Summary Comparison of Part II of the CICA Handbook

advertisement

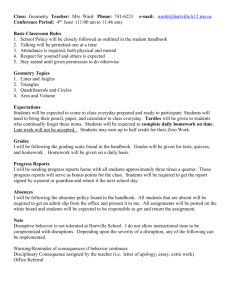

Summary Comparison of Part II of the CICA Handbook – Accounting to XFI Version in Part V As of December 31, 2009 1. This comparison has been prepared by the staff of the Accounting Standards Board (AcSB) and has not been approved by the AcSB. 2. This document provides a high-level comparison of accounting standards for private enterprises (Part II) and the XFI version of Part V of the CICA Handbook – Accounting (Handbook). It covers significant recognition and measurement differences only and does not necessarily include all of the differences that might arise in a particular entity’s circumstances. Presentation and disclosure requirements are not within the scope of this comparison. Presentation requirements for Part II are provided in Section 1520, Income Statement, Section 1521, Balance Sheet, and Section 1540, Cash Flow Statement. A compilation of disclosure requirements is also provided in Part II of the Handbook. 3. This document should not be used in preparing financial statements. To understand fully the implications of preparing financial statements in accordance with Part II of the Handbook, users of this comparison must refer to the standards themselves. 4. The standards in Part II and the XFI Version of Part V of the Handbook are based on common conceptual frameworks. Part V of the Handbook was used as a starting point in developing the standards in Part II. Standards in Part V that are largely irrelevant to the private enterprise sector have been excluded from Part II and a limited number of issues that have caused significant concern for private enterprises have been reconsidered. However, the majority of the recognition and measurement requirements in Part V of the Handbook do not cause significant concern for private enterprises and have been retained in Part II “as is”. Emerging Issues Committee (EIC) Abstracts of Issues Discussed have been excluded from Part II but in a limited number of instances, guidance on significant issues addressed in EIC Abstracts has been incorporated into Part II. 5. This comparison is organized according to Handbook Sections and Accounting Guidelines and reflects standards issued as of December 31, 2009. The term “converged” has been used in the comparison when the standards in Part II are substantially the same as the relevant standards in the XFI version of Part V. Similar requirements compiled in a single standard in Part II that were previously reflected in two or more standards in Part V, are not considered “differences” for the purpose of this comparison. Accounting Standards Board 277 Wellington Street West, Toronto, Ontario, Canada M5V 3H2 Tel: (416) 977-3222 Fax: (416) 204-3412 Page 1 of 18 (As of December 31, 2009) The following table of concordance relates each accounting standard for private enterprises in Part II of the CICA Handbook – Accounting, to the corresponding standard in XFI version of Part V. The table does not include differences in disclosure requirements. Handbook standards, Part V (XFI) Handbook standards, Part II Comparison of accounting treatments Significance 1 of differences Section 1000, Financial Statement Concepts Section 1000, Financial Statement Concepts Section 1000, Part II, is converged with XFI Section. None. Section 1100, Generally Accepted Accounting Principles Section 1100, Generally Accepted Accounting Principles Section 1100, Part II, is converged with XFI Section. Section 1100, Part II, has been redrafted to be consistent with the content of Part II. Not significant. Section 1300, Differential — Reporting No corresponding standard in Part II. — Section 1400, General Standards of Financial Statement Presentation Section 1400, General Standards of Financial Statement Presentation Section 1400, Part II, is converged with XFI Section. None. — Section 1500, First-time Adoption No corresponding standard in XFI standards. Significant on first-time adoption of accounting standards for private enterprises in Part II. 1 The assessment of significance of differences is a judgment made by AcSB staff in general terms. A difference may be significant to a particular transaction or entity depending on its materiality or nature. Page 2 of 18 (As of December 31, 2009) Handbook standards Part V (XFI) Section 1505, Disclosure of Accounting Policies Handbook standards, Part II Significance of differences Section 1505, Disclosure of Accounting Policies All requirements in this Section relate to disclosures, which are outside the scope of this summary comparison. — Section 1506, Accounting Changes Section 1506, Accounting Changes Section 1506, Part II, is converged with XFI Section, except that Section 1506, Part II, permits certain accounting policy choices to be changed without meeting the criterion in 1506.06 of providing more relevant or reliable information (see 1506.09). Significant. Section 1508, Measurement Uncertainty Section 1508, Measurement Uncertainty All requirements in this Section relate to disclosures, which are outside the scope of this summary comparison. — Section 