here - Postinitial

advertisement

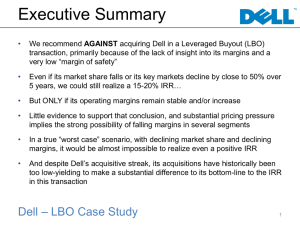

General Course Information Course Title How do LBO’s work? Course Description Explore the principles of a Leveraged Buy-out (LBO) transaction. In this 80minute course you’ll learn about the key characteristics of LBO’s, get an overview of the financing instruments used in structuring deals, get a grasp of the main drivers of the IRR and learn more about the sources and uses fund statement. Learning Goals By the end of this course you know enough to structure an LBO on headlines and you’ll have a firm basis to learn more about advanced LBO topics, like mezzanine financing, cum. prefs., cash sweeps, envy ratio’s, and so on. Target Audience This course is perfect for first and second year analysts active in M&A and Private Equity, who are familiar with LBO’s but haven’t completed an LBO transaction yet. Time effort Learner Videos 30 min. Quizzes 10 min. Case 30 min. Exam 10 min. Challenge Title Structuring the Deal LBO Style Baby! Heehaa Description Challenge Create a sources and uses statement for the acquisition of a Mexican fast food chain by a PE fund from Texas. Your firm is approached by a Texan PE fund that is looking to acquire a Mexican fast food chain in a leveraged buy-out transaction. They have received a number of term sheets from banks and they need your help in figuring out how they would finance the deal. Deliverable Upload your sources and uses statement in Excel and a short video discussing your result. A finished challenge should have a balancing sources and uses statement, including all the items, used in the financing package. Course Elements Course element Title Content type Length in min. Talking Points & Key Concepts Video Course Introduction (Shown on course overview page) Talking Head 1 ● Young professional not familiar with LBO’s, is asked by a senior to work on a LBO transaction. ● I am a Sr. professional advised on a wide range of LBO transactions. ● In this course we are going to cover: ● LBO Characteristics ● LBO Modeling principles ● Sources and Uses Video Structuring the Deal LBO Style Baby! Heehaa Talking Head, Slides 2 ● A senior explain that your firm is asked by a crazy Texan PE Boss to pitch for an acquisition of a Mexican fast food chain. ● He asks you to setup a deal structure and complete the sources and uses table. Open question 2 ● Which steps would you take to solve the problem? Quiz Video Introduction Talking Head, Slides 1 ● ● ● ● Video LBO definition Talking Head, Slides 4 ● Definition of an LBO ● Characteristics PE firms look for ● Main sources LBO targets Video Typical LBO structure Talking Head, Slides 2 ● Legal structure of a typical LBO Quiz To acquire or not to acquire? MC questions 1 ● What do PE firms look for? ● Contains two hints and an explanation of the answer Video LBO Basics Talking Head, Slides 2 ● Simple financial structure LBO ● IRR targets Video Return Opportunities Talking Head, Slides 2 ● How do PE firms create value? Quiz What’s our return? MC question 1 ● Calculate the IRR for a PE deal Video Main sources of funding Talking Head, Slides 2 ● How are PE transactions funded ● Main characteristics of funding Video Capital structure over time Talking Head, Slides 2 ● Development of Equity / debt funding ratios for LBO’s over time. Quiz How much equity do we put in? MC question 1 ● What are the factors determining the amount of equity in the financing structure? Topics discussed in this course: LBO Characteristics LBO Modeling principles Sources and Uses Video Structuring Parameters Talking Head, Slides 2 ● Key parameters you have to assess when structuring a LBO and effect on IRR ● Business plan, Purchase price, Funding structure, Management package, Exit strategy Video Sources & Uses Talking Head, Slides 2 ● Key items in sources & uses ● How do they balance Video Funding structure Talking Head, Slides 2 ● Example funding structure and returns of LBO including management package Quiz Maximizing returns MC question 1 ● What are the key drivers of IRR? Video Structuring the Deal Talking Head, Demonstration in Excel 6 ● Discussion of how to go from a closing balance sheet and a deal structure to a sources and uses statement. ● Goal is to provide the learners with a mental framework for solving the challenge. ● Give an example of wrong solution and a “right” solution. Video Structuring the Deal LBO Style Baby! Heehaa Talking Head, Slides 2 ● Texan PE Boss skipped the senior because he knows you are the one who does the work anyway. ● He asks you to structure the deal, given a certain financing package. ● And he wants it in 30 min. Challenge Structuring the Deal LBO Style Baby! Heehaa Excel file 20 ● The learner gets a closing balance, a purchase price and a financing package ● Goals is to prepare a sources and uses statement. ● Asks learner to post his / her solution on the forum and tick a box. ● After submission learner sees the model solution and is asked to grade the challenge Video Challenge Solution Talking Head, Slides 4 ● Discussion of a model sources and uses statement and degrees of freedom. Video Final Thoughts Talking Head, Slides 2 ● ● ● ● Quiz Open question 1 ● Review answer to the open question answered in the beginning of the course Exam MC questions 10 ● 5 x MC questions Lesson summary: Characteristics LBO candidates Modeling parameters Sources and Uses