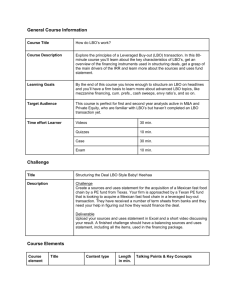

transaction framework 2

advertisement

Transaction Framework Joseph V. Rizzi March, 2013 Transaction Framework Strategic Issues • Do I make the acquisition? Valuation • How much do I pay? Tactics • How do I make the offer? Financing • How do I pay? Integration • Implementation of acquisition 2 Transaction and Structuring Overview Creditors Rights Regulatory and Antitrust Contract Business Plan Market Conditions Deal Accounting Transaction Characteristics Securities Financial Preferences Corporate Law Tax Competing Bidders 3 Transaction and Structuring Overview Creditors Rights Regulatory and Antitrust Contract Business Plan Market Conditions Deal Accounting Transaction Characteristics Securities Financial Preferences Corporate Law Tax Competing Bidders 4 Summary of Complicating Factors Competing Bids Size Financial Strength Dilution Analysis Strategic Fit Tax Capital Gains to Seller WHT on divs and int Basis NOL’s Interest deductibility Tax treaties Consolidation Exit planning Rating Agencies Regulatory Contract Form Consideration Pricing Conditions Repos and Warranties Indemnities Change of Control Covenants Securities Notice S/H Vote Tenders Preemption Rights Triggers Bankruptcy Framework (Inter-creditor Concerns) Subordination Guarantees Corporate Notice Percent by Region/State Lock-Up/Break Up Fee/No Shop Pills/Defenses Merger/Consolidation Antitrust Hart/Scott/Rodino Sherman Act HHI European Commission Monopolies & Mergers Commission Accounting Goodwill Fair Market Value Net Worth Consolidation 5 Complex Corporate Structure Equity Equity #1 Equity #2 European Holding Company United States Holding Company Preferred Stock NEWCO High Yield/Sub Notes Bank Deal with Upstream Guarantee Collapsed After Closing United States Target Guarantee Due to the structural nature of Subordination in Europe, bank Debt would be placed at the Operating subsidiary level. Domestic Operating Subsidiary Domestic Operating Subsidiary Domestic Operating Subsidiary Foreign Operating Subsidiary* * Tax limitations surrounding guarantees from foreign subs. 6 Structure of an LBO Transaction Players LBO financing package LBO funds (1) Equity 30% Target company (2) 100% = 30 (equity) + 70 (debt financing) Debt financing 70% Banks Senior debt 60% CLO Debt financing 70% Hedge funds Second lien loans 5% Mezzanine funds Subordinated debt 5% Public Markets High Yield, PIK Leverage effect =debt/EBITDA =70/12 =5.8 (EBITDA 12%) 7 LBO Fund US Investors Exempt US Investors Non US Investors (1) LBO fund LP A General Partner LP B LP C Fund I Investment A Investment B Investment C Target (2) Target Holdco I Holdco II OPCO 8 Negotiated Cash Merger Timeline HSR Review Period (30 Calendar Days) Pre-Commencement Day 1 Calendar Calendar Calendar Calendar Period (1 Week) Week 2 Day 10 Day 20 Day 30 Day 40 •Engage Investment Bankers • Prepare Merger Agreement, Stockholders Agreement & HSR Premerger Notification • Due Diligence • Fairness Opinion Issued and Boards Approve Merger Agreement • Arrange Financing • Determine Structure (Tax, Accounting, Form, Consideration) • Sign Merger Agreement & Stockholders Agreement • File HSR Premerger Notification • Commence Preparation of Preliminary Proxy Materials (Schedule 14A) • Issue Press Release • File 8Ks and Schedules 13D • File Preliminary Proxy Materials (Schedule 14D) with SEC • Print and Mail Proxy Materials To Target Stockholders (Assumes Definitive Proxy Materials Are Available) • HSR Waiting Period Expires, Assuming No Second Request • Target Stockholder Meeting Week 7 • Close Merger 9 Auctions and negotiations differ on five dimensions Negotiation Auction Competition Low or no competition unless target and buyer can convince each other that they have strategic alternatives to a negotiated transaction (e.g., LBO, liquidation, etc.) Highly competitive Structure Few rules and deadlines. Some uncertainty about whether target will be sold at all. Clear rules and deadlines. Strong probability that the target will be sold. Controlled by target management. Social issues important. Independent directors control. Price important. Flexibility High Low Speed Slow Fast Goals and control Robert F. Bruner, Copyright © 2007, Used by Permission 10 Due Diligence • Making sure you get what you thought you were getting – Legal – Contingencies: ABB – – Accounting: McKesson/HBOC Business Typical violations of U.S. GAAP include: – Recording revenues that are fictitious, unearned, or uncertain – Recording fictitious inventory – Improperly capitalizing costs – Licenses Violators tend to be smaller (by sales and assets), more leveraged, and faster growing. – Employment Warning signs include: – Leases – EPA – Earnings Revisions Study (Messod D. Beneish) Etc. – Increase in days receivables – Decrease in gross margin – Increase in percentage of total assets represented by assets other the PP&E. – Comparatively hgh rate of sales growth – Increase in percentage of total assets represented by accruals. 