1510, Current Assets and Current Liabilities Section 1510, Current Assets and Current Liabilities Section 1510, Part II, is converged with XFI Section. None. Comparison of accounting treatments The following Sections in Part V have been incorporated into Section 1510, Part II: • Section 3000 (see 1510.07); and • Section 3040 (see 1510.06). Certain guidance from the following EIC Abstracts has been included in Section 1510, Part II: • EIC-59 (see 1510.14); and • EIC-122 (see 1510.13). Section 1520, Income Section 1520, Income Statement This presentation Section reflects income statement presentation requirements from other Sections – — Page 3 of 18 (As of December 31, 2009) Handbook standards Part V (XFI) Statement Handbook standards, Part II Significance of differences Comparison of accounting treatments presentation is outside the scope of this summary comparison. — Section 1521, Balance Sheet This presentation Section reflects balance sheet presentation requirements from other Sections – presentation is outside the scope of this summary comparison. — Section 1535, Capital Disclosures — No corresponding standard in Part II. — Section 1540, Cash Flow Statement Section 1540, Cash Flow Statement Section 1540, Part II, is converged with XFI Section. However, under Part II, all enterprises must provide a cash flow statement. Significant for enterprises that do not provide a cash flow statement under XFI standards. Section 1582, Business Combinations Section 1582, Business Combinations Section 1582, Part II, is converged with XFI Section. Significant for Section 1582 is effective on adoption of Part II as Part II enterprises adopting Part does not include Section 1581. II prior to 2011. Section 1590, Subsidiaries Section 1590, Subsidiaries Section 1590, Part II, is converged with XFI Section, except as noted below. Under Section 1590, Part II, an enterprise may account for subsidiaries by consolidating them, or using either the cost or equity method. This is consistent with the differential reporting option in XFI Section. However an investment in a subsidiary whose equity securities are Significant for a subsidiary that would now be accounted for at fair value rather than cost. Page 4 of 18 (As of December 31, 2009) Handbook standards Part V (XFI) Handbook standards, Part II Significance of differences Comparison of accounting treatments quoted in an active market is not accounted for at cost, but may be accounted for at fair value. Section 1601, Consolidated Financial Statements Section 1601, Consolidated Financial Statements Section 1601, Part II, is converged with XFI Section. None. Section 1602, Noncontrolling Interests Section 1602, Noncontrolling Interests Section 1602, Part II, is converged with XFI Section. Section1602 is effective on adoption of Part II as Part II does not include Section 1600. Significant for enterprises adopting Part II prior to 2011. Section 1625, Comprehensive Revaluation of Assets and Liabilities Section 1625, Comprehensive Revaluation of Assets and Liabilities Section 1625, Part II, is converged with XFI Section except for the accounting for income tax benefits (see 1625.43-44). Not significant. Section 1650, Foreign Currency Translation Section 1651, Foreign Currency Translation Section 1651, Part II, is converged with XFI Section 1650. None, except for hedge accounting addressed in Section 3856, Part II. Section 1701, Segment Disclosures — Hedge accounting (other than a hedge of an investment in a self-sustaining foreign operation) is addressed in Section 3856, Part II, rather than in Section 1651, Part II, and differs from XFI Section 1650. No corresponding standard in Part II. — Section 1751, Interim Financial Statements — No corresponding standard in Part II. — Page 5 of 18 (As of December 31, 2009) Handbook standards Part V (XFI) Section 1800, Unincorporated Businesses Handbook standards, Part II Section 1800, Unincorporated Businesses Section 1800, Part II, is converged with XFI Section. Section 3000, Cash — No corresponding standard in Part II. Guidance from XFI Section incorporated in Section 1510, Part II (see 1510.07). — Section 3010, Temporary Investments — No corresponding standard in Part II. Measurement and impairment requirements are provided in Section 3856, Part II. Designation as “temporary” is no longer relevant. Financial instruments are classified as current if they meet the requirements in Section 1510, Part II. Significant. Section 3020, Accounts and Notes Receivable — No corresponding standard in Part II. Guidance from XFI Section incorporated in Section 3856, Part II (see 3856.16-.19). — Section 3025, Impaired Loans — No corresponding standard in Part II. Guidance provided in Section 3856, Part II, differs from that in Section 3025 (see 3856.16-.19) in that alternative measurements are possible. When measurement of impairment is based on recoverable amounts, these estimates are discounted using market interest rates rather than the original effective interest rate. Often not significant. Section 3031, Inventories Section 3031, Inventories Section 3031, Part II, is converged with XFI Section. None. Comparison of