationship between market value of common stock and earnings. Dividends Shares of common stock outstanding To indicate the extent to which earnings are being distributed to common stockholders Dividends per share of common stock Market price per share of common stock To indicate the rate of return to common stockholders in terms of dividends