11 Issues in Structuring a Deal • Goal of deal structure should be to maximize value – but different parties have different objectives. • Some Buyer Shareholder Objectives: – Minimize after-tax price paid for the acquisition – Minimize the dilution of their pre-merger ownership stake • Some Seller Shareholder Objectives: – Maximize after-tax price received – Minimize risk of the offer (for a given dollar value of the deal) 12 Issues in Structuring a Deal • Goal of deal structure should be to maximize value – but different parties have different objectives. • Some Buyer Shareholder Objectives: – Minimize after-tax price paid for the acquisition – Minimize the dilution of their pre-merger ownership stake • Some Seller Shareholder Objectives: – Maximize after-tax price received – Minimize risk of the offer (for a given dollar value of the deal) 13 Deal Terms • Price • Form of Transaction • Form of Payment • Control and Governance • Social Issues • Timing and Deadlines • Transaction Hedges 14 Deal Terms - Price • Price – Tends to be the focus, but is linked to virtually all other deal terms as well as a number of external influences – Influenced by – Economic cycle – Premiums are higher in buoyant stock market conditions – Current target stock price – Comparable deal premiums 15 Interplay of Price and Range Financial Terms Buyer’s Max Terms Seller’s Min Terms Non-Financial Terms 16 Price/Premium Paid • Does the price/premium paid really matter if the acquirer is offering its own stock to pay for the deal? • Time Warner – AOL 17 Deal Terms – Form of Transaction • Form of Transaction – Influencing Factors – Taxable or Tax Deferred – What are the tax consequences for buyer and seller? Is seller subject to double taxation? – Risk Exposure – Does the structure isolate the hidden liabilities of the target? – Control – Will it require a vote of S/Hs of the target and/or buyer? How will voting control be affected? – Continuity – Which, if either firm will survive? What are the implications for ability to assign leases & licenses, for corporate identity, and for stat of incorporation – Strongly linked to Form of Payment 18 Deal Structure: Stock vs. Asset Purchase Stock Purchases Asset Purchases Advantages Disadvantages • Avoids double taxation • Higher net proceeds to seller shareholders • Less documentation • Risk fo unknown liabilities • No future tax savings • Buyer avoids unknown liabilities • Possible step-up of asset tax basis • Seller keeps identity • Buyer loses seller’s NOLs and tax credits • Rights to licenses, franchises, patents are not transferred • Double taxation 19 Deal Structure: Stock vs. Asset Purchase Stock Purchases Asset Purchases Advantages Disadvantages • Avoids double taxation • Higher net proceeds to seller shareholders • Less documentation • Risk fo unknown liabilities • No future tax savings • Buyer avoids unknown liabilities • Possible step-up of asset tax basis • Seller keeps identity • Buyer loses seller’s NOLs and tax credits • Rights to licenses, franchises, patents are not transferred • Double taxation 20 A Note About Taxes • Tax factors are significant in some mergers (<10% of mergers) • Tax effects not the main motivation for mergers • Tax effects that are seen in mergers could generally be replicated by a stand-alone firm changing its own leverage or engaging in an asset sale/leaseback transaction 21 A Note About Taxes • Tax factors are significant in some mergers (<10% of mergers) • Tax effects not the main motivation for mergers • Tax effects that are seen in mergers could generally be replicated by a stand-alone firm changing its own leverage or engaging in an asset sale/leaseback transaction 22 A Note About Taxes Tax Consequences (after-tax proceeds) Riskiness Of Future Cash Flows (creditworthiness) Form of Transaction Price, & Form of Payment EPS Consequences (manager/investor perceptions) Ownership Claims (dilution) 23 Deal Terms – Form of Payment • Payments to Target Shareholders – – Fixed payments (cash or senior debt) – resolves target S/H uncertainty about deal value Contingent payments (mezzanine or “junk” debt, preferred, or common equity, earn-outs, convertibles, caps, floors & collars) – allows target S/Hs to participate in upside potential, resolve strong disagreements about target value, and limit post announcement adverse stock price movements • Side Payments – Payments to other stakeholders that may influence the success of the post-merger firm (golden parachutes, buyouts of employments contracts, consulting commitments to target management) 24 Method of Payment Type Characteristics of deal Cash • Target shareholders exchange for cash • Typically taxable transactions Stock • Firms negotiate a ratio of acquirer shares to exchange for target • Market risk high – target shareholders lose when acquirer stock fails Stock with collar • 25% of stock deals use collars to lower risk • Many types of collars: – Specify dollar amount of stock exchanged – Fixed dollar amount within a max and min – Fixed stock ratio within a max and min 25 Contingent Payments • Earnouts and contingent payments in mergers (used in 2.5% of deals) – Payment based on future performance of target – Provides incentive for owner-managers to stay with acquirer – Mostly used to buy small firms with key employees (high tech, service, etc.) – Problem: hard to measure in post-merger performance (high frequency of lawsuits) 26 Other Deal Terms • Control & Governance – Relative proportions of share ownership and voting rights, composition of the new board • Social Issues – Identity of executive management team, corporate name, headquarters location • Timing and Deadlines – Time value of money impact on valuation and ability to structure postmerger integration efforts • Transaction Hedges – Walk-away fees 27 Documentation • Confidentiality Agreement • Letter of Intent – Exclusive – Nonexclusive • Acquisition Agreement – Reps and Warranties – Conditions 28