Discussion

advertisement

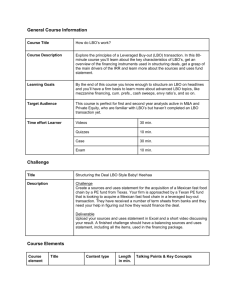

The evolution of capital structure and operating performance after LBOs: Evidence from US tax returns Cohn, Mills, and Towery UBC Winter Conference, 2011 Motivation • Difficult to study what happens after firms go private—No longer file financial statements. • Existing evidence largely based on: – Firms with public debt outstanding. – Firms that exit (provide some backward looking data). • Firms do have to file tax returns! – Unique access to tax returns allows for a more complete view. Questions addressed • What are the real and financial effects of LBOs? – Real Effects: • Do better incentives provided by concentrated ownership and disciplining effects of debt lead to better operating performance? – Financial Effects: • How does leverage evolve after the LBO – Temporary versus permanent effects on capital structure. – Tax implications. LBO Trends Axelson et al. (2009) Answers Answers What should one expect? • Practitioners talk about three sources of gains in LBOs. – Deleveraging. – Multiples expansion. – Operating Improvements. – Generally target >20% IRR to LP’s. Deleveraging Year 0 100 1 100 -100 2 100 -100 3 100 -100 4 100 -100 5 100 -100 Debt Levels 750 650 550 450 350 250 FCF Multiple 10 10 10 10 10 10 1000 -750 250 1000 -650 350 1000 -550 450 1000 -450 550 1000 -350 650 1000 -250 750 Free Cash Flow Debt Repayment Enterprise Value Less Debt Equity Value IRR 24.57% Multiples Expansion Year 0 100 1 100 0 2 100 0 3 100 0 4 100 0 5 100 0 Debt Levels 750 750 750 750 750 750 FCF Multiple 10 11 12 13 14 15 1000 -750 250 1100 -750 350 1200 -750 450 1300 -750 550 1400 -750 650 1500 -750 750 Free Cash Flow Debt Repayment Enterprise Value Less Debt Equity Value IRR 24.57% Operating Improvements Year 0 100 1 110 0 2 120 0 3 130 0 4 140 0 5 150 0 Debt Levels 750 750 750 750 750 750 FCF Multiple 10 10 10 10 10 10 1000 -750 250 1100 -750 350 1200 -750 450 1300 -750 550 1400 -750 650 1500 -750 750 1100 10.0% 1210 9.9% 1330 9.8% 1460 9.6% 1600 9.4% Free Cash Flow Debt Repayment Enterprise Value Less Debt Equity Value IRR Assets ROA 24.57% 1000 10.0% LBO Value Creation Comments • Paper would benefit from some structured hypotheses. – Jensen’s Free Cash Flow. • Decrease in investment and increase in profitability. – Underleverage. • Permanent increase in leverage. – Debt used as a transaction mechanism. • Transitory increase in leverage. Why do firms go private? Comments • Need for some better comparisons to existing studies. – Mainly regarding how the tax data compares to Gaap financials. – Would be useful to compare your measures versus the gaap data pre-LBO and then during the LBO for the sample of public debt users. • EBIT versus EBIAT. – I think you actually report earnings before interest after tax. Axelson et al. (2009) Hotchkiss et al. (2010) This paper This Paper Means Debt EBITDA Interest Total Assets Int Cov Debt/EBITDA D/A Asset Growth Pre (t-1) Post (t+2) 446.60 749.20 26.90 52.40 17.70 45.50 679.00 897.10 1.52 1.15 16.60 14.30 0.66 0.84 0.32 Incentives and Performance Improvements (Oyer and Leslie) – Difficult to observe counterfactual. – Significant Heterogeneity. Leverage changes • If this is an optimal capital structure why can’t public firms replicate this? – If the tax benefits are so large??? – What is special about the LBO structure to support so much debt? • Debt overhang? • Ability of sponsors to minimize risk/reduce bankruptcy costs? • Private versus public? – Reduce leverage again after an IPO. Are LBOs Underlevered? Axelson et al. (2009) Why isn’t leverage decreased? Oyer and Leslie Increase in leverage is not permanent. Comments • This does not look like Jensen’s free-cash flow hypothesis. – Higher incentives and debt curtail wasteful spending by managers and focus attention on cash flow generation. • • • • No substantial operating improvements. Significant asset growth. Financed largely by debt. Why does interest coverage hardly change despite increased debt? Is Asset Growth From Cash? Kwik Fit LBO Conclusions • • • • Observe LBOs throughout the lifecycle. How does the data compare to Compustat? More direct tests of hypotheses. Heterogeneity in LBOs. – Underleveraged prior to LBO? – Free cash flow problems? – Overinvestment?