Programme - TARC - University of Exeter

advertisement

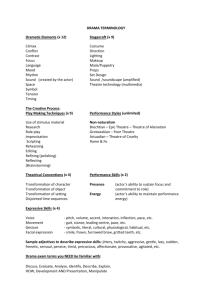

Shadow Conference 2015 Thursday 23 , Friday 24th, and Saturday 25th July 2015 University of Exeter rd Programme Thursday 23rd July 16.00-17.00 Registration Location: Xfi Café 17.00-17.15 Welcome Location: Henderson Lecture Theatre, Xfi 17.15-18.15 Keynote presentation: Chris Heady Taxing the informal economy in developing countries Location: Henderson Lecture Theatre, Xfi 18.45-20.15 Conference Dinner Location: Holland Hall Friday 24th July 08.30-09.00 Argentiero, Amedeo Tax evasion and economic crime. Empirical evidence for Italy Location: Henderson Lecture Theatre, Xfi Myles, Gareth Explaining taxpayer non-compliance evidence from UK administrative data Location: Conference Room 1 & 2, Xfi 09.00-09.30 Gokcekus, Omer Political contributions and corruption in the U.S.: an empirical analysis Location: Henderson Lecture Theatre, Xfi Doerrenberg, Philipp Tax incidence in the presence of tax evasion 09.30-10.00 Briand, Oceane Value-added tax, informality, and distortions: evidence from state-level reform in India Location: Henderson Lecture Theatre, Xfi Granda-Carvajal, Catalina On informality and macroeconomic volatility 10.00-10.30 Location: Conference Room 1 & 2, Xfi Location: Conference Room 1 & 2, Xfi Coffee Break – Xfi Cafe 10.30-11.00 Davidescu, Adriana Yousefi, Hana There is any link between shadow economy and Endogenous corruption and seigniorage: a theoretical official economy? An empirical evidence for the case analysis in a dynamic monetary model of Romania Location: Henderson Lecture Theatre, Xfi Location: Conference Room 1 & 2, Xfi 11.00-11.30 Frecknall-Hughes, Jane Corruption and tax evasion: an exploratory study of Bangladesh Location: Henderson Lecture Theatre, Xfi Ho, Mariesa Corruption and capital structure: evidence from Vietnamese firms Location: Conference Room 1 & 2, Xfi 11.30-12.00 Jahnke, Bjoern How does petty corruption affect tax morale in sub-Saharan Africa? An empirical analysis Location: Henderson Lecture Theatre, Xfi Desai, Sameeksha Tax policies, corruption, and entrepreneurship Location: Conference Room 1 & 2, Xfi 12.00-13.00 Lunch – Xfi Café 13.00-13.30 Cesaroni, Claudio Prinz, Aloys Tax reforms and the underground economy: a A Lewinian field theory of tax compliance simulation-based analysis Location: Henderson Lecture Theatre, Xfi Location: Conference Room 1 & 2, Xfi 13.30-14.30 Wijesinghe, Sanith & Chamberlain, Daniel Foreign account tax compliance act agent based model Location: Henderson Lecture Theatre, Xfi Munkacsi, Zsuzsa Structural reforms, openness and the informal economy Location: Conference Room 1 & 2, Xfi 14.30-15.00 Seibold, Goetz Hendrickx, Jef Behavioral economics and tax evasion – calibrating Measuring tax evasion with multi-country surveys; how an agent-based econophysics model with history events imprint a social desirability bias experimental tax compliance data Location: Henderson Lecture Theatre, Xfi Location: Conference Room 1 & 2, Xfi 15.00-15.30 Coffee Break – Xfi Café 15.30-16.00 Walsh, Keith & Hopkins, Andrew Cichocki, Stanislaw The oil market in Ireland: duties, prices and The Laffer curve as a framework for studying tax evasion consumption Location: Henderson Lecture Theatre, Xfi Location: Conference Room 1 & 2, Xfi 16.00-16.30 Loeprick, Jan Rablen, Matthew MSME taxation in transition economies: country Prospect theory and tax evasion: a reconsideration of the experience on the costs and benefits of introducing Yitzhaki Puzzle special tax regimes Location: Henderson Lecture Theatre, Xfi Location: Conference Room 1 & 2, Xfi 16.30-16.45 Break 16.45-17.45 Keynote presentation – Edgar Feige Reflections on the meaning, measurement, and implications of unobserved economies Location: Henderson Lecture Theatre, Xfi 18.00-18.45 Drinks Reception Location: Holland Hall 18.45-20.45 Gala Dinner Location: Holland Hall Saturday 25th July 09.00-09.30 Santoro, Alessandro The Revenue Cost of Audit Shields: Evidence from a Natural Experiment in Italy Location: Henderson Lecture Theatre, Xfi Pavel, Raluca Tax evasion dynamics, an experimental study 09.30-10.00 Caballé, Jordi Disclosure of corporate tax reports, tax enforcement, and insider trading Location: Henderson Lecture Theatre, Xfi Bazart, Cecile Do people contribute to punish evaders? 10.00-10.30 Wrede, Matthias Collusive tax evasion and social norms Gemmell, Norman Is more information always better? Evidence on taxpayer responses to tax debt penalties in a taxpayer experiment Location: Conference Room 1 & 2, Xfi Location: Henderson Lecture Theatre, Xfi Location: Conference Room 1 & 2, Xfi Location: Conference Room 1 & 2, Xfi 10.30-11.00 Coffee Break – Xfi Café 11.00-11.30 Hassan, Mai Panades, Judith Estimating the size of the shadow economy in Egypt Could higher standards of living discourage tax evasion? Location: Henderson Lecture Theatre, Xfi Location: Conference Room 1 & 2, Xfi 11.30-12.00 Gonzalez Cabral, Ana Cinta In or out? Participation in the hidden economy: a European perspective Location: Henderson Lecture Theatre, Xfi Neumann, Martin A case study of laundering drug money 12.00-12.30 Giammatteo, Michele Cash payment anomalies: an econometric analysis of Italian municipalities Location: Henderson Lecture Theatre, Xfi Somare, Maryte & Majdanska, Alicja Relevant factors concerning suspicious transaction reporting Location: Conference Room 1 & 2, Xfi Location: Conference Room 1 & 2, Xfi 12.30-13.00 Paulus, Alari Uribe–Teran, Carlos Micro-estimates of income underreporting based on Tax avoidance and the elasticity of taxable income: a income-consumption gaps: survey vs tax records macroeconomic perspective Location: Henderson Lecture Theatre, Xfi Location: Conference Room 1 & 2, Xfi 13.00-14.00 Lunch – Xfi Café 14.00-14.30 Duncan, Denvil Unequal inequalities: do progressive taxes reduce income inequality? Location: Henderson Lecture Theatre, Xfi 14.30-15.00 Ratto, Marisa Audit perceptions and compliance behaviour Location: Henderson Lecture Theatre, Xfi Benzoni, Martino Education and taxpayer mentality 15.00-15.30 Priazhkina, Sofia Definition of systemic risk in financial networks Besim, Mustafa Using labour amnesty to fight shadow employment: evidence from a natural experiment Location: Conference Room 1 & 2, Xfi Location: Henderson Lecture Theatre, Xfi Location: Conference Room 1 & 2, Xfi Wijesinghe, Sanith Computer aided tax evasion detection Location: Conference Room 1 & 2, Xfi