accounting treatments Significance of differences None. Page 6 of 18 (As of December 31, 2009) Handbook standards Part V (XFI) Section 3040, Prepaid Expenses Section 3050, Long-term Investments Handbook standards, Part II Significance of differences Comparison of accounting treatments — No corresponding standard in Part II. Guidance from XFI Section incorporated in Section 1510, Part II (see 1510.06). — Section 3051, Investments Section 3051, Part II differs from XFI Section 3050. Significant differences are noted below. Significant. Under Section 3051, Part II, an enterprise may account for significantly influenced investees using either the cost or equity method. This is consistent with the differential reporting option in XFI Section 3050. However, an investment in a significantly influenced investee whose equity securities are quoted in an active market is not accounted for at cost but may be accounted for at fair value. Under Section 3856, Part II, an investment in an equity security that is traded in an active market and not subject to significant influence is accounted for at fair value rather than at cost. Section 3055, Interests in Joint Ventures Section 3055, Interests in Joint Ventures The impairment provisions in Section 3051, Part II, are consistent with those in Section 3856, Part II. Section 3055, Part II, differs from XFI Section. Significant differences are noted below. Significant. Under Section 3055, Part II, an enterprise may account for interests in joint ventures using proportionate consolidation, the cost method or the equity method. Page 7 of 18 (As of December 31, 2009) Handbook standards Part V (XFI) Handbook standards, Part II Comparison of accounting treatments Significance of differences This is consistent with the differential reporting options in XFI Section. However an investment in a joint venture whose equity securities are quoted in an active market is not accounted for at cost but may be accounted for at fair value. The impairment provisions in Section 3055, Part II, are consistent with those in Section 3856, Part II. Section 3061, Property Plant and Equipment Section 3061, Property Plant and Equipment Section 3061, Part II, is converged with XFI Section. None. Section 3063, Impairment Section 3063, Impairment of Long-lived Assets of Long-lived Assets Section 3063, Part II, is converged with XFI Section. None. Section 3064, Goodwill and Intangible Assets Section 3064, Part II differs from XFI Section. Significant differences are noted below. Significant. Section 3064, Goodwill and Intangible Assets Internally developed intangible assets Section 3064, Part II, permits an enterprise to make an accounting policy choice to capitalize or expense development costs. Goodwill and other intangible assets – impairment testing Section 3064, Part II, requires enterprises to test goodwill and other intangible assets not subject to Page 8 of 18 (As of December 31, 2009) Handbook standards Part V (XFI) Handbook standards, Part II Comparison of accounting treatments Significance of differences amortization on an events and circumstances basis, rather than each year. This is consistent with the differential reporting option in XFI Section. Section 3064, Part II, requires goodwill impairment testing to be done at the reporting unit level, removing the requirement in XFI Section to determine fair values of individual assets and liabilities. Section 3065, Leases Section 3065, Leases Certain guidance from EIC-133 has been incorporated in Section 3064, Part II (see 3064.68). Section 3065, Part II, is converged with XFI Section, except that the requirements for (a) removing a lease liability from a lessee’s balance sheet, and (b) the impairment testing of lease receivables of a lessor in Section 3065, Part II, are consistent with those in Section 3856, Part II. Not significant. Certain guidance from the following EIC Abstracts has been incorporated into Section 3065, Part II: • EIC-19 (see 3065.03(r); • EIC-21 (see 3065.27); • EIC 25 (see 3065.64 and Illustrative Examples 3 and 4); • EIC-52 (see 3065.25 and Illustrative Example 5); and Page 9 of 18 (As of December 31, 2009) Handbook standards Part V (XFI) Handbook standards, Part II Comparison of accounting treatments • Section 3110, Asset Retirement Obligations Section 3110, Asset Retirement Obligations Significance of differences EIC-97 (see 3065.26). Section 3110, Part II, is converged with XFI Section except that the measurement requirements have been simplified. Significant. Under Section 3110, Part II, asset retirement obligations are measured at the best estimate of the expenditure required to settle the present obligation at the end of the reporting period, rather than at fair value. Section 3210, Long-term Debt — No corresponding standard in Part II. — Guidance provided in Section 3856, Part II. Section 3240, Share Capital Section 3240, Share Capital Section 3240, Part II, is converged with XFI Section. None. Section 3250, Surplus Section 3251, Equity All requirements in this Section relate to presentation, which is outside the scope of this summary comparison. — The scope of Section 3251, Part