Finance Interview Prep Workshops November 3

advertisement

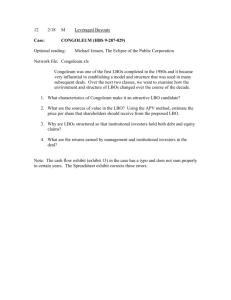

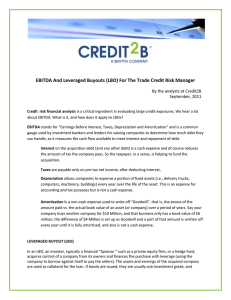

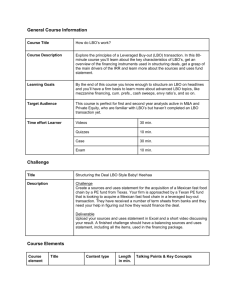

Finance Interview Prep Workshops November 3 - 22 In partnership with the Joshua Jia Jules Koifman | CEO / Instructor | Instructor Limestone Capital 1 Our Mission “…Provide an educational experience for students seeking employment in the financial services sector by offering weekly interview prep sessions, tutorials on financial analysis, valuation techniques, and sector research…” Background Situation Solution Implementation Present Situation 2 Inaccessible Interview Resources • • • Marquee workshop is focused on basics, not enough for Bulge Bracket interview Finance attracts interest from many students, but can have high barriers to entry Purchasing finance resources is expensive Breaking Into Wall Street modules, 4 modules, $197 each Investment Banking Institute, a popular workshop in Toronto, costs $2,000 Accounting 16% Class of 2011 Job Acquisition Statistics. Queen’s Commerce 2011 Annual Report. 27% 14% Marketing, Sales, Advertising Finance 19% 24% Consulting Other Background Situation Solution Implementation Limestone Capital Offering 3 Finance Interview Preparation Workshops 6 Sessions: Saturdays at 4 p.m., Thursdays at 7 p.m.: November 3 – November 22 1. 2. 3. 4. 5. 6. Comparables Analysis and Precedent Transactions Discounted Cash Flows and Accounting Mergers & Acquisition (M&A) Leveraged Buyouts (LBO) Market Questions Fit / Deals / Networking Rationale • • • • Candidates differentiate themselves by knowing hard M&A and LBO questions Queen’s needs to offer comprehensive resources to continue being competitive Further Queen’s Commerce’s reputation as a career-minded institution Eliminate perception that Ivey offers superior opportunities in finance Background Situation Solution Implementation Session Instructors 4 Joshua Jia Barclays, Investment Banking Summer Analyst, Toronto, Ontario • • • • • Built precedent transactions valuation for the $414 mm Yamana-Extorre acquisition Compiled and analyzed financial data in the $1.1 bn BCE-Q9 acquisition Analyzed financials of potential buyers, worked on live sellside mandate from start to finish Projected financials in LBO model for a live ~$10 bn acquisition Created an LBO model on a $7+ bn infrastructure company for a pitch Jules Koifman RBC, Investment Banking Summer Analyst, Toronto, Ontario • • • Worked on a variety of live M&A deals in the mining and diversified sectors Created model for a pitch in the CMT industry Worked on investor presentation for Standard Life’s first debt issue in Canada ($400 mm) JCM Capital, Project Analyst, Toronto, Ontario • • Built financial models for a $150 million portfolio composed of multiple solar energy projects Wrote three investment proposals to potential investors totalling $60 million in development and construction capital Background Situation Solution Implementation Conclusion 7 Finance Interview Preparation Workshops • “Preparing for finance recruiting isn’t just skimming The Vault anymore. Students should study for recruiting like a course and do their homework, because the final exam is the interview.” – VP at RBC, recruiter for Queen’s • Like a course, there should be: “Homework:” regular readings are necessary Practice (mock interviews) Comprehensive, accessible resources for all interested students • The most important “exam” of any Commerce student’s life • Budgetary needs are modest, but partnership with Commerce Society is key • Uniquely positioned to offer comprehensive course Experience is the best teacher Background Situation Solution Implementation Session One 9 Comparables Analysis and Precedent Transactions Material includes: mechanics of Enterprise Value and multiples, comparables and precedent valuation, advantages and disadvantages of different methods • If Company A and Company B have the exact same financials and are in the exact same line of business, why might they have different EV/EBITDA multiples? • If you have a P/E of 10x and a cost of debt of 10%, what consideration would you use to finance a transaction? • What happens to P/E if the company issues debt to buy back stock? Background Situation Solution Implementation Session Two 10 Accounting and Discounted Cash Flows Material includes: transactions flowing through the three financial statements, accounting for NOLs / deferred tax assets, DCF valuation, treasury stock method, unlevering and relevering beta • How does purchasing $100 of equipment with 50% debt affect all three of your financial statements? What about a dividend recap? • How do you value an NOL? • Will discounting levered free cash flows vs. discounting unlevered free cash flows give you the same enterprise value, and why? Background Situation Solution Implementation Session Three 11 Mergers & Acquisitions Material includes: stock vs. cash transactions, merger modeling, shortcuts for calculating accretion/dilution, calculating goodwill, synergies, M&A deal process, pitching M&A deals • Walk me through a merger model. • What is the shortcut to calculating if a deal is accretive or not in an all-stock deal? Allcash deal? • Walk me through a typical M&A buyside process. Background Situation Solution Implementation Session Four 12 Leveraged Buyouts Material includes: LBO modeling, balance sheet adjustments in an LBO, shortcuts for calculating IRR, mechanics of an LBO, ideal LBO candidates, pitching LBO deals • Walk me through an LBO. • Would you rather do an LBO on a copper mine, or a cobalt mine? • Would you rather have Senior Debt / Assets as a covenant, or EBITDA / Interest Expense? Background Situation Solution Implementation Session Five 13 Market Questions Material includes: structuring macroeconomic answers, pitching stocks (both long and short), walking through investment strategies, answering S&T questions • Pitch me a stock. • If I gave you $10 million, how would you invest it? • Where do you think the price of oil is going in the next 6 months? Background Situation Solution Implementation Session Six 14 Fit, Situation, Deals Material includes: how to answer the first three standard fit questions, how to answer difficult situational questions, how to talk about deals • How to master the “Walk me through your resume,” “Why this firm?” and “Why investment banking/S&T/finance?” questions • It’s 5:15 a.m. and you’re in the office. The printer just broke and your MD is at the airport, waiting for a flight to Montreal for a client meeting. The flight leaves in 30 minutes. He has no pitchbook, and is waiting for you to give it to him before the flight takes off. There are no working printers nearby. What do you do? • Tell me about a deal our firm has done in the last 6 months. Background Situation Solution Implementation