Study Guide - made by a student

advertisement

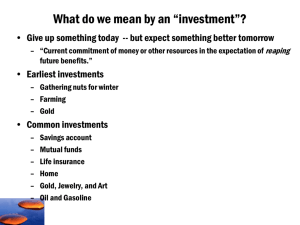

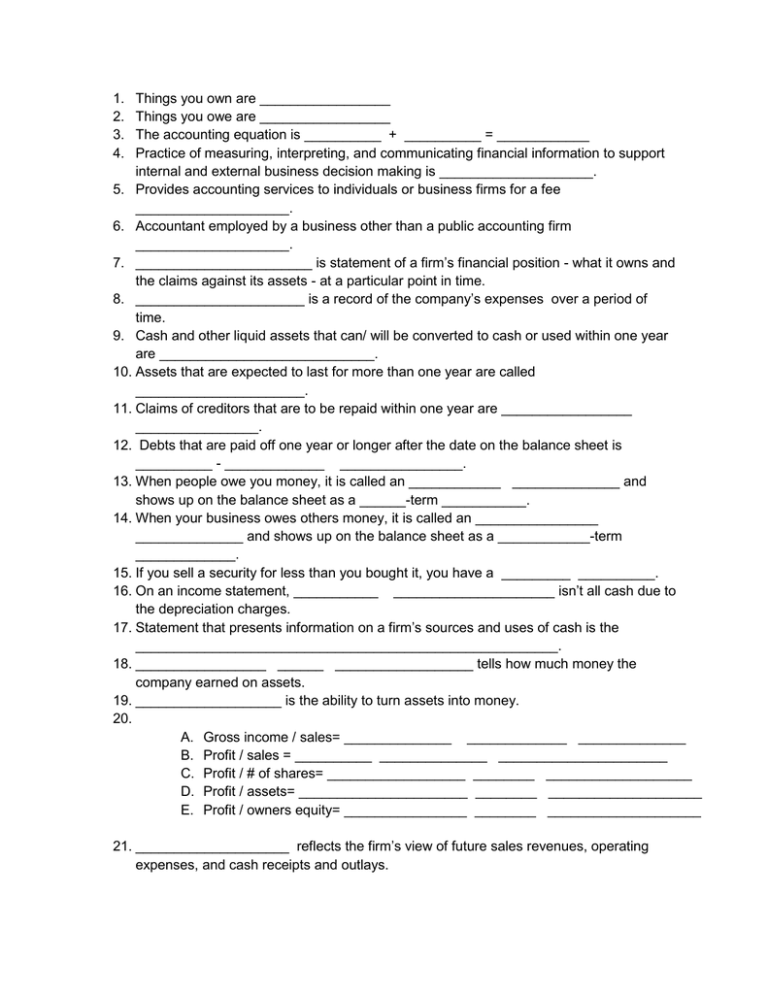

1. 2. 3. 4. Things you own are _________________ Things you owe are _________________ The accounting equation is __________ + __________ = ____________ Practice of measuring, interpreting, and communicating financial information to support internal and external business decision making is ____________________. 5. Provides accounting services to individuals or business firms for a fee ____________________. 6. Accountant employed by a business other than a public accounting firm ____________________. 7. _______________________ is statement of a firm’s financial position - what it owns and the claims against its assets - at a particular point in time. 8. ______________________ is a record of the company’s expenses over a period of time. 9. Cash and other liquid assets that can/ will be converted to cash or used within one year are ____________________________. 10. Assets that are expected to last for more than one year are called ______________________. 11. Claims of creditors that are to be repaid within one year are _________________ ________________. 12. Debts that are paid off one year or longer after the date on the balance sheet is __________ - _____________ ________________. 13. When people owe you money, it is called an ____________ ______________ and shows up on the balance sheet as a ______-term ___________. 14. When your business owes others money, it is called an ________________ ______________ and shows up on the balance sheet as a ____________-term _____________. 15. If you sell a security for less than you bought it, you have a _________ __________. 16. On an income statement, ___________ _____________________ isn’t all cash due to the depreciation charges. 17. Statement that presents information on a firm’s sources and uses of cash is the _______________________________________________________. 18. _________________ ______ __________________ tells how much money the company earned on assets. 19. ___________________ is the ability to turn assets into money. 20. A. Gross income / sales= ______________ _____________ ______________ B. Profit / sales = __________ ______________ ______________________ C. Profit / # of shares= __________________ ________ ___________________ D. Profit / assets= ______________________ ________ ____________________ E. Profit / owners equity= ________________ ________ ____________________ 21. ____________________ reflects the firm’s view of future sales revenues, operating expenses, and cash receipts and outlays. 22. Many financial managers invest the majority of their firms’ excess cash balances in marketable securities such as: 1. _______________________________________ 2. _______________________________________ 3. ______________________________________ 4. _______________________________________ 23. ___________________________________ is the “risk free” asset. 24. ______________________________________________ loans banks money for the banks to loan out for higher interest rates. 25. __________________________ _________________________ is when a company sells an asset with the intention to purchase it back with interest after a specified time period. The company will still get the asset back if the company goes out of business. 