WORKING CAPITAL MANAGEMENT

advertisement

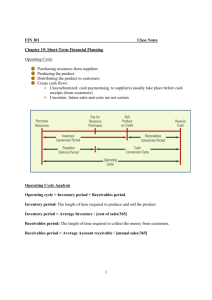

WORKING CAPITAL MANAGEMENT Vanaja M.Varghese 1 What is Working capital? Liquidity available to a business Gross working capital refers to the current assets Net working capital = current assets – current liabilities Working capital – component of the operating capital of the business along with plant and machinery. 2 What are the components? Current assets Cash Accounts receivables Inventory Marketable securities Current liabilities Accounts payable Accrued expenses. 3 Cash conversion cycle Illustration Inventory conversion period = inventory/sales per day Payables deferral period = payables/cost of goods sold Receivables collection period =DSO= receivables/sales. 4 Cash conversion cycle (contd.) Cash Conversion Cycle = Inventory conversion period + Receivables collection period – payables deferral period It indicates the gap between when the firm has spend the money to purchase the production materials and when the firm is able to get that money back. 5 Cash conversion cycle (contd.) The objective of a firm should be to reduce the cash conversion cycle Faster they recover the money- so need lesser working capital – free cash flow Increase the time to pay its suppliers Collect the receivables faster Reduce the inventory conversion period. 6 Why do firms hold cash? John Keynes Firms hold cash for three main reasons Speculation ( trade discounts) Precaution ( inflows uncertainty) Transaction ( payments) Compensating balances - deposits that must be maintained in the banks for the services 7 Cash Budget Projected cash inflows and outflows for a specific period of time. Example of a cash budget Target cash balance can be determined with the help of several models like the Baumol model, Miller and Orrs model etc. 8 Cash Management techniques Cash flow synchronization Timing the receipts of bills – in time for the payments-maintain cash balances to the minimum. Using float Float is the difference between a firm’s book balance and the balance indicated in the banks books 9 Cash Management techniques Float can be of two types Disbursement float The firm pays and thus it is deducted from the firm’s books but not from the banks books. Collection float When the customer writes the cheque it is recorded as received in the firms books but it is still unavailable for use unless the bank clears the cheque. 10 Collection process 11 Managing the float Lock boxes Concentration Banking Mailed to the lock boxes Payments made at the local sales offices, cleared in the local banks and net amount is transferred to the main bank Wire transfers This is direct transfer of funds from the account of one entity to another entity. 12 Inventory management The twin goals of inventory management are To ensure that inventory is available to sustain operations To keep the ordering and holding costs to the minimum. Decisions Lead time Uncertainty in demand Cost of holding inventory Cost of losing inventory Projected sales and availability of raw materials 13 Receivables management Selling on credit essential to cope with the competition. A credit policy Credit period ( 2/10 , net 30 ) Discounts ( discount for early payments ) Credit standards Collection policy ( toughness/laxity) 14 Receivables management Days of sales outstanding time the customers take to pay the bills. Also indicates the average that the company takes to pay their creditors. DOS = Receivables/Sales per day Aging schedules It breaks down the firms receivables by the age of the account. It is developed from the accounts receivable ledger. Aging schedule 15 Receivables management A firm should see to it that the DSO and the aging schedules are working well in comparison with the industry. These need to be reviewed from time to time and kept in control. The credit policy needs to be revised. 16 Accrued expenses It includes the expenses like the wages that needs to be paid to the workers The taxes Cannot be controlled by the firm It expands with the expansion of the firms operations. External forces may it obligatory. 17 Accounts payables 40% of the current liabilities is constituted by accounts payables. Trade credit Smaller companies will have higher trade credit. Trade credit can be divided into two Free trade credit Costly trade credit 18 Short term financing Marketable securities Working capital loans Promissory note – amount borrowed, rate of interest , the repayment schedule, collateral that may be required, terms and conditions. Line of credit – informal agreement between a bank and borrower. Revolving credit agreement – formal line of credit Commercial paper 19 REFERENCES CORPORATE FINANCE by Michael&Eugene CORPORATE FINANCE by Ross Westerfield CORPORATE FINANCE by Meyers 20 THANK YOU 21