Page 1 of 7 SOLE TRADER BALANCE SHEET Learner Note

advertisement

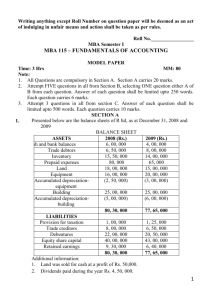

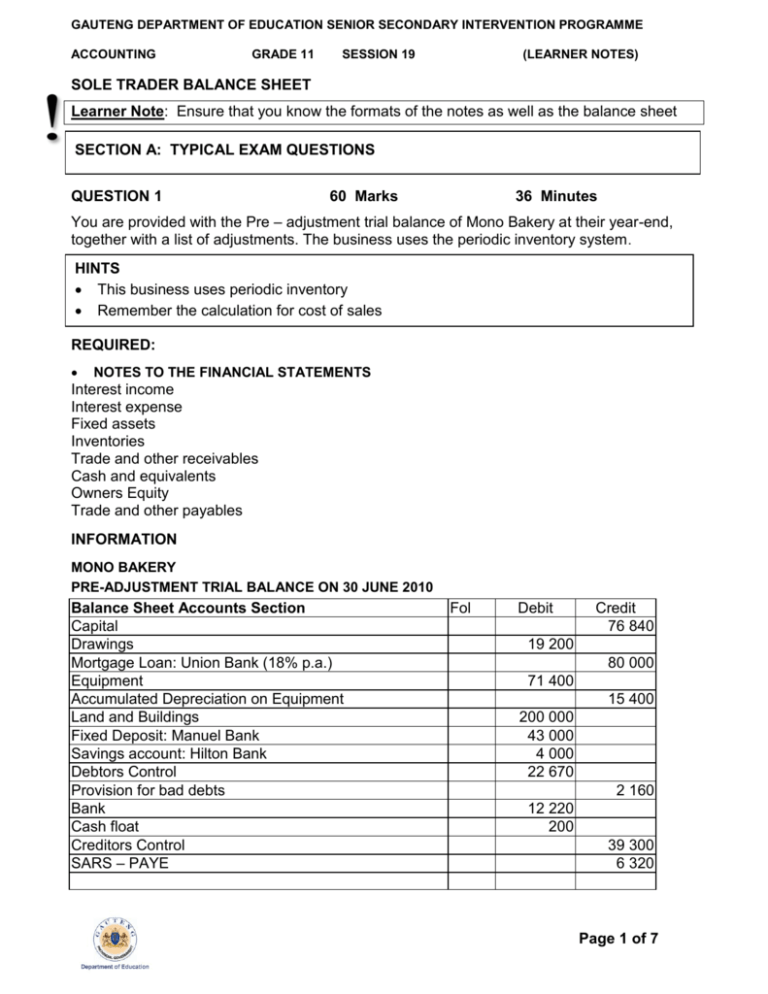

GAUTENG DEPARTMENT OF EDUCATION SENIOR SECONDARY INTERVENTION PROGRAMME ACCOUNTING GRADE 11 SESSION 19 (LEARNER NOTES) SOLE TRADER BALANCE SHEET Learner Note: Ensure that you know the formats of the notes as well as the balance sheet SECTION A: TYPICAL EXAM QUESTIONS QUESTION 1 60 Marks 36 Minutes You are provided with the Pre – adjustment trial balance of Mono Bakery at their year-end, together with a list of adjustments. The business uses the periodic inventory system . HINTS This business uses periodic inventory Remember the calculation for cost of sales REQUIRED: NOTES TO THE FINANCIAL STATEMENTS Interest income Interest expense Fixed assets Inventories Trade and other receivables Cash and equivalents Owners Equity Trade and other payables INFORMATION MONO BAKERY PRE-ADJUSTMENT TRIAL BALANCE ON 30 JUNE 2010 Balance Sheet Accounts Section Capital Drawings Mortgage Loan: Union Bank (18% p.a.) Equipment Accumulated Depreciation on Equipment Land and Buildings Fixed Deposit: Manuel Bank Savings account: Hilton Bank Debtors Control Provision for bad debts Bank Cash float Creditors Control SARS – PAYE Fol Debit Credit 76 840 19 200 80 000 71 400 15 400 200 000 43 000 4 000 22 670 2 160 12 220 200 39 300 6 320 Page 1 of 7 GAUTENG DEPARTMENT OF EDUCATION SENIOR SECONDARY INTERVENTION PROGRAMME ACCOUNTING GRADE 11 SESSION 19 Nominal Account Section Purchases Carriage on Purchases Customs Duty Opening stock Sales Debtors Allowances Rent income Interest on Investments Salaries and Wages Packing materials Discount Allowed Discount Received Bank Charges Interest on Loan Sundry expenses (including insurance) (LEARNER NOTES) 96 000 1 890 5 210 25 300 362 000 4 500 7 500 4 480 50 000 6430 510 835 1 445 10 000 20 860 594 835 594 835 Adjustments 1. The SARS – PAYE balance represents PAYE deductions from salaries and wages for June 2010 which have not yet been paid over to the South African Revenue Services (SARS). This amount must be treated as an item under Trade and other payables. 2. Provide for any interest outstanding on the mortgage loan. 3. The Union Bank owes R500 interest on fixed deposit. 4. An annual insurance premium of R1 360 was paid on 1 January 2010 5. An unused storeroom has been rented out. Rent has been received up to 30 April 2010. Provide for outstanding rent. 6. An amount of R450 is owed to Nelspruit Transport Services for delivery of flour to the shop. 7. The accountant has omitted to record an amount of R1440 in respect of customs duty on imported confectionery. The amount has not yet been paid. 8. Equipment is to be depreciated by 10% p.a. on the diminishing balance method. 9. The provision for bad debts is to be decreased by R290. 10. The stock count at the year-end reflects the following : Stock of flour, R16 800 Stock of packing material, R1 000 11. Transfer the debit balance from Cabala Suppliers account in the Creditors Ledger to his account in the Debtors ledger, R1 130. 