26. ___________________-__________________ sources of funds are repaid within one year; examples are: a. _________________ ________________ b. _________________ ________________ c. _________________ ________________ 27. _______________________ ___________________ sources of funds are repaid over many years and consist of: a. _________________ ________________ b. _________________ c. _________________ ________________ 28. __________________ are certificates of indebtedness sold to raise long-term funds for a corporation or government agency. (fixed income; no ownership) 29. __________________ ____________________ is acquired by selling stock in the company or reinvesting company earnings. (stock; ownership of business) 30. Making money by using money borrowed from other people is called _______________. 31. Things you invest in are called _____________________. Examples are: a. _________________________ b. _________________________ c. _________________________ 32. _________________ _________________ is the percentage of your assets in each asset class. State if the risk and return is high, moderate, or low: ASSET CLASSES RISK CASH 33. BONDS 35. STOCKS 37. RETURN 34. 36. 38. 39. U.S treasury, Commercial Papers, Repurchase agreements, and Certificates of Deposit are examples of what asset class?________________________ 40. Interest rates for bonds are based upon expected ______________ and default risk. 41. Types of Bonds are: A. ___________________________________ B. ___________________________________ C. ___________________________________ 42. When interest rates increase; bond prices __________________. 43. Bonds that are tax free and pay for cities, roads, and buildings are _______________________. 44. Bonds issued by businesses are called ___________________________________. 45. Bonds issued by governments with a promise to pay but no revenue stream are called __________________________________. 46. _____________________________________ shows interest rates over time and is the market’s prediction of future inflation. 47. Three major categories of securities (asset classes) are: A. _________________ B. _________________ C. _________________ 48. Types of equities: A. _________________ _________________ B. _________________ _________________ C. _________________ _________________ 49. _______________________ stock shares the ownership in a company and allows the owners to vote on major company decisions. Also has optional dividends. 50. ________________________ stock allows their holders to receive preference in the payment of dividends, but have no voting rights. 51. _____________________________________________ gives the holder the right to exchange their securities for a fixed number of shares of common stock (money). 52. _________ is the largest stock exchange. 53. ____________ is the stock market for many technology companies. 54. A ________________ _______________ is the centralized marketplace where primarily common stock is traded. 55. __________________ ___________________ is the trading on information that you know only because you or someone you know works at a business. 56. _______________________ __________________ is the financial intermediary that buys and sells securities for individual and institutional investors. 57. __________________ _________________instructs a brokerage firm to obtain the highest price possible at that moment – if the investor is selling – or the lowest price possible at that moment – if the investor is buying. 58. __________________ _________________ instructs the brokerage firm not to pay more than a specified price for stock if the investor is buying, or accept less than a specified price if the investor is selling. 59. _______________ _________________ _______________ is an indicator of the expected growth of a company. 60. _______________________ _________________ is when the financial institution pools investment money to acquire diversified portfolios of securities consistent with the fund’s investment objective. 61. _____________ funds have a charged fee to buy and sell a stock 62. ________________ funds have no fee.