Financial Accounting Assignment: Balance Sheet, Income Statement, OCF

advertisement

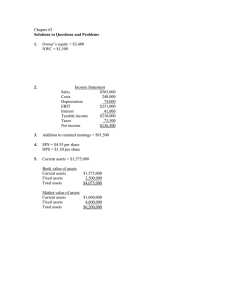

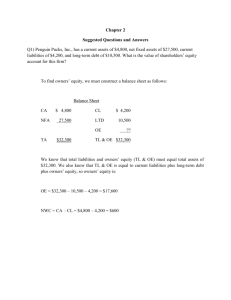

Assignment Session 1 1. Building a Balance Sheet [LO1] Penguin Pucks, Inc., has current assets of $5,100, net fixed assets of $23,800, current liabilities of $4,300, and long-term debt of $7,400. What is the value of the shareholders’ equity account for this firm? How much is net working capital? Solution Based on given information, we can form a balance sheet as followed: Penguin Pucks Inc. Balance sheet Assets Liabilities and Owner’s Equity Current assets $ 5,100 Current liabilities $ 4,300 Net fixed assets $23,800 Long-term debt $ 7.400 Owner’s Equity $17,200 [= 23,800 – (4,300 + 7,400)] Total $28,900 Networking Capital $ Total $28,900 800 (= 5100 – 4300) 2. Building an Income Statement [LO1] Papa Roach Exterminators, Inc., has sales of $586,000, costs of $247,000, depreciation expense of $43,000, interest expense of $32,000, and a tax rate of 35 percent. What is the net income for this firm? Solution Based on given information, we can form an income statement as follow: Papa Roach Exterminators, Inc. Income statement Sales $586,000 Costs 247,000 Depreciation Earnings before interest and tax Interest paid Taxable income Taxes Net income 43,000 $296,000 32,000 $264,000 92,400 $171,600 3. Dividends and Retained Earnings [LO1] Suppose the firm in Problem 2 paid out $73,000 in cash dividends. What is the addition to retained earnings? Solution Addition to retained earnings = Net income – Dividends = 171,600 - 73,000 = $98,600 8. Calculating OCF [LO4] So Long, Inc., has sales of $27,500, costs of $13,280, depreciation expense of $2,300, and interest expense of $1,105. If the tax rate is 35 percent, what is the operating cash flow, or OCF? Solution Based on given information, we can form an income statement as follow: So Long, Inc. Income statement Sales $27,000 Costs 13,280 Depreciation 2,300 Earnings before interest and tax Interest paid $11,420 2,300 Taxable income $ 9,120 Taxes 3,192 Net income $ 5,928 According to the income statement, we can calculate the OCF: OCF = Earnings before interest and tax + Depreciation – Taxes = 11,420 + 2,300 - 3,192 = $10,528 10. Calculating Additions to NWC [LO4] The 2008 balance sheet of Saddle Creek, Inc., showed current assets of $2,100 and current liabilities of $1,380. The 2009 balance sheet showed current assets of $2,250 and current liabilities of $1,710. What was the company’s 2009 change in net working capital, or NWC? Solution NWC = Current assets – Current liabilities 2008 NWC = 2,100 - 1,380 = $720 2009 NWC = 2,250 - 1,710 = $540 Therefore, the company’s 2009 change in NWC = 2009 NWC – 2008 NWC = 540 - 720 = $-180