12. Discount allowed, R190 was in error debited to discount received. Correct the error SECTION B: SOLUTIONS AND HINTS HINT: MAKE SURE YOU KNOW YOUR FORMATS Page 2 of 7 GAUTENG DEPARTMENT OF EDUCATION SENIOR SECONDARY INTERVENTION PROGRAMME ACCOUNTING GRADE 11 SESSION 19 (LEARNER NOTES) Trading as: MONO BAKERY Notes to the financial statements for the year / period ended 1. Interest income From investments ( e.g. fixed deposit) (4 480 + 500) From overdue debtors From current account 4 980 4 980 2. Interest expense/Finance cost 14 400 Interest on mortgage loans (10 000 + 4 400) Interest on overdraft 14 400 3. Tangible assets ( Fixed assets ) 1. Land and Buildings 200 000 Cost Accumulated depreciation Carrying value (Last date of previous year) 200 000 2. Equipm ent 3. Total 71 400 271 400 (15 400) 15 400 56 000 256 000 (5 600) (5 600) 50 400 250 400 9. Movements Additions at cost Disposals at carrying value Depreciation for the year # Cost Accumulated depreciation 200 000 71 400 (21 000) 271 400 21 000 # Carrying value (Last date of current year) 200 000 50 400 250 400 4 Inventories Trading inventory Consumable stores on hand 16 800 1 000 17 800 Page 3 of 7 GAUTENG DEPARTMENT OF EDUCATION SENIOR SECONDARY INTERVENTION PROGRAMME ACCOUNTING 5. GRADE 11 SESSION 19 (LEARNER NOTES) Trade and other receivables Trade debtors (22 670 + 1 130) Provision for bad debts (2 160 – 290) 23 800 (1 870) Net trade debtors Deposit on electricity, etc. Accrued income (500 + 1 500) Prepaid expenses (680) 21 930 2 000 680 24 610 6 Cash and cash equivalents Fixed deposits ( maturing <12months ) Savings accounts Bank Cash float Petty cash 7 Owner’s equity Balance ( last day of previous year ) Net profit ( loss ) for the year Additional capital contributed Drawings Balance ( last day of current year ) 8 4. Trade and other Payables Trade creditors (39 300 + 450+ 1 130) Accrued expenses (4 400 + 1 440 Income received in advance /Deferred income Creditor for wages/salaries Pension fund Medical aid fund Short term loan SARS –PAYE 4 000 12 220 200 16 420 76 840 161 550 (19 200) 219 190 40 880 5 840 6 320 53 040 Page 4 of 7 GAUTENG DEPARTMENT OF EDUCATION SENIOR SECONDARY INTERVENTION PROGRAMME ACCOUNTING GRADE 11 SESSION 19 (LEARNER NOTES) Learner Note: You have to see the importance of showing all calculations to earn part marks. SECTION D :HOMEWORK QUESTION 1 60 Marks 36 Minutes REQUIRED: Now that you have completed the notes to the balance sheet , complete the face of the balance sheet INFORMATION MONO BAKERY PRE-ADJUSTMENT TRIAL BALANCE ON 30 JUNE 2010 Balance Sheet Accounts Section Capital Drawings Mortgage Loan: Union Bank (18% p.a.) Equipment Accumulated Depreciation on Equipment Land and Buildings Fixed Deposit: Manuel Bank Savings account: Hilton Bank Debtors Control Provision for bad debts Bank Cash float Creditors Control SARS – PAYE Nominal Account Section Purchases Carriage on Purchases Customs Duty Opening stock Sales Debtors Allowances Rent income Interest on Investments Salaries