II, is broader than XFI Section 3250. Certain guidance from EIC-132 has been incorporated into Section 3251, Part II (see 3251.10). Section 3260, Reserves Section 3260, Reserves Section 3260, Part II, is converged with XFI Section. None. Page 10 of 18 (As of December 31, 2009) Handbook standards Part V (XFI) Section 3280, Contractual Obligations Handbook standards, Part II Significance of differences Section 3280, Contractual Obligations All requirements in this Section relate to disclosures, which are outside the scope of this summary comparison. — Section 3290, Contingencies Section 3290, Contingencies Section 3290, Part II, is converged with XFI Section. None. Section 3400, Revenue Section 3400, Revenue Section 3400, Part II, is converged with XFI Section. None. Comparison of accounting treatments Certain guidance from the following EICs has been incorporated into Section 3400, Part II: • EIC-78 (see 3400.17); • EIC-79 (see 3400.22); • EIC-123 (see 3400.23-.24); • EIC-141 (see 3400.07-.10); • EIC-142 (see 3400.11); • EIC-144 (see 3400.25-.27); and • EIC-156 (see 3400.28). Section 3461, Employee Future Benefits Section 3461, Employee Future Benefits Section 3461, Part II differs from XFI Section. Significant. Section 3461, Part II, permits defined benefit plans to be recognized and measured using either: • an “immediate recognition approach,” whereby the accounting is based on a funding valuation, the funded status of the plan is recognized on the balance sheet and there is no deferral or amortization of actuarial gains and losses or past service costs; or Page 11 of 18 (As of December 31, 2009) Handbook standards Part V (XFI) Handbook standards, Part II Significance of differences Comparison of accounting treatments • the “deferral and amortization approach” as in the XFI Section, which requires a separate valuation for accounting purposes and deferral and amortization is required for past service costs and permitted for actuarial gains and losses. The definitions of a defined benefit plan and a defined contribution plan have been modified. The difference is not expected to be significant for most private enterprises. Section 3465, Income Taxes Section 3465, Income Taxes Section 3465, Part II, is converged with XFI Section. Under Section 3465, Part II, either the taxes payable method or the future income taxes method may be chosen. This is consistent with the differential reporting option in XFI Section. None. Certain guidance from the following EIC Abstracts has been incorporated into Section 3465, Part II: • EIC-104 (see 3465.75); and • EIC-146 (see 3465.65). Section 3475, Disposal of Section 3475, Disposal of Long-lived Assets and Long-lived Assets and Discontinued Operations Discontinued Operations Section 3480, Extraordinary Items — Section 3475, Part II, is converged with XFI Section. None. No corresponding standard in Part II. — Page 12 of 18 (As of December 31, 2009) Handbook standards Part V (XFI) Section 3500, Earnings per Share Handbook standards, Part II Significance of differences Comparison of accounting treatments — No corresponding standard in Part II. — Section 3610, Capital Transactions Section 3610, Capital Transactions Section 3610, Part II, is converged with XFI Section. None. Section 3800, Government Assistance Section 3800, Government Section 3800, Part II, is converged with XFI Section. Assistance None. Section 3805, Investment Tax Credits Section 3805, Investment Tax Credits Section 3805, Part II, is converged with XFI Section. None. Section 3820, Subsequent Events Section 3820, Subsequent Events Section 3820, Part II, is converged with XFI Section. None. Section 3831, Nonmonetary Transactions Section 3831, Nonmonetary Transactions Section 3831, Part II, is converged with XFI Section. None. Section 3840, Related Party Transactions Section 3840, Related Party Transactions Section 3840, Part II, is converged with XFI Section. None. Certain guidance from the following EIC Abstracts has been incorporated into Section 3840, Part II: • EIC-66 (see 3840.44(a)); • EIC-77 (see 3840.38); • EIC 89 (see 3840.44(b)); and • EIC-103 (see 3840.33). Section 3841, Economic Section 3841, Economic Dependence All requirements in this Section relate to disclosures, which are outside the scope of this summary — Page 13 of 18 (As of December 31, 2009) Handbook standards Part V (XFI) Dependence Handbook standards, Part II Significance of differences Comparison of accounting treatments comparison. Section 3850, Interest Capitalized Section 3850, Interest Capitalized All requirements in this Section relate to disclosures, which are outside the scope of this summary comparison. — — Section 3856, Financial Instruments Section 3856, Part II, differs from equivalent requirements under XFI standards. The requirements in Section 3856, Part II, correspond to or replace guidance in Sections 3020, 3025, 3210, 3860, AcG-4, AcG-12 and AcG-13. Significant. The significant differences between the guidance on financial instruments in XFI standards and Section 3856, Part II, include the following: • Investments in equities that are traded in an active market are measured at fair