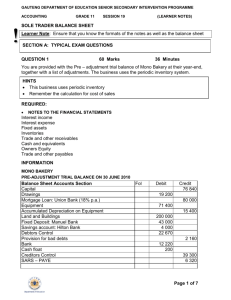

Cash Flow Statement

advertisement

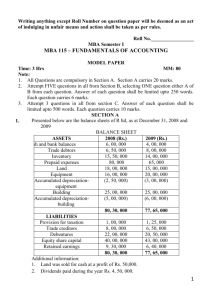

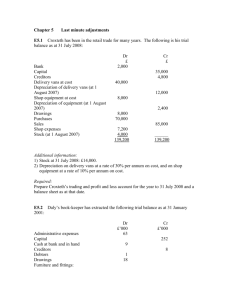

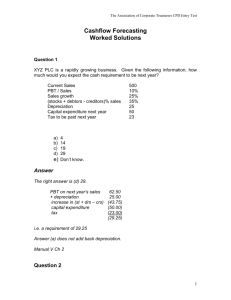

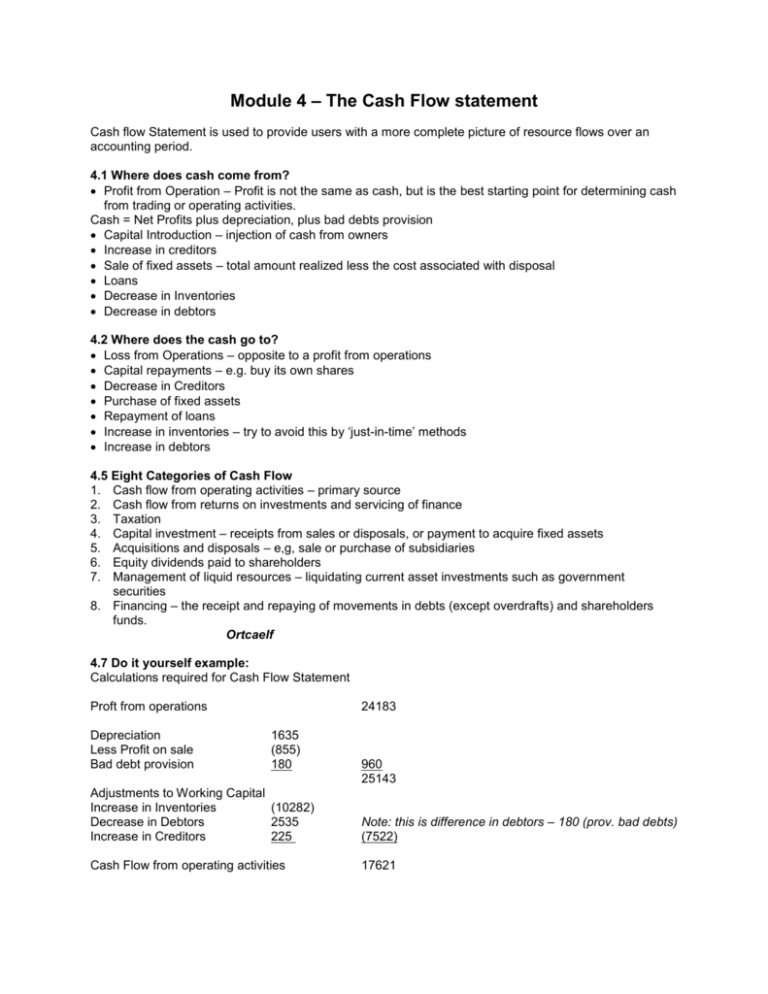

Module 4 – The Cash Flow statement Cash flow Statement is used to provide users with a more complete picture of resource flows over an accounting period. 4.1 Where does cash come from? Profit from Operation – Profit is not the same as cash, but is the best starting point for determining cash from trading or operating activities. Cash = Net Profits plus depreciation, plus bad debts provision Capital Introduction – injection of cash from owners Increase in creditors Sale of fixed assets – total amount realized less the cost associated with disposal Loans Decrease in Inventories Decrease in debtors 4.2 Where does the cash go to? Loss from Operations – opposite to a profit from operations Capital repayments – e.g. buy its own shares Decrease in Creditors Purchase of fixed assets Repayment of loans Increase in inventories – try to avoid this by ‘just-in-time’ methods Increase in debtors 4.5 Eight Categories of Cash Flow 1. Cash flow from operating activities – primary source 2. Cash flow from returns on investments and servicing of finance 3. Taxation 4. Capital investment – receipts from sales or disposals, or payment to acquire fixed assets 5. Acquisitions and disposals – e,g, sale or purchase of subsidiaries 6. Equity dividends paid to shareholders 7. Management of liquid resources – liquidating current asset investments such as government securities 8. Financing – the receipt and repaying of movements in debts (except overdrafts) and shareholders funds. Ortcaelf 4.7 Do it yourself example: Calculations required for Cash Flow Statement Proft from operations Depreciation Less Profit on sale Bad debt provision 24183 1635 (855) 180 960 25143 Adjustments to Working Capital Increase in Inventories (10282) Decrease in Debtors 2535 Increase in Creditors 225 Note: this is difference in debtors – 180 (prov. bad debts) (7522) Cash Flow from operating activities 17621 Cash Flow Statement for year ended 30 June 1997 Cash flow from Operations 17621 Return on investments Taxation Capital 3450 Acquisition of Subsidiaries Equity payments (18750) Management of liquid assets Financing (1500) Increase in Cash 821 How do you get from opening and closing balances of fixed assets from 1996 to ’97: Original purchase price of sold asset was 16800-10800 = $6000 sold fixed assets for $3450 at a profit of 855 => the actual residual cost was $2595 Original – residual = depreciation = $3405 So depreciation in ’96 was Minus the depreciation for sold asset Plus depreciation charged in 97 Total depreciation in balance sheet 6240 3405 2835 1635 4470 Review Questions: 1. d 2. c 3. b 4. 