and Wages Packing materials Discount Allowed Discount Received Bank Charges Interest on Loan Sundry expenses (including insurance) Fol Debit Credit 76 840 19 200 80 000 71 400 15 400 200 000 43 000 4 000 22 670 2 160 12 220 200 39 300 6 320 96 000 1 890 5 210 25 300 362 000 4 500 7 500 4 480 50 000 6430 510 835 1 445 10 000 20 860 594 835 594 835 Page 5 of 7 GAUTENG DEPARTMENT OF EDUCATION SENIOR SECONDARY INTERVENTION PROGRAMME ACCOUNTING GRADE 11 SESSION 19 (LEARNER NOTES) Adjustments 13. The SARS – PAYE balance represents PAYE deductions from salaries and wages for June 2010 which have not yet been paid over to the South African Revenue Services (SARS). This amount must be treated as an item under Trade and other payables. 14. Provide for any interest outstanding on the mortgage loan. 15. The Union Bank owes R500 interest on fixed deposit. 16. An annual insurance premium of R1 360 was paid on 1 January 2010 17. An unused storeroom has been rented out. Rent has been received up to 30 April 2010. Provide for outstanding rent. 18. An amount of R450 is owed to Nelspruit Transport Services for delivery of flour to the shop. 19. The accountant has omitted to record an amount of R1440 in respect of customs duty on imported confectionery. The amount has not yet been paid. 20. Equipment is to be depreciated by 10% p.a. on the diminishing balance method. 21. The provision for bad debts is to be decreased by R290. 22. The stock count at the year-end reflects the following : Stock of flour, R16 800 Stock of packing material, R1 000 23. Transfer the debit balance from Cabala Suppliers account in the Creditors Ledger to his account in the Debtors ledger, R1 130. 24. Discount allowed, R190 was in error debited to discount received. Correct the error. Learner Note: As you attempt the homework, you need to ensure that you are able to answer the questions in the allocated time frames. If you get stuck, you should refer to either the additional notes or your class teacher. SECTION E: SOLUTIONS TO SESSION 18 HOMEWORK Tangible assets / Fixed assets Cost Accumulated depreciation Carrying value at beginning of year Movements Additions at cost Land & Buildings 81 000 81 000 - Disposals at carrying value Depreciation for the year Carrying value at end of year 81 000 Cost Accumulated depreciation 81 000 0 Equipme nt 100 000 (35 000) 65 000 4 000 (2 040) (13 080) 53 880 94 000 (40 120) (10) Page 6 of 7 GAUTENG DEPARTMENT OF EDUCATION SENIOR SECONDARY INTERVENTION PROGRAMME ACCOUNTING GRADE 11 SESSION 19 (LEARNER NOTES) 1.1..2 Trade and other receivables Trade and other receivables Net trade debtors: Trade debtors [73 500 – 600] Provision for bad debts [3 300 – 300] Accrued income Expenses prepaid 69 900 72 900 (3 000) 345 1 350 71 595 (10) 1.1.3 Trade and other payables Creditors control Income received in advance Current portion of loan SARS (PAYE) [460 + 4 360] Pension Fund [620 + 1 720 + 1 720] Creditors for salaries[6 100 + 9 420] 45 000 250 6 000 4 820 4 060 15 520 75 650 (15) The SSIP is supported by Page 7 of 7