value, with changes recognized in net income. An entity may also irrevocably elect on initial recognition to measure any other financial instrument at fair value. Derivatives, other than those in qualifying hedges, continue to be measured at fair value. • A single model is applied to the recognition and measurement of impairment for all financial assets. • All financial instruments are recognized on trade date. • Transaction costs on financial instruments measured at amortized cost are capitalized. Transaction costs Page 14 of 18 (As of December 31, 2009) Handbook standards Part V (XFI) Handbook standards, Part II Comparison of accounting treatments Significance of differences on financial instruments measured at fair value are expensed. • The equity component of convertible debt and warrants or options issued with, and detachable from, financial liabilities may be measured at zero. • Hedge accounting is available by designation for relationships specified in the Section if the critical terms of the hedging instrument match those of the hedged instrument. • Preferred shares issued in a specified tax planning arrangement must be classified as equity. (This is consistent with the differential reporting option in XFI Section 3860.) Certain guidance from the following Sections, Accounting Guidelines and EIC Abstracts and has been included in Section 3856, Part II: • Section 3020 (see 3856.16-.19); • Section 3025 (see 3856.16-.19); • AcG-4 (see 3856.07); • AcG-12 (see 3856, Appendix B.); • AcG-13 (see 3856.30-.36); • EIC-88, 96 and 101 (see 3856.26-.29); • EIC-149 (see 3856.20-.23); and • EIC-158 (see 3856.14). Page 15 of 18 (As of December 31, 2009) Handbook standards Part V (XFI) Section 3860, Financial Instruments – Disclosure and Presentation Handbook standards, Part II Significance of differences Comparison of accounting treatments — No corresponding standard in Part II. Guidance provided in Section 3856, Part II. — Section 3870, Stockbased Compensation and Other Stock-based Payments Section 3870, Stock-based Compensation and Other Stock-based Payments Section 3870, Part II, differs from XFI Section. Significant. Section 4100, Pension Plans — No corresponding standard in Part II. The accounting standards for pension plans can be found in Part IV. — Section 4211, Life Insurance Enterprises – Specific Items Section 4250, FutureOriented Financial Information — No corresponding standard in Part II. — — No corresponding standard in Part II. — Section 3870, Part II, replaces the minimum value method (i.e., the ability to ignore volatility in measuring stock-based compensation), with the calculated value method. Under the calculated value method an enterprise estimates the volatility that is used as an input to a stock option pricing model based on an appropriate sector index. Page 16 of 18 (As of December 31, 2009) Handbook standards Part V (XFI) AcG-2, Franchise Fee Revenue Handbook standards, Part II AcG-2, Franchise Fee Revenue AcG-2, Part II, is converged with XFI Guideline. Significance of differences None. AcG-3, Financial Reporting by Property and Casualty Insurance Companies — No corresponding Guideline in Part II. — AcG-4, Fees and Costs Associated with Lending Activities — No corresponding Guideline in Part II. Guidance provided in Section 3856, Part II (see 3856.07). — AcG-7, The Management Report — No corresponding Guideline in Part II. — AcG-8, Actuarial Liabilities of LifeInsurance Enterprises – Disclosure AcG-9, Financial Reporting by Life Insurance Enterprises — No corresponding Guideline in Part II. — — No corresponding Guideline in Part II. — AcG-11, Enterprises in the Development Stage — No corresponding Guideline in Part II. — Comparison of accounting treatments Page 17 of 18 (As of December 31, 2009) Handbook standards Part V (XFI) AcG-12, Transfers of Receivables Handbook standards, Part II Significance of differences Comparison of accounting treatments — No corresponding Guideline in Part II. Guidance provided in Section 3856, Part II (see 3856, Appendix B). — AcG-13, Hedging Relationships — No corresponding Guideline in Part II. Guidance provided in Section 3856, Part II (see 3856.30-.36). AcG-14, Disclosure of Guarantees AcG-14, Disclosure of Guarantees AcG-14, Part II, is converged with XFI Guideline. None. AcG-15, Consolidation of AcG-15, Consolidation of Variable Interest Entities Variable Interest Entities AcG-15, Part II, is converged with XFI Guideline. AcG-15, Part II, does not apply to an enterprise that chooses to prepare non-consolidated financial statements. None. AcG-16, Oil and Gas Accounting – Full Cost AcG-16, Oil and Gas Accounting – Full Cost AcG-16, Part II, is converged with XFI Guideline. None. AcG-17, Equity-linked Deposit Contracts — No corresponding Guideline in Part II. AcG-18, Investment Companies AcG-18, Investment Companies AcG-18, Part II, is converged with XFI Guideline. None. AcG-19, Disclosures by Entities Subject to Rate Regulation AcG-19, Disclosures by Entities Subject to Rate Regulation All requirements in this Guideline relate to disclosures, which are outside the scope of this summary comparison. — Page 18 of 18