20% of 50,000 = 10,000; so cash flow is profit + depreciation = 22,500 ans: c 5. d 6. d 7. a 8. c 9. b 10. b 11. a 12. b 13. d 14. c 15. Movement in Cash = 18-12-8+28-4+2=24 Ans: c Wrong! don’t understand why its 4+28 = d 16. 27+18-12-8=25 Ans: b 17. 10000 –500 – 700+3000 = 11800 Ans: a 18. Note: the older column is on right! -33-17+52 = increase of 2 , ans: b 19. 65000 –16000 – 3000 = the fixed assets from ’96 left at end of 97 = $46,000. But the balance sheet shows the actual end og ’97 figure is $80,000 , so assets must have been increased by $34,000 during the year, by a purchase of fixed assets. Ans: d 20. a 21. False 22. False DIY Example: ORTCAELF Operation Return on Investment Taxation Capital Acquisitions Equity Liquid Finance Cash flow from operations Profit Add back Depreciation 1635 Increase in provision 180 Less Profit on sale of P&E 24183 1815 25998 855 Cash flow from Working Capital Increase in Inventory (10282) Decrease in Debtors 2535 Increase in Creditor 225 25143 (7522) 17621 Cash Flow Statement Cash from Operations Return on Investments Taxation Capital Expenditure Acquisitions Equity Liquid resources Finance 17621 3450 (18750) (1500) 821 = Increase in Cash at bank between two balance sheets Case Study 4.2 Cash Flow from Operations 97 $ (000s) (136) Profits Add back: Depreciation Decrease in inventories Decrease in debtors Increase in Creditors 10 (126) 54 17 30 101 (25) Disposal of fixed assets Fixed Assets end of 96 Depreciation during 97 End of 97 value Actual 97 value Value of assets disposed 100 (10) 90 50 40 Cash Flow statement Cash flow from operations Return on Investment Taxation Capital Expenditure Acquistions Equity Liquid resources Finance (25) 40 30 (25) 20 Case Study 4.1 Cash flow from operations Profit Add Depreciation 9288 3706 12994 From Working Capital Increase in Inventories Increase in Debtors Decrease in Creditors (3240) (3720) (2594) Fixed Asset Expenditure Fixed asset at end of 96 Depreciation during year Value at end of 97 Increase in fixed assets Actual Value at end of 97 9606 (3706) 5900 9400 15300 (9554) 3440 Cash Flow Statement Operations Purchase of Fixed Assets Increase in Equity 3440 (9400) 2000 (3960)