1_146 - Baroda ICAI

advertisement

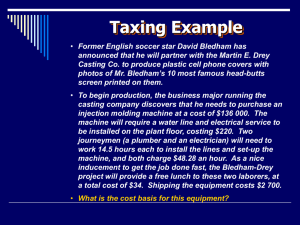

Finalisation of Accounts Workshop for Accountants ICAI Bhawan, Vadodara – 8th July, 2014 ********************************************* CA. Kejal V. Pandya Partner Contractor, Nayak & Kishnadwala Chartered Accountants Content History of Accounting Purchase, Sales, Direct Expenses, Inventory Routine Accounting Vs. Finalisation of Accounts Recurring /Regular Expenses Comparative Analysis Statutory payments Depreciation calculation Foreign exchange gain/loss Provision for taxation Deferred tax working Analysis of debtors and creditors Investment Finalisation of Partnership Firms History of Accounting Emerged more than 7000 years back in Mesopotamia Modern Professional Accounting developed in Scotland in 19th Century Closely related to developments in writing, counting and money Two types : Financial Accounting (for external Purpose) Transformation and Management from Single Accounting (for Internal Entry purpose) Accounting to Double Entry Accounting Purchase / Sales Verify with VAT/CST returns the amounts of purchase and sales Purchase and sales return should be accounted in separate accounts Purchase of raw material only should be shown as part of trading activity. Other purchases should be part of indirect expenses Direct Expenses Direct Expenses Wages Freight Inward Factory Electricity Indirect Expenses Salary Freight Outward Office Electricity Inventory Follow FIFO method to find value of inventory Maintain quantity records A summary should be prepared with rate and quantity with vendor name and invoice no. Routine Accounting Vs. Finalisation of Accounts Routine Accounting Day to day entries No cross references with other related transactions Maintenance of supporting documents Finalisation of Accounts Normally at year end Cross verification of related transactions Reconciliation with supporting documents Compliance with legal provisions Disclosure requirements under AS / Laws Recurring / Regular Expenses Recurring Expenses Rent Electricity Telephone / Mobile Internet Salary / Wages Regular Expenses Insurance Professional Tax Municipal Tax License Fee Membership Fee Comparative Analysis… Analyse transactions within same year Last few years’ comparison Ratio Analysis Reasons for deviation to be recorded and maintained for future reference …Comparative Analysis Ratio Analysis Gross Profit Ratio = Gross Profit/ Turnover*100 Inventory Turnover Ratio = COGS / Average Inventory Net Profit Ratio = Net Profit/ Turnover*100 Debtors Turnover Ratio =Net Credit sales / Average Debtors Operating Ratio = COGS +Operating Exps / Net Sales Creditors Turnover Ratio =Net Credit purchases / Average Creditors Liquid Ratio = Current Assets Inventory/Current Liabilities Current Ratio = Current Assets/Current Liabilities Statutory payments… TDS TDS Payable TDS paid Interest on late payment Late filing fee Professional Tax Employer Employees Service Tax ST Payable ST paid by cheque / cash CENVAT availed / utilised Statutory payments VAT/CST VAT/CST Payable 2% reduction VAT Credit Excise Excise Payable Excise paid by cheque / cash CENVAT availed / utilised Provident Fund Entertainment Tax Reconciliation with relevant returns per periodicity Depreciation calculation… As per old Companies Act, 1956 Schedule XIV deals with only depreciation of tangible assets. contained rates of depreciation of tangible assets. 100% Depreciation shall be charged on assets whose actual cost does not exceed Rs.5,000/Unit of production method of depreciation not permissible As per New Companies Act, 2013 Schedule XIV deals with the amortization of intangible assets also. contains only useful lives of tangible assets and does not prescribe depreciation rates. Omits the provision for 100% Depreciation on immaterial items i.e, assets whose actual cost does not exceed Rs.5,000/ Unit of production method of depreciation permitted …Depreciation calculation… As per Companies Act, 1956 / 2013 As per income tax Act, 1961 Purchase of asset up to /after 30th September Profit/loss on sale of FA Purchase price Depreciation WDV Sale value Profit 100000 20000 80000 90000 10000 Purchase of asset - pro rata calculation …Depreciation calculation – Profit on sale of assets Entries for Corporates Entries for Non-corporates Accum Deprn A/c Dr To Gross Block 20,000 20,000 Cash/Bank A/c Dr To Gross Block 90,000 90,000 Gross Block A/c Dr 10,000 To Profit on sale of asset 10,000 Cash/Bank A/c Dr To Fixed Asset 90,000 90,000 Fixed ASset A/c Dr 10,000 To Profit on sale of asset 10,000 Foreign Exchange Gain/Loss On conclusion of transaction For incomplete transactions, on outstanding balance on Balance Sheet date On balance of foreign currency bank accounts Discount given/taken not considered as forex gain/loss Forex Gain/loss working Analysis of debtors and creditors Analyse Debtors and creditors per transaction Write off amount not receivable / payable Confirm closing balance bill wise Obtain balance confirmation at least for top debtors / creditors Deferred tax Calculation… Difference between Depreciation as per as per Companies Act and Income Tax Act Tax on difference is deferred tax to be provided during the year Add the same to opening balance to derive closing balance Difference between WDV of Fixed Assets on Balance Sheet date as per Companies Act and Income Tax Act Reduce cost of land from WDV as per Companies Act Tax on difference is closing balance of deferred tax Difference between opening and closing balance is Deferred Tax Income / Expense …Deferred tax Calculation Example Based On Difference of Depreciation Based On Difference of WDV Net Block as per Books Less:Value of land 13803196 26250 13776946 WDV as per IT Act 13436226 Diff in WDV as per IT and books 340720 Deferred tax asset @ 30.9% 105282 Depreciation as per books of account 495432 Depreciation as per IT Act 393269 Difference in amount of depreciation 102163 Deferred tax assets @30.9% Opening Balance 39609 Opening balance To be provided 65673 Addition Closing Balance 105282 Closing Balance 31568 212218 31568 243786 Provision for taxation… Compute taxable income as per Income Tax Act, 1961 Calculate Tax Payable at applicable rate …Provision for taxation Net Profit as per P/L account before tax Add: Depreciation as per books Donation (add other disallowances here) Loss on sale of FA 6801169 2989788 4575 0 9795532 Less: Depreciation as per Income Tax Act 3,267,999 6,527,533 Less: Deduction u/s. 80G Taxable Income 2288 6,525,245 Tax Payable @ 30.9% 2016301 Round off 2025000 Investment Verify closing balance of investments (specially investments in FDRs etc) Account for accrued income on the same Verify TDS deducted if any, on income accrued and account for the same Obtain fair market value for disclosure requirements Finalisation of Partnership Firms Remuneration to Partners… To be given as prescribed in partnership deed As per section 40(b) of the IT Act,1961 if remuneration to partners exceeds prescribed limit, excess remuneration will be disallowed. …Finalisation of Partnership Firms Remuneration to Partners Prescribed Limit Loss/Profit up to 166666 = 150000 166666<Profit =<300000=90% of profit Profit>300000 = 60% of (profit – 300000)+270000 …Finalisation of Partnership Firms Interest on Capital to Partners At rates applicable as per Income Tax act, 1961 (maximum 12% for AY 2013-14) Excess rate will be disallowed How to calculate??? !!! Thank You !!! !!! never give up !!!