Structuring a LBO

advertisement

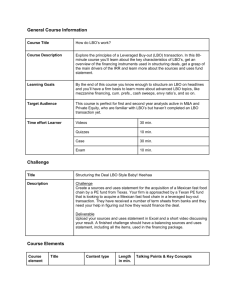

Structuring a LBO Olivier Levyne Principle • In the case of an industrial purchase, the multicriteria valuation the firm is the first step… • … before any analysis of the financial consequences of such a transaction • In a LBO transaction, the valuation of the firm is the outcome of the structuring the firm has a specific value in a LBO context Valuation of the firm in a LBO context Target Holding 100% Value of Assets Equity value of the target Equity (H) Shares of the target Financial leverage Debt (H) Debt • It is the maximum price that can be paid by the ad hoc holding the financing of which is twofold: – Debt financing, ie long term loan granted by banks – Equity financing, ie capitalisation by private equity funds Debt financing • Maximum debt that can be repaid by the holding, provided that its net cash balance (ie cash and cash equivalents – overdrafts) is always positive – Otherwise, it would mean that the holding has to run into debt before the end of the LBO which would constitute a breach in one of the covenants • When the LBO is structured, the cash balance is equal to 0, as the whole cash is invested in the target’s shares. • Then, its cash balance is changed by the cash flows generated at the holding level • If the cash (ie the net cash balance) becomes negative, it means that the firm has to use overdraft to face its financing needs ie a new indebtedness is required Holding P&L • • • Dividend received from the target Tax received from the target (Tax paid) _______________ Net profit As it is an adhoc holding, it has no assets other than the target shares and cash (and potentially intangibles such as transaction costs which have been activated) For this reason, its main income is the dividend paid by the target. Moreover, for tax optimization purpose, the target and the holding are tax consolidated: – The interests paid by the holding are tax deductible – But the holding has no taxable income because the dividends are tax free (except for 5% of the amount received). Then, the deductibility of interests can not be used, whereas the target has taxable profits – The tax consolidation enables the use the deductibility of the interests paid on the acquisition debt. Then, the tax saving enables to increase the cash flows of the holding and therefore the amounts of debt repayments – From a practical point of view, the target and the holding sign a tax agreement whereby: • The target pays to the holding the tax which should have been paid to the Tax Authority • The holding pays to the Tax Authority the corporate tax based on the consolidated income for the whole tax group Holding cash flow • The Holding cash flow can be directly derived from the net income Net profit + Depreciation (ie: 0) Amortization Capex (ie: 0) D WCR (ie: 0 Debt repayment _______________ Cash flow – It owns no tangible assets which would have to be depreciated (only the activated transaction costs, if any, have to be amortized) – It is not supposed to invest before the end of the LBO – It has no WCR as it is not dedicated to trade purposes • It has to repay the acquisition debt Acquisition debt conditions • The A-tranch (80% of the senior debt) has to be repaid over a 7-year period: – Flat payments or progressive payments – Cost = 6 months Euribor + 225 bp • The B-tranch (20% of the senior debt) is a bullet debt – Full repayment at the end of the 8th year – Cost = 6 months Euribor + 275 bp • A 100 bp additional cost of swap (to hedge the 6– month Euribor floating rate) has to be taken into account Holding balance sheet • Assets: Target’s shares Net cash balance ____________ Total assets Equity Financial debt _____________ Total equity and liabilities – The book value of th target’s shares is hopefully flat: its decrease would mean that they have to be depreciated because of losses which would have an adverse impact on the LBO – The cash is changed, every year, by the cash flows • Shareholders’ equity and liabilities – The equity is increased by the net profit (no dividend being paid by the holding as the whole available tax is dedicated to debt repayment) – The acquisition debt is reduced by its repayments Equity financing • The private equity fund require a 20% minimum IRR • Notations: – V0 = investment of the private equity fund in the ad hoc holding – Vn = value of the group (ie: holding + target) when the private equity fund will sell its holding shares • Vn can be calculated based on an EBITDA or EBIT multiple: Vn = EBIT multiple x EBITn – net consolidated debtn • If the average duration of the investments is 3 years, then: V0= Vn / (1+20%)3 Appendix: Balance sheet of the target Fixed assets (n) WCR (n) _____________ Total assets (n) Fixed assets (n+1) = Fixed assets (n) + Capex (n+1) – D&A (n+1) WCR (n+1) = WCR(n) + DWCR(n+1) _____________ __________________________________________________ Total assets (n+1) = Total assets(n) + Capex(n+1)-D&A(n+1)+DWCR(n+1) Equity (n) Provisions (n) Net debt (n) _____________ Total equity and liabilities (n) Equity (n+1) = Equity(n)+Net profit(n+1) – Dividend(n+1) Provisions (n+1) = Provisions (n) Net debt (n+1) = Net debt (n) - Cash flow (n+1) _____________ ________________________________________________ Equity &liab. (n+1) = Total equity & liab.(n)+Net profit (n+1)-Dividend(n+1) -[Net profit(n+1]+D&A(n+1)-Capex(n+1)-Dividends(n+1) -DWCR(n+1)] = Total assets(n) + Capex(n+1)-D&A(n+1)+DWCR(n+1) = Total assets (n+1)