Instructions for exam preparation

advertisement

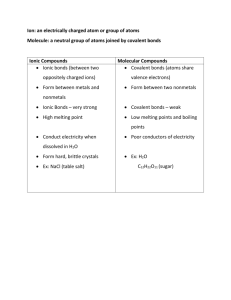

Financial Markets,Regulation and Governance (ECONS 528) Instructions for exam preparation 1. There will be three categories of questions - Concepts and Definitions. It tests your knowledge and understanding of key concepts and regulations covered in the course. You will have 10 questions to which you must answer in one or two lines, as specified in the question. Examples of question: Define “security” o Answer: it is a negotiable instrument that carries rights vis-a-vis the issuer (of bonds, shares or funds - What is “fungibility of an asset” o Answer: characteristic of a depository agreement where the depository must return, not the same certificate (with same serial number), but with an asset wit the same characteristics and same value. - What is the 40% rule in (Basel III, UCITS and AIFMD) regulations regarding the compensation of bankers and fund managers? o Answer: at least 40% of the variable compensation must be paid in shares of their own company. - Analysis. - It evaluates your capacity to analyse subjects and trends across different topics. Example of question: You are a regulator considering whether to modify the current set of regulations applicable to hedge funds. What are the key failures that you seek to address and how would you do it? What are the potential unintended consequences that this regulatory tightening could have and how would you seek to minimize them? - Reflexion. It checks your transversal understanding of themes that were covered in the course and assesses your ability to bring together different concepts and trends. Example of question: You are the Chief Financial Officer of a bank and the CEO asks you to evaluate the pros and cons of three different market instruments, such as bonds, covered bonds, and repos. You must identify the pros and the cons by reference to the characteristics of the instruments. 2. Analysis and reflexion questions. ALL slides are potentially relevant (except annexes). You should re-read ALL OF them. 3. Knowledge question Attention: For the Knowledge question - you do not need to know anything that is in an “Annex” section or in a slide that states “Annex” in the heading even in the slides listed below. - you do not need to know graphs or figures (e.g., statistics, size of markets, etc), examples, EVEN in the slides listed below. - you do not need to know slides OTHER THAN those indicated below. Chapter Chapter I Chapter II-Part 1 Chapter II- Part 2 Chapter III Chapter IV Chapter V Chapter VI Chapter VII Direct Financing and Shadow Banking Financial regulation Typology of Risks Evolution of Banking Model Causes of 2007 Financial Crisis General Shares Bonds Funds Derivatives Money Market Funds Repos Securitisation CDS Covered Bonds Banks Banking Regulation – Basle III Banking Regulation - BRRD Investment Banks Asset Management Hedge Funds Private Equity Infrastructures Need to study for Knowledge Questions 18-46 71-78 105-110 29-51 5-22 6-20 28-34 and 45-47 50 and 60-65 67-71 93-94 , 98-103, and 111-115 9-18 and 25-27 30-48 57-76 94-96 and 100 103-108 and 114-115 5-8 95-111 123-135 and 127 8-22 and 30 63 and 71-74 79-80 and 85-87 92 and 97-102 5-37 4. Exercises You will not be asked about the subjects covered in the Exercises in the Knowledge question. But you should read the papers submitted by the teams Exercises, as it may well be relevant to fully answer the Analysis or Reflexion questions. GOOD LUCK. December 2015